The views expressed in this policy brief are of the authors and not those of the National Bank of Belgium, the Central Bank of Ireland, or the Eurosystem.

The ECB’s strategy review in 2020-21 recommended including owner-occupied housing (OOH) costs in the euro area’s inflation measure. We analyse how households’ long-run expectations about euro area inflation, interest rates, and OOH inflation would react to this change. Using a survey experiment, we find significantly higher inflation expectations when respondents assume that OOH costs are fully included in the inflation measure. This information effect is heterogeneous as, among others, homeowners and respondents with low trust in the ECB react more strongly. However, additional information about past OOH inflation reverses this increase in inflation expectations. Thus, communication is important to stabilise long-term expectations at the time of significant changes to the inflation measurement.

Survey evidence showed that increases in the cost of housing (i.e., purchase prices, accommodation costs, and rent) are the most salient price changes for European citizens. Moreover, most believe housing costs are relevant when measuring inflation (ECB, 2021; Wauters, 2021). In contrast, the Harmonised Index of Consumer Prices (HICP) — the main euro area inflation measure — only partially includes owner-occupied housing (OOH) costs related to owning, maintaining, and living in one’s home. Specifically, it does not cover what homeowners pay to buy their dwellings, the costs of the consumption of dwelling services, and major renovations.1 Therefore, following a monetary policy strategy review in 2020-21, the European Central Bank (ECB) recommended expanding the coverage of OOH costs in the HICP in the future.

Since house prices increased significantly in recent years and people may overweight house prices when forming inflation expectations (Dhamija, Nunes and Tara, 2023), there is a risk that implementing and communicating this policy would raise inflation expectations. Indeed, a special ECB survey (Meyler et al., 2021) finds that most professional forecasters would raise the level and uncertainty of their long-term euro area inflation expectations if OOH costs were fully included in the HICP. Euro area monetary policymakers are actively communicating with the wider public, so it is beneficial to anticipate how the announced change would impact household inflation expectations.

In Wauters, Zekaite and Garabedian (2024), we provide the first quantitative analysis of how households’ long-term inflation expectations may respond to the full inclusion of OOH costs into the HICP. So far, only Ehrmann, Georgarakos and Kenny (2023) study household beliefs considering the ECB’s strategy outcomes that also include information about the plan to cover housing costs more extensively in the future. However, their primary focus is how communication about policy strategy affects the credibility of the ECB. Also, we focus on the actual implementation of the new strategy.

We implemented a novel survey experiment using the Bundesbank’s online household survey in July 2022. We randomly divided the respondent sample into four groups, who received the following information treatments:

Next, all respondents received the same three questions. We asked them about their expectations for euro area overall inflation and OOH cost inflation ten years ahead (i.e., in 2032). In addition, respondents were asked where they thought interest rates would be in 2032 relative to today. From these responses, we derive and compare the mean expectations between treatment groups. The four main results of the analysis are summarised below.

Long-term inflation expectations for the euro area are de-anchored among German households at the time of the survey. Across the four treatment groups, respondents expect high inflation to persist ten years into the future and give low weight to outcomes close to the 2% target. Moreover, long-term expectations are typically higher for OOH inflation than overall inflation. For the baseline group, overall inflation expectations were 3.7% on average, while for OOH expectations, they were about 3.9%.

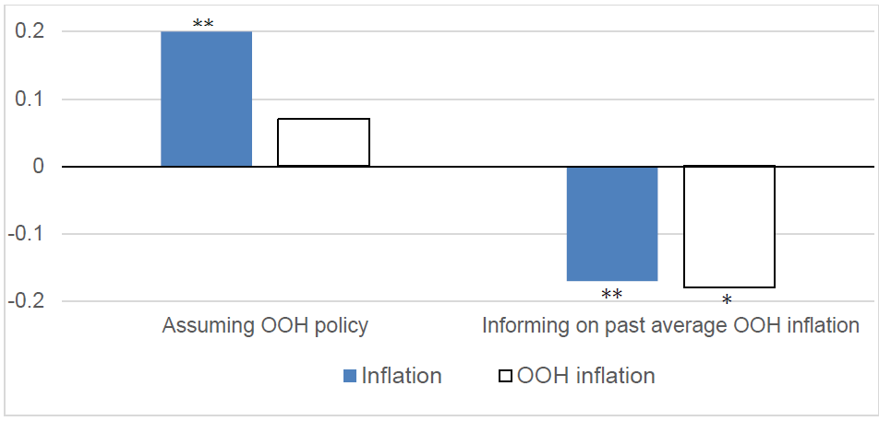

Providing respondents with information related to OOH costs affects their long-term expectations. Relative to the baseline group, overall inflation expectations are 20 basis points higher in the OOH policy group, which assumes the full OOH inclusion today (Chart 1, left). This effect is both statistically and economically significant. For instance, our sample’s estimates of the well-documented effects of female gender (+14 bps) or higher education (-17bps) on average inflation expectations are smaller in absolute values than this treatment effect. However, informing the respondents additionally about the past average of OOH inflation (OOH policy + mean) almost fully reverses this upward (de-anchoring) effect on overall inflation expectations and lowers OOH inflation expectations (Chart 1, right). Relative to the OOH policy group, mean overall inflation (OOH inflation) expectations are 17 (18) basis points lower in the OOH policy + mean group.

Chart 1. Selected average treatment effects on (OOH) inflation expectations

Notes: The left bars show the treatment effect of Group 3 — asked to assume OOH costs are included — vs baseline Group 1. The right bars refer to the comparison of Group 4 vs Group 3, where the only difference is that the former is informed on the past average of OOH inflation being 2.2%. Significance as * p<10, ** p<0.05.

The mediation analysis in our paper suggests that higher non-OOH inflation expectations explain higher overall inflation expectations in the OOH policy group compared to the baseline group, while OOH inflation expectations are broadly the same. Meanwhile, information about past OOH inflation lowers overall inflation expectations through both OOH and non-OOH components in the OOH policy + mean group relative to the OOH policy group.

What could explain the treatment effect via the non-OOH component of overall inflation expectations? Using a Bayesian learning model, we argue that respondents find the 2% medium-term inflation target less credible when asked to assume OOH policy is in place. As a result, they update their prior long-term inflation expectations for all inflation components less strongly to the target. However, including information on average OOH inflation reinforces the target’s credibility, lowering the expectations for both OOH and non-OOH inflation components.

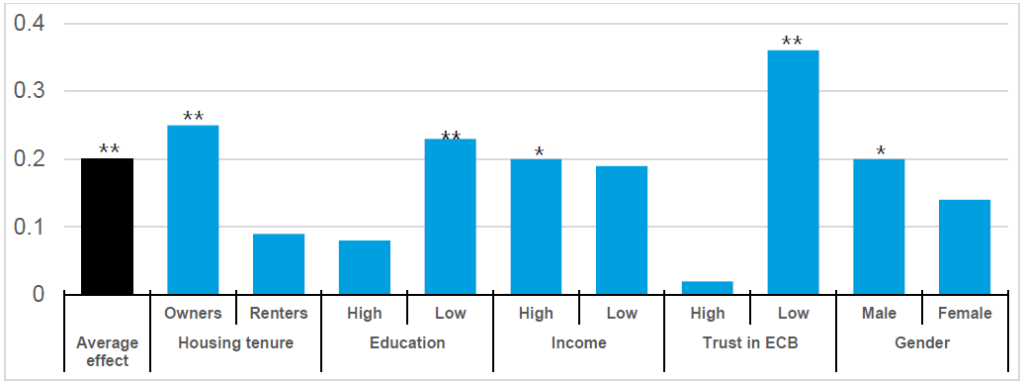

The OOH policy treatment effect on overall inflation expectations, positive on average, differs across types of respondents (Chart 2). We find highly significant de-anchoring effects for homeowners, respondents with low trust in the ECB’s ability to meet its price stability objective, and those with lower levels of education.2 These groups also show a stronger downward reaction when informed on past average OOH inflation, as well as low-income households, and men. Thus, the effect of central bank communication about the change in OOH treatment on inflation expectations may depend on which respondent groups are reached. For instance, effects may be stronger in countries with higher homeownership rates.

Chart 2. Heterogeneous effects on inflation expectations from assuming OOH costs are included in HICP

Notes: Treatment effect comparisons of OOH policy (group 3) compared to the baseline group (group 1). The first (black) bar shows the average treatment effect; the next (blue) bars show treatment effects based on sample splits. Significance as * p<10, ** p<0.05.

Following the monetary policy strategy review in 2020-21, the ECB has recommended expanding the coverage of OOH costs in the main measure of euro area inflation in the future. We ran a novel survey experiment among German households to examine whether implementing this change would influence their long-term inflation expectations for the euro area.

Our survey results show that long-run expectations are typically higher for OOH inflation than overall inflation, and that both are unanchored from the ECB’s target at the time of the survey. Furthermore, inflation expectations are significantly higher if OOH costs are assumed to be fully included in the inflation measure. This positive information effect is heterogeneous as, among others, homeowners and respondents with low trust in the ECB react more strongly. However, this de-anchoring effect could be prevented if information about past OOH inflation, which averaged 2.2% over the ten years before the survey, is also given.

Overall, households generally seem to lack trust in the ECB to achieve its inflation target at the time of the survey, and communicating the inclusion of OOH costs in the inflation measure could further de-anchor long-term inflation expectations. This effect strongly depends on household characteristics. However, we show that a more detailed communication regarding the change could ensure the stability of long-term inflation expectations.

Dhamija, V., Nunes, R., and Tara, R. (2023). House price expectations and inflation expectations: Evidence from survey data. Discussion papers 2318, Centre for Macroeconomics (CFM).

ECB (2021). ECB Listens – Summary report of the ECB Listens Portal responses. https://www.ecb.europa.eu/home/search/review/html/ecb.strategyreview002.en.html.

Ehrmann, M., Georgarakos, D., and Kenny, G. (2023). Credibility gains from communicating with the public: evidence from the ECB’s new monetary policy strategy. Working Paper Series 2785, European Central Bank.

Meyler, A., Moreno, M. S., Arioli, R., and Fischer, F. (2021). Results of a special survey of professional forecasters on the ECB’s new monetary policy strategy. Economic Bulletin Boxes, 7.

Wauters, J. (2021). Summary Report on the NBB Listens Portal. Economic Review, (iii):24-42.

Wauters, J., Zekaite, Z., and Garabedian, G. (2024). Owner-occupied housing costs, policy communication, and inflation expectations. Working Paper Research 449, National Bank of Belgium.

Presently, the HICP covers rents paid for housing (with a weight of around 6%), routine maintenance, minor repairs, and other running costs for tenants and owner-occupiers.

While the increase is statistically significant at the 10% level for high-income households and not for their low-income counterparts, the effect size is almost the same.