The policy brief is based on ECB Working Paper Series, No 2963.

The market for ETFs in the euro area has grown considerably in recent years, with investment funds being the largest type of investor in ETFs. During the March 2020 market turmoil, investment funds experienced substantial outflows. We examine to what extent investment funds used ETFs to manage liquidity during this stress episode. Our results show that investment funds were the most procyclical investors in the ETF market during the first quarter of 2020, relative to other investors. Also, investment funds that faced larger outflows in March 2020 scaled down their ETF holdings more strongly than investment funds with smaller outflows. Finally, ETFs with higher investment fund ownership experienced larger outflows in the primary market. These results are consistent with open-ended funds passing on their outflows to their ETF holdings and point to a novel contagion channel from the investment fund sector to the market for ETFs.

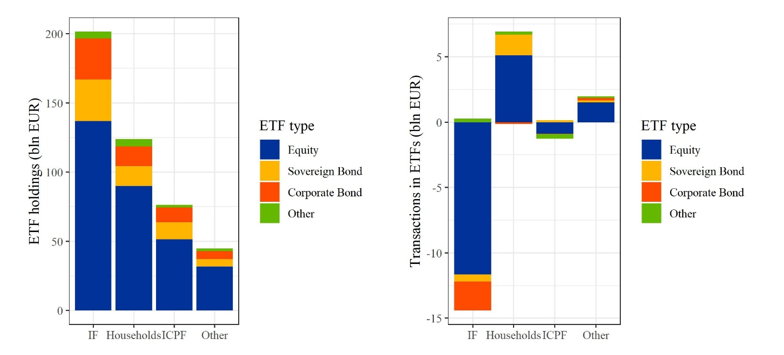

The market for exchange-traded funds (ETFs) in the euro area has experienced significant growth over the past decade, reaching €1.5 trillion in total net assets by 2023. Within the euro area, investment funds are the largest group of investors in ETFs (Figure 1, left-hand side). Investment funds may invest in ETF shares for a variety of reasons. Besides the low-cost diversification opportunities provided by ETFs, open-ended funds may also use ETFs for liquidity management purposes (Grill, Lambert, Watfe, Weistroffer, & Marquardt, 2018; Sherrill, Shirley, & Stark, 2020). The intraday liquidity inherent to the ETF structure makes ETFs a viable alternative to cash and other liquid asset holdings for managing liquidity in a portfolio context, while providing higher expected returns. At the same time, ETFs generally have a low tracking error and allow for a closer alignment with a fund’s portfolio benchmark.

During the COVID-19 market turmoil in March 2020, ETFs suffered from significant redemptions and the spread between ETF share prices and net asset values widened substantially (European Central Bank, 2020). The redemptions in ETFs coincided with substantial ETF sales by investment funds, which faced significant outflows themselves during this period. This Policy Brief summarises the findings of a recent analysis assessing the role of open-ended investment funds in ETF markets during market stress (Dekker, Molestina Vivar, & Weistroffer, 2024). By linking ETF redemptions to outflows faced by other investment funds, it highlights a novel contagion channel from the open-ended investment fund sector to ETF markets.

The investor base of ETFs consists of various investor types, including investment funds, households, insurance companies, and pension funds. Investment funds are the largest holders of ETFs in the euro area, followed by households and insurance companies/pension funds (Figure 1, left hand side). Most of the investment funds that hold ETFs are classified as mixed asset funds that allocate their investments to multiple asset classes simultaneously, including ‘funds of funds’ which predominantly invest in shares of other investment funds.

Figure 1 (right-hand side) shows that the investment fund sector was on aggregate the largest net seller of ETFs during the first quarter of 2020. Other sectors sold less ETFs in absolute amounts (ICPF) or were net buyers of ETFs (in particular households), suggesting that investment funds were the most procyclical investor type in ETFs during the COVID-19 crisis.

To investigate this point more formally, we compare the behaviour of different types of investors within the same ETF during the first quarter of 2020 in a regression framework. By keeping the ETF fixed, we implicitly control for ETF characteristics. This way, we can rule out the alternative explanation that ETF sales are driven by ETF characteristics, such as the ETF’s underlying portfolio composition. The results from these tests suggest that investment funds on average scaled down their ETF holdings more strongly than other investor sectors. The economic magnitude of this result is material. For instance, investment funds liquidated their equity ETFs by an additional 22 percentage points relative to households that held the same ETF. For corporate bond ETFs, this difference is even larger and amounts to 38 percentage points.

These results are in line with recent findings for open-ended equity and corporate bond funds (Fricke, Jank, & Wilke, 2023; Allaire, Breckenfelder, & Hoerova, 2023): also for these funds, the investment fund sector appears to be the most procyclical investor type.

Figure 1. Ownership and transactions in euro area ETFs during 2020-Q1

Notes: The left-hand panel shows the value of ETFs held by euro area investors as of December 2019, broken down by investor type and ETF type. The sample of ETFs consists of ETFs belonging to the Undertaking for Collective Investment in Transferable Securities (UCITS) framework. We distinguish between investment funds (IF), households, insurance companies and pension funds (ICPF), and the remaining investor types are classified as ‘Other’. The right-hand panel shows the net transactions by euro area investors during the first quarter of 2020, broken down by investor type and ETF type. Source: Refinitiv Lipper, Securities Holdings Statistics.

During the peak of the COVID-19 market turmoil, open-ended funds suffered from severe outflows. In order to accommodate these outflows, open-ended funds engaged in large asset sales, including sales of ETFs. A natural hypothesis is therefore that the large ETF sales by investment funds are driven by the fact that those funds were themselves suffering from large outflows, which gave rise to significant liquidity needs. We therefore exploit the cross-section of open-ended funds to test whether ETF sales were indeed larger for those funds that were subject to larger outflows.

By comparing the selling decisions of various open-ended funds in the same ETF, we again implicitly control for ETF characteristics. By doing so, we also rule out the possible alternative explanation that the selling decision of a given fund is purely driven by ETF characteristics. In line with our hypothesis, we indeed find that open-ended funds that faced larger outflows sold relatively more ETFs compared to other open-ended funds that faced smaller outflows. Specifically, our tests reveal that a one percentage point increase in outflows during March 2020 implies a 1.4 percentage point additional reduction in ETF holdings.

Fund managers can employ various liquidity management strategies to accommodate flows. For instance, fund managers can horizontally slice their portfolios in response to outflows, meaning that they sell their most liquid assets first in order to minimize liquidation and portfolio rebalancing costs. Alternatively, fund managers can choose to vertically slice their portfolios, meaning that they sell assets in proportion to their portfolio weights to preserve the fund’s portfolio composition. Since both strategies would predict that larger outflows would be associated with larger ETF sales, we test whether fund managers liquidated a larger fraction of their ETF holdings relative to their holdings in other asset types.

In our sample of open-ended funds, other investment fund shares comprise the largest portfolio component. This is not surprising given that a material fraction of the funds in our sample can be classified as ‘funds of funds’. For funds investing both in other investment fund shares as well as ETF shares, we find that an increase in net outflows during March 2020 is associated with a larger reduction in ETF share holdings relative to holdings in other investment fund shares. These results suggest that funds relied relatively more on selling ETF shares than other investment fund shares when accommodating outflows during March 2020. A potential explanation is that the intraday liquidity offered by ETFs made them the preferred instrument to raise liquidity over a short period. Overall, our results suggest that open-ended funds used ETFs as a tool for managing liquidity in times of market stress.

Because of the large presence of investment funds in the ETF market, it is plausible that ETF sales by investment funds had a material impact on primary ETF flows. This can however not be observed directly, as only ‘Authorized Participants (APs)’ are able to create and redeem ETF shares, while investment funds usually trade ETFs on secondary markets.1 We thus hypothesise that sales of ETFs by investment funds led to significant liquidity imbalances for the corresponding ETFs in secondary markets, subsequently driving APs to redeem ETF shares.

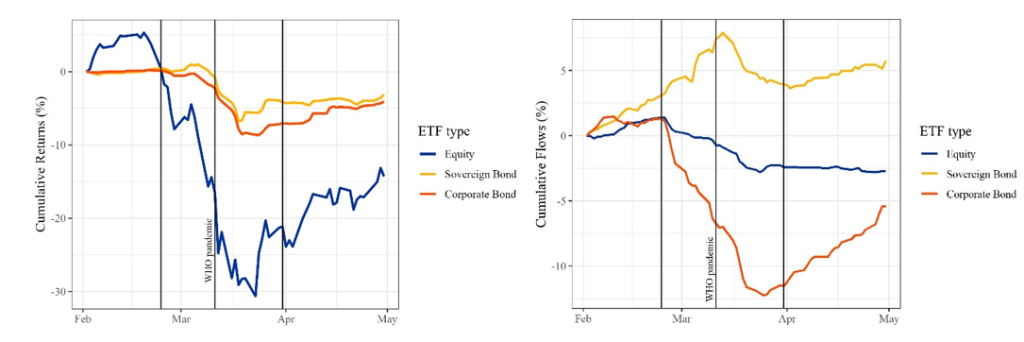

Figure 2 shows the aggregate cumulative returns (left-hand side) and cumulative flows (right-hand side) for different types of ETFs during the COVID-19 market turmoil. All types of ETFs faced negative cumulative returns between February 24th and March 31st, with equity ETFs suffering from the largest declines in value. Despite the more negative returns for equity ETFs, observed outflows were comparatively larger for corporate bond ETFs. Moreover, sovereign bond ETFs even faced net inflows during the COVID-19 episode.

Based on a multivariate panel regression model, in which we control for lagged ETF performance among other variables, we find that ETFs with a higher concentration of investment fund ownership experienced significantly larger outflows in the primary market during the COVID-19 crisis. Specifically, a one-standard deviation increase in lagged investment fund ownership is associated with an increase in daily net outflows of 7 basis points for equity ETFs and 17 basis points for corporate bond ETFs during the peak phase of the crisis (March 12th – March 31st). This is an economically meaningful effect given that average daily flows amounted to -12 basis points for equity ETFs and -38 basis points for corporate bond ETFs during March 12th – March 31st.

In sum, the link between open-ended investment fund outflows and primary ETF redemptions points to a possible contagion channel, which has not been much explored to date. Stress in the open-ended fund sector can, through this channel, lead to material spill-over effects to ETF markets.

Figure 2. ETF performance and primary ETF flows during 2020-Q1.

Notes: The left-hand panel shows aggregate cumulative returns for all UCITS ETFs, broken down by ETF type. The right-hand panel shows cumulative primary flows for all UCITS ETFs, broken down by ETF type. The starting date in both panels is February 1st, 2020. The vertical lines in both panels correspond to February 24th, March 11th, and March 31st, respectively. Source: Refinitiv Lipper.

Investment funds are the largest group of ETF investors in the euro area. When comparing the behaviour of different investor types within the same ETF (at ISIN level) within the same quarter, we find that investment funds were the most procyclical investor type during the COVID-19 crisis. Moreover, we find that investment funds facing large outflows sold significantly more ETFs during March 2020 compared to funds with lower outflows. This finding is consistent with the use of ETFs by other investment funds for managing liquidity and raising cash. Finally, we find that a larger share of fund ownership in ETFs translates into more sizable redemptions in the primary market for equity and corporate bond ETFs during the COVID-19 episode.

Selling ETF shares in stressed markets allowed open-ended funds to preserve larger cash positions and holdings on to other assets. At the same time, they were passing-on the increased liquidity demand to the ETFs and ultimately to the liquidity providers in underlying securities markets. The results are consistent with open-ended investment funds passing on a substantial part of their outflows (the ‘hot potato’) to the ETFs that they are invested in. As such, our findings highlight an important contagion channel from the open-ended fund sector to ETF markets.

Allaire, N., Breckenfelder, J., & Hoerova, M. (2023). Fund fragility: the role of investor base. ECB Working Paper No. 2874.

Dekker, L., Molestina Vivar, L., & Weistroffer, C. (2024). Passing on the hot potato: the use of ETFs by open-ended funds to manage redemption requests. ECB Working Paper No. 2963.

European Central Bank. (2020). Financial Stability Review.

Fricke, D., Jank, S., & Wilke, H. (2023). Who Creates and Who Bears Flow Externalities in Mutual Funds? Available at SSRN 4227047.

Grill, M., Lambert, C., Watfe, G., Weistroffer, C., & Marquardt, P. (2018). Counterparty and liquidity risks in exchange-traded funds. Financial Stability Review, 2.

Sherrill, D. E., Shirley, S. E., & Stark, J. R. (2020). ETF use among actively managed mutual fund portfolios. Journal of Financial Markets, 100529.

For instance, in a hypothetical situation where ETF sales by investment funds would have been fully absorbed by other market participants, ETF sales by investment funds may have had no effect on primary ETF flows.