The contents included in this note do not necessarily reflect the official opinion of the European Commission. Responsibility for the information and views expressed lies entirely with the authors.

This note discusses the implications of physical risk from climate change for local banks. Our discussion suggests that inherent characteristics such as geographical concentration, limited size and significant support to the agricultural sector may expose local banks to physical risk at a greater extent than other bank types, mainly via the lending channel. In addition, we argue that physical risk may have a negative impact on the lending capacity of local banks when they have limited access to risk-sharing mechanisms, face obstacles in raising capital or fail to effectively integrate physical risk into existing risk management frameworks due to lack of data or expertise. These elements are expected to affect local banks unevenly, depending on the specific impact of climate change in the geographic areas where they operate and on their organisational structure (e.g. whether or not they are part of a group or network). In this context, we also discuss what role relationship banking and availability of soft information can play in the management and pricing of physical risk.

The summer of 2023 is likely to be remembered by many as one of the hottest summer seasons in recorded history1. Natural ecosystems, human beings as well as businesses and other economic players all experienced the unprecedented consequences brought about by destructive heatwaves, wildfires and droughts, which are but a few examples of extreme weather-related events that are bound to increase in both frequency and magnitude within a warmer climate (e.g. IPCC, 2018). In line with the potentially catastrophic consequences for nature and people, there is an increasing awareness concerning the effective materiality of climate change for businesses, households, public institutions and financial intermediaries (e.g. BCBS, 2021; Bolton et al., 2020).

This note discusses the implications of physical risk from climate change for local banks. We define local banks as banks of relatively small size that primarily serve local businesses and households and are closely embedded in local economies. Local banks are essential actors for the development of local communities and territories, and often play a distinctive role within the financial system by extensively serving small and medium enterprises, households and associations (e.g. Ferri et al., 2014; Masera, 2019).

This note begins with an overview of physical risk and its transmission channels to banks’ financial risks. The central part of the note reviews the main features of local banks that are likely to affect the impact of physical risk drivers on local banks’ lending. This analysis includes the main findings from our current work on the impact of physical risk on credit risk for the US banking sector. The note concludes by discussing some key policy considerations and by highlighting the need for further research.

The profound consequences of climate change for nature and the economy have spurred growing interest in understanding how banks and other financial institutions may be impacted by climate risks. Mark Carney, former Governor of the Bank of England and former Chair of the Financial Stability Board, was the first to propose a typology of climate-related risk factors in a famous speech given at Lloyd’s London in September 2015 (Carney, 2015). In describing climate change as the ‘Tragedy of the Horizon’, Carney (2015) explains that climate change may influence financial risks and the stability of the financial system at large via three main channels: physical risk, transition risk and liability risk. This note focuses on physical risk2.

Physical risk indicates the direct losses caused by long-term shifts in climate patterns or extreme weather events. Long-term shifts in climate patterns (chronic physical risk) include higher average temperatures, melting glaciers and rising sea levels. Examples of extreme weather events (acute physical risk) are hurricanes, droughts, floods and heatwaves. All these risks have the potential to cause severe disruption to businesses and life, even forcing the relocation of companies and households away from affected or exposed areas. Chronic and acute physical risk factors are closely interconnected, in that extreme weather events are exacerbated by long-term shifts in climate patterns (IPCC, 2021).

Many of the risks associated with a changing climate, including physical risk, present new features such as non-linearity, (likely) fat-tailed probability distributions, interconnectedness and irreversibility (e.g. BCBS, 2021; Bolton et al., 2020). Nevertheless, researchers and policymakers agree that climate-related risks should not be treated as a standalone category but rather as an additional source of financial risks. In this sense, physical risk from climate change has the potential to transmit to credit, market, liquidity and operational risk (e.g. Migliorelli, 2023).

The physical risk from climate change might harm the quality of banks’ credit portfolios (credit risk) by weakening the capacity of households and businesses to repay their debt (income effect). Acute and chronic physical risk drivers such as floods or long-term shifts in temperatures could reduce borrowers’ revenue through decreased or lower-quality production (e.g. agricultural yield), resulting in a higher probability of default and loss given default. Physical risk also has the potential to translate into higher credit risk by causing write-offs of assets located in areas significantly exposed to physical risk or by eroding the value of collateral because of damages to property (wealth effect).

Along with credit risk, physical risk factors might exacerbate the level of market risk faced by banks. Extreme weather events such as tropical and convective storms might cause large-scale damage to national infrastructure, for example telecommunication infrastructure and rail networks. Large-scale damage to national infrastructure could result in a slowdown in economic growth and an ensuing increase in sovereign risk, with a corresponding drop in the value of government securities held on banks’ balance sheets.

As concerns liquidity risk, there is increasing evidence in the literature that banks’ liquidity buffers may be impacted by physical risk factors (e.g. Brown et al., 2021). For example, households and businesses hit by extreme weather events may withdraw deposits or draw on credit lines to finance recovery and other cash flow needs.

Finally, acute and chronic weather-related events could disrupt banks’ business and translate into higher operational risk. Direct damage to banks’ premises, IT infrastructure or commercial fleet is more likely within a warmer climate, which may also have severe implications for staff’s productivity and well-being. In addition, banks’ operational performance could be weakened by higher volatility in the prices of key inputs such as electricity and water.

In the last few years, academic researchers, financial intermediaries and financial regulators have been focussing their attention on the implications of climate change for credit and market risk. In this respect, efforts have been recently made by financial actors to incorporate physical risk into existing risk management frameworks (e.g. BCBS, 2022)3. Under an operational point of view, this has been mainly done by developing new forward-looking computational modelling, notably scenario analysis, and stress tests. In this way, initial measures of the impact of physical risk on both the credit and market portfolios are being made available (e.g. ACPR, 2023; BoE, 2022). Recent evidence highlighting that banks are increasingly pricing physical risk in new loans issuances (Huang et al., 2022; Nguyen et al., 2022) confirms the start of a transformative effort. On a broader perspective, climate-related risks are expected to progressively become a topic of strategic relevance for all financial intermediaries, with important governance implications (e.g. BCBS, 2022; Caby et al., 2022).

Given its increasing materiality, physical risk has received growing attention also by financial regulators, as exemplified by the inclusion of two physical risk scenarios (flood risk and drought and heat risk) in the ECB Climate Risk Stress Test conducted in 2022 (ECB, 2022). The aim of recently run climate stress tests was to assess the readiness of financial intermediaries to manage climate-related financial risks. Conclusions highlighted that, despite recent advances, climate scenario analysis is still in its infancy, with important data gaps remaining and making projections of climate-related losses on credit and market portfolios still uncertain (BoE, 2022). Furthermore, high heterogeneity has emerged in terms of expected risk exposure, risk awareness and governance of the risks (e.g. BoE, 2022; ECB, 2022).

Within the financial sector, efforts to shed light on how banks are responding to climate-related risks have tended thus far to focus on larger, global systemically important banks (e.g. Beltran et al., 2023), whilst smaller, locally oriented banks have received little attention. Our initial assessment of the link between physical risk and lending hints that key bank characteristics such as size and capitalisation may account for a differential impact of risk factors on banks’ credit risk (see Box 1).

There is a dearth of literature on how other important bank characteristics, for example being locally owned and operated, affect the transmission of physical risk to financial risks, and to credit risk in particular. Against this backdrop, we are interested in understanding how physical risk factors may impact lending by local banks. Examples of local banks include cooperative banks in Europe and community banks in the US, but other examples are building societies in the UK and credit unions in the US. In this note, we define local banks as banks of relatively small size that primarily serve local businesses and households and are closely embedded in local economies4.

The expected materiality of physical risk for local banks will likely depend on the combination of several nested factors5. Differently from larger, highly diversified banks, these factors include specific features of local banks’ operations such as geographic concentration and significant exposure to the agricultural sector; structural characteristics like capitalisation rigidity and limited size; and the availability of soft information on both existing and potential clients.

Box 1: Impact of physical risk on credit risk: are bank loans ‘getting warmer’? (source: Caselli, 2024)

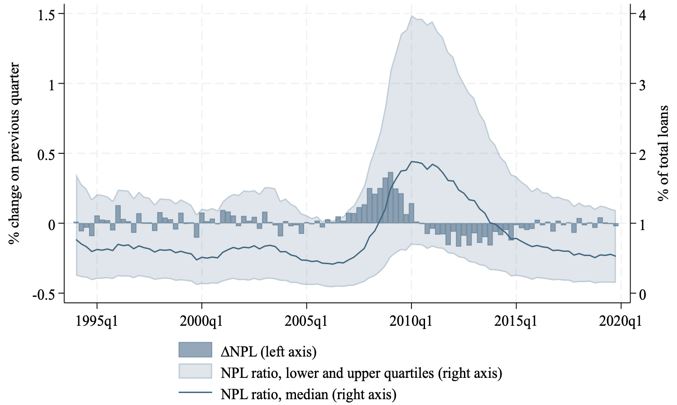

Whilst the implications of physical risk factors for the quantity and pricing of bank loans have attracted increasing attention by the banking literature (e.g. Huang et al., 2022; Nguyen et al., 2022), the materiality of physical risk for the quality of banks’ loan portfolios has so far been less researched. Our current work contributes to this line of enquiry by exploring the impact of chronic physical risk factors on banks’ credit risk (Caselli, 2024). We seek to establish whether US banks’ loans ‘are getting warmer’ by examining how deviations of temperature from its long-term trend affect banks’ non-performing loans. Figure 1 shows how non-performing loans of the sample banks have changed over the observation period.

Figure 1: Non-performing loans of US commercial banks from 1994q1 to 2019q4

Source: Author’s elaboration based on data from the Consolidated Reports of Condition and Income (Call Reports). Notes: ∆NPL is the average quarterly change in loans not accruing plus loans 90 days or more past due and still accruing (non-performing loans) divided by beginning-of-quarter total loans. The NPL ratio is the ratio of non-performing loans to total loans.

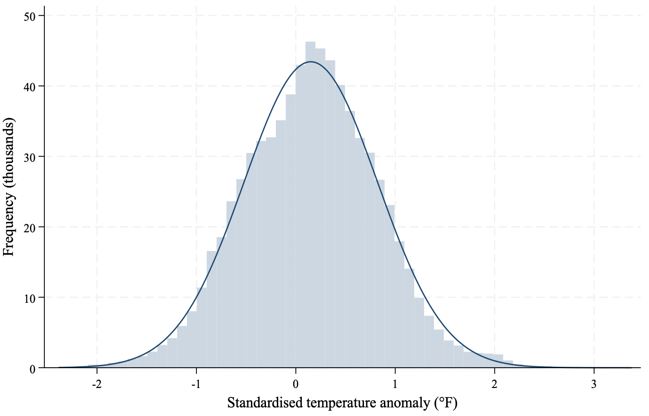

We consider the population of FDIC-insured commercial banks from the contiguous US states over the period 1994Q1 to 2019Q4. Our approach consists in computing a measure of temperature exposure for each bank by taking a weighted average of standardised temperature anomalies across all the counties where a bank’s branches are located, with the weights being the sum of deposits held by the bank in each county. To obtain standardised temperature anomalies, we divide temperature anomalies by the standard deviation of temperature over the period 1981-2010. The distribution of our bank-level measure of temperature exposure is presented in Figure 2.

Figure 2: Non-performing loans of US commercial banks from 1994q1 to 2019q4

Source: Author’s elaboration based on data from the National Oceanic and Atmospheric Administration (NOAA). Notes: Standardised temperature anomaly is the weighted average of standardised temperature anomalies across all the counties where a bank’s branches are located, where the weights are the sum of deposits held by the bank in each county. Standardised temperature anomalies are calculated with respect to the period 1981-2010.

The results of our econometric estimations show that standardised temperature anomalies have a statistically and economically significant effect on banks’ non-performing loans. We find that the quality of US commercial banks’ loan portfolios is negatively impacted by deviations of temperature from its long-term pattern. More precisely, one unit (1°F, or 0.56°C) increase in standardised temperature anomaly causes an increase of 0.010 percentage points in non-performing loans. Considering that the average quarterly change in non-performing loans is 0.013 percentage points, the estimated increase is non-negligible.

We also explore whether exposure to variations in temperature has a differential impact on non-performing loans depending on bank size. To this end, we divide our sample into smaller banks (banks whose total assets are below the 95th percentile in any quarter) and larger banks (those in the top 5% of the size distribution). We find that one unit (1°F, or 0.56°C) increase in standardised temperature anomaly results in an increase of 0.016 percentage points in smaller banks’ non-performing loans, whereas the coefficient on the standardised temperature anomaly term is positive but not statistically significant for larger banks.

Similarly, we test whether physical risk affects non-performing loans of less-capitalised and well-capitalised banks differently by grouping banks based on their capitalisation ratios. This part of the analysis shows that the impact of positive temperature anomalies on non-performing loans is larger for less-capitalised banks (banks whose capitalisation ratios are below the median in any quarter) than for well-capitalised banks (banks whose capitalisation ratios are above the median in any quarter). The coefficient on the standardised temperature anomaly variable is 0.020 for less-capitalised banks and 0.012 for well-capitalised banks.

Overall, these results, which are robust to alternative size and capitalisation thresholds, provide initial evidence that the credit risk of smaller and less-capitalised banks may be more sensitive to the physical risk from climate change compared with larger and well-capitalised banks.

Local banks tend to operate within a limited geographic area. The commitment towards their community and territory often means that these banks are present in otherwise underserved locations. A case in point is the statutory requirement for Banche di Credito Cooperativo (Italian cooperative banks) to provide a minimum of 95% of their loans to local households and businesses. As a result of such a geographical concentration, local banks may not be able to effectively diversify their lending across areas featured by different levels of physical risk. Furthermore, if the area within which most of their activities are concentrated experiences a material physical risk shock, it might be difficult for local banks to reallocate resources from/to unaffected areas and rebalance credit portfolios. An argument can hence be made according to the idea that local banks may tend to suffer from a relatively higher exposure to physical risk compared to geographically well-diversified banks.

Recent data from Italian cooperative banks seems to confirm that local banks face a higher exposure to physical risk due to the features of their operating model (Meucci and Rinaldi, 2022). Specifically, cooperative banks with more than half of their loans to firms in provinces with ‘high’ or ‘very high’ physical risk exposure account for 27% of cooperative banks’ total outstanding credit to firms, against an average figure of 4% across the entire banking sector. Some evidence on the channels through which local and regionally less diversified banks are impacted by natural disasters is also emerging, confirming the relevance in this respect of the lending channel. More specifically, it was found that German savings and cooperative banks located in affected regions during the 2013 flooding of the river Elbe suffered considerably higher, yet short-lived, impairment flows, mostly associated with corporate loans (Shala and Schumacher, 2022).

A common feature of many local banks, in particular community banks in the US and cooperative banks in Europe, is their high exposure to the agricultural sector. In some cases, cooperative banks were founded by groups and associations of farmers as an answer to credit limitations from traditional commercial, profit-oriented lending institutions (e.g. Rabobank in the Netherlands). This high dependence on the agricultural sector is usually captured by their significant market shares in loans to farmers and agricultural firms, and businesses operating within the associated value chains.

Agriculture is among the sectors most exposed to the physical risk from climate change, particularly to heatwaves, droughts and hails. Weather-related events such as large-scale flooding may have significant effects on agricultural yields (Hsiang et al., 2017)6, possibly impairing agricultural firms’ income and their ability to repay debt. Furthermore, agricultural firms’ land and property could suffer damage from extreme weather events, lowering the value of banks’ collaterals. Both of these drivers have in turn the potential to exacerbate the riskiness of local banks’ portfolios.

Literature is now consolidating around the thesis that physical risk from climate change can cause losses for the banking sector and have detrimental effects on banks’ capital buffers (e.g. Battiston et al., 2021; BCBS, 2021). Empirical literature from the US over the period 1994-2012 confirms that weather-related disasters do affect the stability of banks conducting business in affected regions, and weather-related disasters lead to lower equity ratios, more non-performing assets and higher probabilities of default (e.g. Noth and Schüwer, 2023).

Cooperative banks in Europe and other member-owned local banks tend to have strong capitalisation ratios because they are required to add large part of their profits to reserves (e.g. Caselli et al. 2020; Ferri et al., 2014; McKillop et al., 2020). In principle, this feature of their business model could provide cooperative banks with a comparative advantage over less-capitalised banks when natural disasters hit. According to recent evidence, firms connected to a disaster-exposed bank with lowest-quartile capitalisation reduce their borrowing by 6.6% and their tangible assets by 6.9% compared with firms connected to a better capitalised bank (Rehbein and Ongena, 2022). Our empirical research on the physical impacts of climate change (see Box 1) also shows that the materiality of variations in temperature for non-performing loans is lower for well-capitalised banks.

On the other hand, cooperative banks’ capital is accumulated slowly over time, mainly through retained earnings (e.g. McKillop et al., 2020). This means that they may typically face greater obstacles in raising capital than larger, shareholder-owned banks in the event of substantial and unexpected losses, including those caused by physical risk. Similar concerns apply to local banks other than cooperative banks. This structural rigidity in managing capitalisation levels may eventually contribute to limit risk-taking, particularly in situations of high uncertainty about the expected losses from physical risk (due for example to the lack of reliable data and estimations) and high probability of occurrence of climate-related tail events in the geographic areas where local banks operate (high inherent risk).

The ability of local banks to properly manage physical risk may also be impacted by their limited size. In this respect, two elements can be highlighted. The first concerns the capacity to effectively integrate physical risk into existing risk management frameworks. The second refers to the availability of effective risk-sharing mechanisms and diversification opportunities.

Assessing physical risk and defining its incidence in terms of credit risk requires new expertise and technical capacities. The development of forward-looking scenario analysis focused on the possible impacts of physical risk requires the availability of new data and statistical modelling. To this extent, small local banks may not have human resources and financial capacities to be able to carry out the needed transformation within their organisation and adapt their risk management frameworks. Furthermore, one of the problems of small banks is that they tend to be less diversified and hence less able to sustain idiosyncratic shocks. These elements may also impact local banks’ ability to effectively and efficiently price physical risk into lending terms.

The aggregation of small local banks into country-wide groups or networks that has been a strong trend in recent times (e.g. Migliorelli and Lamarque, 2022) may alleviate the impact of these challenges. A risk management function at a central level can indeed provide the necessary expertise in terms of integration of physical risks into existing risk management frameworks, while contributing to diversify the risk exposure. Available literature, albeit still scarce, has already pointed out that local banks exposed to physical risk (namely from flooding) which supplied recovery lending but had no access to geographically diversified interbank markets had higher credit risk and lower equity capital than banks belonging to spatially diversified banking groups or networks (Koetter et al., 2020).

Local banks like many cooperative banks tend to have a comparative advantage over large banks in lending based on ‘soft information’ (Berger et al., 2005), which they collect through continued interactions with their borrowers. Soft information, as opposed to ‘hard information’ based only on credit scores and accounting records, tends to reduce information asymmetries between the bank and its borrowers. The seminal paper by Petersen and Rajan (1994) establishes that relationship lending operates primarily through quantities rather than prices. Their findings, based on a survey of small business finance in the US, reveal that credit availability is increased when small firms establish close ties with their creditors7.

Importantly, emerging literature suggests that local banks have the potential to mitigate the adverse effects of the physical risk drivers of climate change on credit supply. Koetter et al. (2020) exploit the exogenous shock associated with the flooding in the counties around the Elbe basin in 2013 and conclude that small savings and cooperative banks domiciled in unaffected counties increase their supply of corporate recovery lending to firms domiciled in flooded counties. This additional lending is driven by unsecured, non-mortgage lending, but there is no indication that it entails excessive risk-taking or rent-seeking on the part of banks. Further evidence is provided by Álvarez-Román et al. (2023) based on a quasi-experimental design and data on all wildfires in Spain from 2004 to 2017. Such evidence confirms that local banks may attempt to smooth financial conditions for their customers even during times of economic and financial turbulence to preserve borrower-lender relationships (Ferri et al., 2014).

In turn, local banks’ use of soft information might allow for a better assessment of borrowers’ physical risk exposure. For example, Blickle et al. (2022) study the severity of weather disasters for the performance of the US banking sector and show that local banks (banks operating in a single county) reallocate mortgage lending away from areas where flood risk may be higher than flood maps suggest, whereas the same behaviour is not observed for multi-county banks. Therefore, specialist knowledge available to local banks might buffer the impact of physical risk drivers on credit risk, or at least enable a better pricing of this risk.

Despite the growing awareness of the physical, transition and liability risks from climate change for the banking sector, empirical research on the specific consequences for local banks is still very limited. This knowledge gap is problematic, as the severity of climate-induced financial risks is bound to increase within a warmer climate. Overall, there is the need for a better understanding of the factors that may amplify or mitigate the transmission of climate-related risks to local banks’ lending. In this respect, it can be reasonably argued that local banks present specific features which must be taken into account in order to both effectively integrate climate-related risks into existing risk management frameworks and steer the most appropriate regulatory response (if needed).

The evidence reviewed in this note suggests that physical risk from climate change has significant implications for bank lending. Our empirical findings drawn from the US banking sector reveal that positive deviations of temperature from its long-term trend increase non-performing loans, with these effects being stronger for smaller and less-capitalised banks. Our narrative discussion also suggests that physical risk factors could have detrimental impacts on lending by local banks, particularly if they have no or limited access to geographically diversified interbank markets, face obstacles in raising capital and fail to effectively integrate physical risk into existing risk management frameworks due to lack of data or expertise.

At the same time, the overview of some of the key features of local banks points to their possible role as mitigators of the physical impacts of climate change on bank lending. For example, existing literature shows that local banks may alleviate credit constraints in the aftermath of a natural disaster by providing corporate recovery lending to affected firms. Knowledge on borrowers’ exposure to physical risk available to local banks may also facilitate a better pricing of credit risk. Therefore, local banks have the potential to address credit market failures induced by a changing climate, including credit rationing and mispricing of climate-related financial risks, particularly in countries where they hold considerable market shares and strong knowledge of clients and territory.8

The increasing awareness of the materiality of climate-related physical risk and its impact on the financial risks managed by banks finds two main areas of attention in terms of policy action. On the one hand, the need to ensure the effective inclusion of physical risk into existing risk management frameworks at single-intermediary level. On the other hand, the necessity to assess the possible implications in terms of financial stability, and eventually identify mitigating measures within the existing prudential regulation (e.g. Battiston et al., 2021; BoE, 2023)9.

The idea that the design of measurement methodologies to address climate-related risks should be conducted according to the nature, size and significance of the concerned financial institutions would need to guide both industry and regulatory efforts (Migliorelli, 2023). For local banks, this would mean to regularly assess the expected impact of climate change in the territory in which they operate, and identify the main specific risk factors, by applying a forward-looking approach. To this extent, a periodic external evaluation of the physical impacts of climate change in the area of operation would help support decision making. On the other hand, local banks may need to put in place mechanisms of risk diversification and risk sharing in case of an expected high exposure to physical risk. Existing group or network structures featured by regional- or national-level layers can effectively play this risk-mitigating role.

As far as financial stability considerations are concerned, the debate on how to mitigate systemic risk linked to climate change is still open. Capital buffers and measures limiting exposure concentration are instruments that in principle would address physical risk in line with the existing microprudential framework. However, such a discussion has started only recently (Hiebert and Monnin, 2023). In framing the most effective regulatory approach, key elements such as the size of the financial institution and the intensity of the climate-related risks at a single-institution level should be taken into account (Migliorelli, 2023). In this respect, and in line with the application of the principle of proportionality that shapes the regulatory action10, the features and characteristics of local banks need to be explicitly considered when deciding on potential modifications to prudential regulation.

Álvarez-Román L., Mayordomo S., Vergara-Alert C. and Vives X. (2023). Climate risk, soft information, and credit supply. Unpublished manuscript.

Autorité de Contrôle Prudentiel et de Résolution (ACPR) (2023). Scenarios and main assumptions of the 2023 climate stress test exercise. Paris.

Bank of England (BoE) (2022). Results of the 2021 Climate Biennial Exploratory Scenario (CBES). London.

Bank of England (BoE) (2023). Bank of England report on climate-related risks and the regulatory capital frameworks. London.

Basel Committee on Banking Supervision (BCBS) (2021). Climate-related risk drivers and their transmission channels. Basel.

Basel Committee on Banking Supervision (BCBS) (2022). Principles for the effective management and supervision of climate-related financial risks. Basel.

Battiston S., Dafermos Y. and Monasterolo I. (2021). Climate risks and financial stability. Journal of Financial Stability, 54, 100867.

Beltran D. O., Bensen H., Kvien A., McDevitt E., Sanz M.V. and Uysal P. (2023). What are large global banks doing about climate change?. International Finance Discussion Papers, 1368. Washington: Board of Governors of the Federal Reserve System.

Berger A.N., Miller N.H., Petersen M.A., Rajan R.G. and Stein J.C. (2005). Does function follow organizational form? Evidence from the lending practices of large and small banks. Journal of Financial Economics, 76(2), 237-269.

Blickle K.S., Hamerling S.N. and Morgan D.P. (2022). How bad are weather disasters for banks?. Federal Reserve Bank of New York Staff Reports, 990.

Bolton P., Despres M., Da Silva L.A.P., Samama F. and Svartzman R. (2020). The green swan. Central banking and financial stability in the age of climate change. BIS Books.

Brown J.R., Gustafson M.T. and Ivanov I.T. (2021). Weathering cash flow shocks. The Journal of Finance, 76(4), 1731-1772.

Caby J., Ziane Y. and Lamarque E. (2022). The impact of climate change management on banks profitability. Journal of Business Research, 142, 412-422.

Carney M. (2015). Breaking the Tragedy of the Horizon—climate change and financial stability. 29 September 2015. London: Lloyd’s of London.

Caselli G. (2022). How do cooperative banks consider climate risk and climate change?. In: Migliorelli M. and Lamarque E. (Eds), Contemporary trends in European cooperative banking: Sustainability, governance, digital transformation, and health crisis response, 193-223. Cham, Switzerland: Palgrave Macmillan.

Caselli G. (2024). ‘Warming’ loans: Temperature anomalies and credit risk. Unpublished manuscript.

Caselli G., Figueira C. and Nellis, J.G. (2020). Ownership structure and the risk-taking channel of monetary policy transmission. Cambridge Journal of Economics, 44(6), 1329-1364.

Ergungor O.E. (2010). Bank branch presence and access to credit in low- to moderate-income neighbourhoods. Journal of Money, Credit and Banking, 42(7), 1321-1349.

European Central Bank (ECB) (2022). 2022 climate risk stress test. Frankfurt am Main.

Faiella I. and Malvolti D. (2020). The climate risk for finance in Italy. Bank of Italy Occasional Papers, 545.

Ferri G., Kalmi P. and Kerola E. (2014). Does bank ownership affect lending behavior? Evidence from the Euro area. Journal of Banking and Finance, 48, 194-209.

Hiebert P. and Monnin P. (2023). Climate-related systemic risks and macroprudential policy. The INSPIRE Central Banking Toolbox, Policy Briefing Paper 14.

Hsiang S., Kopp R., Jina A., Rising J., Delgado M., Mohan S., Rasmussen D.J., Muir-Wood R., Wilson P., Oppenheimer M., Larsen K. and Houser T. (2017). Estimating economic damage from climate change in the United States. Science, 356(6345), 1362-1369.

Huang H.H., Kerstein J., Wang C. and Wu F. (2022). Firm climate risk, risk management, and bank loan financing. Strategic Management Journal, 43(13), 2849-2880.

Intergovernmental Panel on Climate Change (IPCC) (2018). Special Report. Global warming of 1.5°C.

Intergovernmental Panel on Climate Change (IPCC) (2021). Climate change 2021: The physical science basis.

Koetter M., Noth F. and Rehbein O. (2020). Borrowers under water! Rare disasters, regional banks, and recovery lending. Journal of Financial Intermediation, 43, 100811.

Masera R. (2019). Community banks and local banks: Can we bridge the gap between the two sides of the Atlantic?. Rome: Ecra.

McKillop D., French D., Quinn B., Sobiech A.L. and Wilson, J.O.S. (2020). Cooperative financial institutions: A review of the literature. International Review of Financial Analysis, 71, 101520.

Meucci G. and Rinaldi F. (2022). Bank exposure to climate-related physical risk in Italy: An assessment based on AnaCredit data on loans to non-financial corporations. Bank of Italy Occasional Papers, 706.

Migliorelli M. (2023). Climate change, environmental sustainability, and financial risks. Are we close to un understanding?. Current Opinion in Environmental Sustainability, 65, 101388.

Migliorelli M. and Lamarque E. (2022). The co-evolutionary nature of European cooperative banks. In: Migliorelli, M. and Lamarque, E. (Eds), Contemporary trends in European cooperative banking: Sustainability, governance, digital transformation, and health crisis response, 1-27. Cham, Switzerland: Palgrave Macmillan.

Nguyen D.D., Ongena S., Qi S. and Sila V. (2022). Climate change risk and the cost of mortgage credit. Review of Finance, 26(6), 1509-1549.

Noth F. and Schüwer U. (2023). Natural disasters and bank stability: Evidence from the US financial system. Journal of Environmental Economics and Management, 119, 102792.

Petersen M.A. and Rajan R.G. (1994). The benefits of lending relationships: Evidence from small business data. Journal of Finance, 49(1), 3-37.

Rehbein O. and Ongena S. (2022). Flooded through the back door: The role of bank capital in local shock spillovers. Journal of Financial and Quantitative Analysis, 57(7), 2627-2658.

Shala I. and Schumacher B. (2022). The impact of natural disasters on banks’ impairment flow – Evidence from Germany. Deutsche Bundesbank Discussion Papers, 36.

According to data from the National Oceanic and Atmospheric Administration (NOAA), the period between June and August 2023 ranks as the Northern Hemisphere’s hottest meteorological summer on record, while August 2023 itself was Earth’s hottest August in NOAA’s 174-year climate record.

Transition risk and liability risk are the two other main drivers of climate-related risks to financial risks. Transition risk refers to the economic and financial consequences associated with the transition to a low-carbon economy. Many countries across the world have taken initiatives aimed at reducing human emissions of carbon dioxide in the atmosphere. These initiatives introduce policy, technology and market changes that, albeit a potential source of opportunities for employment and growth in ‘green’ sectors, could lead to ‘stranded assets’ or at least to a revaluation of a wide range of assets. Sectors directly concerned with the extraction and production of fossil fuels are the most exposed to transition risk, but sectors further down the value chain such as utility providers or car manufacturers may also be materially exposed. This fall in asset prices might lead to a decline in the value of banks’ loan portfolios. Unlike physical risk, transition risk is not persistent but could nonetheless threaten the overall stability of the financial system (Faiella and Malvolti, 2020). Liability risk is typical of the insurance sector and relates to the legal liabilities arising from insurance on climate-related losses or damages. Examples include claims from people or businesses who have suffered the consequences of extreme weather events against those parties they deem responsible for exacerbating climate change. For banks, liability risk might materialise in the form of credit risk insofar as borrowers’ rising costs associated with climate-related compensation result in an increase in default rates. Whilst this third type of climate-related risk factors has so far received less attention in the literature compared with physical and transition risk, its significance is bound to increase in the coming years as investors and regulators demand reliable disclosure of climate-related risks.

Parallel work has been made as concerns transition risk.

Other definitions are also in use to identify banks with these or similar characteristics, as for example ‘proximity banks’ (e.g. Masera, 2019).

For a focus on the European cooperative banking sector, see Caselli (2022).

A recent case of large-scale flooding is the one that hit the Emilia-Romagna region in Italy in the spring of 2023.

These findings are confirmed by Berger et al. (2005), who show that small banks are more willing to lend to informationally opaque borrowers than large banks. Conversely, large banks appear to lend mainly to larger firms with good accounting records. Berger et al. (2005) also find that small banks lend at a shorter physical distance, have longer and more exclusive relationships with their borrowers, and are more effective at mitigating credit constraints relative to large banks. More recent evidence indicates that relationship lending may have beneficial effects on loan pricing. According to an analysis on a sample of Ohio mortgages by Ergungor (2010), the presence of a bank branch in a low-to-moderate-income neighbourhood increases mortgage originations and reduces interest spreads. The beneficial effects of bank branch presence in terms of access to credit get stronger the closer the branch to the neighbourhood.

However, the potential for local banks to act as mitigators of the physical impacts of climate change on bank lending will most likely be reduced if climate-related shocks prove to be permanent.

The same applies for transition risk, although it is not within the scope of this note.

In the EU context, the principle of proportionality is laid down in Article 5(4) of the Treaty on European Union. Under this principle, EU measures: must be suitable to achieve the desired end, must be necessary to achieve the desired end, and must not impose a burden on the individual that is excessive in relation to the objective sought to be achieved (proportionality in the narrow sense). It is closely linked to the principle of subsidiarity, which requires that the EU take action only if it is more effective than action taken at the national, regional or local level.