The adoption of inflation tolerance ranges has been proposed by some policymakers and observers in the context of the Fed and the ECB reviews of their strategies. In recent work, we have analyzed, using a standard New Keynesian macroeconomic model, the consequences of tolerance range policies, characterized by a stronger reaction of the central bank to inflation when inflation lies outside the range than when it is close to the target. We argue that (i) a tolerance band should not be an inaction range: the lack of reaction within the band endangers macroeconomic stability and leads to the possibility of multiple equilibria; (ii) the trade-off between the reaction needed outside the range versus inside seems unfavorable: a very strong reaction, when inflation is far from the target, is required to compensate for even a moderately lower reaction within tolerance band.

In the context of recent Monetary Policy Strategy Reviews in the US and the euro area, there has been a renewed interest for the notion of an inflation “tolerance band”, as a possible element to include in a revamped monetary policy framework.

In spite of the recurrence of debates about inflation ranges in discussions of monetary policy frameworks, the analytical literature is surprisingly scarce on the properties of such set-ups. To our knowledge, there has not been a systematic attempt to study such policies in the New-Keynesian model – arguably by now the most standard set-up for monetary policy analysis. In a recent paper (Le Bihan, Marx, Matheron, 2021), we contribute to filling this gap. Papers close to our work are the study of an asymmetric range to offset the deflationary bias coming from the lower bound constraint in Bianchi et al. (2021) and the study of the impact of an indifference range in Chung et al. (2020).

We interpret the notion of “tolerance bands” as the central bank having a more aggressive response to inflation when inflation is outside the “tolerance band” than when it lies within the band. (Other interpretations are briefly discussed in Le Bihan et al., 2021). This notion appears as an extension of the concept of indifference band, in which the policy rate would not react at all to inflation provided it lies within the range. As we argue later, indifference ranges pose a threat to macroeconomic stability, which is the reason why we rather focus on tolerance ranges.

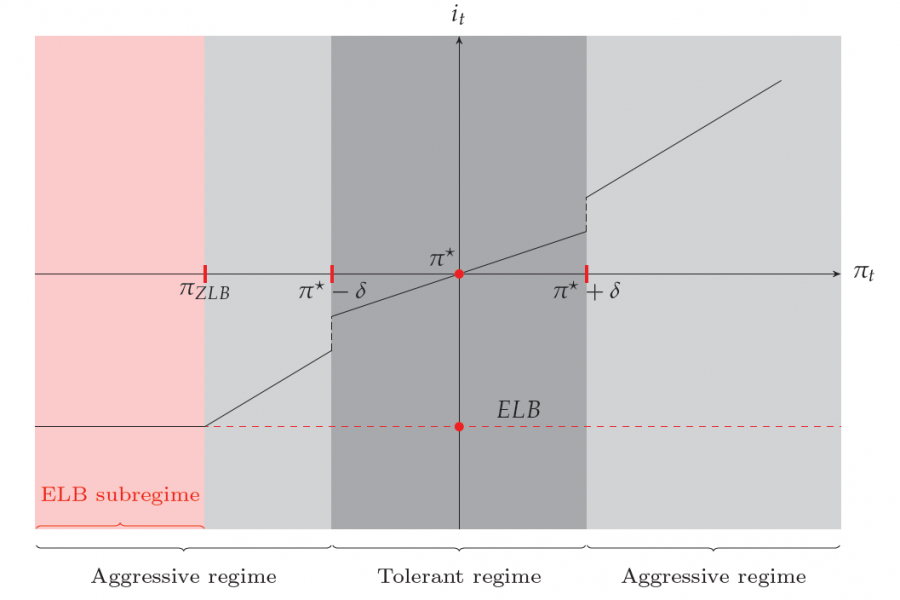

Figure 1 gives an illustration of tolerance ranges in a simplified context in which the central bank would follow a rule focused exclusively on inflation.

Figure 1. The interest rate rule with inflation tolerance ranges

The dark grey area delineates the “tolerant” regime, corresponding to inflation (on the x axis) lying in a given symmetric range around an inflation target. In this regime, the policy rate (on the y axis) is a linear function of inflation, with a given slope. Conversely, the light grey areas delineate the aggressive regime. There, the policy rate is still a linear function of inflation but with a higher slope than in the tolerant regime. There is finally a light red area corresponding to the Effective Lower Bound (ELB) subregime, in which the policy rate is stuck at the ELB. This regime comes into play whenever inflation is below a certain trigger value. Notice that the larger the slope of the policy rule in the aggressive regime, the larger the width of the ELB subregime.

This approach is particularly relevant in the context of the euro area debate. Indeed, back in the initial stage of the euro, prior to 2003, the framework of the Eurosystem could be interpreted as an “indifference range”. More recently, some policy proposals for inflation “tolerance bands” were calling for a higher degree of flexibility in monetary policy. The idea was that, whenever inflation is reasonnably close to the target – and reflecting secondary objectives for monetary policy, such as financial stability concerns –, a given deviation of inflation from target may call for a smaller reaction than otherwise warranted by a strict inflation targeting.

In effect, the state-dependent policy rule we consider captures this notion of policy patience. Indeed, after an inflationnary shock, whenever inflation lies within the bands (i.e, is close to the target), the tolerance range setup will allow for a slower convergence back to the inflation target.

We conduct a theoretical and quantitative evaluation of inflation “tolerance bands” in a standard New Keynesian model. The model consists of two key equations: (i) a New Keynesian Philips curve governing the dynamics of inflation. The latter is assumed a linear function of expected inflation over the next quarter and the output gap. The coefficient linking this quarter’s inflation to the output gap is commonly referred to as the slope of the Phillips curve; (ii) a demand (IS) curve, linking current output gap to the expected output gap over the next quarter and to the ex ante real interest rate. Each of the demand curve and the Phillips curve is also subject to a structural random shock, which jointly trigger inflation and output dynamics.

The model is closed by a policy rule similar to that described in Figure 1. Technically, this policy rule induces a non-linearity in the model, which raises a serious computational challenge. We address this issue resorting to the endogenous regime-switching approach developed by Barthe lemy and Marx (2017).

Our analysis (reported in details in Le Bihan et al., 2021) leads to several clear-cut conclusions. First, to achieve macroeconomic stability, an active monetary policy rule is needed even when inflation lies within the tolerance range. In particular, we show that a pure indifference range would be conducive to unwarranted macroeconomic fluctuations resulting from sunspot equilibria. Thus, a policy maker actively seeking to stabilize inflation should refrain from adopting indifference ranges. This provides a formal basis for claims by policymakers (e.g. in Coeure , 2019) that a tolerance range should not be interpreted as an inaction range.

Second, there is a trade-off between the degree of activism within the inflation range vs. that outside the range, which proves to be quantitatively unfavorable. Imagine the following policy scenario. The policy maker considers lowering the response to inflation within the tolerant regime and at the same time increasing the reaction in the aggressive regime, in such a way as to keep the variance of inflation unchanged. We show that the required adjustment of the reaction to inflation in the aggressive regime is substantial.

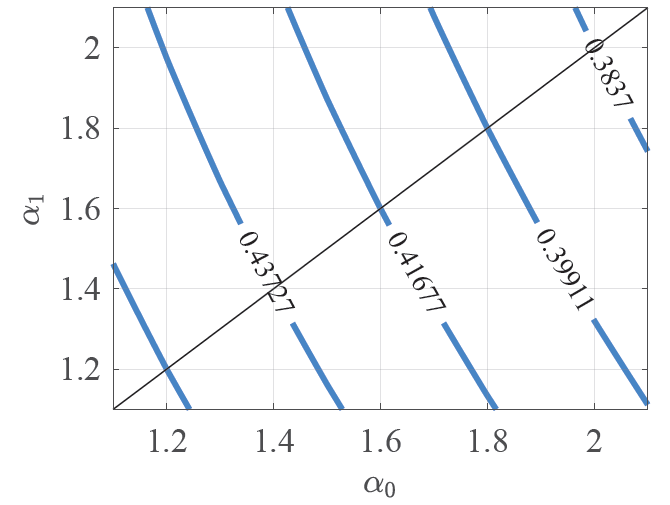

This is illustrated in Figure 2. On the x axis, we report the coefficient of reaction to inflation in the tolerant regime. The coefficient of reaction in the aggressive regime is on the y axis. The dark 45-degree line corresponds to policy configurations in wich the tolerant and the aggressive regimes exactly coincide. Each blue line gives the different combinations of reaction coefficients in and out of the tolerance regime yielding the same variance of inflation (each line corresponding to a certain variance).

As the figure makes clear, the “iso-variance curves” are downward sloping and rather steep. The slope is close to -3. Thus, starting from the interestion of any blue curve with the 45-degree line, if the central bank wishes to lower the reaction to inflation in the tolerant regime by 0.1 (say moving this coefficient from 1.5 to 1.4), the coefficient in the aggressive regime will have to increase by about 0.3 (i.e., move from 1.5 to 1.8).

Figure 2. Iso-variance curves

Moreover, along these “iso-variance” curves, the volatility of both the output gap and the nominal interest rate increases with the difference between the degrees of reaction to inflation inside and outside the tolerance range. Thus: it is indeed possible to maintain a constant level of inflation volatility by adopting a slightly more lenient policy within the tolerance range and a strongly more aggressive policy outside the range. But this comes at the cost of a substantial increase in the volatility of the nominal interest rate. Put another way, if the adoption of a tolerance range were motivated by financial stability concerns, the strategy would defeat its own purpose.

Incidentally, our analysis also shows that when the risk of interest rates hitting the Zero Lower Bound (or an Effective Lower Bound) is taken into account, while the overall stabilization performances are worsened, the trade-off involved by tolerance ranges is broadly unchanged.

There is certainly the need for further work on inflation ranges to incorporate other possible functions, e.g., monitoring the central bank. However, our analysis shows that adoption of inflation tolerance ranges raises several challenges for the central bank. First, such ranges should not be designed as inaction ranges. The concern for macroeconomic stability requires an active policy even within the tolerance range. Second, tolerance ranges come hand in hand with an increased volatility of the nominal interest rate and the output gap, arguably an undesirable feature of any policy concerned with macroeconomic stability. Our work has not been designed to analyse the current spike in inflation in advanced economies. Extrapolating on our results however, one can easily conjecture that the ECB would not have been in a better position to address the challenges raised by this spike if it had concluded it Strategy Review by adopting an inflation tolerance range.

Barthélemy, Jean and Magali Marx. «Solving endogenous regime switching models», Journal of Economic Dynamics and Control, vol 77(C), 2017, pages 1-25.

Bianchi, Francesco, Leonardo Melosi and Matthias Rottner. «Hitting the elusive inflation target», Journal of Monetary Economics, Elsevier, vol. 124 (C), p107-122.

Chung, Hess, Brian M. Doyle, James Hebden and Michael Siemer. «Considerations regarding inflation ranges», FEDS Working Paper no 2020-75, 2020.

Coeuré, Benoît (2019): «Monetary policy: lifting the veil of effectiveness » Speech at the at the ECB colloquium on «Monetary policy: the challenges ahead».

Le Bihan, Hervé, Magali Marx and Julien Matheron. «Inflation tolerance ranges in the New Keynesian model», Banco de España Working Paper Series, 2021, No 2142.

The views expressed herein are those of the authors and should not necessarily be interpreted as reflecting those of the España, the Banque de France or the Eurosystem.