References

Barro, R. (2006), ‘Rare disasters and asset markets in the twentieth century’, Quarterly Journal of Economics 121, 823–866.

Bilal, A. & Känzig, D. R. (2024), ‘The macroeconomic impact of climate change: Global vs. local temperature’, NBER WP No. w32450.

ECB (2021), ‘Climate change and monetary policy in the euro area’, Occasional Paper Series 271.

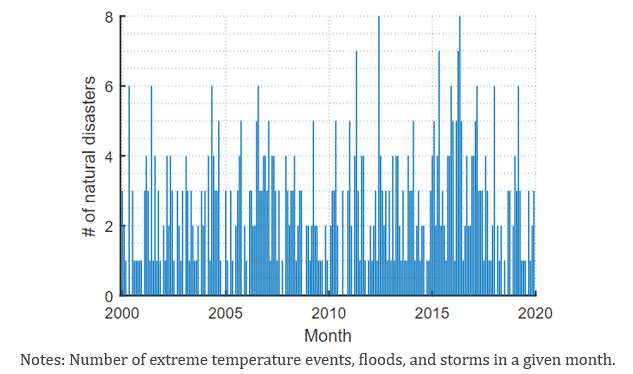

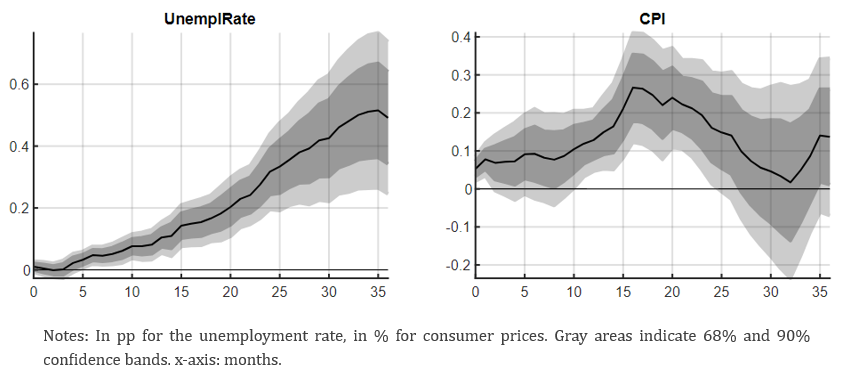

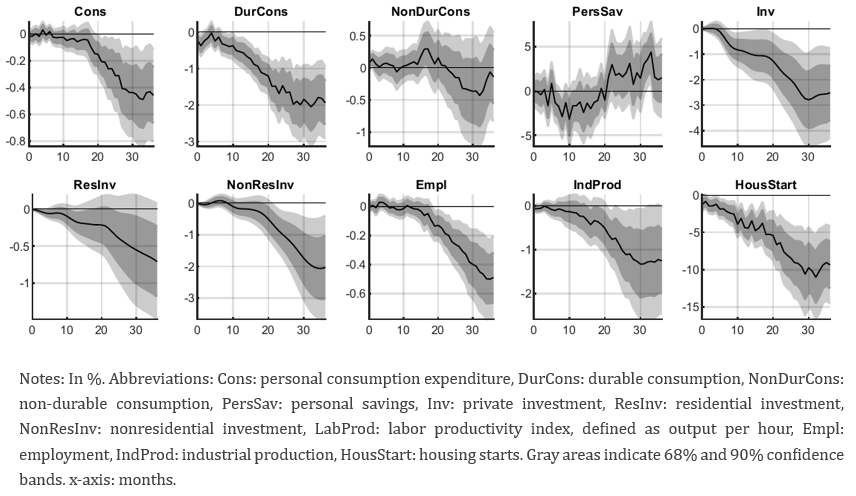

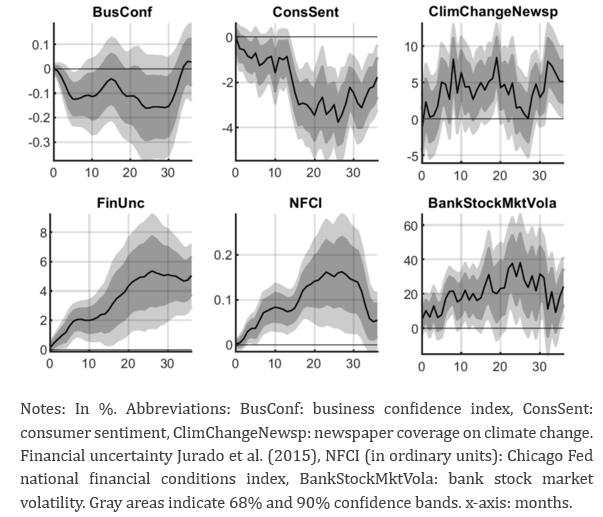

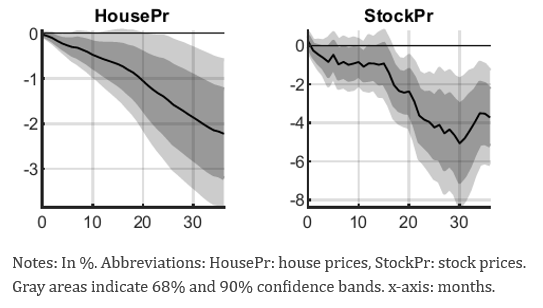

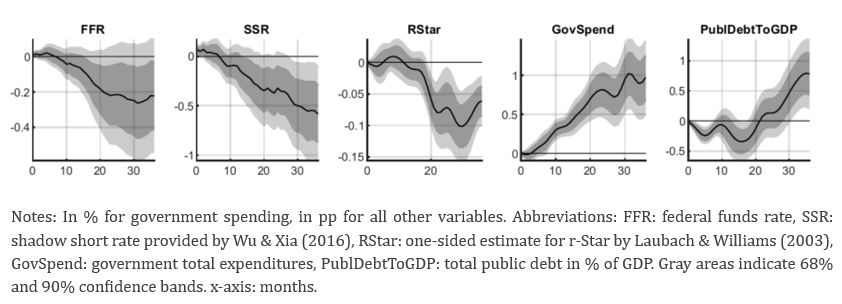

Eickmeier, S., Quast, J. & Schüler, Y. (2024), ‘Macroeconomic and financial effects of natural disasters’, Deutsche Bundesbank Discussion Paper 45/2024.

Laubach, T. & Williams, J. C. (2003), ‘Measuring the natural rate of interest’, Review of Economics and Statistics 85, 1063–1070.

Wu, J. C. & Xia, F. D. (2016), ‘Measuring the macroeconomic impact of monetary policy at the zero lower bound’, Journal of Money, Credit and Banking 48, 253–291.