I am grateful to Marcus Brunnermeier, Arvind Khrishnamurty and Alex Smith for useful comments. The views in this paper are my own and do not necessarily reflect those of De Nederlandsche Bank.

Abstract

In a world of unpredictable shocks impossible to calibrate, bank stability cannot be assured by buffers. Resilience requires concrete tools to stem a gradual loss of confidence once its solidity is called into doubt. At present, Pillar II authorities are reluctant to act on a timely base, out of fear of unstoppable runs. Thus, current recovery tools are not credible, leading often to an “intervention gap” causing more losses and chaotic defaults. A key insight is that timely intervention can be credible once a self-fulfilling escalation of outflows can be disrupted, granting time to act and refocusing attention around recovery options. Both dike and bank resilience face shocks that can escalate rapidly. We draw analogies with flood control procedures to discuss tools such as usable buffers, prepositioned collateral and contingent redemption charges aimed at going-concern bank recovery.

In The Resilient Society, Markus Brunnermeier (2023) considers lessons from the COVID-19 experience and other large shocks which could not have been anticipated, let alone prevented. He proposes rebalancing our prudential approach towards resilience, reinforcing our capacity to respond to a shock after primary defenses fail.#f1

The classic analogy drawn by Aesop, the ancient Greek writer of moral fables, is how thin reeds bend to strong winds without breaking, while strong oaks fully resist a storm but ultimately break. The key insight is that a flexible response can adjust better under intense pressure.

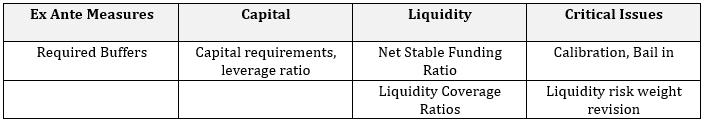

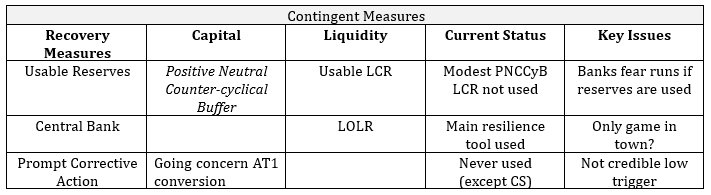

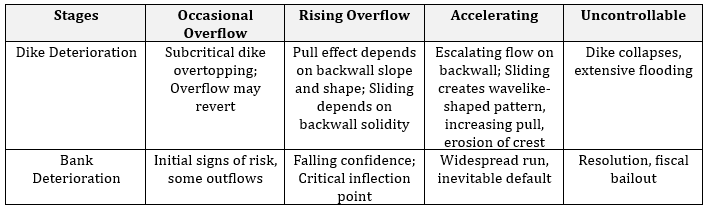

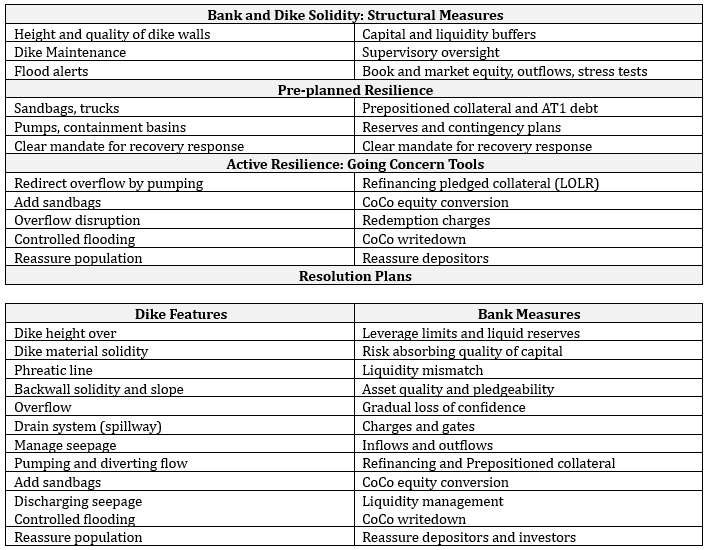

Similarly, financial stability requires a balance of ex-ante solidity to withstand shocks, and ex-post resilience in response to large shocks that overcome primary defences. Table I summarize how capital and liquidity buffers provide structural solidity, while Table II lists tools for corrective action by Pillar II authorities once buffers are breached. Our focus will be on this second set of contingent measures.

Table 1. Bank Solidity Norms under Basel III

Table 2. Current and Proposed Contingent Measures

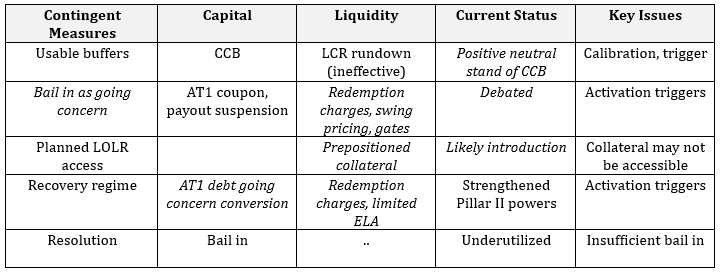

At present, Pillar II supervisory powers are inadequate to respond promptly to signals of early distress (e.g., an inadequate capital conservation buffer). Delayed intervention on banks drifting into debt overhang reduces recovery chances even for viable banks.

Figure 1a and 1b. The intervention gap (Martino and Perotti 2023)

Forbearance is driven by concerns that any public sign of weakness may create a self-fulfilling escalation of outflows even on a viable bank (Diamond and Dybvig, 1983; Walther and White, 2020). Existing tools available to banks and regulators (usable capital and liquidity buffers, emergency window lending, convertible debt) are rarely used until default, as there are no tools available once a runs start.

As a result, market participants do not view going concern intervention as credible.#f2 The combination of weak contingent tools and fears of runs produces supervisory hesitation, an ”intervention gap” that hides bad risk incentives, resulting in greater losses and chaotic runs (Martino and Perotti, 2024).

In this ambiguous phase both the bank and the regulator often delay any action, hoping that distress will resolve itself without revealing weaknesses (Martynova et al., 2022). Attempts to hide losses induce poor risk choices (zombie banking), often leading to insolvency and bailout.

Resilience requires a chance of recovery ahead of resolution, an early chance for viable banks to regain confidence. Yet a timely intervention needs some reassurance on the risk of outflows, some measure containing escalation.

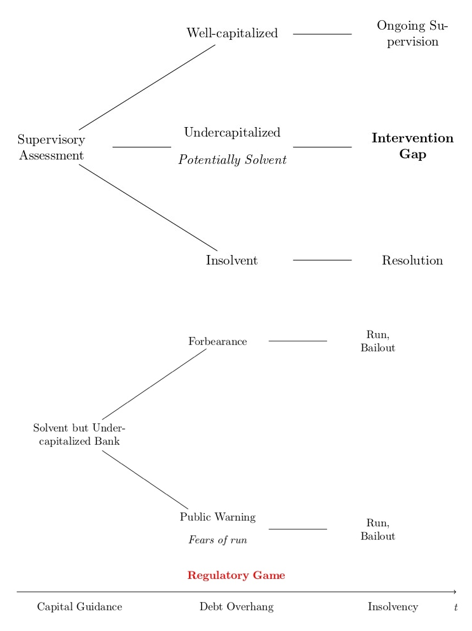

Table 3. Solidity and Predefined Resilience Measures

This paper reviews proposed resilience measures aimed at disrupting the self-reinforcing pull of outflows, drawing inspiration from dike hydraulics. Flood control is a risk containment policy focused on avoiding escalation by a prompt response, activating pumps and placing sandbags to redirect overflow. A key insight is the focus on disrupting overflow, eg by adding air turbulence via a stepped backwall to break the self-reinforcing effect of water pull.

Consider the case of a dike in need of some repairs (a bank potentially viable), whose owners are unable or reluctant to contribute enough solid material (capital) to shore up dike (bank) solidity. Once the dike is challenged by high water (excess leverage), prompt activation of emergency procedures (supervisory intervention) can avoid escalation of the overflow to secure the dike (bank recovery).#f3

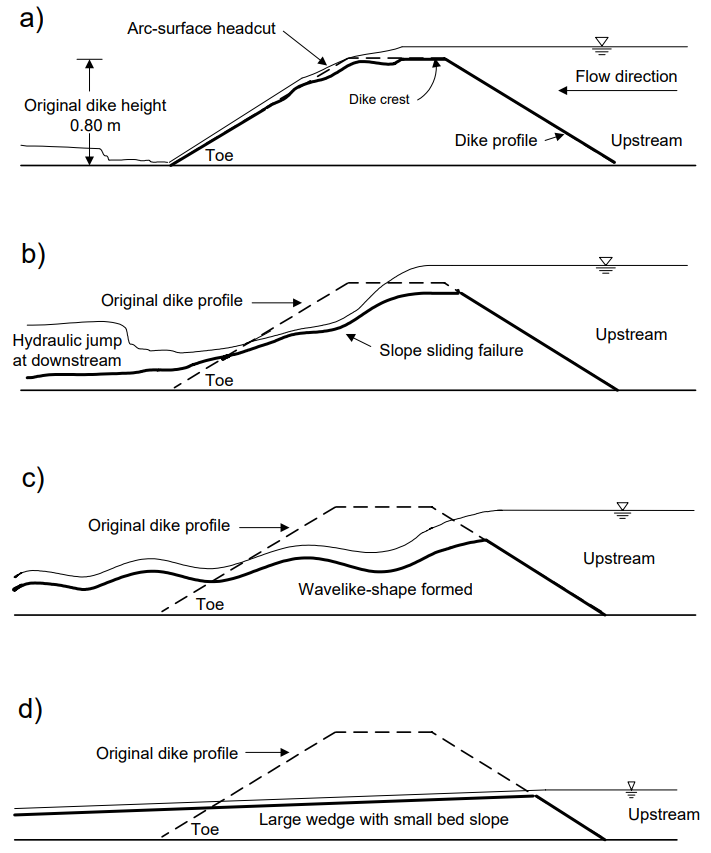

Once water starts to flow steadily over the dike crest, the process has four visible stages (see Table 4 and Figure 2). At first, the overtopping flow (henceforth overflow) is incidental and may revert over time. Yet it should induce an alert monitoring process. A steady overflow leads to erosion of the “dike crest,” undermining the solidity of the barrier. If unattended, the overflow may accelerate gradually as it falls along the dike backwall.

As water molecules share a strong chemical bond (the cause of surface tension), water flow pulls surrounding water into its own movement. This effect mimics strategic complementarity across depositors in a bank run, where the perception that others are withdrawing encourages withdrawals by those who may not need to.

Figure 2. Phases of dike overtopping (Chinnarasri et al., 2003)

As long as the pull effect of overflow is still modest, it may still be valuable for dike owners and supervisors to wait and hope the waters may recede, sparing any capital, effort or reputational costs. However, unattended overflow leads to progressive dike degradation.#f4

A first measure of resilience is the slope and shape of the surface behind the crest (downstream wall or backwall). Intuitively, a steep drop soon behind the dike crest leads to faster water movement across the dike, increasing the pull factor of the overflow over the water mass behind it. Evidence from hydraulic engineering (Chinnarasri et al., 2003) suggests that progression in dike degradation depends the cohesiveness of its backwall material (in banking terms: asset quality and pledgeability, reputation) against the speed of overflow (loss of confidence and outflows).

Unattended overflow erodes the backwall until sliding starts to occur (Figure 2), soon resulting in an uncontrollable wavelike-shaped pattern and dike breach (see Figure 1 c and d). Table 4 compares the process of dike and bank degradation over time.

Table 4. Phases of dike overtopping, with analogy to bank distress

Once the front barrier offered by capital and liquidity buffer is challenged by overflow, resilience depends on both physical features (the width of the dike, the cohesiveness of the barrier material and its backwall) as well as timely intervention of reserves. Flood prevention mobilizes trucks, sandbags and pumps. Emergency procedures may first seek to raise barriers by piling sandbags and redirecting flow to containment areas, to stop a self-reinforcing pull due to water falling on the backwall.#f5

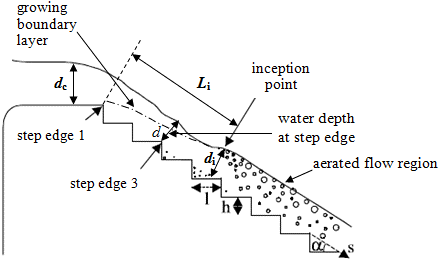

The slope of the backwall turns out to be a critical factor in the process of overflow, since a steep fall accelerates the pull effect of the flow. Intriguingly, dike engineers have found solutions to contain overflow escalation besides pumps and sandbags. A key design feature is a stepped backwall, especially used to slow down flow in spillways. A stepped profile is designed to dissipate the excess kinetic energy at the downstream of dikes. The insight is that water flow on a stepped surface is disturbed by the aeration effect at the corners, and turbulence directly reduces cavitation damage. Air entrainment starts where the boundary layer attains the free surface of flow: this point is called the ”point of inception” (see Fig. 3).#f6 Thus, an appropriate stepping profile on the backwall behind the crest creates air turbulence that disrupts the self-reinforcing pull factor of overflow.

Figure 3. Position of the inception point in stepped spillway

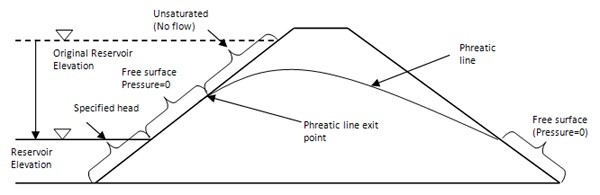

Next to occasional overflow, water infiltrates slowly across the dike base, flowing above its saturation level. This area is called the phreatic surface and is defined as the area where atmospheric pressure equals hydraulic pressure. Its slope is affected by the hydraulic gradient and the mass and cohesiveness of the dike material (Darcy, 1856).#f7 A steeper backwall reduces the weight of the dike and raises the phreatic line.

In most dikes water seeping through the dike emerges into a ditch at the base of the back wall. Dike stability thus requires adequate capacity for discharge (an analogy to liquidity management tools).#f8 The impact of seepage depends on the coherence of the dike material. With a steep hydraulic gradient (high liquidity mismatch) water pressure on the dike is high, raising the phreatic line and the rate of seepage (Punmia and Jain, 1994).

The banking analogy of the hydraulic gradient is the liquidity mismatch between bank assets and liabilities, balanced by liquidity risk management and depositor confidence.

Figure 4. Phreatic line (Punmia and Jain, 1994)

Table 5 summarizes analogies between flood control and bank recovery policy tools. The banking analogy for a wide dike and backwall resilience would be the scale and quality of unpledged collateral available for refinancing. The pre-positioning of collateral would enable prompt central bank refinancing (King, 2023). A similar effect to counter overflow comes from usable buffers or conversion of contingent AT1 debt. The effect is however limited by available collateral or convertible buffers. The beneficial effect comes by moving forward barrier material near the dike crest, at the cost of a steeper slope further.#f9

The full proposal by King (2023) to prevent banks from issuing more runnable claims than pre-accepted collateral would rule out inefficient runs, but would imply a form of narrow banking, leaving no space for credit provision. A fractional coverage would represent an improved LCR/NSFR norm (with adjusted liquidity risk weights for uninsured deposits) but not rule out runs. Once pledgeable assets and reserves are used up, resilience depends on a prompt intervention to restore confidence.#f10

To be credible, recovery tools need to be backed by contingent measures avoiding an escalation in outflows. By analogy, flood control seeks to stem the overflow to buy time to restore barriers and arrange redirect water flow.

Adding sandbags and barrier material is analogous to converting AT1 debt into equity. Pumps redirect overflow, just as refinancing allows more liquidity resilience. Both AT1 conversion and prepositioned collateral are effective tools but ultimately with limited risk absorbing capacity. If outflow expectations escalate, they will be insufficient to avoid default.

The chance of a bank run is too often seen as an arbitrary and unstoppable process, a sudden escalation that cannot be contained once it starts. This view is too simplistic and ultimately self-defeating. To be able to deal lucidly with the threat of runs, it is important to break down the key phases in the outflow process.

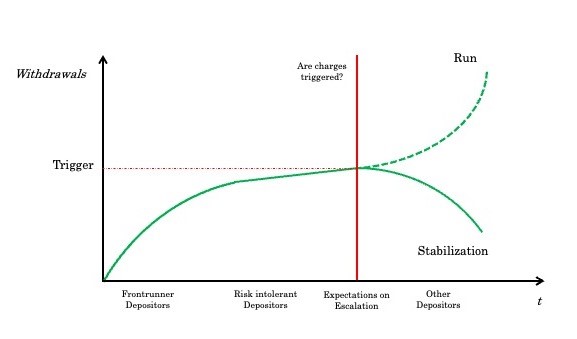

Initial outflows follow some loss of confidence and involve depositors with need for liquidity, ‘risk intolerant’ depositors who would not accept any risk, and sophisticated investors who may choose to front-run. Yet a full run on a solvent bank is not a necessary outcome even after large outflows.#f11 The phase of escalation occurs only when depositors with no need of liquidity become concerned about what others will do. Such strategic uncertainty can lead to a run even on a bank known to be viable.#f12 Some measure is thus needed before the escalating stage, disrupting run incentives.

How can escalation of outflows be controlled? Just as water flows beget more flow pull, bank run incentives are fed by the diffused perception that others may withdraw. Redemption charges reduce immediate run incentives by imposing a direct cost, and by disrupting the perception of inevitable escalation (Capponi et al., 2020; Matta et al., 2024). Disrupting run incentives creates an automatic market stabilizer and buy time to elaborate concrete steps to restore confidence. They help shift the attention of depositors to a positive narrative on a path to recovery, reversing the self-fulfilling focus on outflows. To further reduce run incentives, charge revenues may be rebated in case of recovery and segregated to refund unwithdrawn deposits in case of default (Martino and Perotti, 2024). Compared with gates (temporary suspension of payout) adopted in the past to contain runs on money market funds, charges maintain access to liquidity for businesses at a marginal cost pricing illiquidity.

Figure 5. Deposit outflows over time (Martino and Perotti, 2024)

Charges would also serve as fractional bail-in undergoing concern, a milder version of as AT1 debt conversion. They may thus affect the share of corporate cash reserves held in uninsured deposits rather than MMF shares, the natural alternative. Yet this effect is likely to be modest. Since 2023 all US institutional MMFs are subject to automatic redemption charges, and the EU is likely to follow on the same path.

Containing run risk allows to buy time to refocus depositor attention to concrete measures aimed at restoring confidence. Possible steps include the conversion of AT1 debt into equity (Martynova and Perotti, 2018), supervisory interventions in bank governance or risk profile and the search for a merger partner. The key is to refocus investor attention from run expectations to recovery options, changing the public narrative on bank prospects.#f13

Table 5 lists draws the analogy between dike construction and Pillar I solidity standards, as well as existing and proposed tools for bank resilience. While current tools for resilience to outflows (e.g., usable LCR buffers, AT1 debt conversion) have been infrequently used, they would become credible tools once they are backstopped by measures to contain outflows.

Table 5. Bank and Dike Resilience Features

What may be expected about the market response to the possibility of temporary charges? Compared to the current situation, some uninsured deposit will be withdrawn earlier, as some seek to avoid the charges.

An earlier triggering of withdrawals would not pose by itself a worse stability issue than after a long period of forbearance. An early market signal would enable to activate a recovery process in time to offer a chance to recovery. As a result, containment of outflows at an early stage should be much easier, as bank prospects are less compromised.

Both financial stability and flood control systems need a solid structure to withstand risk, but also resilient capacity to contain the consequences of distress. At present, bank stability relies primarily on ex ante buffers, leaving weak supervisory tools and modest reserves (‘redundancies’) once a bank approaches distress. Chances for orderly reorganization and recovery of viable banks are thus compromised, leaving bailout as the final solution.

We discuss contingent tools for bank resilience, recognizing the need to act promptly with credible tools to prevent further losses. A timely recovery process can only be credible when outflows can be contained during Pillar II intervention. Tools like prepositioned collateral, AT1 debt conversion and automatic redemption charges (activated directly by large outflows) serve as automatic stabilizers during the process. Runs are not inevitable when self-fulfilling expectations can be disrupted. A recovery regime activated by a mix of market and supervisory triggers (Perotti, 2023a; Martino and Perotti, 2024) would enable timely and decisive changes in governance or bank risk profile and restore confidence and protect the deposit franchise. A credible Pillar II process is urgently needed to ensure a timely intervention and buy time for recovery or a merger, especially at a time when outflows can self-escalate rapidly via social media coordination (Cookson et al., 2023).

A final analogy with flood control concern regulatory arbitrage, which is most intense around binding constraints. A dike may suffer water infiltration at weak spots in its front wall. In a dike with an impervious core (a solid dike segment), all vulnerability shifts to erosion around its border (Pugh and Gray, 1984). In this case, the risk of breach depends not on the average strength of the cohesive core (e.g., capitalized banks), but especially about the less cohesive shoulder material next to it (shadow banks).

More research is necessary to understand how to enhance a timely, legitimate and proportionate response to prevent forbearance and an inevitable slide into default.

Admati, A. and Hellwig, M. (2023). The Bankers’ New Clothes: What’s Wrong with Banking and What to Do About It – New Edition. Princeton University Press.

Admati, A. R., DeMarzo, P. M., Hellwig, M. F., and Pfleiderer, P. C. (2013). Fallacies, irrelevant facts, and myths in the discussion of capital regulation: Why bank equity is not socially expensive. Stanford University Graduate School of Business Research Paper No. 13-7. Available at SSRN: https://ssrn.com/abstract=2349739.

Bentalha, C. and Habi, M. (2019). Free surface profile and inception point as characteristics of aerated flow over stepped spillway. Journal of Water and Land Development, 42(1):42–48.

Brunnermeier, M. (2023). The Resilient Society: Lessons from the Pandemic for Recovering from the Next Major Shock. Princeton Economics.

Capponi, A., Glasserman, P., and Weber, M. (2020). Swing pricing for mutual funds: Breaking the feedback loop between fire sales and fund redemptions. Management Science, 66(8):3581–3602.

Cecchetti, S. and Schoenholtz, K. L. (2023). Making banking safe. CEPR Discussion Paper, (18302).

Chinnarasri, C., Tingsanchali, T., Weesakul, S., andWongwises, S. (2003). Flow patterns and damage of dike overtopping. International Journal of Sediment Research, 18(4):301–309.

Cookson, J. A., Fox, C., Gil-Bazo, J., Imbet, J. F., and Schiller, C. M. (2023). Social media as a bank run catalyst. Working Paper.

Correia, S., Luck, S., and Verner, E. (2024). Failing banks. NYFED Manuscript.

Darcy, H. (1856). Les fontaines publiques de la Ville de Dijon. Dalmont.

Diamond, D. and Dybvig, P. (1983). Bank runs, deposit insurance, and liquidity. Journal of Political Economy, 91(3):401–419.

Drechsler, I., Savov, A., Schnabl, P., and Wang, O. (2023). Banking on uninsured deposits. Working Paper 31138, National Bureau of Economic Research.

Glasserman, P. and Perotti, E. (2017). The unconvertible coco bonds. In Evanoff, D. e. a., editor, Achieving Financial Stability: Challenges to Prudential Regulation, pages 317–329. World Scientific.

Goldstein, I. and Pauzner, A. (2005). Demand deposit contracts and the probability of bank runs. Journal of Finance, 60:1293–1328.

Jiang, E., Matvos, G., Piskorski, T., and Seru, A. (2023). Monetary tightening and us bank fragility in 2023: Mark-to-market losses and uninsured depositor runs? NBER Discussion Paper, (31048).

King, M. (2023). We need a new approach to bank regulation. Financial Times.

Martino, E. and Perotti, E. (2024). Containing runs on viable banks. CEPR Policy Insight 127.

Martynova, N. and Perotti, E. (2018). Convertible bonds and bank risktaking. Journal of Financial Intermediation, 35:61–80. Banking and regulation: the next frontier.

Martynova, N., Perotti, E., and Suarez, J. (2022). Capital forbearance in the bank recovery and resolution game. Journal of Financial Economics, 146(3):884–904.

Matta, R., Enrico, P., and Oostdam, R. (2024). Contingent charges to control bank runs. Technical report, Amsterdam Business School.

Matta, R. and Perotti, E. (2023). Pay, Stay, or Delay? How to Settle a Run. The Review of Financial Studies, 37(4):1368–1407.

Perotti, E. (2023a). Measures to prevent runs on solvent banks. VoxEU Column.

Perotti, E. (2023b). The swiss authorities enforced a legitimate going concern conversion. VoxEU Column.

Perotti, E. and Suarez, J. (2011). A pigouvian approach to liquidity regulation. International Journal of Central Banking, 7(4):3–41.

Powledge, G. R., Ralston, D. C., Miller, P., Chen, Y. H., Clopper, P. E., and Temple, D. M. (1989). Mechanics of overflow erosion on embankments i: Research activities. Journal of Hydraulic Engineering, 115(8):1056–1075.

Pugh, C. A. and Gray, E. W. J. (1984). Fuse plug embankments in auxiliary spillways: Developing design guidelines and parameters.

Punmia, B.C., A. and A.K.Jain (1994). Soil Mechanics and Foundations. Laxmi Publications New Dehli.

Quanyi X, Liu J ea (2018). Critical hydraulic gradient of internal erosion at the soil–structure interface. Processes, 67-92.

Walther, A. and White, L. (2020). Rules versus discretion in bank resolution. Review of Financial Studies, 33:5594–5629.

Weitzman, M. (1974). Prices vs. quantities. Review of Economic Studies, 41(4):477–491.

Wikipedia (2024). Definitions of stepped spillway. Accessed May 2024.

Brunnermeier (2023) points out that resilience has a lower capital cost but a higher operating cost than solidity, as it needs committed resources (redundancies) that may be mobilized in an emergency.

Since 2016 CoCo bond prices do not reflect any risk of going concern conversion ahead of default (Glasserman and Perotti, 2017).

We focus on dikes, where water is held to one side. A dam contains water at different heights.

Hiding bank vulnerability for some time may temporarily reduce overflow, at the cost of a faster response once revealed.

A traditional saying from Friesland states that a large dike is better than a high dike.

“At the inception point upstream, the flow is smooth and glassy whereas at the downstream of the inception point the depth of the air-water mixture grows” (Bentalha and Habi, 2019).

Darcy’s Law on the movement of water shows that discharge is proportional to the hydraulic gradient and the density of the soil.

The critical hydraulic gradient defines the threshold for seepage stability (Quanyi et al., 2018).

An advantage of prepositioned collateral is that it does not require a visible activation which may cause a stigma effect.

See Martino and Perotti (2024) for a study of legitimate triggers and scope of the recovery mandate.

Historically, banks fail only after several quarters of outflows (Correia et al., 2024).

When many are expected to join the queue it becomes best to withdraw even on a bank that depositors expected to survive in the absence of a run (Goldstein and Pauzner, 2005).

Martino and Perotti (2024) propose a short-term recovery regime led by supervisors, activated (and legitimized) by market and supervisory triggers. The phase of intervention would be protected by charges and limited Emergency Liquidity Assistance (ELA).