The views expressed in this article are those of the authors and should not be interpreted as reflecting the official views of any institution with which the authors are affiliated. Based on: Ahnert, Hoffmann, Monnet (2022). The Digital Economy, Privacy, and CBDC. CEPR DP 17313, 2022.

We study how the choice of payment instruments affects privacy and welfare in the digital economy. Cash allows merchants to preserve their anonymity but cannot be used for online transactions that generate higher sales from more efficient distribution. By contrast, bank deposits can be used online but do not preserve anonymity: the merchant’s bank learns from payment flows and exploits the underlying information to extract rents. Payment tokens issued by digital platforms allow merchants to hide from the bank but also enable platforms to stifle competition (e.g. by limiting the entry of more efficient competitors by creating a walled garden). An independent digital payment instrument that allows agents to share their payment data with selected parties—a privacy-enhancing CBDC—can overcome all frictions and achieves the efficient allocation.

The rapid rise of the online economy has created a demand for digital payment services. Cash is losing its supremacy in many economies (BIS 2021) because new electronic payment services (e.g. mobile wallets) provide increased speed and convenience to merchants and consumers alike. Seizing the opportunity, large tech firms have expanded into retail payment services. In China, WeChat and AliPay account for more than 90% of digital retail payments, while in Western economies products such as ApplePay or GooglePay are becoming increasingly popular.

While using digital payments in a digital economy seem like a no brainer, unlike cash, digital payments generate troves of data of rather personal nature. Profit-seeking enterprises can use this data for commercial purposes, which raises privacy concerns. While a proliferation of data promises efficiency gains, policy makers have become increasingly uneasy about the dominance of data-centric business models and their potential to stifle competition, avoid creative destruction, and engage in price discrimination (e.g., Bergemann et al. (2015), Jones and Tonetti (2020), and Ichihashi (2020)). At the same time, scandals such as the one surrounding Facebook and Cambridge Analytica have heightened public sensitivity about data privacy issues in the context of the digital economy.

Fuelled by this debate, policymakers have advanced the idea of creating a central bank digital currency (CBDC), an equivalent to physical cash for the digital economy. Like cash, a CBDC would allow its users to retain some degree of privacy.

In Ahnert, Hoffmann and Monnet (2022) we develop a stylized model of financial intermediation to analyze the interconnections of payments and privacy in the context of the digital economy. We assume merchants have to borrow from a monopolistic bank. After they produce, merchants realize whether their goods are of low or high quality. Merchants who produce a high quality good will have future sales that merits further funding for a second round of production. The other merchants will not have future sales and should not receive any more funding. The monopolistic bank would like to know which good quality a merchant produces, but this is private information to that merchant.

That information could be revealed depending on the payment services that the merchant uses. If the merchant uses bank deposits, the bank can infer the quality of the good produced. If the merchant uses cash, however, the bank cannot observe the merchant’s sales and has to elicit information through contractual terms. It would seem merchants would always prefer cash then, because it protects them from being held up by the monopolist bank by preserving their information.

However, merchants can only be paid with cash if they trade offline (through a brick-and-mortar store), and this is inefficient because sometimes merchants cannot sell their goods to the consumers who like it the most. Alternatively, merchants can distribute their goods online, which enables a more efficient matching with potential buyers, thus generating a higher surplus. But then they have to give up information to the bank because online sales can only be settled with a digital means of payment. Therefore, merchants will trade off the efficiency of online trading with preserving some rents when offline.

In equilibrium, merchants opt for online distribution and settlement with bank deposits if the benefits of more efficient matching outweigh the costs of freely revealing the quality of the good produced to the bank. This is the case if the resulting efficiency gains that merchants can appropriate are large enough. Otherwise, goods are distributed offline, which again is inefficient.

When merchants can receive payment for online sales via an anonymous CBDC, the bank can only learn the good’s quality by leaving some informational rents to merchants. There are two sources of welfare gains: First, merchants are more likely to trade online when sales are settled with CBDC, which ensures efficient matching. Second, with CBDC, the bank always elicits information through a separating contract. This ensures that merchants selling high quality good are more likely to receive continuation investment from the bank, which creates additional surplus.

We then extend the model to include a digital platform which provides a settlement token and competes with the bank for continuation loans to merchants. The platform only observes the merchants’ good quality whenever they use its tokens as a means of payment. Perhaps surprisingly, we show that merchants always prefer settlement in tokens over CBDC or deposits. The reason is intuitive: since banks can elicit information through contracting for the initial loan, the use of tokens ensures that the platform and the bank can compete for the continuation loan. By contrast, with either CBDC or deposits, only the bank is informed and acts as a monopolist in the lending market. Accordingly, merchants opt for tokens.

However, tokens also enable the platform to fend off potential competitors by creating a so-called “walled garden”. While deposits or CBDC enable merchants to potentially benefit from switching to a more efficient entrant platform, the resulting lack of competition in the lending market ensures that all the efficiency gains are appropriated by banks. Accordingly, merchants are better off with tokens.

Next, we enrich the CBDC with a data-sharing functionality which enables merchants to reveal the quality of the good produced costlessly to both the bank and the platform. Importantly, they can do so after repaying their initial bank loan to avoid ceding any surplus to banks. Merchants then enjoy perfect competition in the second round of lending. Thus, they always opt for online sales through CBDC, which is the socially efficient outcome.

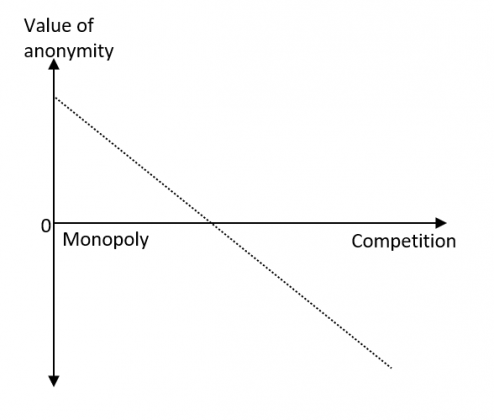

Figure 1: The relationship between the value of privacy (vertical axis) and the degree of competition in financial intermediation (horizontal axis).

Figure 1 illustrates how the competitive environment in the credit market shapes the value that merchants attach to anonymity. When facing a monopoly lender, they attach a positive value to anonymity because this enables them to extract informational rents. By contrast, in the face of multiple lender, anonymity harms the merchant in our setting because this prevents competition in the credit market.

Finally, we show that a CBDC with a data-sharing feature also enhances competition among platforms by preventing the incumbent from acting as “walled garden”. Accordingly, sellers are able to reap the additional efficiency gains associated with entrant platforms.

Ahnert, T., P. Hoffmann, and C. Monnet (2022). The digital economy, privacy, and CBDC. CEPR DP 17313.

Bank for International Settlements (2021). BIS annual economic report 2021.

Bergemann, D., B. Brooks, and S. Morris (2015). The limits of price discrimination. American Economic Review 105 (3), 921–57.

Kosse, A. and I. Mattei (2022). Gaining momentum – Results of the 2021 BIS survey on central bank digital currencies. BIS Papers No. 125.

Ichihashi, S. (2020). Online privacy and information disclosure by consumers. American Economic Review 110 (2), 569–95.

Jones, C. I. and C. Tonetti (2020). Nonrivalry and the economics of data. American Economic Review 110 (9), 2819–58.