Against the need for alternative or additional financing channels for Small and Medium-Sized Enterprises (SMEs), private debt (PD) funds have gained importance as an alternative asset class for European investors and a new financing tool for European SMEs and mid-caps. This Policy Brief summarises findings from a recent EIF research project: it provides a market overview and insight into the results of the EIF Private Debt Survey, a new study that provides unique perspective and helps increase the transparency of the market to the public.

The analysis shows overall a very positive market sentiment for PD in Europe. However, the PD markets are still young and have developed unevenly across countries, with Central Europe being in the lead. The paper discusses opportunities and challenges in the different PD markets; it finally presents the EIF’s action plan to address identified market weaknesses.

Against the need for alternative or additional financing channels for Small and Medium-Sized Enterprises (SMEs), private debt (PD) funds have gained importance as an alternative asset class for European investors and a new financing tool for European SMEs and mid-caps.

These funds provide non-bank debt financing. Many of them focus on mid to large-sized companies, but there is also a segment covering SMEs – with still room for a further increase of this market segment, offering different forms of lending like senior debt, subordinated debt, and unitranche structures. This is perfectly in line with the ideas of the Capital Markets Union and the ambition to diversify the financing sources of SMEs (see Kraemer-Eis and Lang, 2017; Masiak et al., 2019; Moritz et al., 2016). The PD market, which originally emerged as an appendage of the private equity market, has now developed into a standalone and significant part of the alternative assets market and embraces alternative lenders, ranging from large asset managers diversifying into alternative debt to smaller funds set up in independent contexts by professionals with relevant investment experience.

In general, available information about the financing market segment of PD funds is scarce. Due to the market fragmentation and opacity, it is even ambitious to speak about a or one market segment – and the debt fund as such does not exist. Hence, it is important to shed more light on major topics around the growing asset class of debt funds and institutional non-bank lenders. This is what we did with our recent survey-based EIF Working Paper1, which we briefly summarise in this Policy Brief.

In our research, we follow a two-step approach (see Kraemer-Eis et al., 2022, for details). We start with a brief market overview, which is based on desk research of various information sources covering PD. However, as several important questions cannot be answered based on desk research only, we add information gained in a survey of PD fund managers in a second research step. This EIF Private Debt Survey provides unique insights into the European PD market and helps to increase the transparency of the market for the public. In order to provide additional information about market heterogeneity and SME financing, we also present more detailed market splits by geography and by portfolio company size. Finally, a brief overview of the EIF’s action plan shows how the EIF intends to address the identified market weaknesses in the PD market segment.

Europe has a growing and developing ecosystem of PD funds that is getting stronger and revolves around funds that predominantly invest in Europe. According to general market statistics2, the European ecosystem of PD funds (around 585 funds) has approximately €311B assets under management. About 30% of the PD funds focus on growth-oriented firms.

The available market statistics reveal that PD fund managers’ preferred market segments are very heterogeneous, at least in terms of portfolio company size. For example, PD fund managers focus on portfolio companies with, on average, a turnover between €43M and €237M, an enterprise value between €53M and €491M, and an EBITDA between €16M and €72M. 27% of managers focus on SMEs and small mid-caps (as defined by the number of employees, see Kraemer-Eis et al., 2021, for more information about the EU definition of SMEs, SMEs in Europe, and the access to finance of SMEs), 24% target large mid-caps, and only 2% target large companies. For the remaining 48%, however, such information is not available. PD fund managers’ preferred average expected loan size is between €9M and €45M. The main target countries are still in Western Europe, but approximately one third of fund managers also target the entire European market covering all regions.

Overall, publicly available data for PD funds are rare and poor. Pure desk research is unable to answer questions regarding the forces in the PD market. The first EIF Private Debt Survey received significant interest in the market: a large group of 146 respondents from 22 countries provided their feedback; the top sectors covered by these funds are industrial/manufacturing (25%), high tech industries (17%), and healthcare/life science (14%).

Positive market sentiment: The current market situation for PD is positive for all market segments. Expectations for the period until end-2022 are good across all market segments. However, several challenges remain, which need to be addressed (e.g., fundraising, in particular for new teams, in countries where PD is still underdeveloped or only emerging, and for SME-focused funds). Nevertheless, this very positive market sentiment is paired with potential high investee valuations in the market and should be closely monitored to avoid bubble building.

In terms of regions, Central Europe is leading the PD market: In Europe, especially Germany, France, and the UK, are well developed markets (in particular in terms of PD market history and framework conditions) that gain considerable attention. PD funds and loan sizes are also significantly larger in these markets compared to countries with less developed or emerging PD markets. Furthermore, the highest market potential in terms of activity seen by PD fund managers is allocated to this region. Therefore, the EU can expect to see an even stronger and growing PD ecosystem in the upcoming years. Underdeveloped PD markets in Europe potentially struggle with structural disadvantages. Public institutions need to evaluate whether these markets could benefit from public support to overcome these challenges.

Involvement of large-scale investors constitutes an important underdeveloped element across all markets. Corporate investors are missing in the ecosystem, in particular in less developed parts of the European PD market, whereas pension funds were stated to be an important missing element in emerging and developed markets. In those market segments, cultural attitudes towards PD were also frequently stated to create difficulties for market growth, while the regulatory framework is a particular issue for PD market players focusing on countries that have less developed PD markets. Regulatory improvements, market education and transparency could provide support to mitigate such difficulties. Since the competition from PD funds was stated to be the biggest challenge in developed markets, it is likely that developed markets’ players will diversify beyond those markets, if transparency and PD ecosystems are properly developed.

PD can be important to mitigate access to debt finance constraints, as 40-60% of PD fund portfolio companies would not have been able to get bank financing. The share is slightly higher in countries with underdeveloped PD markets than in other regions. The reasons why firms choose PD over bank debt are manifold. The certainty and speed of the execution is particularly relevant for firms in developed and emerging markets. In underdeveloped markets, respondents most frequently mentioned that PD fund managers are willing to accept a higher leverage than banks. However, other reasons (e.g., the certainty and execution speed or the flexible covenant structure) were rated almost equally important.

Fund managers that target SMEs differ considerably from PD managers that target other investee company sizes. Funds that focus on SMEs have lower average loan sizes paired with a slightly shorter time to maturity and a higher average targeted unlevered IRR. These elements largely reflect the higher risk perception associated with financing provided to SMEs.

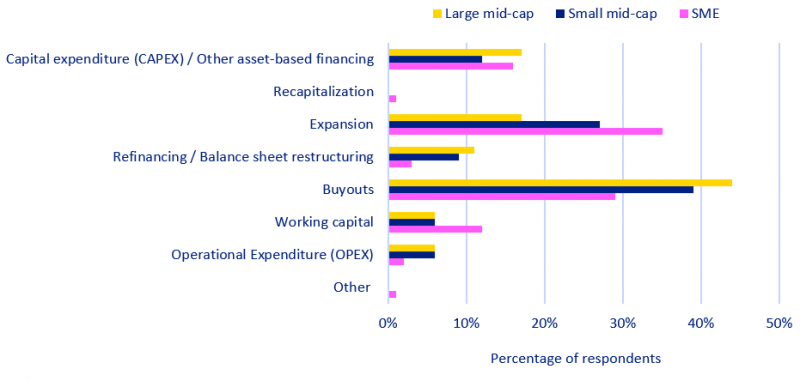

In terms of loan purposes, the share of fund managers providing financing for the expansion of the company is the highest among those managers that target SMEs. A similar observation can be made for working capital. Both results reflect the specific characteristics of SMEs. Financing for expansion might typically be linked to a high growth potential of the company. However, SMEs also frequently have challenges in accessing working capital financing through traditional (bank) channels.

Figure 1: Most important loan purpose, by preferred investee company size

Source: Kraemer-Eis et al. (2022)

There are only minor differences in the perceived market potential in Europe among PD players focusing on mid caps, small caps, and SMEs. PD players from all target sectors see the most market potential in already developed markets in Europe. Public institutions could investigate how SMEs and small caps could gain more market attention in emerging markets.

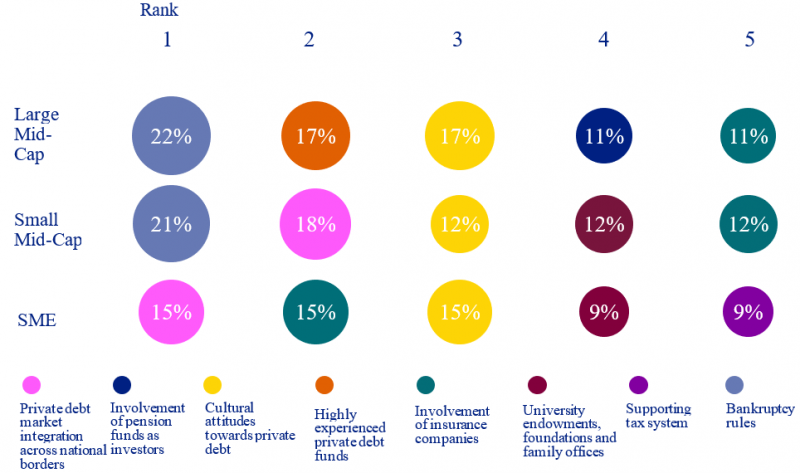

Cross-border market integration is especially relevant for PD fund managers targeting SMEs and small mid-caps. The mitigation of hurdles for cross-border financing could help enhance SMEs’ access to alternative PD financing. In addition, SME-focused PD managers saw room for improvement in the involvement of insurance companies as investors in the PD market.

Figure 2: PD ecosystem elements that are particularly underdeveloped in the EU, by preferred investee company size

Source: Kraemer-Eis et al. (2022)

Public institutions could help to overcome market challenges: Fundraising is one of the largest challenges across segments in the PD market, which could negatively influence the long-term outlook of the PD market. Public institutions could investigate whether they can help overcome this challenge with more transparency and market research in the PD space. Equally, enforcement rights / bankruptcy rules and cross-border integration are seen as the most underdeveloped elements in the PD market in the EU. Here, public institutions are advised to consider whether they need to initiate reforms in those areas in order to overcome those structural disadvantages for the PD market in the EU.

Considerable investment tickets are needed to support fundraising traction and development of new teams, in particular countries with underdeveloped or emerging PD markets. From the perspective of the EIF PD Survey respondents, the most appreciated aspects of governmental support programs are the relatively large commitments to the funds across all markets. In European countries with underdeveloped PD markets, the contribution of networking opportunities is regarded as very relevant as well.

PD has become a considerable part of the financing market for SMEs and mid-caps. It has grown in recent years, but there are challenges and market weaknesses. Public support can help improve the further development of this new market segment. Given the breadth of the EIF’s investment activities and the EIF’s market recognition as a specialist provider of alternative risk finance for SMEs and lower mid-market companies across Europe, the EIF has played a significant role in building and growing the PD asset class in Europe since 2014 for two types of funds. These are “diversified debt funds” (which typically have more granular portfolios), as well as “selective debt funds” (funds that are closer to private equity structures).

Going forward, in order to address the weaknesses identified in the market assessment and in line with its public policy objectives, the EIF intends to support the following types of managers:

The following strategies will be supported:

Kraemer-Eis, H., and Lang, F. (2017). “Access to funds: how could CMU support SME financing?” DIW Quarterly Journal of Economic Research, 86(1), 95-110.

Kraemer-Eis, H. (report leader), Block, J. (report leader), Botsari, A., Gvetadze, S., Lang, F., Krause, C., Moritz, A., Schulze, A. (2022). EIF Private Debt Survey 2021: Private Debt for SMEs – Market Overview. EIF Working Paper 2022/79.

Kraemer-Eis, H., Botsari, A., Gvetadze, S., Lang, F., Torfs, W. (2021). The European Small Business Finance Outlook 2021. EIF Working Paper 2021/75.

Masiak, C., Block, J., Moritz, A., Lang, F., Kraemer-Eis, H. (2019). How do micro firms differ in their financing patterns from larger SMEs? Venture Capital. An International Journal of Entrepreneurial Finance, 21(4): 301-325.

Moritz, A., Block, J., Heinz, A. (2016). Financing patterns of European SMEs – An empirical taxonomy. Venture Capital–an International Journal of Entrepreneurial Finance, 18(2): 115-148.

EIF working paper 2022/079: EIF Private Debt Survey 2021 – Market Overview. For more detailed information please visit eif_working_paper_2022_79.pdf

Using sources like Pitchbook, Preqin and Private Debt Investor, as well as information from related associations, fund manager websites, general web research, etc. and applying on purpose broad search filters.