References

S., Lerner, J., and Mezzanotti, F. (2019). Private equity and financial fragility during the crisis. The Review of Financial Studies, 32(4):1309–1373.

Biesinger, M., Bircan, C., and Ljungqvist, A. (2020). Value creation in private equity. EBRD Working Paper No. 242, Swedish House of Finance Research Paper No. 20-17.

Black, J., Spowage, M., Cooper, B., McGeoch, A., and Watts, R. (2021). Estimating the relationship between exports and the labour market in the UK. UK Government report, Department for International Trade.

Boucly, Q., Sraer, D., and Thesmar, D. (2011). Growth LBOs. Journal of Financial Economics, 102(2):432–453.

Davis, S. J., Haltiwanger, J., Handley, K., Jarmin, R., Lerner, J., and Miranda, J. (2014). Private equity, jobs, and productivity. The American Economic Review, 104(12):3956–90.

Feenstra, R. C., Li, Z., and Yu, M. (2014). Exports and credit constraints under incomplete information: Theory and evidence from china. Review of Economics and Statistics, 96(4):729–744.

Fracassi, C., Previtero, A., and Sheen, A. (2018). Barbarians at the store? private equity, products, and consumers. Private Equity, Products, and Consumers (June 19, 2018). Kelley School of Business Research Paper, (17-12).

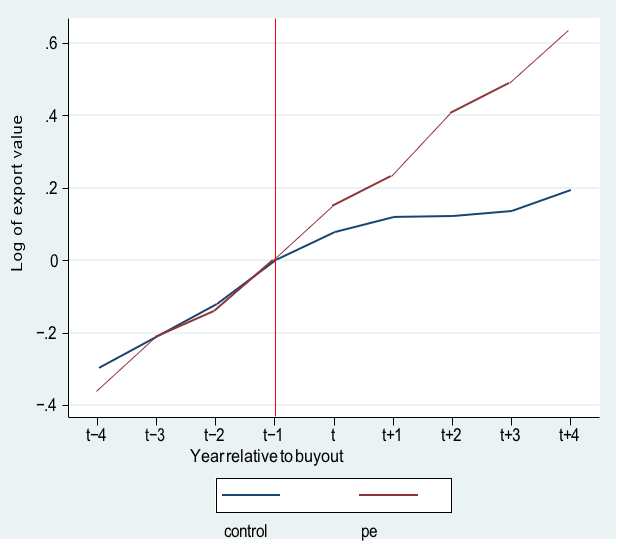

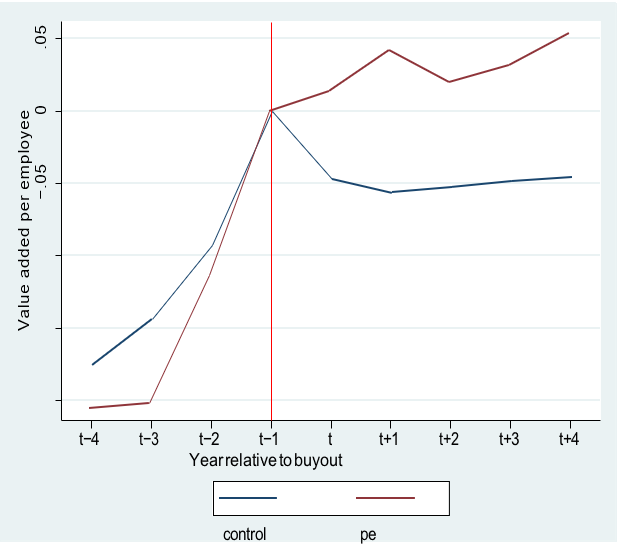

Lavery, P., Serena, J.-M., Spaliara, M.-E. and Tsoukas, S. (2021). Private equity buyouts and firm exports: evidence from UK firms. Working Paper No. 961, Bank for International Settlements.

Lerner, J., Davis, S., Haltiwanger, J., Hanley, K., Jarmin, R. S., and Miranda, J. (2019). The economic effects of private equity buyouts. Harvard Business School Working Paper 20-046.

Manova, K. (2013). Credit constraints, heterogeneous firms, and international trade. Review of Economic Studies, 80(2):711–744.

Muûls, M. (2015). Exporters, importers, and credit constraints. Journal of International Economics, 95(2):333–343.