This policy paper presents an empirical framework for understanding the effects of privatization on enterprises in Central and Eastern Europe (CEE) based on a comprehensive bibliometric analysis. By utilizing co-word analysis, we examined 1,393 peer-reviewed scholarly papers from prominent management databases, spanning the period from 1989 to 2016. The analysis identified 54 main research clusters that depict the interconnections among concepts related to privatization’s impact on enterprises. Noteworthy clusters include corporate governance, management, ownership, performance, reforms, and restructuring. Analyzing the evolution of the research field over time, three periods were considered: 1989–1996, 1997–2004, and 2005–2016. Each period witnessed the prominence of certain concepts and the emergence of new ones, including Human Resource Management, EU integration, and financial crisis. Concepts like monopoly and corruption remained central but underdeveloped. Additionally, cluster similarities were examined over time, highlighting the dynamic nature of the research field with clusters persisting, emerging, or transforming between periods. These concrete findings contribute to a comprehensive understanding of the intellectual structure and evolution of the research field on privatization’s impact on CEE enterprises and form the basis for the proposed empirical framework. The framework encompasses the components of privatization, economic factors, and non-economic factors, shedding light on their direct and indirect influences on company performance, corporate governance, and restructuring. By bridging the gap between research and practice, this framework provides valuable insights for policymakers, researchers, economists, managers, and legal professionals involved in privatization processes. It emphasizes the complexities involved in privatization and helps inform evidence-based decision-making and policy formulation. The framework’s application contributes to the ongoing discourse on privatization in the CEE region and facilitates more informed policy-making.

The economic transition in Central and Eastern Europe (CEE) during the 1990s resulted in significant changes, including the privatization of enterprises. Privatization involved transforming centralized planning into decentralized decision-making with the goal of maximizing profits in a competitive market environment. This process has attracted substantial attention in the literature on economic transition, focusing on its impact on CEE enterprises. Previous studies have explored various aspects such as company performance, ownership, corporate governance, efficiency, and comparisons between different types of enterprises. Despite extensive research on the effects of privatization on CEE enterprises, there is no clear consensus on the topic. The literature lacks a comprehensive understanding of the intellectual structure of this research field, integrating the available papers. Mapping the intellectual structure of a research field can provide valuable insights for future research and facilitate better focus. Previous studies have identified the need for analyzing the impact of specific components of economic transition on CEE enterprises. This paper aims to fill this research gap by providing a comprehensive framework for understanding the effects of privatization on CEE enterprises. To achieve this, we employ a scientometric approach called co-word analysis (CWA). This method quantitatively analyzes the literature to identify key concepts and their connections, allowing us to visualize the intellectual structure of the field. The contributions of this paper can be summarized as follows: (1) identification of core concepts and clusters in the privatization research field; (2) mapping of the intellectual structure, offering new insights for future research; and (3) development of an empirically derived framework, enhancing our understanding of privatization’s impact on CEE enterprises from different economic perspectives.

To map the intellectual structure of the research field, we utilized co-word analysis (CWA). CWA is a quantitative technique that examines the frequency of word co-occurrence in academic papers. By identifying the concepts that frequently appear together, CWA enables the construction of clusters and the visualization of the intellectual structure.

We followed four main steps in the CWA process. First, we selected and extracted academic papers from relevant databases, focusing on publications from 1989 to 2016 that addressed the impact of privatization on CEE enterprises. After eliminating duplicates and ensuring relevance, we obtained a database of 1,393 papers.

The second step involved data pre-processing. We removed stop words, stemmed words to their common representation, merged synonyms, and consolidated concepts. This resulted in a selection of 248 concepts for further analysis.

In the third step, we built clusters of strongly linked concepts using the equivalence index to measure association strength. The algorithm created clusters based on pairs of concepts and their strength of association. This process was performed in two passes, with the first pass forming the initial clusters and the second pass refining and expanding them.

The fourth step included constructing strategic diagrams to map core concepts based on their centrality and density within the research field. We categorized clusters into four quadrants: “motor clusters” (high centrality and density), “basic and undeveloped clusters” (high centrality and low density), “peripheral and developed clusters” (low centrality and high density), and “peripheral and undeveloped clusters” (low centrality and low density).

Additionally, we examined the interrelationships between clusters over time using a similarity index. This allowed us to identify super clusters or networks and analyze their associations and changes.

Next, we will present the most relevant findings from the cluster analysis, evaluate their significance, and provide an empirically derived framework. We will also discuss the limitations of the study before concluding and highlighting the main contributions of the research.

The analysis of core concepts revealed the key concepts closely linked to privatization. These concepts include state, market, reforms, policy, ownership, government, restructuring, industry, investments, management, property, performance, and capital.

In the intellectual mapping of the research field, a total of 54 clusters were identified. These clusters varied in size and interconnections. The clusters were categorized into four quadrants based on their centrality and density. In Quadrant 1, which represents high centrality and density, the core concepts such as capital, corporate governance, environment, management, ownership, performance, policy, reforms, and restructuring were located. Quadrant 2 consisted of underdeveloped clusters, including banks, labor, human capital, and post privatization. Quadrant 3 represented specialized domains like defense industry and oil industry. Quadrant 4 contained peripheral clusters such as welfare, social safety nets, and EU integration.

The analysis of cluster interaction revealed the connections between different clusters. The Property – Reforms – Policy cluster emerged as a primary cluster for several others, including Enterprise restructuring, EU integration, Performance – Ownership, and Labor – Productivity – Capital markets – Human capital. The Performance – Ownership cluster also played a significant role, serving as a primary cluster for Strategic restructuring – Post privatization and Corporate governance.

The evolution of the research field over time was analyzed for three periods: 1989–1996, 1997–2004, and 2005–2016. During each period, certain concepts gained prominence, while others remained underdeveloped. New concepts emerged in later periods, such as HRM, EU integration, and financial crisis. Concepts like monopoly and corruption remained central but underdeveloped.

The analysis of cluster similarities over time revealed clusters that have persisted and those that have emerged or transformed between periods, indicating the dynamic nature of the research field. These results provide a comprehensive understanding of the intellectual structure and evolution of the research field, highlighting the core concepts, cluster interactions, and changes over time.

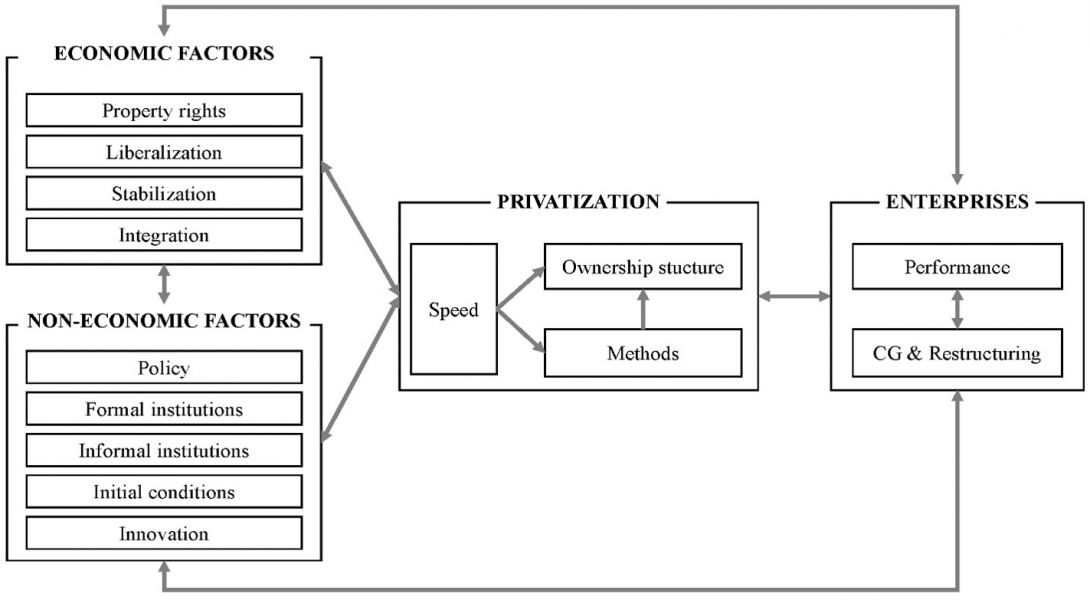

Based on our co-word analysis (CWA) findings, we propose an empirically derived framework that integrates the various components of privatization and their impact on company performance, corporate governance, and restructuring. The framework consists of four main elements: privatization components (privatization methods, speed, and ownership structure), economic factors (property rights, liberalization, stabilization, budget constraint, economic growth, FDI, integration, etc.), non-economic factors (policy, formal institutions, informal institutions, initial conditions, and innovation), and their interconnections.

The construction of an integrative framework allows us to identify and explain the links between privatization components, economic factors, non-economic factors, and their influence on enterprises. The framework highlights both direct and indirect connections among its constituents, emphasizing the complex interplay between privatization, economic factors, non-economic factors, and enterprise outcomes.

Figure 1: Integrative conceptual framework

One crucial issue is the speed and sequence of reforms, which are closely linked to economic and non-economic factors. The debate between shock therapy and gradualism exemplifies this connection. Advocates of shock therapy, driven by the ’Washington Consensus,’ argue for its effectiveness, while others support a gradualist approach. The success or failure of shock therapy in different regions can be attributed to inconsistent policies and the absence of complementary legal and institutional reforms. These discussions underline the interconnections among economic factors, non-economic factors, and privatization speed.

Another important issue is the interpretation of privatization results. While some studies emphasize the positive effects of privatization on efficiency and economic performance, others argue that the choice between complete privatization and complete ownership is not straightforward and depends on the specific context. The role of ownership structure in enterprise performance is highlighted, and evidence shows that privatization alone may not necessarily lead to improved competitiveness and efficiency.

The methods employed for privatization also play a significant role in shaping post-privatization ownership structures and subsequently impacting company performance. Conventional methods like public offers, direct sales, and tenders were initially less appropriate in the early stages of transition. New methods, such as manager-employee buyouts and mass privatization, emerged due to underdeveloped institutional frameworks and low levels of domestic savings. These methods, however, brought about challenges related to fairness, inequality, and political factors in the privatization process. Foreign direct investments (FDIs) have potential beneficial effects on enterprises, including technology diffusion, access to new markets and investment finance, improved corporate governance, and stricter budget constraints. The role of institutional reforms in attracting FDIs is crucial. The importance of institutions, both formal and informal, is widely recognized. Informal institutions, such as ethics, norms, and trust, can improve company performance even in the absence of formal securities or corporate governance laws. However, the low quality of formal institutions and the presence of organized crime can hinder enterprise restructuring and development. The choice of privatization methods can also influence the development of market institutions, such as macroeconomic stability, competitive markets, and property rights enforcement. The background environment, including initial conditions and the post-privatization political and economic context, shapes the effects of privatization.

The proposed framework aligns with theoretical conceptualizations of privatization and integrates the research clusters, sub-clusters, and concepts identified through CWA. It emphasizes the interconnections between economic and non-economic factors and their direct and indirect impacts on enterprises.

Overall, the framework offers valuable insights into the multifaceted nature of privatization and its effects on enterprises. It helps to better understand the complexities involved in privatization processes and provides guidance for policymakers and stakeholders. By considering the interactions between privatization components, economic factors, and non-economic factors, the framework contributes to evidence-based decision-making in privatization policies.

Our findings should be interpreted in light of several limitations. First, the Clustered Word Association (CWA) analysis focuses on priority themes and may not capture concepts that have limited occurrence or appear in an anecdotal manner. This limitation may restrict the comprehensiveness of our analysis and exclude certain important aspects of privatization. Second, conducting research of a novel and interdisciplinary nature presents substantial challenges when comparing diverse countries with different histories, cultures, and traditions. The impact of economic transition on enterprises can vary significantly, making it difficult to draw universal conclusions applicable to all contexts. A third limitation relates to the methodological aspect of our analysis. Comparing the occurrence and interconnection of constructs over time can be influenced not only by changes in research activities but also by changes in terminology. The choice of key words and concepts is crucial, and variations in their selection can yield different themes and results. Despite these limitations, our study contributes to the understanding of privatization effects on enterprises in the Central and Eastern European (CEE) region. It underscores the importance of terminology choices, the challenges of comparing diverse contexts, and the need for careful consideration of methodological approaches. In conclusion, this paper provides valuable insights for policymakers, researchers, economists, managers, and lawyers examining the impact of privatization. The proposed empirically derived framework integrates principal and secondary clusters, highlighting the direct and indirect impacts of economic and non-economic factors on company performance and restructuring during the transition process. The findings emphasize the significance of reform implementation speed and the choice of privatization methods in shaping outcomes for enterprises. They also shed light on the interplay between economic and non-economic factors, highlighting the need for a nuanced evaluation of privatization effects. The proposed framework identifies key research gaps, particularly in relation to underdeveloped clusters related to non-economic factors. Future research should focus on these areas to enhance our understanding of privatization effects on enterprises.

By addressing these considerations, policymakers can make informed decisions and ensure a more effective and beneficial privatization process. While acknowledging the limitations of our study, such as the focus on priority themes and the challenges of comparing diverse contexts, we believe that this research contributes to the current state of knowledge on privatization effects. It demonstrates the importance of terminology choices and the impact of economic and non-economic factors, providing guidance for future research and policymaking efforts.

SUERF Policy Notes (SPNs) focus on current financial, monetary or economic issues, designed for policy makers and financial practitioners, authored by renowned experts. The views expressed are those of the author(s) and not necessarily those of the institution(s) the author(s) is/are affiliated with.

Editorial Board: Natacha Valla (Chair), Ernest Gnan, Frank Lierman, David T. Llewellyn, Donato Masciandaro.

SUERF – The European Money and Finance Forum

c/o OeNB

Otto-Wagner-Platz 3

A-1090 Vienna, Austria

Phone: +43-1-40420-7206

www.suerf.org • suerf@oenb.at

Bevan, A. & Estrin, S. & Shaffer, M. (1999). Determinants of Enterprise Performance during Transition. CERT Working Paper, no.99/03, Heriot Watt University.

Birdsall, N. & Nellis, J. (2003). Winners and Losers: Assessing the Distributional Impact of Privatization. World development, 31(10), 1617-1633.

Boycko, M., Shleifer, A., & Vishny, R. W. (1996). A Theory of Privatisation. The Economic Journal, 106(435), 309–319.

Burda, M. C. (2008). What Kind of Shock was It? Regional Integration and Structural Change in Germany after Unification. Journal of Comparative Economics, 36(4), 557–567.

Callon, M., Law, J., & Rip, A. (1986). Qualitative Scientometrics. In M. Callon, J. Law, & A. Rip (Eds.), Mapping the Dynamics of Science and Technology, London, Macmillan Press, 102–123.

Claessens, S., Djankov, S. (1999). Ownership Concentration and Corporate Performance in the Czech Republic. Journal of Comparative Economics, 27, 498–513.

Djankov, S., & Murrell, P. (2002). Enterprise Restructuring in Transition: A quantitative Survey. Journal of Economic Literature, 40(3), 739–792.

Earle, J. S., & Estrin, S. (1997). After Voucher Privatization: The Structure of Corporate Ownership in Russian Manufacturing Industry. CEPR Discussion Paper Series, no. 1736.

Estrin, S., & Pelletier, A. (2018). Privatization in Developing Countries: What are the Lessons of Recent Experience?. The World Bank Research Observer, 33(1), 65-102.

Frydman, R., Gray, C., Hessel, M., & Rapaczynski, A. (1997). Private Ownership and Corporate Performance: Some Lesson from Transition Economies.

Frydman, R., et al. (2000). The Limits of Discipline: Ownership and Hard Budget Constraints in the Transition Economies. Economics of Transition, 8(3), 577-601.

Gros, D. & Steinherr, A. (1991). From Centrally-planned to Market Economies: Issues for the Transition in Central Europe and the Soviet Union.

Hendley, K., Murrell, P., and Ryterman, R. (2000). Law, Relationships, and Private Enforcement: Transactional Strategies of Russian Enterprises. Europe-Asia Studies, 52(4).

Intriligator, M. D. (1996). Reform of the Russian Economy: The role of Institutions. International Journal of Social Economics, 23(10/11), 58-72.

Moers, L. (2002). Institutions, economic performance and transition.

Nellis, J. (2000). Privatization in Transition Economies: What Next? World Bank Washington.

Svejnar, J. E. (1991). Microeconomic Issues in the Transition to a Market Economy. Journal of Economic Perspectives, American Economic Association, 5(4), 123-138.

Svejnar, J., & Kocenda, E. (2003). Ownership and Firm Performance after Large-Scale Privatization. William Davidson Institute at the University of Michigan, no. 471a.

Topalli, M., & Ivanaj, S. (2016). Mapping the Evolution of the Impact of Economic Transition on Central and Eastern European Enterprises: A Co-word Analysis. Journal of World Business, 51(5), 744-759.