This policy brief note analyzes the post-pandemic financial policy responses in G20 countries, considering possible interlinkages between the pandemic and threats posed by climate change. The proposed review highlights that these measures are not aligned with the goals of the Paris Agreement. It is argued that this failure to account for climate change could amplify the build-up of additional climate-related financial risks and existing vulnerabilities in the financial system, leading to increased overall exposure to climate risks and thus undermining the low-carbon transition in G20 countries. An enhanced macro-prudential policy framework is proposed to tackle climate-related financial risks, scale up green finance for a greener and more sustainable recovery, and preserve the global financial system’s resilience.

The pandemic represents a significant challenge to the real economy and financial stability worldwide. Activities in several economic sectors directly affected by the pandemic have collapsed, and the effects spread quickly to other sectors since demand rapidly fell. Moreover, because of lower corporate profits and investments, decreased households’ wealth, and increased demand for bank credit, both supply and demand shocks deriving from the burst of the pandemic have affected the financial sector worldwide. However, as pointed out by Giese and Haldane (2020), compared to what happened in the Great Financial Crisis (GFC), the financial sector has proved to be more resilient and better equipped to sustain financing to the real economy thanks to the regulatory reforms implemented in the aftermath of the 2007-2008 financial crisis. Nevertheless, financial markets and intermediaries face fundamental challenges related to funding and lending activities, which imply credit, market, and liquidity risks.

As described in D’Orazio (2021c), exceptional measures to sustain the supply of credit to the real economy and preserve the financial system’s resilience have been thus approved by G20 countries2. Most of them eased capital requirements to facilitate the absorption of credit losses and to support lending to real economy sectors. Several regulatory authorities promoted the deactivation of existing buffers (such as capital conservation, countercyclical, systemic buffers, and other regulatory buffers introduced) to mitigate system-wide vulnerabilities and ensure that such buffers would not be used for payouts in the form of dividends, pay-checks, or bonuses. Some countries have also lowered the risk weights for loans directed to small and medium enterprises (SMEs) and sectors significantly affected by the pandemic.

Overall, the review of pandemic-related financial measures suggests almost no action in the direction of including climate risks or sustaining green lending into pandemic macro-prudential responses. However, since the pandemic and climate changes are both threats to financial stability, it is worth asking whether the financial measures implemented after the outburst of the pandemic should have included – at least to some extent – concerns about climate-related risks. This is also relevant considering that the majority of G20 countries so far adopted only “soft” green or climate-related financial measures, such as “green finance principles,” or disclosure requirements aimed at companies or non-financial institutions (see D’Orazio and Popoyan (2019) for an early contribution and the most recent review in D’Orazio (2021a,c)). Moreover, only very few countries, namely Canada, China, France, and the UK, actively consider climate-related financial risks through stress tests. Banks’ mandatory disclosure requirements have been adopted only in few emerging economies, i.e., China, Indonesia, Mexico, and Turkey.

The evidence collected in D’Orazio (2021a,c) reveals that the existing financial framework is insufficient to assess the financial system’s exposure to climate-related financial risks or reorient financial flows towards sustainable investments. Additionally, it is emphasized that the financial policies promoted in response to the pandemic can amplify existing vulnerabilities related to climate change. Since they do not include any concern related to green financial policymaking and regulation, they could be promoting an increase in lending to carbon-intensive sectors, thus reinforcing the so-called carbon bias. Consequently, the overall exposure of the G20 to climate risks is worsened, and the green transition is negatively affected.

To complement fiscal or monetary policies implemented to offset the damages brought on by COVID-19, we propose using an enhanced climate-related macro-prudential framework to guide action. The rationale for this is that macro-prudential policies are important complements to monetary and fiscal policies (Beck, 2020; Bénassy-Quéré & Weder di Mauro, 2020) and could support green market development to enhance the transition towards relevant green economic sectors (Allan et al., 2020).

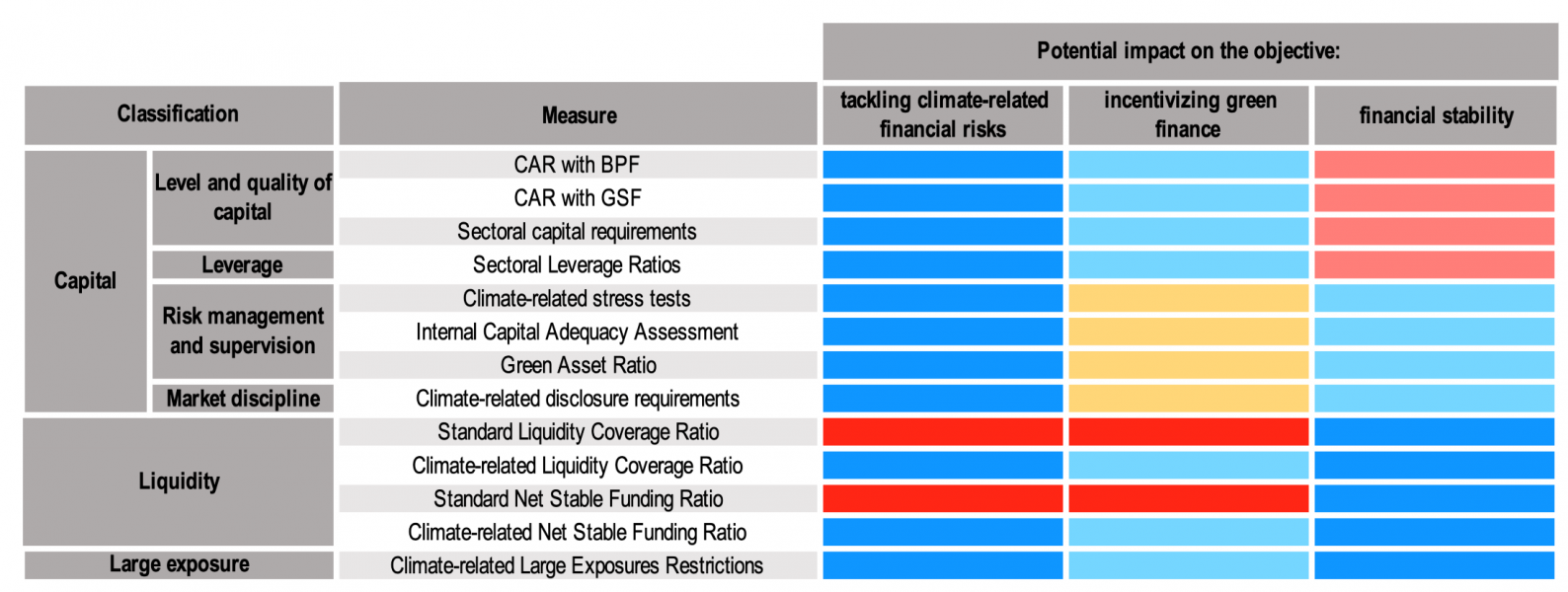

Based on the results of our analysis, we argue that policymakers in the G20s should be alerted that the pandemic-related recovery measures could be promoting an increase in lending to carbon-intensive sectors, thus worsening countries’ overall exposure to climate risks, negatively affecting the green transition, and raising risks to the financial system as a whole. Moreover, because these policies are crucial for determining the global responses to climate change (D’Orazio & Dirks, 2021), we maintain that when temporary, pandemic-related prudential measures are lifted, financial regulators should devote particular attention to achieving three interrelated objectives: tackle climate-related financial risks, scale up green finance for a greener recovery, and preserve the financial system’s resilience (i.e. financial stability). To this aim, we outline a set of prudential instruments, which could be chosen when revisions to regulations are considered. We distinguish between capital, liquidity, and large exposure measures and classify them according to their potential impacts on tackling climate risks, scaling up green finance, and taming financial instability. An overview of the policies and their potential impact the three objectives is offered in Figure 1.

Figure 1. Overview of climate-related macro-prudential policies and their potential impact on tackling climate risks, scaling up green finance and taming financial instability.

Source: D’Orazio 2021c.

Source: D’Orazio 2021c.

Notes: CAR: capital adequacy ratio; BPF: brown-penalizing factor; GSF: green supporting factor.

In particular, we outline five main policy recommendations.

First, particular attention should be devoted to capital and liquidity measures; we advocate for further studies on how to integrate climate risk in capital requirements because they could represent an important instrument to address climate risks and scale up green finance jointly.

Second, to avoid over-leveraging, (standard) leverage ratios should be used and closely observed to carry out monitoring exercises designed to enhance green investments.

Third, developing climate-related large exposure limits would help contain systemic risks deriving from the materialization of climate risks.

Fourth, we emphasize the importance of climate-related risk assessment by promoting mandatory climate-related stress tests and climate-related internal capital adequacy assessments.

Finally, for the correct functioning of the proposed climate-related instruments, we advocate using a harmonized taxonomy of financial assets, such as the one proposed at the European level. Beyond this, there is also a need for an enhanced climate-related disclosure requirement framework, which should be made mandatory for all financial institutions.

Calling for a coherent macro-prudential strategy that is aligned with the Paris Agreement does not imply that the burden of addressing the climate change emergency should be carried by central banks and financial regulators alone. Instead, it emphasizes the crucial role they could play in reducing systemic risks related to the low-carbon transition, directing capital flows to meet climate objectives, incentivizing financial institutions to factor climate risks into decision-making, and protecting investors from market failures related to possible abrupt changes in climate (Batten et al. 2016). As discussed in Schnabel (2020), “COVID-19 provides a chance to build a greener economy. [. . .] And it is a chance to make a deeper and greener financial market that reduces the costs of transitioning towards a low-carbon economy”.

Allan, J., Donovan, C., Ekins, P., Gambhir, A., Hepburn, C., Reay, D., Robins, N., Shuckburgh, E., & Zenghelis, S. (2020). A net-zero emissions economic recovery from COVID-19. COP26 Universities Network.

Alonso Gispert, T., Feyen, E., Kliatskova, T., Mare, D. S., & Poser, M. (2020). COVID-19 pandemic: A database of policy responses related to the financial sector. World Bank Finance, Competitiveness, Innovation Global Practice.

Batten, S., R. Sowerbutts, and M. Tanaka (2016). Let’s talk about the weather: the impact of climate change on central banks. Technical report, Bank of England.

Beck, T. (2020). Finance in the times of coronavirus. Economics in the Time of COVID-19, 73.

Bénassy-Quéré, A., & Weder di Mauro, B. (2020). Europe in the time of COVID-19: A new crash test and a new opportunity. Europe in the Time of COVID-19, 1.

D’Orazio, P. (2021a). Data on climate-related financial policies in G20 countries. FigShare, https://doi.org/10.6084/m9.figshare.16358961

D’Orazio, P. (2021b). Pandemic-related financial policies in G20 countries. FigShare, http://doi.org/10.6084/m9.figshare.14706444.

D’Orazio, P., (2021c) Towards a post-pandemic policy framework to manage climate-related financial risks and resilience, Climate Policy, DOI: https://doi.org/10.1080/14693062.2021.1975623

D’Orazio, P., Dirks M. (2021) Exploring the effects of climate-related financial policies on carbon emissions in G20 countries: a panel quantile regression approach; Environmental Science and Pollution Research, DOI: https://doi.org/10.1007/s11356-021-15655-y

D’Orazio, P. , Popoyan, L., (2019) Fostering green investments and tackling climate-related financial risks: Which role for macroprudential policies?, Ecological Economics, vol 160, Pages 25-37.

IMF. (2020). Policy responses to COVID-19 – policy tracker. International Monetary Fund.

Schnabel, I. (2020a). Never waste a crisis: COVID-19, climate change and monetary policy – speech by Isabel Schnabel, member of the executive board of the ECB, at a virtual roundtable on “sustainable crisis responses in Europe” organised by the inspire research network, 17 July 2020. European Central Bank.

YPFS. (2020). Yale program on financial stability, COVID-19 financial response tracker. Yale Program on Financial Stability.

Chair of Macroeconomics, Faculty of Economics and Management, Ruhr-Universität Bochum, Universitätsstraße 150, 44801 Bochum (Germany); Email: paola.dorazio@ruhr-uni-bochum.de

D’Orazio 2021c provides an analysis of the pandemic-related financial policies enacted from March to December 2020 and reviewed all existing policy measures implemented by G20 countries. Three data sources were considered: the World Bank database (Alonso Gispert et al., 2020), the IMF policy tracker database (IMF, 2020), and the Yale Program on Financial Stability COVID-19 Financial Response Tracker (YPFS, 2020). After selecting the G20 countries from the three datasets, we built a policy database, which resulted in 737 policies. For further details, see D’Orazio 2021a.