Author’s Note: For their very insightful comments and suggestions, I thank two anonymous reviewers, Pierre-Cyrille Hautcoeur, Eric Monnet, Angelo Riva, Pierre Sicsic and Stefano Ungaro. I acknowledge my debt to archivists at the Banque de France, the Ministry of Finance and Crédit Lyonnais. The views expressed do not necessarily represent the views of Banque de France.

In the follow-up to the 1926 political and monetary crisis in France, a new government led by Raymond Poincaré attempted to restore monetary stability by restructuring public debt. A sinking fund was missioned to withdraw short-term public bills from money markets. This policy disorganized the largest Parisian banks of the time, as they relied on these bills to manage their liquidity. Without developed domestic money markets, no other asset could absorb the excess liquidity freed by the withdrawal of these bills, and these leading banks faced a low-rate environment. In search of yield, they expanded their activities abroad a few months before the 1929 crash. These findings renew our understanding of the expansion of France’s banking sector in the 1920s. In addition, they shed new light on the role of public debt in financial stability in an open economy.

Government bonds are widely recognized as being central for modern financial economies: they enable to overcome financial frictions, as these assets are liquid (Woodford 1990, Holmström and Tirole 1998, Angeletos et al. 2023) and safe (Gorton 2016). In addition, the degree of substitution between privately and publicly produced safe assets in modern money markets is regarded as imperfect, especially in periods of stress: a lower share of publicly produced assets may thus threaten financial stability (Stein 2012; Krishnamurthy and Vissing-Jorgensen 2015).

In Espic (2023), I discuss how the Poincaré monetary stabilization of 1926-1928 in France fits into these theories. By withdrawing short-term bills, the Poincaré government deprived French banks of an asset that had become central in their liquidity management since the end of World War I. In the absence of a developed money market producing an alternative safe and liquid asset, French banks turned to riskier assets on foreign market places, on the eve of the 1929 financial crash. These events tends to validate the special role attributed to government bonds, although they are unlikely to explain by themselves the failure of a number of small French banks in the early 1930s (Baubeau et al. 2021).

During World War I (1914-1918), France faced a huge need to finance its war efforts and was unwilling to raise taxes. The State thus mainly used two debt instruments: Avances of Banque de France (BDF) – a credit line opened by the BDF for the Treasury, with a maximum amount voted by Parliament – and short-term bills (less than 2 years of maturity), Bons de la Défense Nationale (BDN), which were freely available for subscription at any time to banks and the general public alike. In 1919, French public debt amounted to 32 years’ worth of tax revenue (End, 2019) and had a very different composition compared to the pre-WWI period. Before 1914, France relied mostly on long-term bonds; after 1918, short-term debt played a considerable role. The post-war period did not witness any dramatic change in this debt structure, partly because of the political instability that impeded any consistent reform for public finance.

This culminated in a financial and government crisis in the spring of 1926. A new government, led by veteran centre-right politician Raymond Poincaré, took office in July 1926 with a clear intention to stabilize public debt. Avances were partly repaid in 1927 and by the monetary law of June 24th, 1928. The issue was more complex for BDNs, which amounted to roughly 45 billion Francs in July 1926. The Poincaré government thus targeted these bills with the creation of a sinking fund, the Caisse Autonome d’Amortissement (CAA) in August 1926. The fund was endowed with fiscal resources, and its mission was to terminate the existence of BDNs by repaying or converting maturing bonds into 2-year bonds with lower maturity. Overall, the circulation of BDN progressively decreased from 49 billion Francs in December 1926 to 33 billion Francs in June 1928, and short-term bills nearly vanished.

These bills were however essential to the activity of French banks in the Interwar. Banks resorted massively to the discount of short-term bills for agents in need of liquidity. They could then hold these bills until maturity or ask BDF to discount them only if their maturity was shorter than three months. Other money markets in France were underdeveloped at this time, in line with BDF’s refusal to pursue open-market policies and prioritization of discounting. BDNs were thus perfectly suited for this system: their 1-month or 3-month maturity enabled banks to satisfy their liquidity needs.

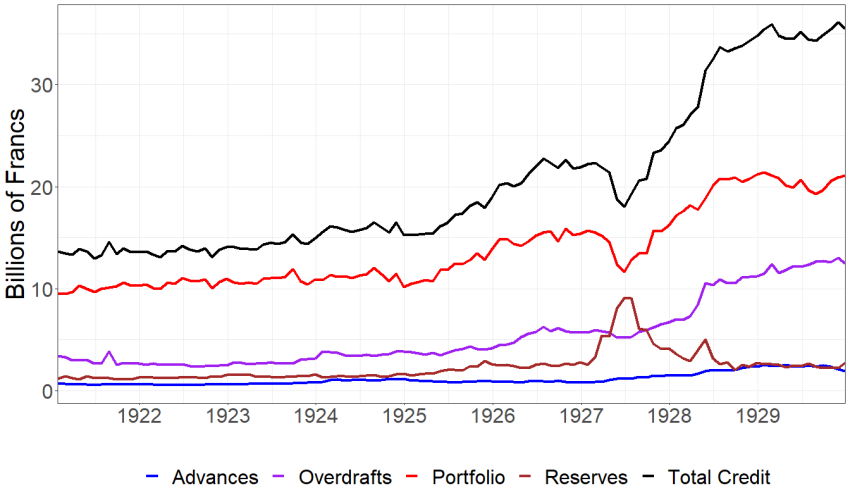

Therefore, in 1927, banks’ credit reduced tremendously and fed their reserves, as banks found no alternatives to BDNs. This is evidenced by figure 1, which presents an aggregate decomposition of banks’ assets. Credits are divided into three categories. ‘Advances’ gathers advances against collateral and is a minor category. ‘Overdrafts’ gathers current accounts and assets held by banks’ correspondents. ‘Commercial portfolio’ is the largest category and gathers discounted short-term bills, whether public or private, domestic or foreign. The last item presented is banks’ reserves, i.e., their most liquid assets held as cash in their vaults or as deposits at BDF and, more surprisingly, perhaps, at the Treasury.

This is confirmed by financial commentators of the time, who argued that the restructuring policy released considerable liquidity, along with the renewed appreciation of the Franc attracting investors. Paul Ricard, for instance, summarized the situation this way:

“The two following factors drove the dynamics of the money market in 1927. On the one hand, a quick decrease in investment opportunities. On the other hand, a sharp increase in available liquidity following the inflow of foreign currencies. The first factor is the consequence of the maturity lengthening conducted by the BDN fund. This measure, which reached its most critical phase with the abolition of one-year bills, pushed Defence bills out of banks’ portfolios and into private coffers… At the time, some people were pleased with this state of affairs, saying that it would finally force banks to do their job: lend capital to commerce and industry. The issue was that commerce and industry did not need more capital, at least not under the short maturities banks could supply.”1

The excess supply of funds created by the shortage of liquid and safe assets and the inflow of foreign funds with ongoing monetary stabilization then led to a decline in interest rates and compressed margins. This low-rate environment may have favoured search-for-yield behaviour. However, if the rebound in credit starting from mid-1927 is very clear (cf. figure 1), which assets could have attracted banks’ funds is less so.

Figure 1: Assets of the four main French banks

Source: Banque de France, Bilans des sociétés de crédit.

Source: Banque de France, Bilans des sociétés de crédit.

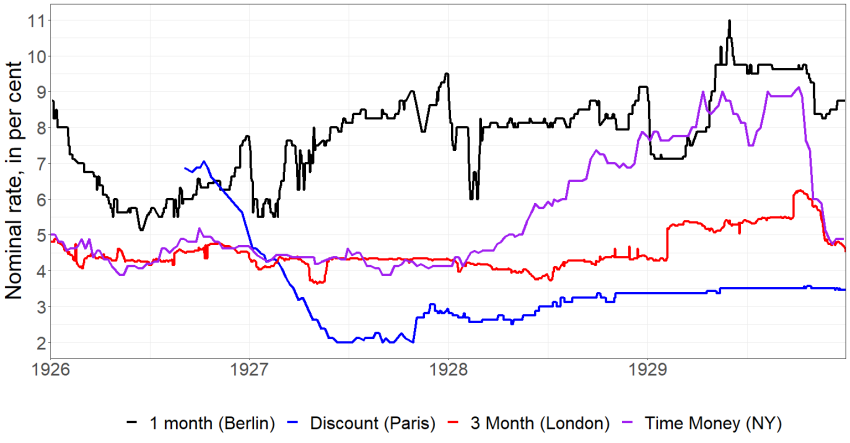

In fact, banks faced a way out of the slump on foreign markets. Indeed, the fall in domestic interest rates, the stability of foreign interest rates, and the stability of the exchange rate with upcoming monetary stabilization provided French banks with some arbitrage opportunities. Figure 2 plots the spreads between different monetary market rates. The fall of French rates until the summer of 1927 and its limited recovery in 1928 led to a sizeable international spread until the end of 1929. At the same time, exchange rates did not adjust to close the gap, as BDF intervened on the foreign exchange market to peg the Franc against the Pound, in order to prepare the upcoming monetary stabilization. This distortion to currency markets thus made expansion abroad a credible option for banks.

There remained a key obstacle to the outflow of funds on profitable foreign markets. Since April 3rd, 1918, capital exports were banned to channel funds towards France’s reconstruction. However, the banking industry found a way to avoid this restriction and started investing in foreign markets before the ban’s repeal. The role of BDF was central, as its interests met that of the large Parisian banks. Indeed, BDF intended to regain control over monetary policy, as the discount rate was losing its edge. It thus saw in the inflow of foreign currency on its balance sheet a way to adopt an ‘open market’ policy. Beginning in July 1927, BDF lent French banks the Pounds it had accumulated since the end of 1926. This solution helped direct excess liquidity abroad, before the official repeal of the capital export ban on January 10th, 1928, after a year of fierce debate at BDF board meetings.

The financial press emphasized this renewed interconnection with foreign financial markets, construing it as a sign of financial power. According to Paul Ricard, France was then back to its pre-1914 glory: ‘We believe that the period of eclipse which the Paris market has experienced in its international function for the past fifteen years is now definitively closed’. However, officials and bankers were not completely blind to the risks such large exposures abroad represented. For instance, Pierre Quesnay, the head of economic studies at BDF, pushed for the further development of money markets beyond simply discounting short-term bills, but faced the resistance of assistant governor Charles Rist, who considered this proposition as purely inflationary. The first concrete project was achieved in 1929, but this was already too late, as financial conditions had already started to tighten, especially in London.

Figure 2: International money market rates

Source: Banque de France, Cours des Changes.

Source: Banque de France, Cours des Changes.

Following the 1926 financial crisis, the Poincaré government restructured public debt, deprived banks of their main liquidity management tools since WWI’s end, and drove down interest rates. Searching for yield, the largest Parisian banks pushed the government to lift restrictions on capital outflows on the eve of the Great Crash of 1929. The transformation of French money markets, which relied extensively on short-term public bills after WWI, was not radical enough to impede excess liquidity from flowing abroad. This episode supports the existence of an imperfect substitution between treasuries and private short-term debt in the supply of liquid assets. In addition, this period highlights that private supply can be a challenge, even outside periods of stress, and relies on the voluntarism of public actors. Henceforth, the impact of fiscal policy on financial markets, notably through the term structure of public debt, is highly dependent on the structure of money markets.

ANGELETOS, G.-M., COLLARD, F., DELLAS, H. (2023). “Public Debt as Private Liquidity: Optimal Policy”. Journal of Political Economy, 131.11, pp. 3233-3264.

BAUBEAU, P., MONNET, E., RIVA A., UNGARO. (2021). Flight-to-safety and the credit crunch: a new history of the banking crises in France during the Great Depression. The Economic History Review, 74.1, pp. 223–250.

END, N. (2019). Two Decades of Walking on a Tightrope: Public Debt Management in France during the Interwar Period. In E. Dabla-Norris (ed.), Debt and Entanglements Between the Wars, pp. 121–171. International Monetary Fund.

ESPIC, A. (2023). Public debt as private liquidity: the Poincaré experience (1926-1929). Financial History Review, 30.3, pp. 308-329.

GORTON, G. (2016). The History and Economics of Safe Assets. NBER Working Paper, 22210.

HOLMSTROM, B., and TIROLE, J. (1998) “Private and Public Supply of Liquidity.” Journal of Political Economy, 106.1, pp. 1–40.

KRISHNAMURTHY, A. and VISSING-JORGENSEN, A. (2015). The Impact of Treasury Supply on Financial Sector Lending and Stability. Journal of Financial Economics, 118.3, pp. 571–600.

RICARD, P. (1928). Le marché monétaire et les changes, Revue d’économie politique, 42.3, pp. 499-529.

RICARD, P. (1929). Le marché monétaire et les changes, Revue d’économie politique, 43.3, pp. 438-47

STEIN, J. (2012). Monetary Policy as Financial Stability Regulation. The Quarterly Journal of Economics, 127.1, pp. 57–95.

De TOYTOT, A. (1991). La Caisse autonome d’amortissement : une expérience de gestion de la dette publique (1926-1932). Revue d’économie financière, 1.1, pp. 159– 174.

WOODFORD, M. (1990). Public Debt as Private Liquidity. American Economic Review, 80.2, pp. 382– 388.

Ricard 1928, pp. 499-502.