This SUERF Policy Brief summarizes Hofmann and Xia (2022). The views expressed in this study reflect those of authors and are not necessarily those of the Bank for International Settlements.

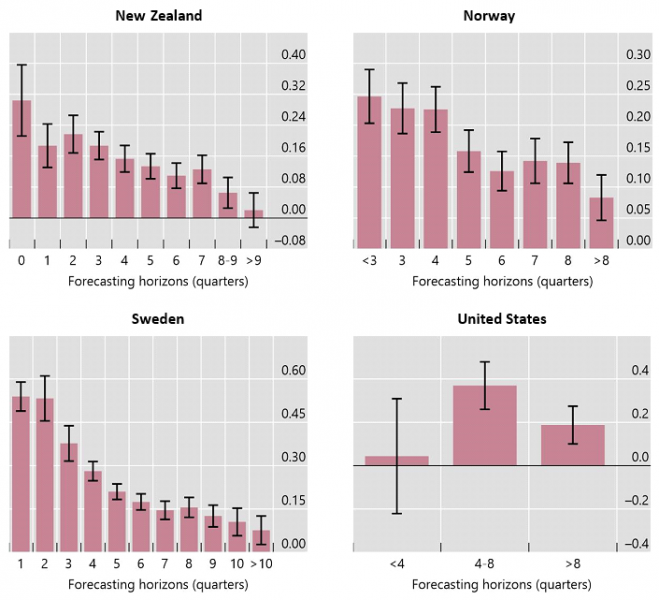

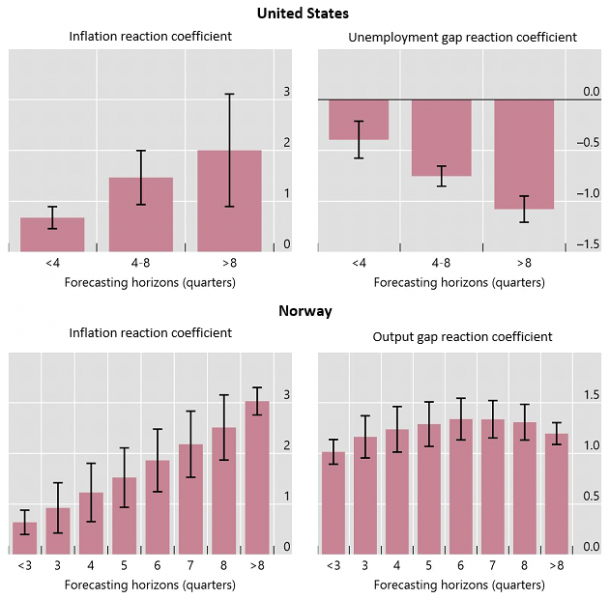

Note: the chart plots estimated coefficients in Taylor-type interest rate reaction functions relating policy rate projections and macroeconomic projections.