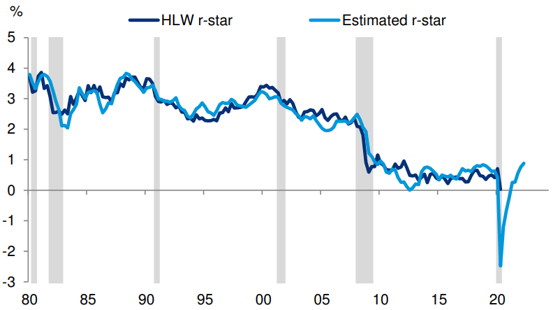

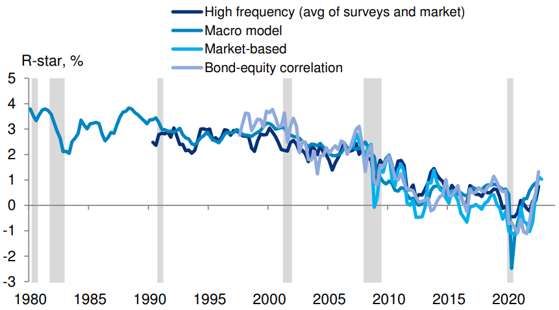

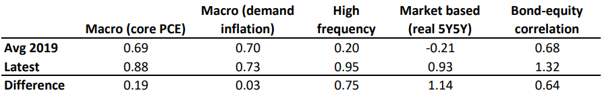

In recent work we used a simple regression framework based on a few fundamental macroeconomic variables to derive new estimates of r-star. Our model fits the pre-pandemic features of HLW r-star very closely. Based on recent developments in these underlying drivers, r-star has likely risen since the pandemic.

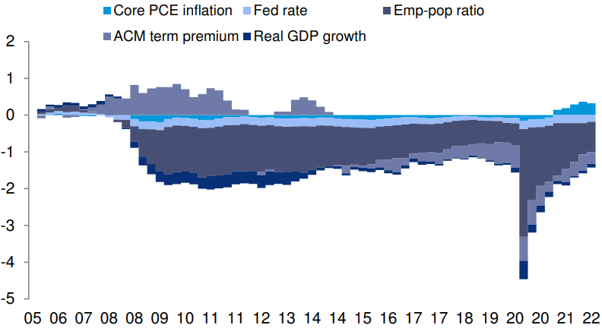

To account for other factors that can impact r-star estimates beyond the traditional macroeconomic variables we also include the 10-year term premium. This variable is intended to capture shifts in the supply and demand for savings — not only domestically but also globally – as well as the possible safety premium that could be associated with US assets that could impact estimates of r-star.3 These forces were especially important in capturing the persistently depressed level of r-star that prevailed following the Global Financial Crisis (GFC) even after the economy had largely recovered.

The shift towards a more proactive fiscal stance is likely to have an important impact on r-star estimates over time as well. For example, if a given growth rate could be delivered with easier fiscal policy in exchange for tighter monetary policy, r-star estimates would likely be higher than if that same growth rate were delivered with tighter fiscal policy and easier monetary policy. This substitutability between fiscal and monetary policy instruments is likely one reason why r-star estimates were lower prior to the pandemic and are currently higher post-pandemic. In other words, whether or not the aggressive fiscal policy response to the pandemic marks a structural shift in the proactiveness of fiscal policy could be critical in determining whether r-star can remain at or above recent estimates.

See Laubach and Williams (2003), “Measuring the natural rate of interest,” Revised of Economics and Statistics 85, no. 4 (November): 1063-70. Holston, Laubach, and Williams (2017), “Measuring the natural rate of interest: International trends and determinants”, Journal of International Economics 108, supplement 1 (May): S39-S75.

A similar approach using a different set of regressors was utilized in an IIF paper earlier this year: Global Macro Views – Remember the thing called R*?.

See this work by the NY Fed: “Safety, liquidity, and the natural rate of interest” Del Negro, Giannone, Giannoni and Tambalotti, May 2017. https://www.newyorkfed.org/research/staff_reports/sr812.html

See, Deutsche Bank US Economic Perspectives, ”(R-)Star gazing: Macro drivers suggest real neutral rate may have risen”