In this column we investigate the interaction between financial constraints faced by firms and their price setting behaviour. Systematic differences in the frequencies of price increases and decreases arise between financially constrained and unconstrained firms, consistently across several alternative proxies. In particular, financial constraints affect price adjustments asymmetrically: When firms are financially struggling, they are more likely to increase their prices, while simultaneously exhibiting greater rigidity in lowering prices.

Firms’ price setting is a classic but elusive object of economic investigation. Indeed, the scarcity of producer price data hindered investigating the determinants of the pricing behaviour of price setters themselves, which is a major unresolved issue for monetary policymakers. In the recent context of soaring prices and firms struggling with rising financing costs, the relation between firms’ financial situation and how they decide to adjust their prices is again attracting attention.

The financial situation of firms could play a role in price setting for several theoretical reasons, potentially affecting upward and/or downward price adjustments. In a recent working paper, Berardi (2024)1, we argue that firms raise their current prices when financially constrained, while financially healthy firms may instead cut their prices to drive out competitors, consistently with the general equilibrium model proposed by Gilchrist et al. (2017). We find empirical evidence of this asymmetric price adjustment behaviour that is not only robust to a wide range of alternative proxies for financial constraints, but at play over an extended period of time, for firms of all sizes including SMEs, and is robust to different periods, transcending a specific period of macroeconomic turmoil.

One of the challenges of investigating the interaction between financial constraints faced by firms and their price setting behaviour is that firms’ financial constraints are difficult to capture. To address the absence of consensus in the literature about the best approach to approximate financial constraints, we exploit a rich micro dataset and test a variety of proxies, such as the exiguity of operating cash flow (OCF) ratio, trade bill payment defaults, the leverage ratio, and the Whited-Wu index.

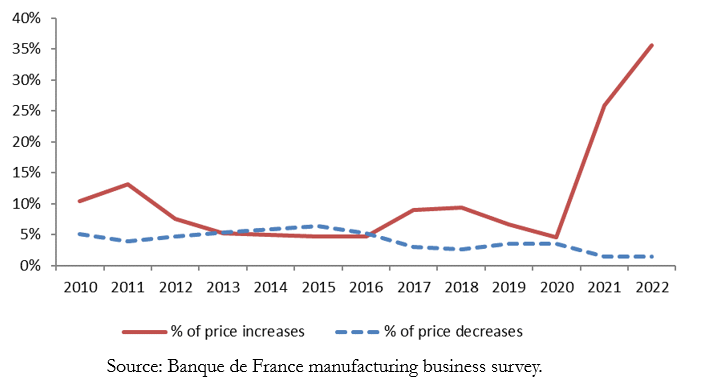

To assess producer prices setting, we exploit the monthly business survey conducted by the Banque de France. The extensive margin of price setting, represented in Figure 1, is the main driver of aggregate price variations in France (Berardi and al., 2013 and Berardi and Gautier, 2016). Over the 2010-2022 period, each month on average 11.1% of firms increased the price of their most representative product and 3.8% of firms decreased it, in the French manufacturing sector.

Figure 1. Annual average of the monthly frequency of price increases and decreases

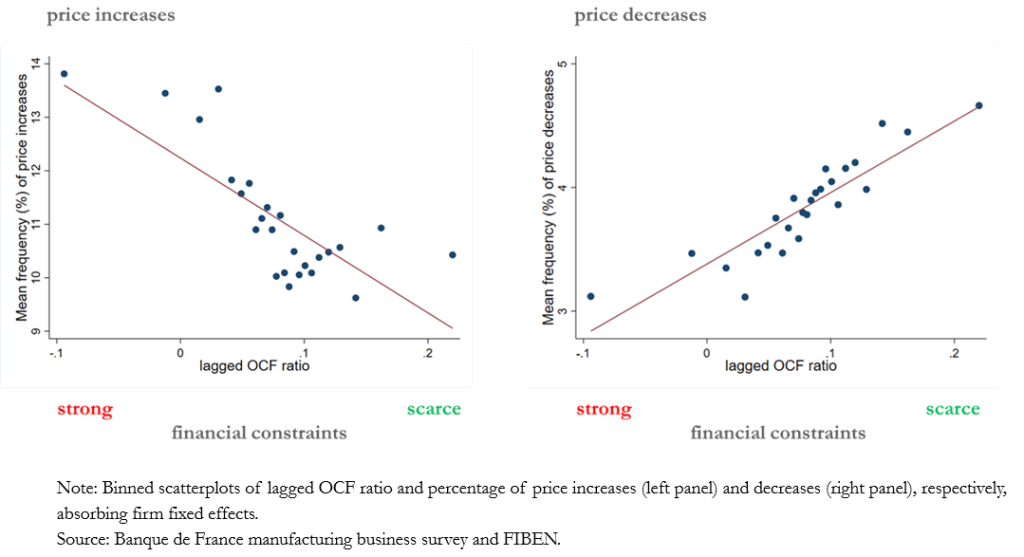

Considering several alternative ways to proxy the financial constraints, we show that, when a firm is more financially constrained, it is consistently more likely to increases its prices and less likely to decrease them. A visual way to illustrate this result is a binned scatterplot representing, over the period 2010-2022, the average effect of firms’ financial constraints on the percentage of their monthly price increases and decreases (Figure 2). For each bin of lagged OCF ratio (here proxying financial constraints) a dot represents the corresponding mean percentage of monthly price increases, controlling for firm time-invariant fixed effects. The illustration suggests that firms are more likely to increase prices and less likely to decreases them when they have a lower availability of internal resources (low lagged OCF ratio), that is, when they are more financially constrained. Indeed, self-financing is the most widespread financing resource for the large majority of companies.

The same conclusion arises estimating an econometric model that also controls for sector times year fixed effects and for a number of time-varying firm characteristics and approximates financial constraints with the scarcity of lagged OCF, as well as a variety of other proxies. The asymmetric impact of a firm’s financial constraints on its price setting also proves robust to different time periods, to taking into account potential endogeneity, to an alternative definition of the dependent variable, and to the estimation of different econometric models.

This column investigates the interaction between financial constraints faced by firms and their price setting behaviour over a long and recent period of time. Financial constraints appear to affect price adjustments in an asymmetric way: when firms have financing difficulties, they exhibit greater upward flexibility, but at the same time, their price setting is more rigid downward.

The relation existing between financial difficulties of a firm and its price setting implies, in the current economic context of rising financing costs, that financially constrained firms may contribute to inflation dynamics.

Figure 2. Firms’ financial constraints and percentage of price increases and decreases

Berardi, “R(a)ising Prices While Struggling: Firms’ Financial Constraints and Price Setting”. Banque de France Working Papers 942, 2024.