r* is widely considered to be an important guidepost for monetary policy: central banks should aim at bringing inflation to the equilibrium consistent with r* by adjusting interest rates accordingly. Due to the decrease in r* over the past decades, driven by secular structural forces, the monetary policy space is constrained by the zero or effective lower bound on interest rates, prompting the use of non-conventional policy tools. Thus, there is an urgent need to increase r*. Assuming that r* is exogenous, there is little monetary policy can do. However, there are reasons to challenge this assumption, for example due to monetary policy’s potential long-term effects on productivity. Yet the effects of monetary policy on productivity, and therefore on an “endogenous” r*, are ambiguous. In the best of all worlds, an expansionary monetary policy may contribute to raising r*. In the worst-case scenario, an expansionary monetary policy may lower r* further and create a vicious circle of falling r* and an increasingly ultra-loose monetary policy. Therefore, the most promising policies to raise r* are outside the monetary policy realm and include structural areas, such as digitalization, decarbonization and measures to address population aging.

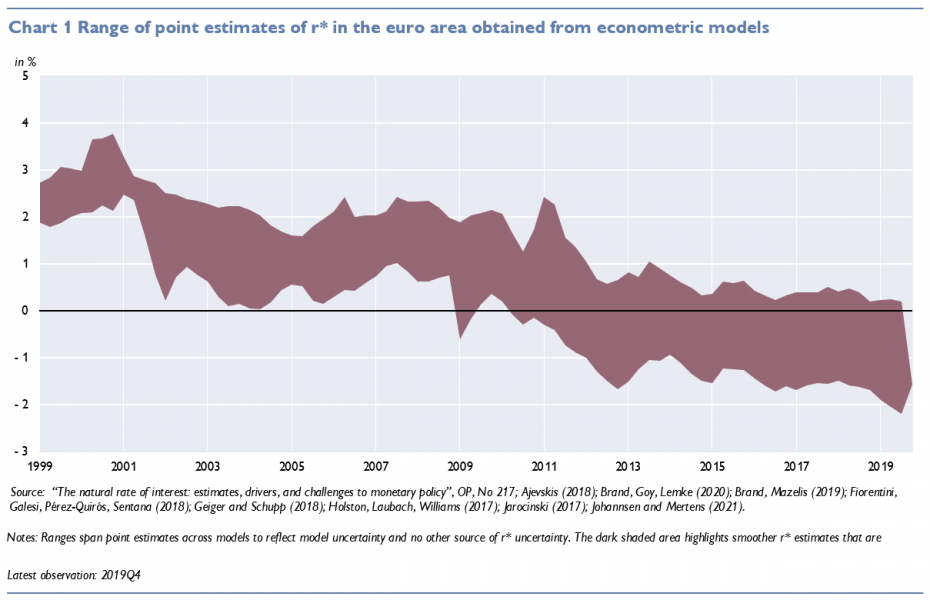

The unobservable equilibrium real interest rate, called r* in central bank circles and academia, has been in decline across advanced economies over at least the last 30 years (chart 11).2 Its decline is typically linked to declining productivity, population aging and an imbalance in the demand for safe assets. The fall in the estimated r* toward or below zero, together with very low inflation rates across much of the developed world, has brought policy rates close to the effective lower bound. This has required that central banks in these countries set interest rates at very low levels. Beyond that, it has led to the introduction of unconventional monetary policy measures, including negative interest rates for central bank deposits in many, but not all, advanced economies, forward guidance on interest rates and other policy measures, large-scale asset purchases as well as targeted lending programs. The need to use these instruments was reinforced with the economic fallout of the Covid crisis.

Without a reversal of the trend of r*, the policy space for central banks will remain limited and economic prospects dim. Central banks will have to extend current, or implement new, unconventional monetary policy instruments. With inflation rates above the now almost common target rate of 2%, nominal interest rates could be positive, stabilizing the inflation level. However, policy and market rates well above zero may exceed the financing capacity of highly indebted governments if economic growth stalls. At zero or negative interest rates, public expenditure may only be able to support a fragile low-level equilibrium (as described by Larry Summers3). This, however, offers little prospect for rising living standards if the conjectured main sources of low r* are not being addressed: low productivity growth, the fallout of population aging and the disequilibria in the supply of and demand for financial resources (beyond safe assets).

A policy call for raising r* to allow conventional monetary policy instruments to reign again and sovereign debt levels to become sustainable ̶ not by keeping nominal debt service low, but rather by rising real and nominal GDP ̶ is confronted with a number of conceptual, analytical and policy challenges. Conceptual challenges include the question whether r* is a well-defined and useful guidepost for monetary policy. After all, it is an equilibrium concept that is typically applied in a disequilibrium setting. So there may be good reasons to believe that r* is not exogenous to monetary policy, which is discussed further below.

Analytically, it is not yet clear what the main drivers of r* are. The empirical link between the estimated r* trend and the trend of its main possible drivers remains typically weak.4 One of the conjectured drivers of r* (increase in excess savings) stems largely from equilibrium conditions of optimal consumption allocation (as described by the Ramsey equation5) mixed with partial-equilibrium considerations such as the demographic fallout of population aging. Furthermore, our knowledge of how to increase productivity – one of the main determinants of r* – remains as limited as the policy instruments available to increase productivity over a longer period. The same applies to the demographic fallout of population aging, although here there seems to be more room for maneuver. Little work has been done so far on the question of the effects on r* stemming from the savings glut – both taking into account and disregarding the effects of demographic developments – as well as the unfulfilled demand for capital in developing countries.

It is clear that the decline in r* has an impact on monetary policy decision-making and that we are all interested in raising r*. Before discussing how this could be achieved, it is necessary to discuss first the usefulness as well as the complications this concept implies for central bankers. r* is a theoretical and therefore unobservable concept widely used as a guidepost to determine the monetary policy stance in real time. In theory, when interest rates are above r*, the monetary stance is restrictive and when they are below r*, as we suppose is the case now, the monetary stance is accommodative. Thus, the central bank’s setting of policy rates needs to be seen relative to the level of r*. We have to make sure that we track movements in r*, and we have to do this in real time based on uncertain estimates of the equilibrium level. Besides the complication of tracking an unobservable variable in real time, when r* is very low our policy space is reduced due to the effective lower bound on nominal interest rates.

The complications that arise from this situation are well known. We can increase policy space only by using unconventional monetary policy measures, which themselves also have limits if we take side effects and proportionality issues seriously (which we no doubt should). If our policy space is limited, we risk falling into a liquidity or debt trap or, as many have argued, we may find ourselves in an equilibrium characterized by very low growth (secular stagnation).6 All these scenarios have negative implications not only for how central banks can conduct policy to stabilize inflation and for the economy as a whole, but more generally for economic growth and welfare.

Thus, there is no doubt that we are not only interested in understanding and measuring r*, but more importantly, in finding ways to raise r*.

3.1 The limitations of monetary policy

Let’s start with the possible contribution of monetary policy to raising r*. An accommodative monetary stance creates incentives for firms to invest – hopefully in productivity-enhancing technologies – and to accelerate the diffusion and adoption of new technology. Hence, besides stimulating aggregate demand, and thus also inflation in the short to medium run, monetary policy might also support productivity growth and, as a result, medium- to long-term growth and r* in the long run. The combined effect of higher inflation and higher real growth should increase the level of nominal equilibrium interest rates, thereby increasing the central bank’s policy space. At first sight, this optimistic view of the positive short-term and potential longer-term effects of monetary policy on output (and thus r*) sounds plausible, and, of course, it would be the best of all worlds. However, in reality, we have seen neither an increase in inflation, nor a rise in productivity, and estimates of r* remain close to zero although monetary policy has been highly accommodative for many years. Besides the euro area, the case of Japan is also telling, or even more so.

There are three possible explanations for this situation: First, we either have been confronted constantly with negative shocks or find ourselves in a low-growth equilibrium from which we are not able to leave. Second, monetary policy is not as accommodative as we think; this means we are mismeasuring the output gap or r* itself. A third, and the most provocative explanation is that r* could be endogenous if monetary policy has long-term effects on productivity. The problem is that if monetary policy has an effect on r* through productivity, this effect is not always positive.

When central banks decide on the monetary stance, they are guided by r*, which we commonly assume is exogenous, meaning that our monetary policy cannot affect it. This is very convenient. It would be difficult to use a guidepost that is influenced by our own policies. There are valid theoretical reasons to assume that r* is indeed exogenous: since r* is a long-term equilibrium concept and monetary policy is commonly thought to be neutral over the long term, then r* should be exogenous. This is the mainstream thinking about r*.

However, there is an increasing number of hypotheses and models that question this simple and convenient notion. First, there may be a circular relationship between productivity and real interest rates.7 Also, endogenous growth models suggest monetary policy may have an impact on productivity beyond the business cycle. Both arguments suggest that r* is not exogenous and therefore we are moving our guidepost by setting policy rates.

The endogeneity of r* raises two questions: Should we keep using r* as our guidepost if we are moving it? And second, in which direction are we moving it? With respect to the first question, if r* is endogenous, we should develop analytical tools that take this fact into consideration. Moreover, our policy decisions should be guided by the insights of such models.

The answer to the second question – “in which direction” – is not straightforward. In theory, and in a world without frictions, a low policy rate encourages investment in productivity-enhancing technologies, which contribute to raising r*. However, by lowering interest rates, the profitability and productivity threshold decreases, and we may then have a circular relationship between low rates and low productivity growth.8

Thus, while an accommodative monetary stance should stimulate the economy, the effect on productivity and therefore on r* may not be as expected. For example, while low interest rates stimulate economic activity and investment, they also support the entry of low-productivity firms or, in the presence of financial frictions, favor low-productivity firms, such as building companies, which face easier access to credit due to ample collateral availability, or reduce the incentives for balance sheet repairs. Moreover, there may be a rise in the number of “zombie” firms if these factors are combined with weak regulatory regimes and banking supervision (which encourage or at least tolerate forbearance) or weak banks. This is only a small excerpt of all the literature that has shown both theoretically and empirically that low interest rates may have negative effects on productivity, potential output and therefore on r* itself.9

Moreover, if we were to follow endogenous growth models that prescribe a very accommodative monetary policy to increase productivity, with the aim of increasing potential output in the medium to long term, we would ignore further possible negative side effects of the low interest rate environment. In fact, such models do not take into account the implications of financial imbalances caused by the low interest rate environment. Taking into account the financial cycle when measuring the output gap, for example, could also change our perception of both the level of the output gap and therefore also the level of r* and of the monetary stance.10

In summary, monetary policy should aim at supporting policies to increase productivity and potential output without prejudice to the price stability target. At the current state of economic knowledge, the effects of an accommodative monetary policy on productivity and on r* are ambiguous. Therefore, we could be doing more harm than good with an ultra-loose monetary policy if the negative effects dominate. More research efforts should be dedicated to clarifying these effects. In the meantime, we should err on the side of caution, recognize the limitations of monetary policy, take potential real and financial side effects very seriously, and focus our attention on other policy areas to raise r*.

3.2 Insights from other areas

One of the core motivations for launching the monetary policy strategy review in 2020 was to adjust our strategy to the lower level of r* compared to the situation we had in 2003. Thus, much of the work done at the analytical level was devoted to exploring the implications of a lower r* for monetary policy, both in the past and for the future. As a result, there are many insights gained from the analysis on productivity, climate change, digitalization and globalization.

For the same reason, fiscal and monetary policy interactions as well as the implications from and for r* were extensively discussed and analyzed not only during the monetary policy strategy review but also during the Covid crisis. It is clear that in many areas, fiscal policy is better equipped than monetary policy for stimulating growth and productivity. The problem is that the fiscal space may be constrained especially in countries with the largest need for such stimulus. Let us connect this aspect with one of the drivers of r*: the disequilibrium in the savings-investment identity, beyond the safe asset scarcity. Some argue that the lack of safe assets ̶ which pushes r* down ̶ could be solved by governments issuing more debt or issuing common EU debt. However, the excess savings problem cannot be solved by increasing the amount of safe assets if this implies increasing debt. This could be self-defeating when higher debt ratios threaten debt sustainability. The problem has to be solved by channeling excessive savings to more productive investment, while increasing the demand for savings by stimulating investment, hopefully in productivity-enhancing technologies. This would also contribute to increasing the supply of safe assets if debt ratios fall and fiscal positions are improved. This cannot be achieved with ultra-loose monetary policy alone. In some cases it may even be counterproductive. Fiscal and structural policies have much better tools to stimulate investment in productivity-enhancing technologies. To mention just one aspect, fiscal policy can contribute to increasing the level of human capital, which could facilitate the diffusion and adaptation of new technologies, thereby boosting productivity.

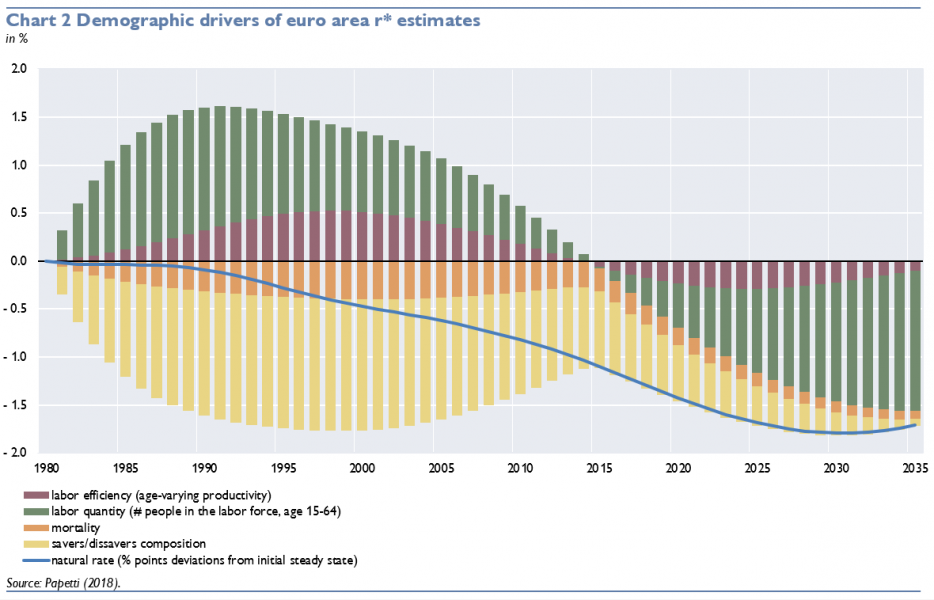

An aging population has negative effects on r* through several channels (chart 211).12 First, an increase in savings for retirement depresses r*. Second, a smaller labor force decreases productivity by decreasing the marginal return on capital, which in turn reduces r*. Third, the hump-shaped productivity profile of individuals leads in the aggregate to lower productivity as the elderly increase in numbers. Fourth, population aging may have reinforced the claimed negative effects of rising income inequality on r*. Last but not least, as population aging is not only driven by higher life expectancy but also lower fertility rates in industrial countries, the resulting lower labor force growth directly impacts r* (as suggested by Samuelson´s natural rate of interest)13. In contrast, a higher dependency ratio decreases the savings ratio and should thus have the opposite effect on r*.14 So far, this last possible positive effect on r* has been more than compensated by the negative effects.

Fortunately, there are steps that can be taken to solve some of these problems. First of all, there is an urgent need to increase the retirement age. This would not only increase the labor force level and growth during the initial catching-up phase, but also permanently if the retirement age is indexed to longevity progress. This measure would also reduce the fiscal burden for pay-as-you go pension systems and decrease the need to save for retirement. Furthermore, we should also implement policies aimed at increasing labor participation, for example, by encouraging a higher labor participation among women and other marginalized groups (migrants, older workers, people with disabilities). All these measures would be helpful in increasing productivity growth and r*.

The current mainstream thinking is that r* is exogenous to monetary policy and therefore a useful guidepost for monetary policy decisions despite the uncertainty surrounding its measurement. This implies that fiscal and structural policies are considered to be solely responsible for implementing polices that contribute to solving the population aging problem and to fostering productivity. As central bankers, we can only use moral suasion to encourage such policies.

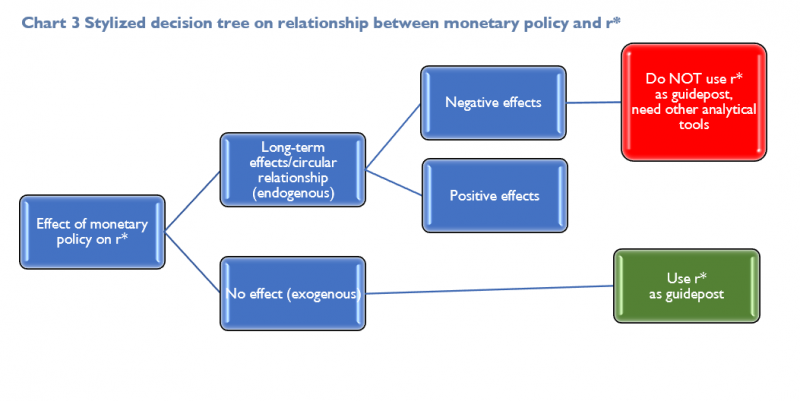

But what if r* is endogenous because of the different channels by which monetary policy affects productivity or if there is a circular relationship between r* and productivity ? (Chart 3) If we consider this possibility, then we cannot simply track r* but we have to consider the effects of our monetary policy decisions on r* itself. As the effects of monetary policy on productivity are ambiguous, we need solid conceptual and empirical grounds to assess and include relevant positive and negative effects in our estimates.

If the positive effects dominate and we can increase r* with an accommodative monetary policy, we could still use r* as a guidepost, since the errors we would make would be beneficial. Over time, r* would increase and therefore we would gain policy space, which should also facilitate the exit from the low interest rate environment. On the other hand, if the negative effects dominate, a low-for-longer interest rate policy will depress r* even further. In this situation, using r* as a guidepost would be self-defeating since we would erode our policy space by depressing growth and productivity even further.

What is clear by all means is that the longer we wait, the worse the negative effects of a low interest rate environment will be. Therefore, raising r* has become even more urgent.

While there may still be a debate on how useful the concept of r* is as a guidepost for monetary policy and whether a more accommodative monetary policy contributes or rather hinders an increase in r*, we can all agree that there is a need to increase r* for reasons that go beyond monetary policy decision-making.

Acharya, V., Eisert, T., Eufinger, C. and Hirsch, C. (2019). Whatever It Takes: The Real Effects of Unconventional Monetary Policy, The Review of Financial Studies, Vol. 32, No 9, pp. 3366–3411.

Banerjee, R. and Hofmann, B. (2018). The Rise of Zombie Firms: Causes and Consequences, BIS Quarterly Review, September, pp. 67–78.

Bergeaud, A., Cette, G. and Lecat, R. (2019). The circular relationship between productivity growth and real interest rates, Banque de France Working Paper No. 734.

Borio, C., Disyatat, P., Juselius, M. and Rungcharoenkitkul, P. (2017). Why So Low for So Long? A Long-Term View of Real Interest Rates, BIS Working Paper No. 685.

Borio, C., Disyatat, P, Juselius, M. and Rungcharoenkitkul, P. (2018). Monetary Policy in the Grip of a Pincer Movement, BIS Working Paper No. 706.

Borio, C., Disyatat, P., Juselius, M. and Rungcharoenkitkul, P. (2019). What Anchors for the Natural Rate of Interest?, BIS Working Paper No. 777.

Brand, C., Bielecki, M., and Penalver, A. (2018). The natural rate of interest: estimates, drivers, and challenges to monetary policy, ECB Occasional Paper No. 217.

Brand, C., Goy, G. and Lemke, W. (2020). Natural Rate Chimera and Bond Pricing Reality, De Nederlandsche Bank Working Paper No. 666.

Brand, C. and Mazelis, F. (2019). Taylor-Rule Consistent Estimates of the Natural Rate of Interest, ECB Working Paper No. 2257.

Cette, G., Fernald, J. and Mojon, B. (2016). The pre-Great Recession slowdown in productivity, European Economic Review, Vol 88, pp. 3–20.

Fiorentini, G., Galesi, A., Pérez-Quirós, G. and Sentana, E. (2018). The Rise and Fall of the Natural Interest Rate, Banco de España Working Paper No. 1822.

Geiger F. and Schupp F. (2018). Estimation of a Holston-Laubach-Williams natural real rate for Germany Deutsche Bundesbank unpublished manuscript.

Goodhart, C. A. E. and Pradhan, M. (2017). Demographics Will Reverse Three Multi-Decade Global Trends, BIS Working Paper No. 656.

Holston, K., Laubach, T., and Williams, J. C. (2017). Measuring the natural rate of interest: International trends and determinants, Journal of International Economics, 108, S59-S75.

Jarocinski, M. (2017). VAR-based estimation of the euro are natura rate of interest, ECB draft paper.

Johannsen, B. K., and Mertens, E. (2021). A Time‐Series Model of Interest Rates with the Effective Lower Bound, Journal of Money, Credit and Banking, 53(5), 1005-1046.

Jordà, Ò., Singh, S. R., and Taylor, A. M. (2020). The long-run effects of monetary policy NBER Working paper No. W26666.

Juselius, M., Borio, C. E. V., Disyatat, P, and Drehmann, M. (2016). Monetary Policy, the Financial Cycle and Ultra-Low Interest Rates, BIS Working Paper No. 569.

Liu, E., Mian, A. and Sufi, A. (2019). Low interest rates, market power and productivity growth, NBER Working Paper, No. 25505.

Papetti, A. (2020). Demographics and the Natural Real Interest Rate: Historical and Projected Paths for the Euro Area Bank of Italy Temi di Discussione No. 1306.

Ramsey, F.P. (1928). A Mathematical Theory of Saving, Economic Journal, 38(4), 543–559.

Samuelson, P. A. (1958). An exact consumption-loan model of interest with and without the social contrivance of money, Journal of Political Economy 66, 467 – 482.

Summers, L. H. and Rachel, L. (2019). On falling neutral real rates, fiscal policy and the risk of secular stagnation. In Brookings Papers on Economic Activity BPEA Conference Drafts, Vol. 7.

Summers, L. H. (2014). U.S. Economic Prospects: Secular Stagnation, Hysteresis, and the Zero Lower Bound, Business Economics 49(2): 65–73.

Summers, L. H. (2015). Demand Side Secular Stagnation, American Economic Review Papers and Proceedings 105(5): 60–65.

Summers, L. H. (2016). Secular Stagnation and Monetary Policy, Federal Reserve Bank of St. Louis Review 98(2): 93–110.

Data kindly provided by Claus Brand.

Brand et al. (2018), Borio et al. (2017), Summers and Rachel (2019).

Summers (2015).

Borio et al. (2017, 2019).

The Ramsey equation states that along the optimal path, the rate of return from saving has to equal the rate of return on consumption, Ramsey (1928).

Summers (2014, 2015 and 2016).

Bergaud et al. (2019), Jordà et al. (2020).

Bergaud et al. (2019).

Cette et al. (2015), Jordà et al. (2020), Acharya et al. (2019), Banerjee and Hofmann (2018) and Liu et al. (2019).

Juselius et al. (2016), Borio et al. (2018).

Data kindly provided by Claus Brand.

Papetti (2020).

Samuleson (1958).

Goodhart and Pradhan (2017).