The views expressed are those of the authors and do not necessarily reflect those of the Bank of Finland or the Eurosystem.

This Policy Brief presents new evidence on the European Central Bank’s (ECB) preferences concerning inflation. By extracting the tone (sentiment) from the ECB’s communication using textual analysis and combining it with the real-time economic outlook available at the time monetary policy decisions are made, we directly estimate the ECB’s loss function. Our findings provide strong evidence of the ECB’s asymmetric preferences, with the ECB being averse to inflation exceeding its target during the period 1999–2021. Additionally, our preliminary analysis suggests that the ECB’s preferences have become more symmetric since July 2021, following the adoption of the ECB’s new monetary policy strategy.

The conventional approach to understanding central bank preferences typically relies on symmetric, quadratic loss functions. Specifically, policymakers are expected to perceive positive deviations of inflation from the target as being equally costly as negative deviations of the same magnitude. While this convention is deeply rooted in the standard New Keynesian models where welfare criteria are based on a linear quadratic approximation, it may not accurately capture the true preferences of central banks.

Recent theoretical literature, such as the works of Benigno and Rossi (2021) and Yun (2005), has challenged the adequacy of the symmetric approach. In particular, a central bank might be more concerned about inflation exceeding the target than falling below it, when higher-order welfare approximations and non-linearities in decision making rules of economic agents are considered.

Central bank preferences are often analyzed through the estimation of policy reaction functions. A reduced form reaction function is a convolution of central bank preferences and structural parameters of the economy, which are difficult, if not impossible, to disentangle using a standard estimation procedure. In particular, factors such as the effective lower bound and potential non-linearities in economic relationships mean that a symmetric (or asymmetric) loss function does not necessarily imply symmetric (or asymmetric) policy reactions, and vice versa (see e.g., Nakov (2009) and Benigno and Rossi (2021)).

In our recent study (Haavio et al. (2024)), we depart from the traditional reaction function-based approach to infer potential asymmetries in the ECB’s preferences during the period 1999–2021. We utilize textual analysis methods to extract the tone (sentiment) from the ECB’s communication and combine it with real time economic outlook of key macro and financial variables available at the time monetary policy decisions are made. Unlike reaction function estimations, this approach remains applicable even during periods when conventional monetary policy tools are constrained by the effective lower bound.

Potential asymmetry of the ECB’s preferences and its aversion to high inflation stems directly from the definition of price stability. In 1998, price stability was defined as a ’year-on-year increase in the Harmonised Index of Consumer Prices (HICP) for the euro area of below 2%’. In 2003, the ECB Governing Council further clarified that ‘in the pursuit of price stability it aims to maintain inflation rates below, but close to, 2% over the medium term’. Both definitions left open the question of whether the ECB would consider inflation rates above 2% more or as equally costly as rates below 2%.

In July 2021, the ECB’s Governing Council redefined its inflation target, committing to a symmetric 2% target over the medium term. We comment the impact of this change on the ECB’s loss function at the end of this Policy Brief.

We collect the ECB’s introductory statements, which are the most important and formal part of the Governing Council’s qualitative communication, from the ECB’s webpage using web scraping techniques.

For sentiment analysis, we employ two approaches. First, following Shapiro and Wilson (2023), who study the Federal Reserve, we employ a lexicon-based approach, tailoring the Loughran and McDonald (2011) finance-specific dictionary to fit the ECB’s communication style and central bank-specific terminology. This adaptation involves several key modifications: updating the dictionary to include British spellings, reclassifying certain words (e.g., ‘stability,’ ‘efficiency’, ‘lag’) from positive or negative to neutral based on their context in ECB texts, and including common two- and three-word phrases (bigrams and trigrams) involving sentiment words. Then, we quantify the tone by calculating the difference between the number of negative and positive words, normalized by the total word count in each introductory statement.

Lexicon-based approaches are transparent and easy to understand, but they typically ignore the context of the sentiment words, as they rely on a search for single words, or frequently recurring word combinations (n-grams). To address these issues, we complement our analysis by using FinBERT language model (Araci (2019)), which can generate context-aware indices. FinBERT, which is based on the BERT model (Devlin et al. (2018)), is tailored for financial texts and designed for sentiment analysis.

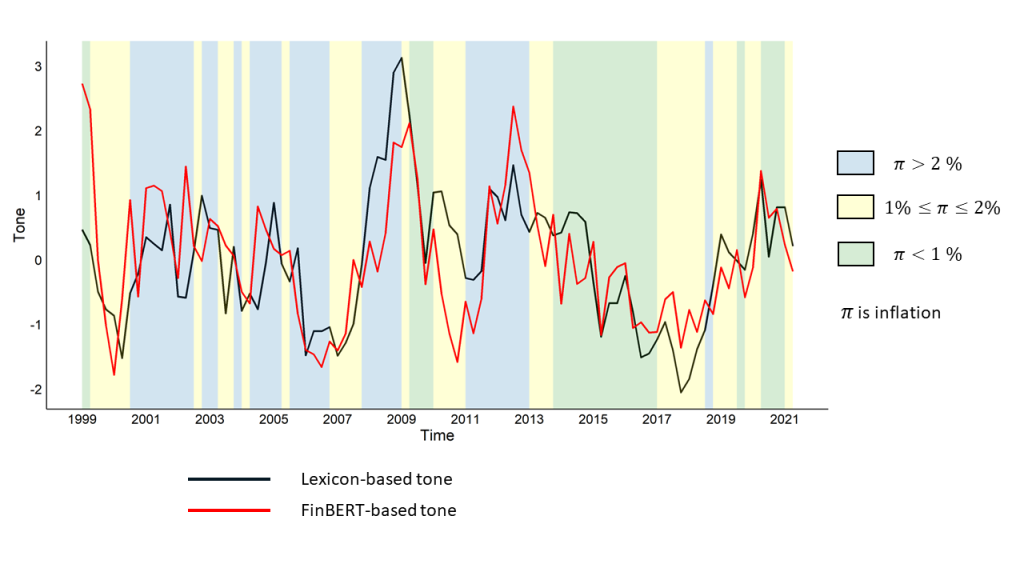

Figure 1 shows the lexicon-based tone index together with the FinBERT-based tone index for the ECB’s introductory statement texts. To facilitate comparison, both index series have been standardized, so that they have the same variance (unity) and the same mean (zero). From the figure one can see that both tone indices give a roughly similar picture of how the sentiment of the ECB’s introductory statements has evolved over time. A casual inspection of the figure already suggests that the ECB has been more unsatisfied when inflation has been above 2% (blue areas) than when inflation has been below 2% (yellow and green areas).

Figure 1. Lexicon-based and FinBERT-based tone indices, with HICP inflation in three ranges.

Note: The tone measures the net negativity of the ECB’s communication. Hence positive (negative) values of the tone indicate that the ECB is dissatisfied (satisfied) with the state of the economy.

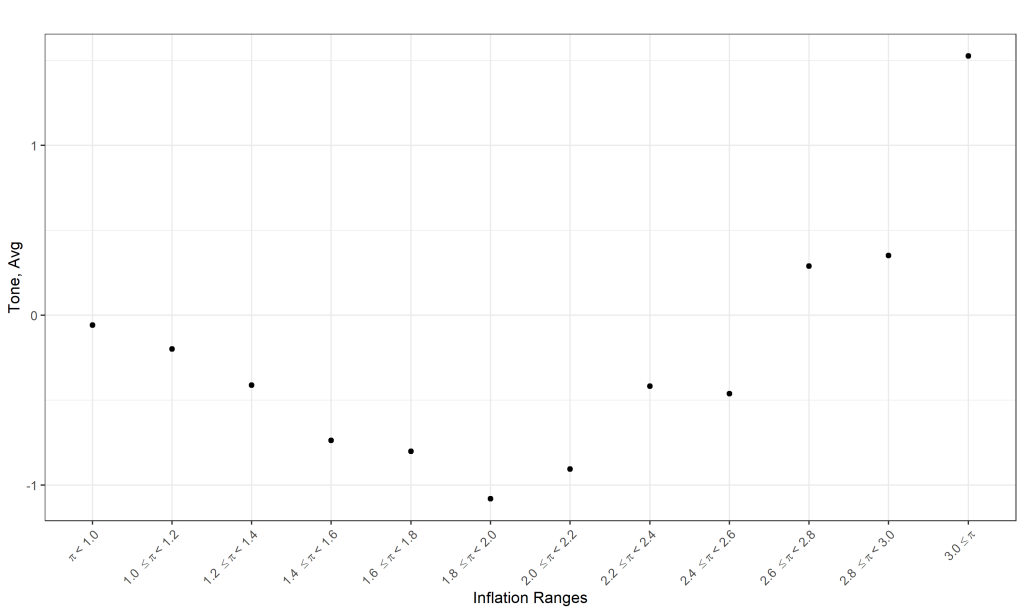

Combining the two alternative tone indices with real time information on inflation and economic outlook available at the time monetary policy decisions are made, we estimate the ECB’s loss function. We find strong evidence of asymmetry. Specifically, the loss function reveals a greater aversion to inflation above the inflation aim than below it. This result is illustrated in Figure 2, which shows a simple non-parametric estimate of the loss function.

Our finding of asymmetric preferences is confirmed by parametric estimations, using both V-shaped (or piecewise linear) and U-shaped (Linex) loss functions, and applying real time measures of the macro economy, financial markets, and economic uncertainty as control variables. Moreover, our results suggest that the departure from symmetry is sizeable: the slope of the (V-shaped) loss function is roughly three times steeper when inflation is above the target than when it is below the target.

We conduct several robustness checks. In particular, we apply topic modelling to identify inflation-focusing segments on the introductory statements. We also consider the temporal dimension of the texts by using the GPT 4.0 language model to identify forward-looking and backward-looking segments. We then compute sentiment indices for inflation texts, forward-looking segments, and backward-looking segments and re-estimate the loss function in each case. In another group of robustness checks we look at different subsamples, leaving out the early years of the monetary union or the effective lower bound period. Finally, we consider different measures of inflation, including lagged inflation and inflation forecasts, as well as different sets and specifications of control variables. The results from these robustness checks reinforce our primary findings, confirming the asymmetry in the ECB’s loss function during the first two decades of the monetary union.

Figure 2. Non-parametric estimate of the ECB’s loss function.

Using the inflation ranges on the x-axis, we calculate the mean tone in each inflation bracket and report it on the y-axis. The tone index is computed with the lexicon-based method applied to the introductory statement texts. Inflation is measured as the average of real-time estimates of current HIPC inflation and HICP inflation lagged by one month.

The ECB Governing Council adopted a new definition of price stability in July 2021, when the new monetary policy strategy was adopted. According to the Governing Council, it ’considers that price stability is best maintained by aiming for a 2% inflation target over the medium term. This target is symmetric, meaning negative and positive deviations of inflation from the target are equally undesirable’. As this change in the definition of price stability explicitly removes the earlier bias towards avoiding inflation above 2%, it may serve as a buffer against disinflationary pressures, which have been a concern due to the effective lower bound on interest rates and a low natural rate of interest.

It is still rather early to comprehensively evaluate the possible impacts of the ECB’s new strategy on its preferences, as the sample is relatively short, covering roughly three years and 26 monetary policy meetings of the ECB Governing Council since July 2021. Furthermore, there are practically only observations of inflation exceeding the 2% target since then.

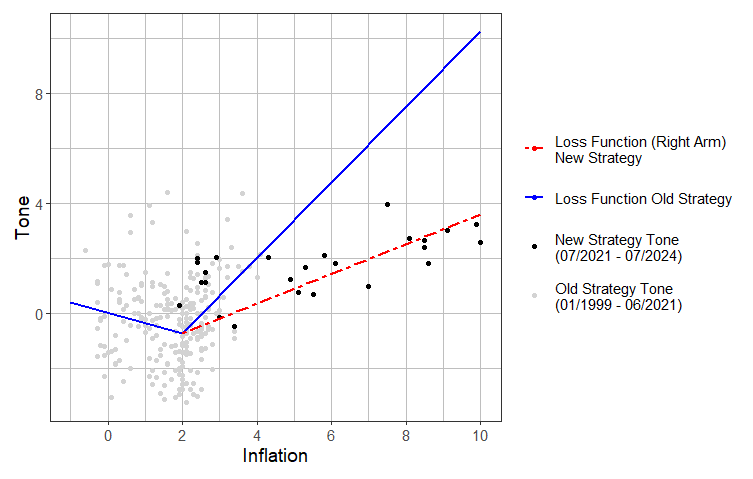

Nevertheless, we have some suggestive and preliminary evidence that the loss function has become less asymmetric. This is illustrated in Figure 3. First, the observations (inflation-sentiment pairs) corresponding to the new strategy lie predominantly below the right arm of the loss function estimated under the old strategy in Haavio et al. (2024). Second, when we re-estimate the right arm of the loss function under the new strategy the slope becomes considerably less steep and in fact not much steeper than the left arm of the loss function under the old strategy. These findings suggest clearly more symmetric policy preferences after July 2021, in accordance with the ECB’s new strategy.

Figure 3. Comparing the relationship between the tone and inflation under the ECB’s old and new strategy.

Textual analysis can be a powerful tool for extracting a central bank’s preferences from its communication and directly estimating the central bank’s loss function that is at the heart of modern monetary policy models and optimal policy recommendations. Our analysis on the ECB’s preferences revealed a strong asymmetry before it adopted a new strategy in July 2021, in contrast to the usually assumed quadratic and symmetric preferences in monetary policy models. At the same time, there is some indication that the ECB’s preferences have become more symmetric after the adoption of a new strategy. Overall, our results from the old and new monetary policy strategies suggest that strategy, and in particular the definition of price stability, is indeed reflected in central bank communication. The extent to which monetary policy has been influenced by the change in strategy during the latest inflation surge, is an issue that merits careful evaluation.