Over recent decades, real interest rates have declined in many countries. In the academic literature, the contemporaneous reduction in population growth has been considered a possible explanation for this decline. However, empirical studies have provided rather weak results supporting a strong and stable relationship. In a recent SNB working paper (Fuhrer and Herger, 2021), we highlight the importance of differentiating between population growth resulting from a birth surplus and net migration. We show that there is a positive, statistically significant, and stable effect from birth surplus on real interest rates. Conversely, the corresponding effect of net migration is more volatile.

Recently, the relationship between population growth and real interest rates has attracted empirical research to help explaining the profound decline in real interest rates. However, and despite the popularity of this “demographic interest rate theory”, the empirical link between population growth and real interest rates has been rather tenuous.

To analyse population growth and real interest rates, ideally data covering a long sample period are required. In the few papers actually focussing on such long-term data, see e.g. Borio et al. (2017, 2019), basic demographic variables, and especially total population growth, have barely a significant effect on the level of long-term real interest rates. Furthermore, the corresponding empirical effect is surprisingly unstable, in the sense that both significantly positive and negative coefficients are observed across subperiods covering different international currency systems, such as the classical gold standard, the interwar period, or the post-war era.

These findings obviously raise questions about the validity of the theoretical link between interest rates and demographic variables. To better identify the relationship, we have emphasised in a recently published SNB working paper (Fuhrer and Herger, 2021) an aspect that has hitherto been neglected by the empirical literature, namely the distinction, between population growth caused by a birth surplus and net migration.

Differentiating between birth surplus and net migration could actually be crucial, because the birth surplus typically captures secular developments in mortality and birth rates as described by the well-known demographic transition theory.1 Conversely, net migration rates are often quite volatile and react relatively quickly to extraordinary events, such as wars and political and economic crises. Accordingly, the growth rate of the total population in a specific country does not only capture the secular decline in mortality and birth rates. However, it is probably these long-term demographic trends, rather than the more erratic movements in migration, that can explain the abovementioned secular decline in real interest rates.

To uncover the empirical impact of demographic variables upon real interest rates across generations, data covering decades and preferably even centuries are required. Although population censuses go back to ancient times, economic and financial data appeared much later and are often only available for a handful of countries. Overall, we have collected data as far back as the year 1820 for a sample encompassing 12 countries, which are either located in Europe or emerged from European settler colonies.

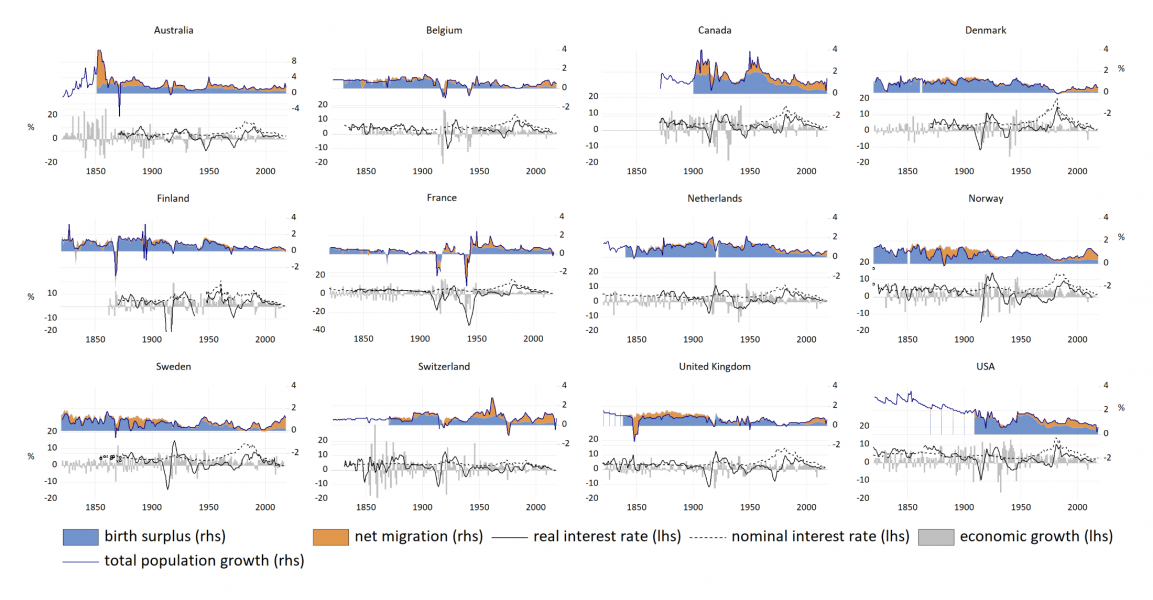

Figure 1: Interest rates, per-capita economic growth, and population growth (1820-2018)

Figure 1 provides an overview of the development of interest rates, the growth rates of the population and their components as well as economic growth. Total population growth rates, which are marked by the solid line in the top part of the graphs, have been largely positive over the past two centuries. The postulated hump-shaped development of population growth can indeed be observed in virtually all countries. It is this development that has recently led to a decline in non-migrant population growth rates by about one to two percentage points, which matters for the ongoing debate about the decline in real interest rates.

For our empirical analysis, we follow the literature, which suggests that in a given country and year, the expected (or ex-ante) real interest rate is primarily a function of secular productivity increases and the growth rate of the population. Based on the data of Figure 1, which covers almost two centuries and 12 countries, a corresponding panel-data regression concurs with the findings of e.g. Borio et al. (2017, 2019). In particular, the effect of overall population growth on real interest rates is surprisingly weak and instable across time. However, when splitting this demographic effect into different growth components, a positive, stable and significant effect from the birth-surplus (or natural rate of population growth) arises, whereas the effect of net migration remains tenuous. This result is remarkably robust to a variety of regression specifications, definitions of the coefficient standard errors, measures of the expected real interest rate, additional control variables, and sub-periods covering the main international currency regimes. Furthermore, given that the secular trends of the above-mentioned demographic-transition theory pertain to birth and mortality rates, it is perhaps not surprising that the movements of the long-term real interest rate across centuries is primarily a function of the birth surplus as population-growth component. Conversely, it is well known that international migration is a rather volatile demographic component.

Across the various regression specifications, the coefficient estimates pertaining to the birth surplus are almost always in the range between 0.4 and 1. This would imply that the reduction in the birth surplus of approximately one to two percentage points observed during the last decades has caused a decline in the long-term real interest rate of approximately one percentage point.

Our results help reconcile standard macroeconomic models with the empirical literature. While our empirical findings indeed help to explain the currently low interest rate levels, one should keep in mind that non-demographic factors, such as credit cycles, monetary policy, increased wealth, or productivity growth, may play an important role and they could still profoundly affect real interest rate developments over the coming years and possibly even decades.

Borio, C., P. Disyatat, M. Juselius, and P. Rungcharoenkitkul (2017). Why so low for so long? A long-term view of real interest rates. BIS Working Paper No. 685.

Borio, C., P. Disyatat, and P. Rungcharoenkitkul (2019). What anchors for the natural rate of interest? BIS Working Paper No. 777.

Fuhrer L. and N. Herger (2021). Real interest rates and demographic developments across generations: A panel-data analysis over two centuries. Swiss National Bank Working Paper, No 2021-07.

Poston, D. L., and Bouvier, L. F. 2010, Population and Society, Cambridge, Cambridge University Press.

The “demographic-transition theory” describes the interrelated trends in birth and mortality rates since the dawn of the modern age (see i.e. Poston and Bouvier (2010). In particular, preindustrial societies typically subsisted in a “Malthusian world”, where birth and mortality rates were high and, as a result, the growth rate of the population remained low. Since around the eighteenth century, improvements in nutrition, medical progress, such as the discovery of vaccines, and better hygienic standards have gradually reduced mortality rates. Because birth rates remained initially high, the early stages of the industrialization were often characterized by a marked upsurge in the birth surplus and, hence, population growth. Depending on the development of a country, this upsurge began as early as the second part of the eighteenth century, but in some cases also substantially later. Eventually, the combination between higher income, more generous pension systems, easier access to contraception, improvements in the status of woman and changing cultural attitudes towards having a family have given rise to declining birth rates. Taken together, these interrelated trends have recently reduced the birth surplus in economically advanced countries, resulted in ageing societies, and are believed to lead to an era with declining populations.