This policy brief is based on Bank of Italy Occasional Papers Number 857. The views expressed are those of the authors and do not involve the responsibility of the institutions to which they belong.

In our recent work (Bernardini, D’Arrigo, Lin and Tiseno, 2024) we present a new market-based measure of the short-term real interest rate in the euro area. Simple metrics based on the difference between 1-year overnight index swap (OIS) and inflation-linked swap (ILS) rates suffer from a timing mismatch arising from the lagged indexation of ILS. The proposed approach addresses this issue by replacing the latter with inflation fixing swaps (IFS), contracts linked to each of the next 24 releases of euro area inflation, and yields a more accurate and reliable measure of the ex-ante short-term real interest rate as well of its expected evolution. We use our new market-based measure to provide a comprehensive analysis of the ECB’s monetary policy stance during the post-pandemic era and to identify its “neutrality date”: the point in time at which the monetary policy stance is expected to become neutral according to financial markets.

The resurgence of policy rates as the primary monetary policy tool has sparked renewed interest for conventional indicators of the monetary policy stance, such as the real rate gap, defined as the difference between the ex-ante short-term real interest rate and the natural rate.1 The sign of the difference indicates the orientation of the stance: restrictive (positive gap), neutral (zero gap), or accommodative (negative gap).

The standard market-based measure of the ex-ante real rate is the difference between the Overnight Index Swap (OIS) rate at a given maturity and the corresponding rate on the Inflation Linked Swap (ILS). In this policy brief we show that the use of this measure leads to a distorted historical assessment of the ECB’s monetary policy stance, both in terms of tightness and evolution.

We propose an alternative, more reliable, market-based measure that replaces ILS with Inflation Fixing Swaps (IFS; contracts linked to each of the next 24 monthly releases of euro area year-on-year inflation rates). After providing some details on its construction, we show how it can be used to estimate the term structure of real interest rates and to gauge how changes in market expectations translate into changes in either the “degree” of restrictiveness of the monetary policy stance (i.e., the distance of the real interest rate path from the natural rate), its “duration” (i.e., the amount of time spent in restrictive territory), or both. A recent paper (Bernardini, D’Arrigo, Lin and Tiseno, 2024) provides all the technical details.

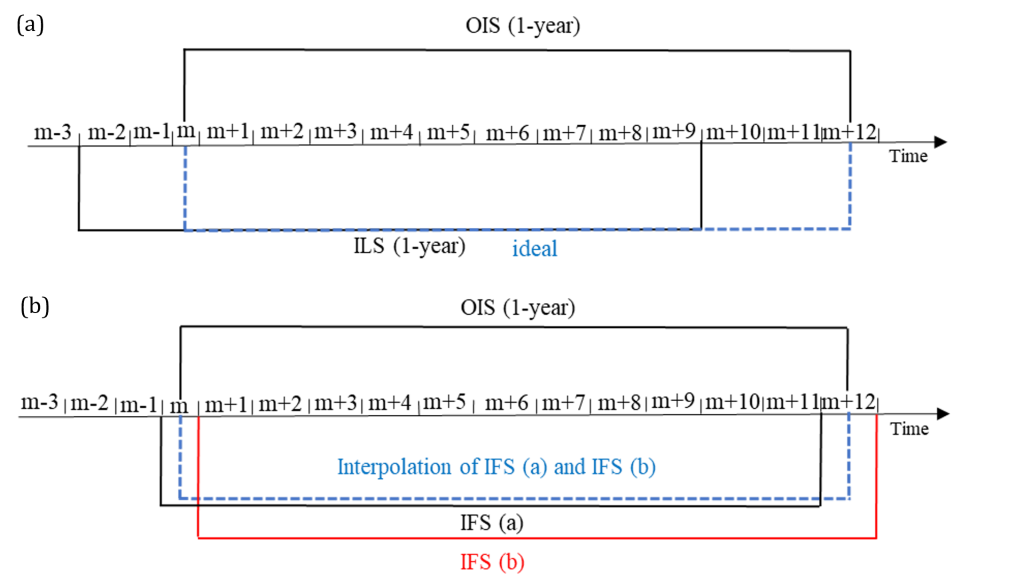

A simple market-based approach to estimate real interest rates in the euro area is to deflate the 1-year OIS rate with the ILS rate of corresponding maturity.2 However, two indexation features of ILS rates introduce a mismatch between OIS and ILS reference periods, interfering with the computation of a purely forward-looking real interest rate (Figure 1a). First, ILS contracts’ reference period for computing the inflation accrued during the life of the contract includes a 3-month indexation lag. Thus, the final pay-off for a 1-year ILS contract depends on the year-on-year inflation rate realised three months prior to the end of the contract. Second, these contracts trade on a fixed base convention. This means that all contracts exchanged during a given month (irrespective of their trading date) are linked to the inflation accrued over the same fixed reference period, which is only updated at the beginning of each new month. Computing a true ex-ante real interest rate by adjusting ILS rates to realign them with corresponding OIS rates is not trivial and requires relatively strong assumptions.3

Figure 1. Timing mismatch between OIS and ILS rates and the proposed solution (a)

Notes: The diagram in Figure 1a) illustrates the timing mismatch between 1-year OIS and ILS rates. Time is expressed in days and divided into monthly intervals (black arrow). 1-year ILS contracts traded on a generic day of month m (black line, bottom) exchange a fixed rate with inflation accruing from the end of month m-3 to the end of month m+9. 1-year OIS contracts traded on a generic day of month m (black line, top) exchange a fixed rate with the average overnight rate over the following 1-year period (i.e., they are purely forward-looking). The diagram in Figure 1b) illustrates the timing matching between nominal and inflation rates that can be achieved by using IFS contracts. This figure shows IFS (a), the IFS rate linked to the inflation rate accruing from the end of month to the end of month (black line, bottom), and IFS (b), the IFS forward rate implicit in inflation fixings swaps linked to the inflation rate accruing from the end of month to the end of month (red line, bottom. An appropriate interpolation of IFS(a) and IFS (b) approximates the expected inflation over the course of the following 1-year period (blue dotted line, bottom).

In a recent paper (Bernardini, D’Arrigo, Lin and Tiseno, 2024) we propose to use Inflation Fixings Swaps (IFS) to solve the timing mismatch. IFSs are a new type of inflation swap contracts linked to each of the next 24 monthly releases of euro area inflation and therefore provide a direct measure of the monthly evolution of annual inflation expected by financial markets, circumventing the issues of lagged indexation posed by ILS contracts. Deflating nominal OIS rates by an appropriate interpolation of IFS rates easily solves the timing mismatch (Figure 1b).4

The maturity structure of IFS rates also allows the computation of a monthly term structure of real interest rates that, compared to estimates of the natural rate, provide an accurate assessment of markets’ expectations of the ECB’s monetary policy stance in the near future. On any given day, OIS contracts are traded for monthly maturities, so that linear combinations of two OIS contracts with adjacent maturities (appropriately weighted to reflect their distance from the end-of-month day) measure the riskless nominal rate for end-of-month maturities. These can be matched with the IFS contracts at corresponding maturities. Deflating the former with the latter provides an estimate of the monthly forward curve of (1-year) real interest rates, a key improvement over existing measures.

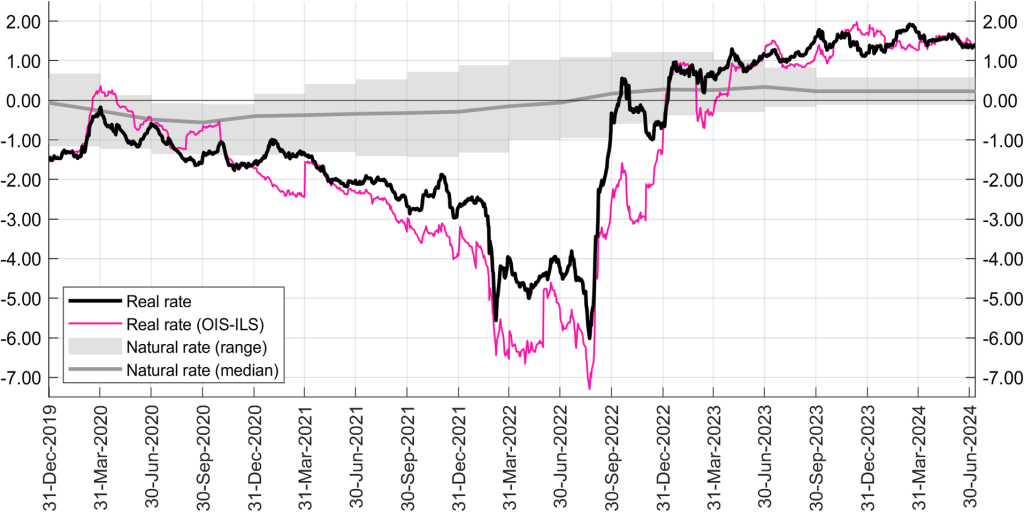

The time series of euro-area real interest rates estimated using IFS provide a timeline of the ECB’s monetary policy stance that differs from that estimated using ILS. According to our proposed measure of real interest rate and taking into account a broad range of Eurosystem’s estimates of r*, the ECB’s monetary policy stance was fully normalised by September 2022, moved into restrictive territory in early 2023, and reached its most stringent level in March 2024, when the ex-ante short-term real interest rate peaked at 2% (Figure 2, solid black line). Notably, this uptick is not reflected in the standard measure of real rates based on ILS, due to the mentioned technical bias (Figure 2, pink line).The time series of euro-area short-term real interest rates estimated using IFS provides a timeline of the ECB’s monetary policy stance that differs from that estimated using ILS. According to this measure and taking into account a broad range of Eurosystem’s estimates of , the ECB’s monetary policy stance was fully normalised by September 2022, moved into restrictive territory in early 2023, and reached its most stringent level in March 2024, when the ex-ante short-term real interest rate peaked at 2% (Figure 2, solid black line). Against this backdrop, the lagged and fixed-based indexations bias both the level and the dynamics of the raw measure based on the OIS-ILS difference, providing a distorted picture (Figure 2, pink line). In fact, between January 2021 and April 2023 our measure of the ex-ante short-term real interest rate has been consistently higher, by approximately 1 percentage point on average and by up to 2 points. In terms of dynamics, some extreme divergences between the two series are found in early 2021 and after October 2023, when the OIS-ILS measure was signalling a decrease in the short-term real interest rate, which instead was stable or even at times rising according to our new measure.

Figure 2. Evolution of the real rate gap since 2020 (percent)

Source: authors’ elaboration on Bloomberg and LSEG data. Notes: The chart shows (i) our measure of the ex-ante 1-year real interest rate based on the use of Inflation Fixing Swaps, (ii) the simple measure based on 1-year OIS-ILS difference and (iii) a range of estimates of r* (10th and 90th percentiles). The range is available until 2023Q4 and kept constant afterwards. The solid grey line denotes the median of this range.

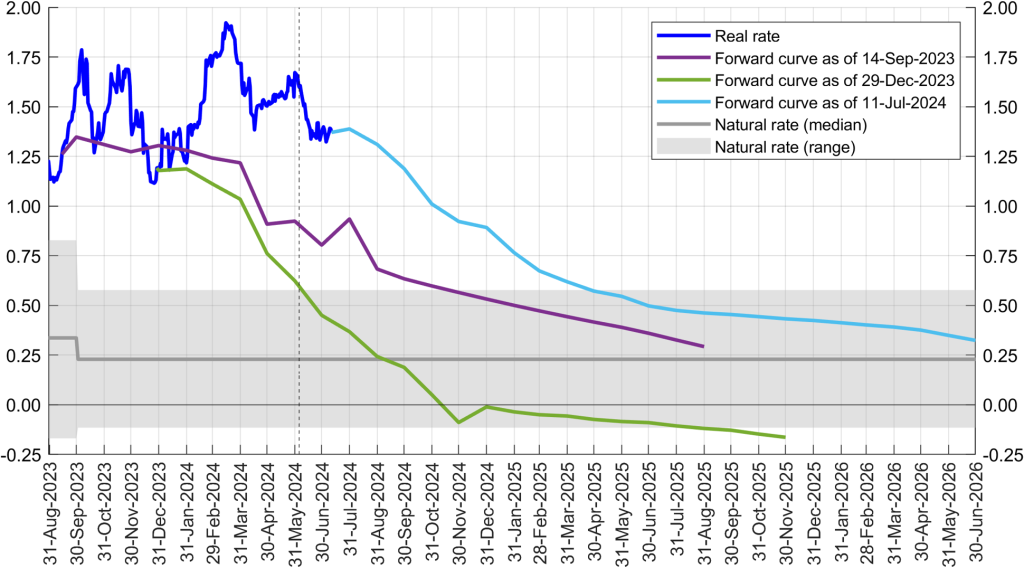

The term structure of real interest rates estimated with IFS rates also allows identifying the degree of restrictiveness/accommodation (overall deviation from the natural rate) and in its duration (amount of time spent in restrictive/accommodative territory) as expected by market participants. According to estimates of the real rates forward curve in July 2024 the expected “neutrality date” (i.e. when real rates enter neutral territory) would be reached no earlier than 2025Q2 (Figure 3, light blue line). This estimate is substantially different when compared to the views in September 2023, when the ECB rates reached the so-called terminal rate level, or December 2023, when markets were pricing a very rapid policy normalization (Figure 3, purple and green lines). Furthermore, the indication is that not only the “duration” of monetary policy restrictiveness was increased, but a substantial difference also emerged in terms of the “degree” of restrictiveness: the future real interest rate path as expected in July 2024, in fact, appeared distinctly higher compared to both September and December 2023, unequivocally signalling expectations of a tighter monetary policy stance than previously anticipated.

Figure 3. Anticipated future real rate gaps (percent)

Source: authors’ elaboration on Bloomberg and LSEG data. Notes: The chart shows (i) our measure of the ex-ante 1-year real interest rate based on the use of Inflation Fixing Swaps, (ii) its expected path as of different points in time and (iii) a range of estimates of the natural rate (10th and 90th percentiles). The range is available until 2023Q4 and kept constant afterwards. The solid grey line denotes the median of this range.

According to our proposed real interest rate measure based on IFS rates and taking into account a broad range of Eurosystem’s estimates of , the ECB’s monetary policy stance became neutral in September 2022 and has turned restrictive since the beginning of 2023. It has further tightened after the last policy rate hike of September 2023, peaking in March 2024. The most recent estimate of our measure (July 2024) suggests a return to a neutral stance in 2025Q2, substantially later than expected last December, when markets were pricing a very rapid policy normalization.

Baker K., L. Casey, M. Del Negro, A. Gleich, and R. Nallamotu (2023), “The Post-Pandemic r*”, Federal Reserve Bank of New York Liberty Street Economics, August.

Bernardini M., L. D’Arrigo, A. Lin and A. Tiseno (2024), “Real interest rates and the ECB’s monetary policy stance”, Bank of Italy, Occasional paper 857, June.

Camba-Mendez G. and T. Werner (2017), “The inflation risk premium in the post-Lehman period”, ECB Working Paper Series, 2033, March.

Lane R. P. (2023), “The euro area outlook”, seminar at the Economic and Social Research Institute in Dublin, 20 December.

Obstfeld M. (2023), “Natural and neutral real interest rates: past and future”, NBER Working Papers 31949, December.

Orphanides A. (2024), “Enhancing Resilience with Monetary Policy Rules”, Hoover Institution Economics Working Papers, 24109, May.

For the purpose of this analysis, we do not make a terminological distinction between “natural” and “neutral” rates (as in Obstfeld, 2023), neither we explicitly specify the exact horizon at which the natural interest rate is supposed to stabilise the inflation rate (as in Baker et al., 2023).

See for instance slide 12 in Lane (2023) and Figure 2 in Orphanides (2024).

See for instance Camba-Mendez and Werner (2017) in the context of an affine term structure model used to estimate inflation risk premia.

This interpolation bridges expected inflation rates of maturities distanced only 1 month apart, with considerably weaker assumptions when compared to the alternative approach of interpolating ILS rates that spans across maturities separated by 12 months (see the paper for more details).