This policy brief is based on DNB Working Paper No 811. The views expressed in this paper are those of the authors and should not be attributed to De Nederlandsche Bank, the European Central Bank or the Bank of England.

Abstract

We study the effects of rising fossil fuel prices on economic activity, labour productivity, and inflation using a New Keynesian multi-sector model that includes firm heterogeneity, and entry and exit dynamics. Energy is produced through both fossil and renewable resources. The final goods sectors differ ex-ante due to an asymmetric intensity in the use of energy. Higher fossil fuel prices increase energy costs, impacting asymmetrically sectoral firms’ revenues due to ex-ante heterogeneity. Less productive firms exit from the market, and new entrants must have higher productivity to be profitable. This raises average labour productivity, but reduces persistently the net entry rate of firms. A central bank with a strong anti-inflationary stance will mitigate the inflationary effects of the energy price increase. While this entails a higher impact cost in terms of output and lower average productivity, it leads to a faster recovery in business dynamism in the medium-term.

What are the effects of energy price surges on inflation, productivity, and business dynamism across sectors? In a recent paper (Chafwehé et al., 2024), we study these issues through the lens of a multi-sector DSGE model with endogenous entry and exit of heterogeneous firms.

Our work – which is motivated by the major energy crisis that hit the global economy following Russia’s invasion of Ukraine in 2022 – sheds light on some of the key mechanisms driving the short- to medium-term impact of a persistent increase in the price of an imported fossil resource, focusing on issues such as sectoral reallocation, productivity, and business dynamism, which all have received little attention in the recent academic literature on the effects of energy price surges.

In our framework, following a rise in the price of fossil resources, the profitability of sectors is impacted asymmetrically due to ex-ante heterogeneity in energy intensity in production. Specifically, we model two sectors: manufacturing and services. The former is assumed to be more energy intensive than the latter.

As production costs rise, less efficient firms leave the market, while new entrants must display higher idiosyncratic productivity to be profitable. While this process enhances average labour productivity, it also results in a lasting decrease in the entry rate of new firms. In this column, we provide more details on the implications of those features for key aggregate and sectoral variables, such as inflation, output, and productivity. We then discuss the implications for monetary policy and the trade-offs faced by a central bank which aims at taming the inflationary impact of energy price shocks.

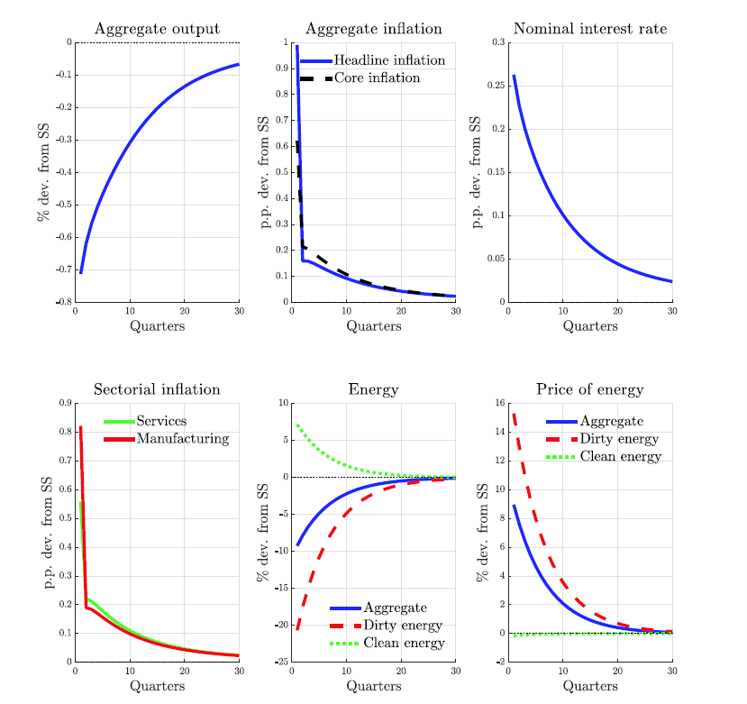

igure 1 reports the dynamics of aggregate variables in our model following a 20% increase in the price of the fossil resource that is used for the domestic production of (dirty) energy. Following the shock, the domestic price of energy rises, while the production of energy contracts. At the same time, the share of green energy, produced with renewables, increases, suggesting that the fossil price increase promotes a greener mix in the production of energy. Higher energy prices affect firms in manufacturing and services through an increase in their marginal costs, that will be gradually passed to consumers resulting in higher output prices. On top of the indirect effects through increases in core goods and services prices, households are also directly affected by the shock because they demand energy for consumption purposes.

The shock to the price of the fossil resource leads to a spike in headline and core inflation, and a decline in aggregate output. Since both the manufacturing and services sectors utilize energy for production, sectoral inflation rates increase. Our calibration, which is consistent with the share of energy in manufacturing being higher than that of services, implies that sectoral inflation in the manufacturing sector increases by relatively more. On the real side, aggregate output declines as households experience a fall in their current income due to an increase in the price of energy, while firms cut back on production due to their reduced profitability.

Figure 1. Effects of fossil price shock on aggregate variables

Notes: Variables are expressed in percentage deviations from the initial steady state. Inflation rates and the nominal interest rate are in per-centage point deviations from the initial steady state. Time on the horizontal axes is in quarters.

The shock to the price of the fossil resource leads to a spike in headline and core inflation, and a decline in aggregate output. Since both the manufacturing and services sectors utilize energy for production, sectoral inflation rates increase. Our calibration, which is consistent with the share of energy in manufacturing being higher than that of services, implies that sectoral inflation in the manufacturing sector increases by relatively more. On the real side, aggregate output declines as households experience a fall in their current income due to an increase in the price of energy, while firms cut back on production due to the resulting lower demand.

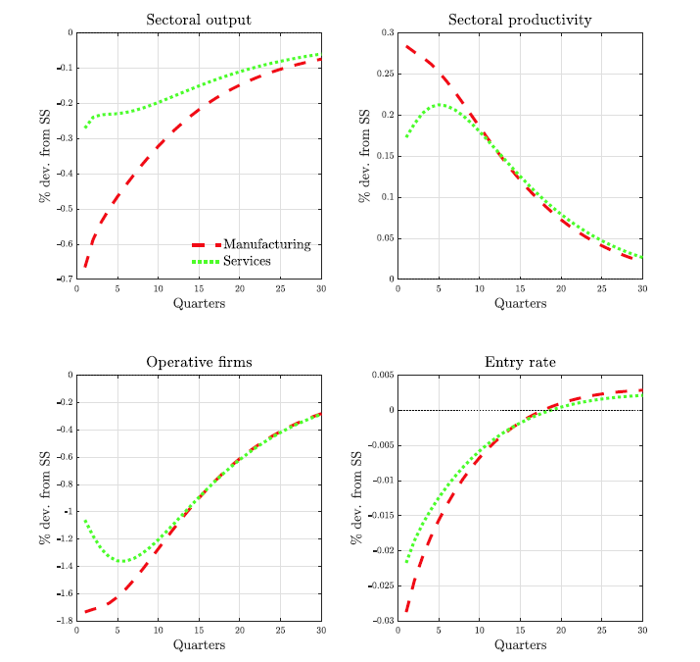

Figure 2 displays the response of sectoral output, productivity, the mass of active firms, and entry. Since fossil resources are used for the production of energy, a higher price of energy affects firm profitability leading to a contraction in sectoral output. However, productivity in both sectors increases in response to the shock. The reason is that a higher price of energy leads to an increase in the marginal costs of production, which in turn induces the exit of the least productive businesses. At the same time, entry into the market is reduced, because a higher idiosyncratic productivity level is required to be profitable in the face of higher energy prices. This cleansing and selection process translates into a persistent reduction in the number of operative firms in both sectors.

Due to its energy-intensive nature, manufacturing suffers a larger increase in marginal costs after the shock. As a result the cleansing and selection process is fiercer in manufacturing than in the service sector. The outcome is a more sizeable surge in productivity in manufacturing.

Figure 2. Effects of the fossil price shock on sectoral variables

Notes: Variables are expressed in percentage deviations from the initial steady state. Time on the horizontal axes is in quarters.

In our framework, monetary policy is summarised by a standard Taylor rule, according to which the monetary authority responds to deviations of inflation and output from their respective steady state values. The Taylor rule coefficients on output and inflation in the benchmark results presented above are assumed to be in line with the values usually assumed in the related literature. Under this scenario, Figure 1 shows that the nominal interest rate increases by 0.25 percentage point following the energy shock.

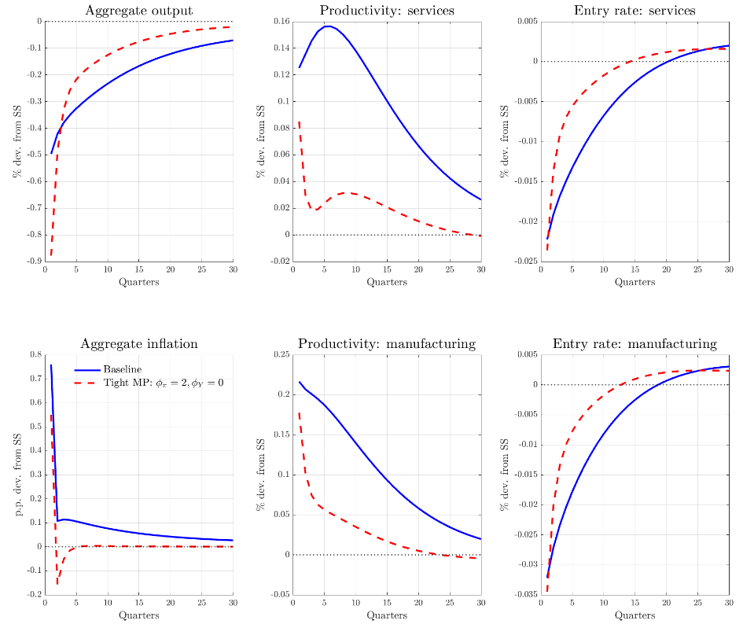

Figure 3 compares the baseline responses of aggregate and sectoral variables to the fossil fuel price shock to those obtained under an alternative parameterization of the monetary policy rule. Solid lines refer to the baseline parameterization, while dashed lines refer to the case where the monetary authority responds more aggressively to inflation, but does not responds to the deviations of output from the steady state.

A monetary policy that fights inflation more actively leads to a weaker response of both headline and core inflation and a larger output loss. In equilibrium, this is associated with the nominal interest rate increasing by more than in the benchmark case. Notably, tighter monetary policy contributes to causing both inflation rates to temporarily undershoot their steady state in the short term due to its stronger effect on marginal costs. While this result may carry over to other frameworks without business dynamism and firm heterogeneity, in our framework with endogenous productivity and business dynamism, there is an additional mechanism operating through the asymmetric impact of monetary policy on firm revenues and costs.

Figure 3. Effects of fossil price shock under alternative monetary policies

Notes: Variables are expressed in percentage deviations from the initial steady state. Inflation rates are in percentage point deviations from the initial steady state. Time on the horizontal axes is in quarters.

On the one hand, a tighter monetary policy produces a stronger negative effect on demand, and ceteris paribus, reduces the revenues of firms. This revenue effect generated by the shock requires a higher idiosyncratic productivity level for both survival and entry into the market. On the other hand, a lower demand for final goods results in lower labour demand, and thus in lower wages. A fall in wages reduces marginal costs. This cost channel makes it easier for firms to break-even on their costs even with a lower productivity.

Overall, our model predicts that the revenue channel dominates the cost channel, implying an increase in average productivity. However, a tighter monetary policy amplifies the cost channel, resulting in lower average productivity under tighter monetary policy compared to the benchmark scenario.

In sum, a tighter policy entails a higher impact cost in terms of output and lower average productivity, but leads to a faster recovery in business dynamism. Thus, our results suggest that monetary policy faces a trade-off between stabilizing aggregate activity and business dynamism.

Chafwehé, B., Colciago, A., & Priftis, R. (2024). Reallocation, Productivity, and Monetary Policy in an Energy Crisis, De Nederlandsche Bank Working Paper Series, No. 811, April 2024.