Disclaimer1

The pandemic has produced unprecedented swings in global growth: early-2020 saw the deepest contraction in nearly 75 years, followed by the strongest growth surge in half a century. Growth plunged at a 15.2%ar in 1H20 before rebounding 22.0%ar in 2H20, despite a second global wave of COVID-19 infections. But if the pandemic has been the primary driver of the global economic outlook over the past year and a half, the policy response is a close second. Extraordinary monetary and fiscal support stabilized credit flows, bolstered aggregate demand, and precluded significant economic scarring.

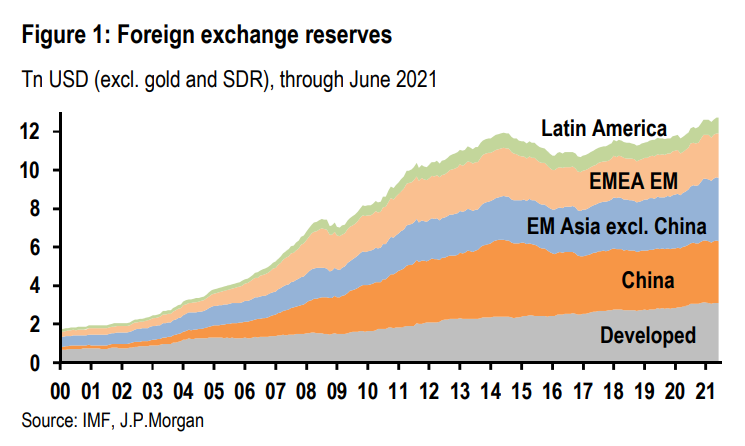

Following a brief dislocation in March 2020, global financial conditions have been broadly supportive thanks to this policy accommodation. As a result, the goods sector in particular has rebounded strongly, boosting the current account surpluses of some EM economies. At the same time, a number of central banks adopted unconventional policy tools, such as QE, that allowed them to pursue multiple objectives—in some cases including FX stabilization. One notable feature of these policies through the pandemic has been a relatively benign impact on global FX reserves. In contrast to past global downturns, when financial instability begat material cross-border capital flows, particularly from EM, the past year has been relatively calm. As a result, rather than dip into rainy day funds to protect currencies, FX reserves have continued to increase, reaching a new record of $12.7 trillion this year (Figure 1).

Even as global growth accelerated further during 1H21, a number of EM economies have faced setbacks as limited progress on vaccination forced them back into lockdowns to combat a jump in cases due to the delta variant. This has created a gap between DM and EM growth that we anticipate will narrow over the next several quarters as rising vaccination rates allow for further re-opening of economies, particularly the service sector. But this dynamic has also created an incentive for EM policymakers to accumulate reserves on a precautionary basis against adverse macroeconomic shocks.

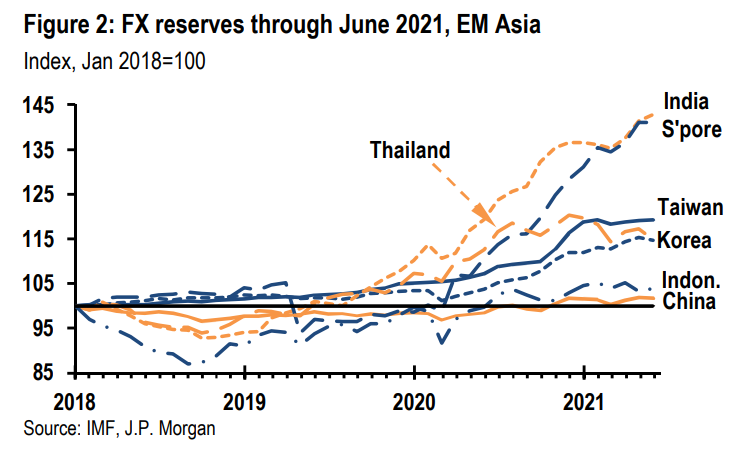

Most of the reserve accumulation since March 2020 has been by EM Asian economies. Data from the IMF indicate that, once swings in exchange rates are taken into account, the share of reserve assets held in US dollars has remained relatively steady since the onset of the pandemic following several years of decline.

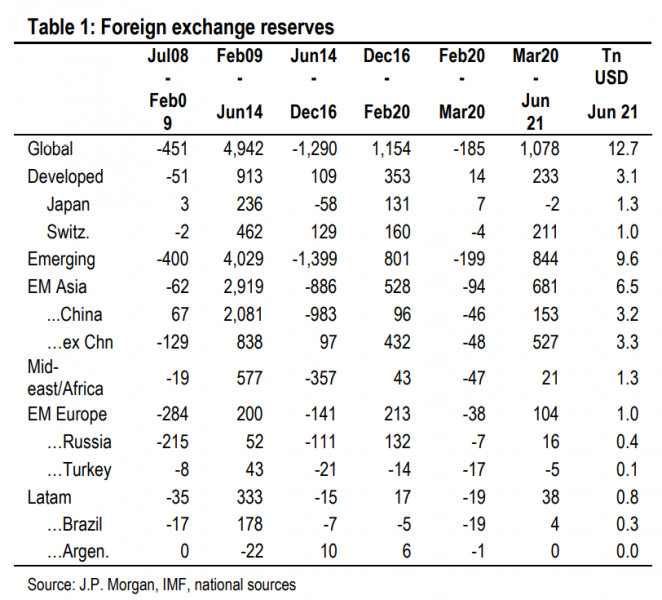

Official holdings of foreign exchange (excluding gold and SDRs) reached a record $12.7tn in May, and remained at that level in June (Table 1). This is nearly $1.1tn higher than the recent pandemic-induced low in March 2020, and exceeds the $12.0tn prior peak reached in 2014. Despite the historically deep global recession in 1H20 and the concomitant rifts in global financial markets, FX reserves declined sharply but modestly during March 2020, and rebounded quickly thereafter. That decline was only a fraction of the cumulative outflow of reserves during the EM credit unwind and commodity price collapse in 2014-16.

EM economies have accounted for most of the increase in reserve holdings since March 2020, with Asian central banks and sovereign wealth funds accounting for more than half of the rise. China’s reserves had been fairly stable in recent years and into the pandemic, but have increased to $3.2tn in June—the largest holdings by any single economy, comprising 25% of global FX reserves. This is down slightly from China’s share prior to the pandemic, and some 7%-pts below its maximum share in mid-2014, when China’s holdings totaled $4tn.

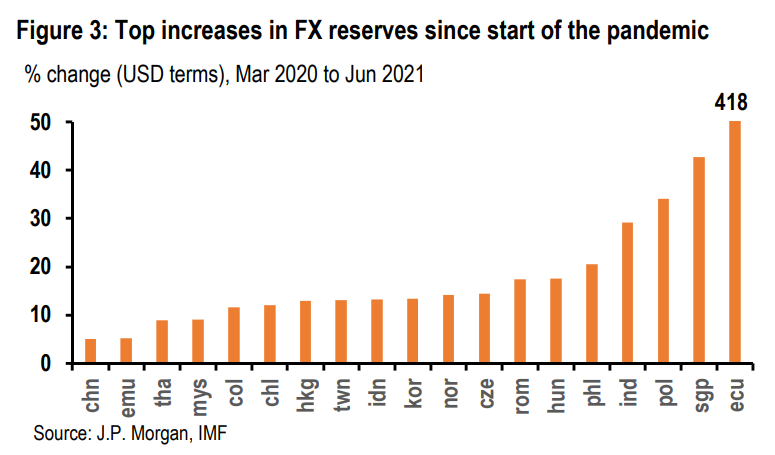

The rest of EM Asia, by contrast, significantly increased its FX reserves over the prior 15 months, and the other economies in the region now collective hold slightly more reserves than China: 26% of the global total. This group’s share has grown by 3%-pts since 2019, and represents the mirror image of China’s 7%-pt decline since 2014. Recent reserve accumulation by Singapore, India, and the Philippines stand out in the region, with their reserves rising 43%, 29%, and 20%, respectively, since March 2020 (Figure 2). In India, the central bank has actively intervened to prevent the rupee from appreciating further, while pandemic-induced precautionary saving and weaker private sector investment helped push India’s current account into surplus. Deposit flows into Singapore, possibly as a safe haven destination, as well as some corporate repatriation, have lifted the financial account there.

A few other economies stand out with large percentage increases in their official holdings since the aggregate reached its nadir in March 2020 (Figure 3). These include Ecuador, which benefitted from the recovery in oil prices last year while weak domestic demand held down imports. The CEE-4 also experienced sizable accumulations; Poland led the way with a 36% gain. Among DM economies, Switzerland saw a near-27% increase, while Norway’s reserves rose 14%. These gains reflect efforts to forestall currency appreciation in the face of unprecedented monetary easing by the Fed and ECB.

The pandemic shock produced a nearly 20% collapse in global goods output through April 2020, as production was temporarily halted and as demand plunged. But the re-opening in 2020 heavily favored a strong rebound in goods output, supported by policy easing and pent-up demand. In addition, spending shifted to the goods sector as restrictions on activity continued to fall most heavily on services. One year after the trough in manufacturing output, production had risen nearly 28%, putting global IP nearly 3% above its pre-pandemic level. Merchandise exports followed a nearly identical path, collapsing in early 2020 and rebounding strongly thereafter. In April 2021, the value of global exports had surged 50% over a year ago (Figure 4). Based on IP dynamics, the growth rate is projected to have slowed to just under half that pace in June, but that remains a remarkable pace of growth as the recovery continues.

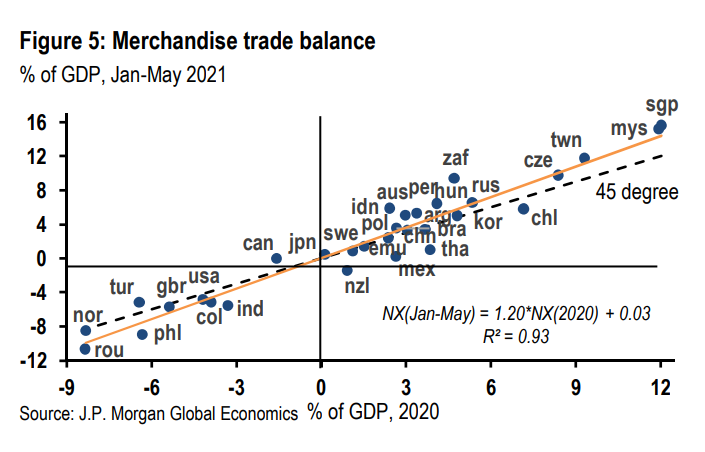

Trade balances tended to narrow in 2020 relative to 2019, thanks to the boom that followed their pandemic-driven collapse. The main exceptions in our panel of economies were Russia and Turkey. For the first several months of this year, merchandise trade balances widened on average across the economies we track (Figure 5). Countries with increasing trade surpluses include exporters of commodities (e.g., Russia, South Africa, Brazil, Australia) and manufactured goods (e.g., Taiwan, Korea, Hungary, Czechia). All else equal, wider trade deficits have put pressure on a handful of EM economies, namely India, Colombia, the Philippines and Romania, to ensure they have sufficient reserves.

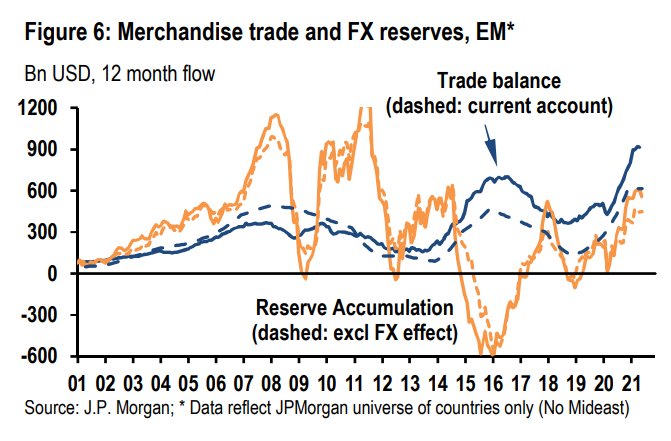

FX reserve dynamics are largely driven by EM economies, as most of the DM have free-floating currencies. Across the EM, central banks have tended to use official reserves to manage the volatility driven by rapid shifts in capital flows. While trade flows typically are not nearly as variable as financial market flows, the past year has seen a sharp rise in trade and current account balances among EM economies that mirrors the sizable accumulation of reserves (Figure 6). The improvement in the EM current account balance is mirrored by much higher net private savings.

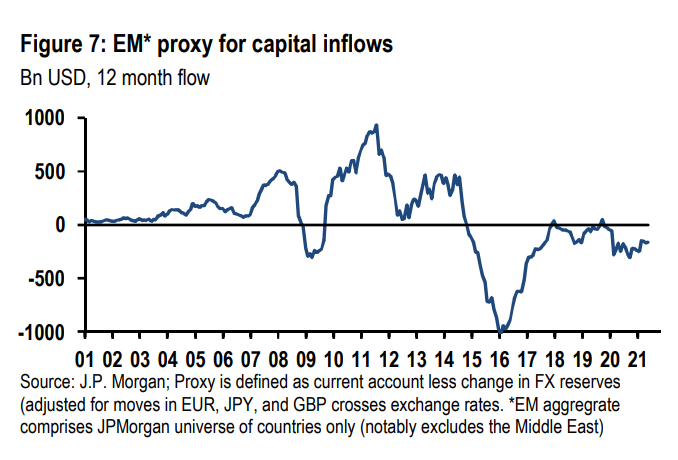

An implication of the recent co-movement between EM FX reserves and the current account is the relative stability of capital flows. The balance of payments identity implies that the current account plus the financial account has to equal official FX reserve accumulation. This allows us to construct a proxy for capital flows in the EM that reflects this recent relative stability, implying modest capital outflows on net since late 2017 (Figure 7). This relative stability is remarkable given the period included protracted uncertainty around the US-China trade war and the deep (if short) COVID-19 pandemic recession.

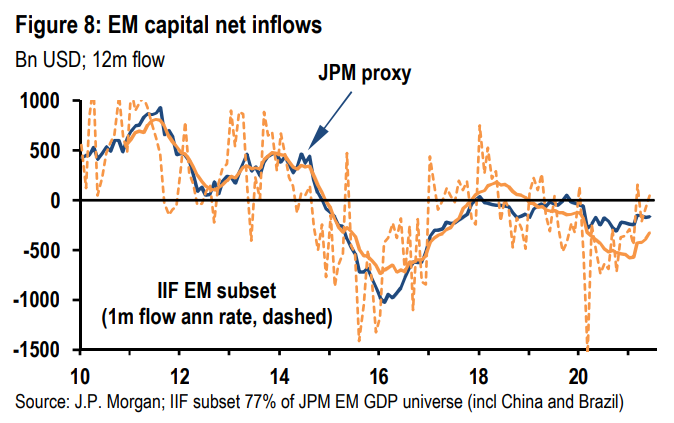

Our proxy for EM capital flows aligns with the capital flow data for a slightly more limited set of economies reported by the Institute for International Finance (IIF), although the fit has weakened somewhat in recent years (Figure 8). But the broad contours of a large outflow between 2014 and 2017, followed by a few years of roughly balanced net capital flows before a more modest net outflow following the onset of the pandemic, remain.

The US dollar’s role as the global reserve currency of choice has weakened somewhat over the past decade, but USD reserves remained nearly 60% of the total as of 1Q21. These data come from the IMF’s latest Composition of Official Foreign Exchange Reserves (COFER) survey, which includes 149 countries and covers nearly 94% of reserves. While it does not give information on holdings by individual institution (in order to maintain confidentiality and thus boost participation), it is considered the most authoritative source on the currency allocation of global FX reserves.

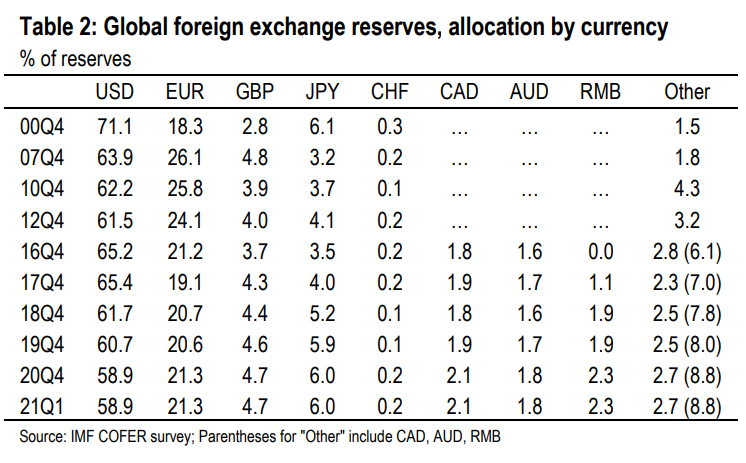

Based on the COFER survey, the USD’s share of global FX reserves declined 9%-pts from 2000 to 2010, largely as the euro gained 7.5%-pts (Table 2). The Japanese yen’s share declined as well, with the difference being made up by increased holdings of British pounds and other currencies not specifically identified. In the subsequent decade, USD holdings slipped modestly further, but the euro saw the biggest decline as both the yen and pound gained somewhat, while the share of “other” currencies—which now includes data on holdings of CAD, AUD, and RMB—more than doubled to around 9%.

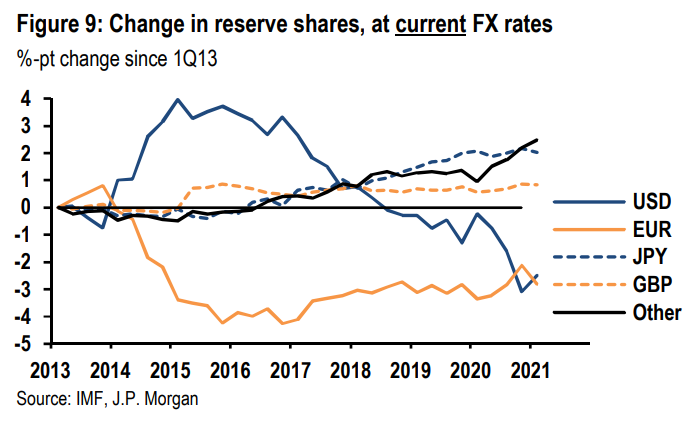

The recent COFER data reveals some volatility in holdings since the pandemic began. The share of USD-denominated holdings hit a recent high of 61.8% in 1Q20, as global financial market stress—and the trade-weighted value of the USD—peaked. It then declined to an all-time (nearly 25-year) low of 58.9% in 4Q20 before inching back up in 1Q21. The JPY’s share also peaked in 1Q20, at 6%, but has largely retained at that level since. Most other currencies, including the EUR, hit recent lows in 1Q20 before largely returning to their pre-pandemic shares (Figure 9).

However, swings in these shares—whether since the pandemic began or over a longer time horizon—should not be interpreted as active policy decisions. Rather, a sizable portion of these moves reflect valuation effects. FX reserves in the COFER survey are denoted in US dollars, so an appreciation of the USD mechanically increases the recorded USD share. This happened in 2014-15, when the trade-weighted USD appreciated over 22% and the USD share jumped over 4%- pts. Its share has been trending lower since 2017 despite a small appreciation over that period. As noted above, the USD share briefly rose over a percentage point in early 2020 when the trade-weighted USD jumped 9%. It has since depreciated over 10% and the USD share has fallen about 3%-pts.

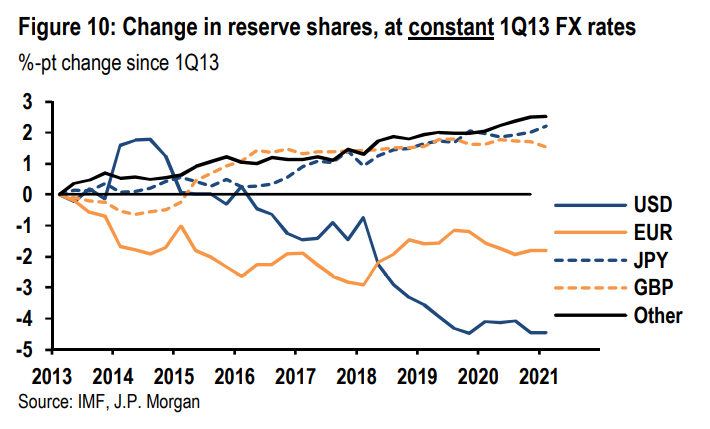

Fixing exchange rates at their 1Q2013 values gives a measure of how monetary authorities have actively adjusted the composition of their reserve holdings since then. By this measure, the US dollar’s share of global FX reserves briefly rose around 2% early in 2014, with the increase fully reversed during 2015. Since then, the USD share has slid lower by about 4.5%-pts over past five years, with most of the decline occurring since 2018 (Figure 10). Put another way, the 25% appreciation of the USD from 2014 to 2016, and 20% cumulative gain to date, should have significantly boosted the USD share of reserves. That it has not reflects active diversification into other currencies by reserve managers.

Despite the volatility around the pandemic shock, fixing exchange rates implies a fairly constant USD share over the past year and a half—a notable stabilization following the considerable move down in 2018 and 2019, likely reinforced by flight-to-safety dynamics set in motion by the pandemic. While the on-going strong recovery in global activity should relax this motivation somewhat, the US remains one of the primary sources of global growth this year.

In fixed-value terms since 2013, the euro has seen its share of global FX reserves decline about 2%-pts, with the “other” category—primarily RMB—accounting for the largest corresponding share increase, followed by the JPY and GBP. However, since 2018, when the USD share has seen its most significant decline (-3.7%-pts), the euro, yen, and renminbi have each seen their shares increase by around 1%-pt or more, with the remaining currency shares up marginally.

Disclaimer: This SUERF policy brief includes research content published by J.P. Morgan on 12 August 2021. J.P. Morgan has granted SUERF a limited right to re-publish this research on an information only basis. J.P. Morgan has no liability in any regard for the publication of this SUERF policy brief or SUERF’s decision to reproduce any J.P. Morgan research content contained herein. It is not an offer to buy or sell any security/instruments or to participate in a trading strategy or trading activity; nor does it constitute any form of personal financial advice or investment recommendation by J.P. Morgan. This information should not be relied upon for any reason whatsoever by any natural or legal person. For important current standard disclosures that pertain to J.P. Morgan’s research please refer to J.P. Morgan’s disclosure website: https://www.jpmm.com/research/disclosures

Courtesy J.P. Morgan Chase & Co, Copyright 2021.