Two years after the start of the pandemic, EU real GDP and investment are already back to pre-pandemic levels, but the crisis is not over and further asymmetric impacts and vulnerabilities may still emerge. The EIB Investment Report 2021/2022 analyses the effects of the pandemic, the effectiveness of policy support and the challenges and opportunities for Europe as we emerge from the current crisis. We argue that an acceleration of investment in the EU remains crucial, to adapt to the new post-pandemic normal and reap the benefits of the green and digital transformation. This requires a policy focus on protecting public investment; maximising the impact of the Recovery and Resilience Facility; and initiatives to unleash private investment through, risk-sharing instruments, investment in skills, policy clarity and public infrastructure.

Two years after the start of the pandemic, we have some grounds to sound a positive note The extraordinary policy support provided in advanced economies has been successful in avoiding economic disruption that could have been far, far worse. EU real GDP and investment are already back to pre-pandemic levels.1

However, the crisis is not over. With Omicron variant still surging, scientists are starting to consider COVID-19 to be something that is “here to stay”. We still do not know what the impact of this will be on the longer-term recovery. And even without this latest wave, we have yet to see what signs of vulnerability and asymmetric impacts may emerge as we go forward.

This is the context examined by the EIB Investment Report 2021/2022, the Bank’s flagship report providing a comprehensive overview of the developments and drivers of investment and its finance in the European Union. In this report, we not only analyse the effects of the pandemic and the effectiveness of policy support, but also look forward to the challenges and opportunities for Europe as we emerge from the current crisis. The topic of this year’s report is Recovery as a springboard for change. We argue that an acceleration of investment in the EU remains crucial, to adapt to the new post-pandemic normal and reap the benefits of the green and digital transformation. This requires a policy focus that should not omit three key elements: protecting public investment; maximising the impact of the Recovery and Resilience Facility; and initiatives designed to unleash private investment through a focus on skills, risk sharing instruments, policy clarity and public infrastructure.

The COVID-19 pandemic has comprised an unprecedented shock to the economy, but the recovery has been fast, beating many expectations. And in contrast to the experience in Europe after the Global Financial Crisis, the rebound in investment has also been strong. Investment by general government and households is already above pre-crisis levels. Investment by non-financial corporations is at pre-pandemic levels, if we exclude Ireland where some one-off factors related to intangibles distort the comparison.

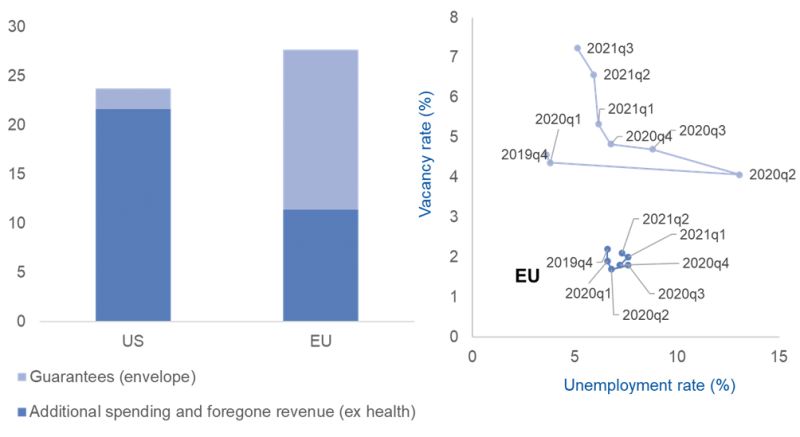

The strength of this recovery would not have been possible without remarkable policy support. The cumulative stimulus in Europe in 2020 and H1 2021 has been estimated at around 27% of GDP by the IMF (Figure 1). In the EU, this took the form of a combination of effective government expenditure and the offer of guarantees. In terms of additional spending, therefore, the fiscal stimulus in the EU has been below that in the US. However, the guarantees offered have provided a further buffer. Moreover, to the extent that they do not eventually materialise as contingent liabilities, they might turn out to be a more efficient (less expensive) stabilisation mechanism than spending alone.

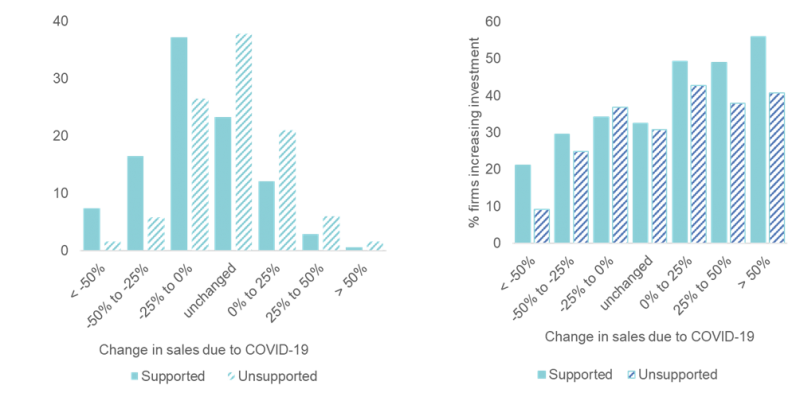

Again in contrast to the United States, policy support in the EU aimed at preserving jobs, thus keeping workers in their existing roles. This is reflected in the very different pattern of the beverage curve in the EU and US (Figure 2). In the EU, this has facilitated the rebound in activity, with much weaker frictions from job-matching and less mismatch in labour demand and supply. However, the EU’s strategy might have some implications in the long-run in terms of reallocation of resources, particularly if we believe that the pandemic will be an accelerator of the digital and green transitions, thus requiring an accelerated reallocation of jobs and reskilling of workers.

| Figure 1: Pandemic response fiscal measures 2020-June 2021, % of 2019 GDP |

Figure 2: Labor market adjustment Vacancy and unemployment rates, EU vs US |

Sources: (1) IMF Fiscal Monitor Database of country fiscal measures in response to the COVID-19 pandemic; (2) Eurostat, BLS, EIBIS 2021.

The EIB Investment Report draws extensively on the results of the annual EIB Investment Survey (EIBIS) a survey of 12 000 firms in the European Union, with representative comparator samples of 800 firms in the United States.

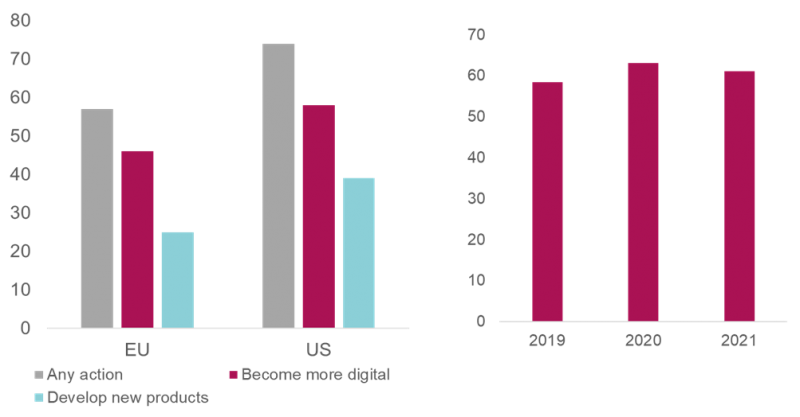

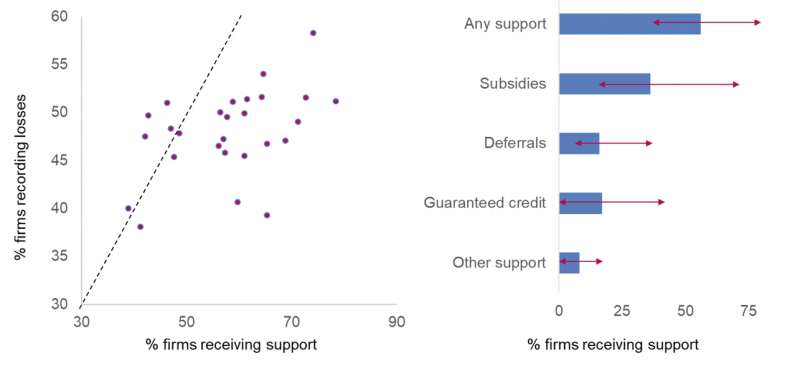

One statistic revealed by the 2021 round of this survey was that some 56% of firms in the EU received pandemic-linked policy support, mostly in the forms of subsidies, guaranteed credit or the deferral of payments. Matching this survey data with other data on firm characteristics, we have been able to discount the suggestion that this support represented a widespread misallocation of resources. We can show that support tended to be directed at firms facing severe short-term difficulties from lost sales as a result of the pandemic (Figure 3), and not to “zombie” firms that were already in poor financial health before the pandemic began.

| Figure 3: Firms with large declines in sales were more likely to receive financial support | Figure 4: Support weakened the link between lost sales and future investment |

Source: EIBIS 2021.

Even more importantly, we see that the policy support received acted as a firewall, substantially insulating firms’ investment activities from the effect of lost sales (Figure 4). This helped many firms to take action to react and adapt to the new demands placed on them by the pandemic. Some 46% of EU firms stated that they have responded to the pandemic by increasing their use of digital technologies, and for many of these, this was the start of their digitalisation journey, involving mostly adaptations to home-working and on-line sales. One quarter of EU firms responded through other innovations to transform their products, services and business processes (Figure 5).

By contrast, the proportion of firms that have adopted advanced digital technologies did not increase in the last year, suggesting that the pandemic understandably distracted from more radical processes of transformation (Figure 6). And while the evidence of firms responding to the pandemic is positive to note, one should also note that EU firms have been slightly less responsive than those in the US.

| Figure 5: Firms’ short term reaction to the effects of the pandemic – Share of firms % | Figure 6: EU firms using advanced digital technologies – Share of firms % |

Source: EIBIS 2021.

The last year also saw no advance in climate-related investment, with aggregate investment in mitigation flat at 1.5% of GDP. The share of firms investing to address climate issues dropped marginally, but more firms now plan to increase investment in the next three years. Overall, the strong leadership and policy direction provided by the EU on climate is an asset, proving to be a catalyst for investment by the private sector. Awareness of risks and opportunities by EU firms is increasing, and Europe’s current leadership in climate innovation bodes well for the future, if it can be maintained.

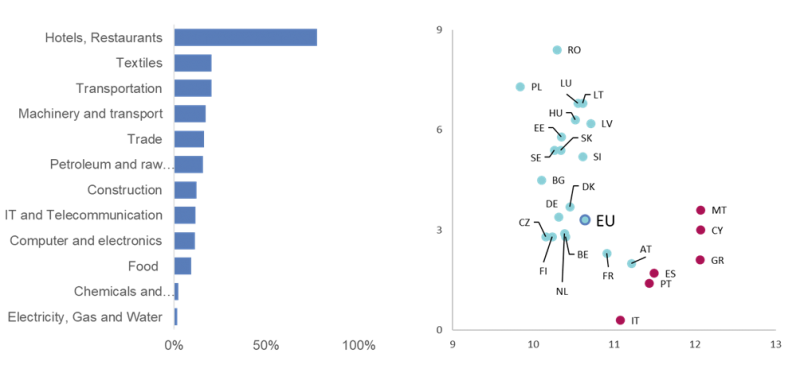

Losses from the effects of the pandemic have been concentrated in certain sectors and classes of firms (Figure 7). And different sectors and classes of firm have a different relevance for the economy of different countries. In Figure 8 we plot the EU Member States against the total pandemic-related shock to GDP (vertical axis) and an indicator measuring the share of vulnerable firms in each country, which we estimate starting from firm and sector level data (horizontal axis). Certain countries emerge as more at risk, with a stronger macro shock and stronger micro vulnerabilities. What is interesting is that the countries more at risk (in red) also tend to be those which entered the crisis with higher sovereign debt. So the risk of asymmetries in how European economies recover from the pandemic clearly remains.

| Figure 7: Impact across sectors Share of firms with more than 25% loss of sales |

Figure 8: Vulnerabilities across countries Economic shock and share of firms at risk |

Source: (1) EIBIS 2021 share of firms reporting losses (indicative data). (2) Vulnerable firms estimated based on ORBIS_EIBIS matched database, with simulations up to mid-2021. Red dots are countries in Southern Europe.

Another issue is how resilient firms are likely to be to the withdrawal of policy support. This resilience is also likely to vary across countries. All countries in Europe have provided support to firms through the crisis, in one way or the other. However, the size of the support relative to firms’ losses, as well as the measures implemented (subsidies or loans), has diverged across countries. Figure 9 indicates that in some countries, the policy support overcompensated for pandemic effects, while in others it undercompensated.

Figure 10, meanwhile, shows that the type of instruments used has been different. It is notable that in a handful of countries, guaranteed credit was the main form of policy support. This means that firms in those countries are now likely to face greater leverage issues. In other countries, subsidies prevailed, which implies that firms can now concentrate on the recovery, without any direct legacy.

| Figure 9: Share of firms recording losses and receiving support, by country | Figure 10: Share of firms receiving different forms of support – EU average and min-max, across countries |

Source: (1) EIBIS 2021, the line represents the 45° line. (2) EIBIS 2021, The red bars represent the min-max across EU countries.

In the report, we also note that existing divides across territories, firms and groups of people might have increased through the crisis:

Overall, we see many reasons why the pandemic could end up widening divides across Europe, creating economic winners and losers.

Looking forward, we see wish to emphasise three crucial areas for policy to focus on in Europe, to consolidate the recovery, to mitigate the risks of further asymmetries developing and to reap the benefits of the green and digital transitions.

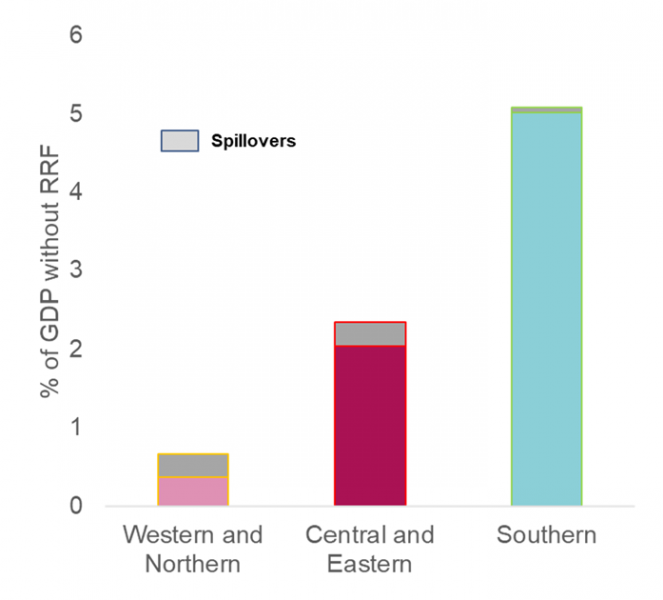

The first is that we need to fully exploit the potential embedded in the Recovery and Resilience Facility (RRF) and to protect public investment from fiscal consolidation. The RRF represents a huge opportunity, and we estimate the macroeconomic impact in the long term. By 2030, the RRF has the potential to expand the economy of countries in southern Europe by 5%, relative to the baseline, and in Central, Eastern and South Eastern Europe by 2.7%. Effects in Northern and Western Europe are likely to be much smaller relative to GDP, and half of the effect there is, notably, likely to come from spillovers from investments that take place in other countries and that reinforce the single market (Figure 11).

Figure 11: Estimated impact of the RRF by 2030 (% of GDP)

Source: EIB Investment Report, based on RHOMOLO JRC-EIB. The bars indicate the estimated impact of the RRF in terms of overall GDP level.

However, achieving these sizable growth impacts will depend on successful implementation, which cannot be taken for granted. In particular, it will require commitment and technical capacity at the country level.

The second crucial area is a focus on protecting public investment. The Global Financial Crisis showed that periods of fiscal consolidation can have a detrimental effect on public investment. Today public investment is above pre-covid levels, but the end of the exemption from the Growth and Stability Pact (GSP) rules could potentially trigger a period of disproportionate fiscal adjustment. We estimate that re-imposing the GSP rules in their existing form might require a primary surplus of 3% of GDP for 20 years in the most indebted EU countries, compared to 1% in the 2015-2019 period. Such a rate of consolidation would be unprecedented, and likely unfeasible. The discussions on this subject are ongoing, but it is clear that we need to find ways to protect public investment going forwards.

The third critical focus area is the need to unlock private investment. With huge investment needs, public investment is not enough. Private investment has to fill the gaps.

Our survey looks at impediments for investment by firms. Unlocking investment also means addressing those impediments, something which can be catalytic. Particular attention needs to be paid to:

At this stage of the recovery, when we look at economic policy, the situation of firms and their investment activities, what we ca say is: so far so good, but vulnerabilities and asymmetries remain! Accelerating investment further will still be critical to adapt to the new normal and reap the benefits of the green and digital transformation. This means that going forward, policy should target investment: protecting public investment, maximizing the impact of the Recovery and Reliance Facility, and prioritising initiatives with the potential to trigger more private investment, including a focus on skills, risk-sharing instruments, policy clarity and public infrastructure.

Data exclude the Republic of Ireland