The design of the key elements of a public budget-neutral environmental fiscal reform could have very different implications not only in terms of its environmental impact but also on its macroeconomic effects. Our proposals rely on a carbon tax on fossil fuels covering all emitting sectors. It would be a powerful and efficient instrument for reducing emissions, as it gives economic agents the right incentives to find ways to save energy and switch to greener energy sources while generating significant tax revenues whose judicious use may have positive macroeconomic effects. We build a model to assess the environmental and economic impact of a set of environmental fiscal reforms in Spain which are defined by the possibility of a border carbon adjustment, to take into account the global dimension of the greenhouse gases emissions, and alternative uses of the tax revenues generated. In this framework, we incorporate technological innovation, which will allow firms to produce with non-polluting inputs and, specifically, the electricity sector, to increase the role of renewables in its generation mix. The results indicate that carbon tax designs with border carbon adjustment tend to be more effective in lowering emissions. They also suggest that an appropriately designed environmental fiscal reform may achieve social support in the short term and even boost economic activity in the medium term if the revenues are used to compensate the individuals more affected by the reform and reduce other, more distorting, taxes.

In the absence of major actions to curb the accumulation of carbon dioxide (CO2) and other greenhouse gases (GHGs) in the atmosphere, global warming will continue, with risks of extreme weather events, higher sea levels and destruction of the natural world. In simple economic terms, this process could be seen as the result of a market failure derived from producing costs not incorporating the social cost of GHG emissions, which has led to larger emissions over decades or centuries than would be socially optimal. There are several alternatives to internalising the externality derived from GHGs such as the Pigouvian taxes. One of them is the carbon tax, which we operationalize as a charge on the carbon content of fossil fuels, given its administrative simplicity. Carbon tax rationale is fairly simple. Since a carbon tax increases the prices of fossil fuels, electricity and consumer goods and services produced using these inputs intensively will be more expensive in relative terms than other, less carbon-intensive, products. This change in relative prices will promote a shift to cleaner technologies and consumption.

A good design of a green reform based on a carbon tax could not only reduce emissions but also have a limited harmful macroeconomic and social effect. In fact, the definition of the tax base, the sectors covered, and the use of the funds raised can make a substantial difference in terms of correcting the externality and affecting the income of the agents. It could lead to achieving emissions close to the social optimum, raise significant public revenue whose smart use could help offset the harmful macroeconomic and social effects, if appropriately designed. First, a good design requires that the carbon tax level reflects the social cost of emissions, which is highly uncertain, and covers all GHG emitting activities2. Second, the macroeconomic and social implications depend on the use of the funds collected, such as to reduce other distorting taxes (social contributions or personal income tax, among others), to decrease public debt, to promote renewable sources of energy, to improve the efficiency in the use of energy, to provide direct payments to the households more relatively affected by these environmental taxes or a combination of all of them. Third, in absence of international coordination, the unilateral introduction of a carbon tax has also side effects; it may lead to carbon leakage, a flight of polluting companies to other countries where such tax does not exist. Fighting the climate change is a global challenge and these leakages would make these country/region specific initiatives highly inefficient. One way to reduce this drawback is through a border carbon adjustment, i.e., charging imports with an equivalent tax and exempting exports from it.

In our paper, we build a novel model to assess the environmental and economic impact of a set of environmental fiscal reforms in Spain which are defined by different levels of the carbon tax, the possibility of a border carbon adjustment and alternative uses of the tax revenues generated. In this framework, we incorporate technological innovation, which will allow firms to produce with non-polluting inputs and, specifically, the electricity sector, to increase the role of renewables in its generation mix.

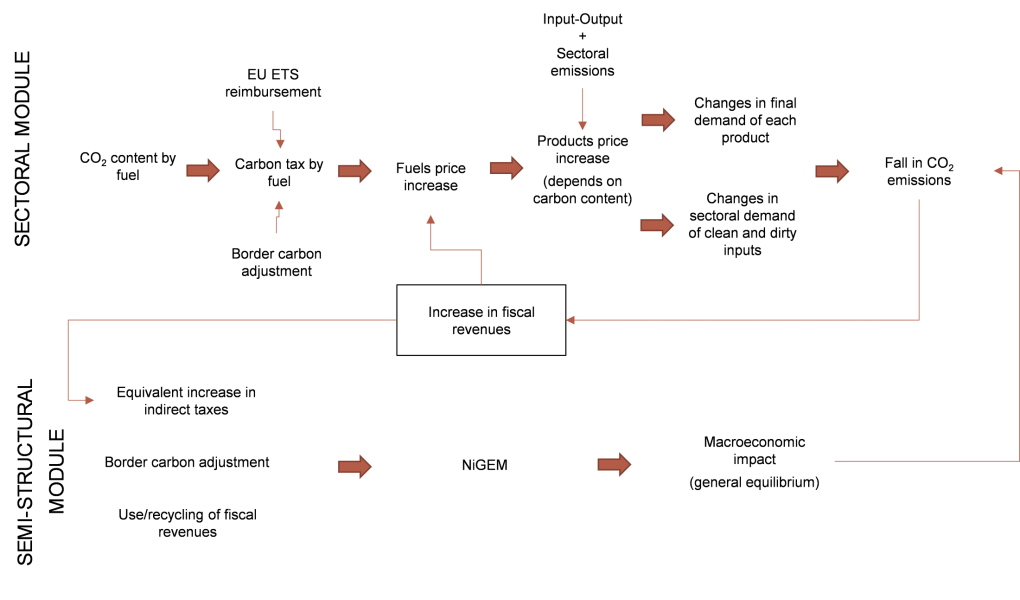

The modular model developed consists of two modules that interact with each other and that combine sectoral information with a general equilibrium approach with real and financial frictions (see diagram below). The first module, sectoral in nature, is made up of a static partial equilibrium model for the Spanish economy that combines information from the input-output tables, sectoral CO2 emissions, a demand system for households and a demand system for intermediate energy inputs. This module provides results in terms of CO2 emissions disaggregated at sectoral level. The main drawback is that it is not possible to simulate a complete tax reform since it does not allow interactions among economic agents. The second module, favouring a general equilibrium approach, allows a parametric tax reform to be simulated, sacrificing the granularity of the results. This module, with aggregate variables, consists of a semi-structural model where accounting identities are combined with behavioural equations estimated for the representative agents (households, firms, public sector, external sector, etc.). This module allows for analysis of the effect on the main macroeconomic variables of the different designs of the carbon tax and of the different uses of the revenues generated. However, this approach does not take them fully into account the costs to reallocating resources across sectors and firms that will be larger the lower the flexibility of the economy.

Diagram of the model

We evaluate a set of green reform proposals to infer the environmental and economic impact of introducing a carbon tax in Spain. The fiscal reforms cover different levels of the carbon tax; the possibility of a border carbon adjustment; and different uses of the tax revenues generated (lower public deficit/debt, reduction in social contributions, lump sum transfers to households, or subsidisation of the electricity bill as a means of increasing the role of renewables in its generation mix).

The conclusions that can be drawn from this study suggest how a reform of the tax system could be designed to reduce CO2 emissions, containing potential adverse effects on macroeconomic performance and also compensating the potential losers of the reform; this is critical to achieve the social support needed to a successful implementation.

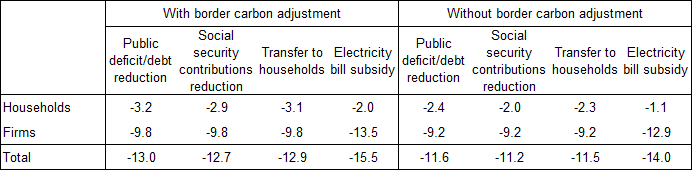

A carbon tax that covers all economic sectors is a powerful instrument to reduce emissions, but it may need to be accompanied by other policies to achieve the Spanish emission goals. Considering that the rise in carbon prices led households to demand products with less carbon content and firms to produce with less polluting inputs and for a carbon tax of EUR 30 per CO2 ton, the reduction in emissions will range between 11-16% per year depending on the scenario considered (see Table 1). The shift towards cleaner technologies by firms is the main driver of this result. In any case, this reduction only accounts for between 32-46% of the Spanish GHG emission goal for 2030. Therefore, either carbon prices are further increased or they must be accompanied by other policy measures. Álthough carbon pricing is the most cost-efficient way to achieve successful mitigation, it could be combined with innovation policy that helps remove obstacles to developing new low-carbon technologies.

Table 1. Change in CO2 emissions, 2015 (%). 30€ per CO2 ton

Source: Estrada and Santabárbara (2021).

Carbon tax designs with border carbon adjustment are more effective to achieve a larger emissions reduction and to preserve the competitiveness of the economy. Our analysis for Spain reveals that border carbon adjustment increases the CO2 emissions reduction by 11% to 14%, with household demand accounting for the major part of it. However, the introduction of a border carbon adjustment scheme would involve introducing environmental tariffs on imports and give grants to export (to compensate for incorporated environmental taxes) potentially subject to challenge and to dispute under WTO rules, since measuring embodied carbon in traded goods can be contentious. Án alternative is to coordinate the introduction of the carbon tax at a supranational level: the coordination at EU level appears to be an effective solution, since carbon leakage and loss of competitiveness are reduced without the need to introduce tax refund/surcharge systems.

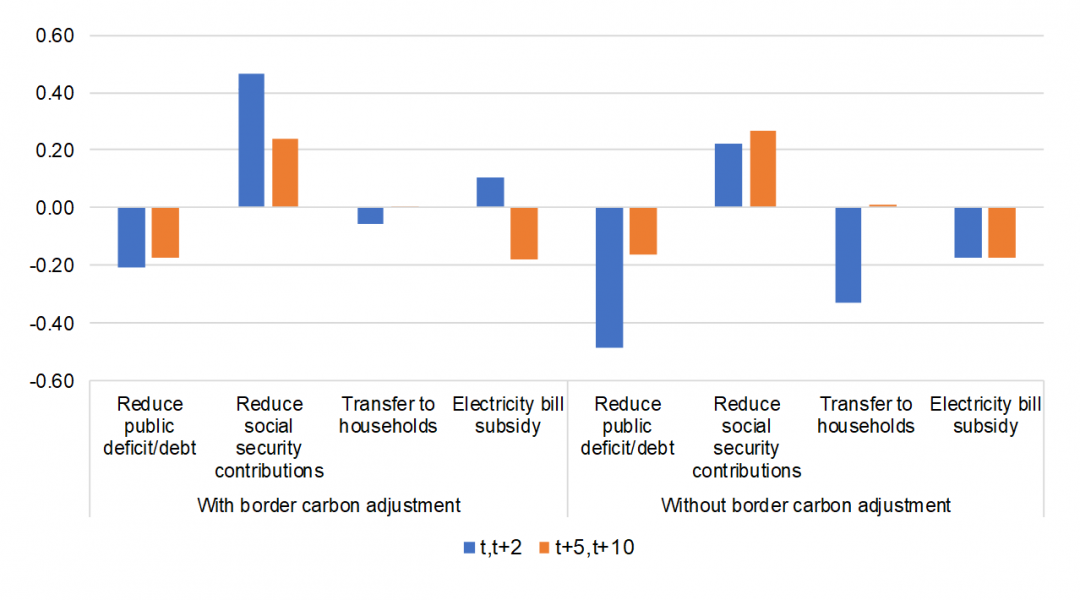

The use of the revenues is crucial to minimise the potential adverse economic and social impact of the carbon tax. If funds raised are used to reduce other distorting taxes, the fiscal reform may even boost economic activity in the medium term, once the reallocation of resources across sectors has taken place (see Figure 1). Specifically, given the recurring problem of unemployment in Spain, the reduction of social contributions seems to be an advisable option. Using tax funds to reduce the electricity bill results in lower emissions, given that all non-electricity sectors are encouraged to use electricity and the electricity sector is, in turn, encouraged to switch the electricity generation mix towards clean technologies; but it also results in lower GDP than the previous option, as labour costs do not diminish.

In addition, it is worth noting that carbon taxes tend to be regressive, increasing inequality and energy poverty. In this respect, the funds collected could be used to mitigate this effect. In our paper, we have considered recycling carbon tax revenues into lump sum payments to households. This proposal is able to offset the negative impact on economic activity of the carbon tax, retaining most of its strength to curb emissions. More targeted alternatives focusing on distributional aspects are outside the scope of our model but are sensible in economic and political economy terms. For instance, revenues could be recycled through payments to the individuals for which the energy bill represents a higher share in their income, conditional upon improving, for example, the climate-related adaptation of their houses or the use of cleaner means of transportation. Probably, the latter measures will increase the social and political acceptability options of the carbon tax.

Figure 1. GDP: deviation from baseline, 30€ CO2 ton (%, average)

Source: Estrada and Santabárbara (2021).

In Spain, the EU Emissions Trading System only covered around 35% of total GHGs emissions in 2019.