The regulatory response to the global financial crisis and broader developments in finance and society have materially expanded regulation in the financial sector. Ideally, financial regulation should be designed so that the societal benefits exceed the costs, even when they relate to different institutions. It should therefore be framed in a manner that includes a system-wide perspective and reference to systemic risk and financial stability. Excessively complex financial regulation contributes to systemic risk by (i) creating the illusion of a well-controlled system and incentivising regulated entities to game the system, (ii) by missing contingencies that are not well understood, thus being unable to address “unknown unknowns”, (iii) by making policy responses convoluted and difficult to judge, hampering public accountability, and (iv) by encouraging the transfer of risks outside the regulatory perimeter. Conversely, overly simple financial regulations are unlikely to properly address the misaligned incentives, informational asymmetries and externalities underlying the need for regulation. A transparent cost-benefit analysis, greater evidence-based design of financial regulation, and evaluations of its effectiveness are desirable actions to improve financial regulation. In addition, financial regulation should be robust in the sense of being able to cope with a variety of failure-inducing circumstances and behaviours, while not trying to offer the best-tailored response to each specific phenomenon. It thereby accounts for the interaction between Knightian uncertainty and systemic risk. The quest for robustness in financial regulation could be facilitated by adopting seven principles: adaptability, diversity, proportionality, resolvability, systemic perspective, information availability, and non-regulatory discipline. Such robust financial regulation could improve the cost-effectiveness of the regulatory outcome while reducing its complexity.

Financial crises are often followed by far-reaching regulatory reforms, as the urgent demands of the situation compel politicians and regulators to respond quickly and decisively. This approach to financial regulation tends to make regulation and institutional architecture more complex. As a result, a financial entity needs to interact with a number of authorities (the microprudential supervisor, the macroprudential authority, the resolution authority, etc.), which, at the same time, need to interact with each other (Blinder, 2010), adding to institutional complexity.

Many other parts of society have also seen substantial growth in regulation, such as civil aviation, or food regulation. The trend towards higher regulatory complexity overall seems to respond to the increase in complexity in the underlying systems to be regulated. At the same time, developments in information technology (IT) may play an important role in managing regulatory complexity as the human capacity to manage complexity is expanded (Deitel and Deitel, 1985; Becker, 1995; Harari, 2015). In this sense, any discussion of the increase in regulatory complexity in recent years must also take into consideration that the costs of some of its aspects (such as the execution of massive routine calculations on a regular basis) have been significantly reduced.

While there is a general consensus on the need for regulation, there is much less agreement on whether recent increases in the complexity of regulation are necessary and appropriate. In general, regulation sets limits on the behaviour of actors in the financial arena in order to prevent socially undesirable outcomes. This inherently entails a certain degree of standardisation and a compliance burden with a large fixed-cost component. Financial regulation should be designed so that its societal benefits exceed the costs, even when benefits and costs relate to different institutions. Ideally, regulation should be framed in a manner that includes a system-wide perspective. It should be able to accommodate the hard-to-predict evolution of the financial system (including the emergence of new business models and financial innovations) while preserving financial stability at a reasonable cost.

It is certainly difficult to know in advance what the optimal regulatory policies to reduce systemic risk will be, because institutions and individuals adapt their behaviour in response to regulation, and their reactions change over time, interacting with the regulatory environment, most likely in nonlinear ways. Therefore, systemic risks are hard to predict in advance with much accuracy. The granular nature of financial regulation has hitherto tended to focus on the “knowns” – i.e. on risks amenable to statistical measurement – at the expense of an emphasis on internal controls and systems that may be more responsive to uncertainties that are hard to predict (Diebold et al., 2010; King, 2016).

Financial regulation may become excessively complex when it comprises regulatory requirements that vary across contingencies at a detailed, granular level, potentially leading to substantial non-linearities and unpredictability in their effects.

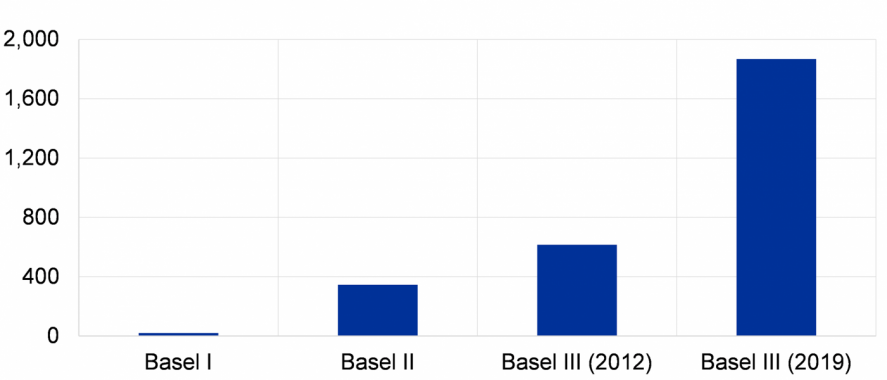

Quantifying complexity in financial regulation is difficult; it commonly relies on indirect measurements, such as the length of regulatory texts or the size of compliance costs. A rough first indicator of regulatory complexity can be the number of pages or articles in the relevant pieces of regulation, assuming that regulatory complexity increases with the number of pages (Figure 1).

Figure 1. Number of pages of the Basel Capital Accords for banks

Sources: Haldane (2012), Basel Committee on Banking Supervision (2019) and own elaboration. Notes: Basel III (2012) refers to the number of pages reported by Haldane (2012) and Basel III (2019) to the number of pages of the draft consolidated version of the Basel III Accord (Basel Committee on Banking Supervision, 2019).

However, regulatory requirements may require long descriptions spanning dozens of pages but be simple to interpret and implement (especially using modern information technologies). Similarly, regulatory requirements that are expressed in concise terms may prove highly complex in practice, e.g. because of their ambiguity or the way they interact with other pieces of regulation. In such a situation, complexity stems from excessive room for discretion and might make the supervisory process more complex, as there would be different possible approaches to implementing and enforcing the same regulation.

Regulatory complexity stems from supply-side and demand-side factors.

Supply-side factors include the evolution of the financial system itself. In the financial sector, intermediation chains have become longer, creating greater interconnections and making financial systems more complex (the mandatory clearing of derivatives is a good example of this). Another supply-side factor is the nature of crisis-generated policymaking, which typically follows a friction-by-friction approach likely to result in greater regulatory complexity than a more integrated approach. Regulatory complexity may also stem from the institutional architecture of financial policy. This typically comprises multiple institutions, with different objectives, compositions, processes and scopes.

Demand-side factors include the self-interest of regulated entities. Financial firms may favour complex frameworks where these are better tailored to their idiosyncrasies or even enable them to maintain a strategic informational advantage over regulators. A financial sector that is subject to excessively complex regulation may entail overburdened regulatory authorities. Therefore, the increased volume and complexity of regulation also reflects a feedback loop or “Red Queen’s race” in which regulatory complexity begets complexity in regulated entities, which in turn induces further regulatory complexity (Kane, 1977; Rogoff, 2012). In the race to complexity, as in other arms races, the common good is generally jeopardised. Furthermore, it has often been argued that regulatory complexity is a consequence of lobbying (take the example of options and national discretions in European financial regulation).

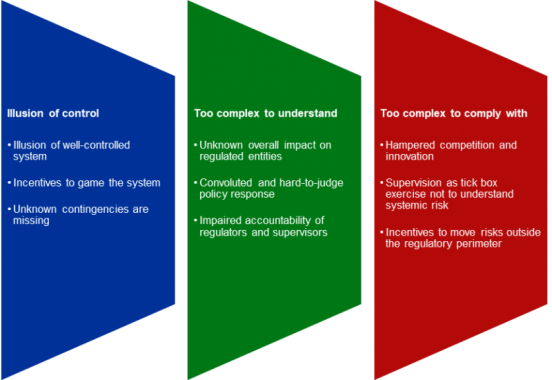

Excessively complex regulations contribute to increased systemic risk in several ways (Figure 2).

First, complex regulatory frameworks create the illusion of a well-controlled system, while at the same time creating incentives for regulated entities to game the system. In this regard, complex regulatory frameworks may provide regulators with a false sense of safety (analogous to the “illusion of control” defined by Langer, 1975). Furthermore, such a framework may be insufficient to deal with new forms of risk, structural change and, in general, phenomena which cannot easily be anticipated or measured in advance (“unknown unknowns”).

When risks materialise, the combination of hard-to-understand interactions between different regulations and a wide array of regulatory tools can make policy responses convoluted and difficult to judge. Failure to recognise the complementary or offsetting effects of the various tools may lead to excessively tough or excessively soft cumulative impacts. Finally, excessive regulatory complexity can also hamper the accountability of regulators and supervisors.

Regulatory complexity entails the risk that supervision becomes a tick box exercise instead of a truly comprehensive assessment of the contribution that the supervised entities and activities make to systemic risk. Overburdened supervisors may end up focused on mere compliance, at the expense of performing deeper independent assessments of risks and the capacity of the supervised entities to withstand them, and at the expense of better understanding the evolution of systemic risk (Warwick Commission, 2009; Hellwig, 2014). Last but not least, excessive regulatory complexity can encourage the transfer of risks to institutions outside the regulatory perimeter, creating an environment where systemic risk is amplified more than it would have been if risks had remained within the perimeter.

Figure 2. Contribution of regulatory complexity to systemic risk

Sources: Gai et al. (2019)

The increasing recognition that fundamental uncertainty, rather than just measurable risk, is relevant for financial stability and the fact that regulators will invariably operate at a lag compared with private institutions have prompted calls for greater simplicity in regulation. The driving idea, building on Hansen and Sargent (2007), is that simpler rules might be more robust to Knightian uncertainty.

However, simple rules are not a panacea. Overly simple financial regulations are unlikely to properly address the misaligned incentives, informational asymmetries and externalities underlying the need for regulation. They are also likely to be too blunt to deal appropriately with system-wide risks. A simpler framework for capital requirements might, for example, treat exposures with very different risk characteristics similarly, discouraging firms from entering into the safer ones among them.

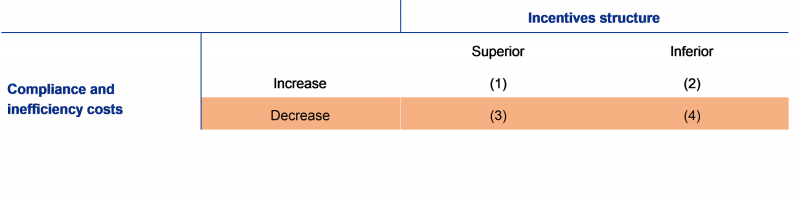

Simplicity by itself is not a goal of financial regulation. To paraphrase Calabresi’s (1970) famous articulation of the law of accidents, the aim of macroprudential policy should be to minimise the sum of the costs of crises and the costs of their prevention, i.e. the compliance costs and any other costs or distortions imposed by the regulatory measures. An excessive focus on simplicity will tend to overemphasise the latter and understate the greater effectiveness (e.g. desirable incentive effects across risk categories) that, in some cases, can be achieved with more complex rules. Following the taxonomy by Epstein (1995), simplicity of financial regulation would focus on decreasing compliance and other costs (in orange in Figure 3) but could also come at the expense of an adequate incentive structure.

Figure 3. Trade-offs between benefits and costs in financial regulation

Sources: Gai et al. (2019)

Public disclosure of information by regulated firms is not by itself sufficient to address regulatory complexity. As Brunnermeier and Oehmke (2009) point out, always seeking to increase the information disclosed to supervisors or the market is not a valid response to complexity as it can lead to information overload.

A transparent cost-benefit analysis, greater evidence-based design of financial regulation, and evaluations of the effectiveness of regulations are desirable actions by regulators to improve financial regulation and to avoid an increase in systemic risk due to excessive regulatory complexity. The “better regulation” framework, developed by the European Commission (2017), is a useful tool in developing cost-benefit analysis and evidence-based regulation. However, its practical implementation involves major challenges, including the collection of necessary information and the fact that estimating the benefits of new regulation will typically require structural models that rely on strong assumptions.

Once financial regulation is in place, evaluations of its effectiveness can serve to identify unintended consequences and potential regulatory failures, contributing to a richer quantification of benefits and costs derived from its implementation. They can also ensure that a given piece of regulation follows developments in the activities of regulated entities, calling for amendments if necessary. To avoid conflicts of interest, these evaluations could be undertaken by independent bodies and could cover a broad set of policies in order to assess their interactions and their possible contributions to systemic risk.

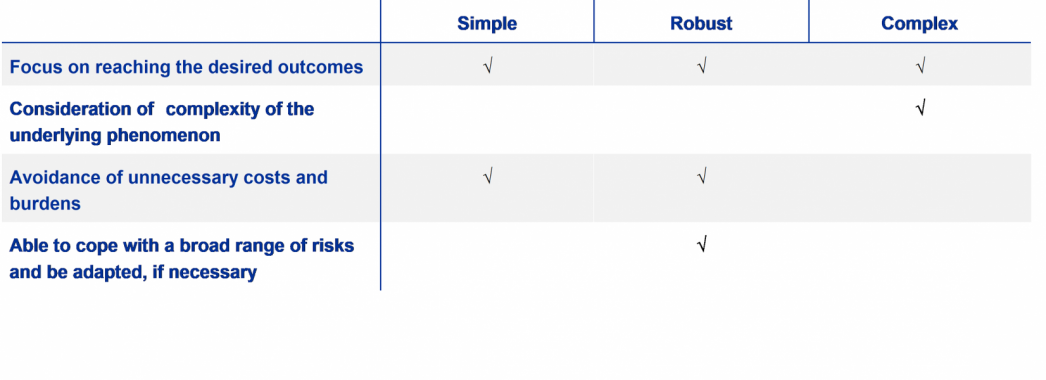

In a complex financial system subject to significant Knightian uncertainty, the optimal regulatory response to deal with systemic risk is unlikely to be along the simplicity-complexity domain. In this area, an effort must be made to avoid unnecessary complexity in financial regulation while increasing robustness towards uncertainty.2

Designing robust regulation requires acknowledging that the capacity to address in detail every possible manifestation or source of systemic risk is limited. If regulators try to detect every new source of systemic risk and develop a tool specifically tailored to such risk, regulation will end up being too complex while not necessarily being prepared for the next source of systemic risk. By contrast, a system of regulation that acknowledges its limitations in perfectly accommodating each vulnerability but is flexible and far-reaching enough to deal with a wide range of vulnerabilities and to adjust to the changing environment should be able to generate a better outcome overall. As shown in Figure 4, the decisive feature of robust regulation is its capacity to deal with a wide range of risks and with uncertainties and endogenous responses by agents in an evolving framework.

Figure 4. Main features of different approaches to financial regulation

Sources: Gai et al. (2019)

In the light of the significant complexity in the financial system, it is clear that robust financial regulation will not be able to fully remove complexity from financial regulation. However, such complexity can pay off if it makes financial regulation better suited to dealing with systemic risk and protecting the real economy from the negative consequences where it materialises.

Robustness in financial regulation is expected to consider the interaction between Knightian uncertainty (the situation in which future contingencies or their probabilities are difficult or impossible to determine) and systemic risk. Arguably, the quest for robustness could improve the cost-effectiveness of the regulatory outcome while reducing its complexity.

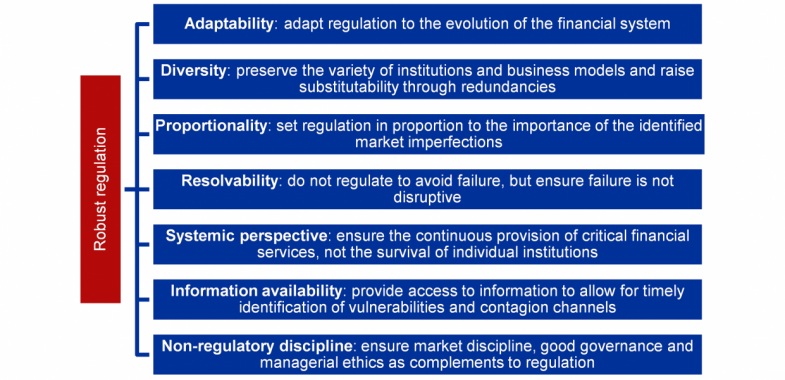

More broadly, the quest for robustness in financial regulation could be facilitated by adopting the following seven principles in the design and reform of financial regulation (Figure 5):

Figure 5. Principles for robust financial regulation

Sources: Gai et al. (2019)

1. Adaptability: financial regulation (including the calibration of its key tools) must be able to evolve with the financial system and not become an obstacle to innovation. This includes not creating material barriers to entry or discouraging the emergence of new business models (Blinder, 2010). Regulatory sandboxes and sunset clauses could be effective tools to deal with innovation in a controlled environment and ensure that obsolete rules are removed or revised.

2. Diversity: the diversity of financial institutions and business practices should be preserved, as this represents a powerful safeguard against systemic instability. By introducing some redundancy, diversity also ensures substitutability, i.e. the ability to find ongoing elements of the system that can replace failed elements and ensure the continuity of core functions (Kambhu at al., 2007; De Nederlansche Bank, 2018). Entity-based regulation could be complemented by activity-based regulation in some areas that require a homogenous treatment of risks across the financial system.

3. Proportionality: the burden of regulation (in terms of compliance and enforcement costs, as well as wider costs such as the induced distortions to competition and innovation and the diversion of activity to less regulated sectors) should be commensurate with the importance of the market imperfection at stake.

4. Resolvability: regulation should allow unviable entities to exit the system, without endangering systemic stability (Blinder, 2010; Carney, 2018). Efforts must be intensified in the areas of recovery and resolution of all financial institutions, and policies tackling internal structure and complexity must be adopted so as to ease the resolution process (Group of Thirty, 2018).

5. Systemic perspective: financial regulation should aim to ensure the continuous provision of critical financial services to society. A regulatory system that favours the concentration of activities in a limited number of financial institutions can become more vulnerable owing to its dependence on the survival of these few institutions. A systemic perspective requires a comprehensive understanding of correlations and interlinkages, as well as an understanding of macroeconomic feedback mechanisms.

6. Information availability: regulatory information should allow for prompt identification of contagion channels and pockets of vulnerability (Squam Lake Group, 2009). Timely information enables policies to be implemented that react effectively to new developments, either by recalibrating or activating existing regulatory tools or by activating crisis management tools.

7. Non-regulatory discipline: the presence of regulatory discipline should not entail the removal of non-regulatory discipline. On the contrary, the discipline that derives from market players, effective governance structures and the prevalence of high ethical and personal responsibility standards in the management of financial institutions is complementary to financial regulation and may reduce its need to rely on complex rules.

Basel Committee on Banking Supervision (2019), The Basel Framework, April.

Becker, J. (1995), The computer: Capabilities, prospects and implications, Central Intelligence Agency.

Blinder, A. (2010), “It’s broke, let’s fix it: rethinking financial regulation”, International Journal of Central Banking, Vol. 6, No 4, pp. 277-330.

Brunnermeier, M. and Oehmke, M. (2009), “Complexity in financial markets”, working paper.

Calabresi, G. (1970), The costs of accidents: a legal and economic analysis, Yale University Press, New Haven.

Carney, M. (2018), True Finance – Ten years after the financial crisis, speech to the Economic Club of New York, 19 October, New York.

De Nederlandsche Bank (2018), Proportional and effective supervision, May.

Deitel, H. and Deitel, B. (1985), Computers and data processing, Academic Press Inc.

Diebold, F., Doherty, N. and Herring, R. (2010), “Introduction”, in Diebold, F., Doherty, N. and Herring, R. (eds.), The known, the unknown, and the unknowable in financial risk management, Princeton University Press, Princeton, New Jersey.

Epstein, R. (1995), Simple rules for a complex world, Harvard University Press, Boston.

European Commission (2017), Better Regulation Guidelines, Commission Staff Working Document.

Gai, P., Kemp, M., Sánchez Serrano, A., and Schnabel, I. (2017), Regulatory complexity and the quest for financial regulation, Report of the Advisory Scientific Committee of the European Systemic Risk Board, No. 8.

Group of Thirty (2018), Managing the next financial crisis: an assessment of emergency arrangements in the major economies, September.

Haldane, A. (2012), “The dog and the frisbee”, speech, Federal Reserve Bank of Kansas City Symposium on The Changing Policy Landscape, Jackson Hole, 31 August.

Hansen, L.P. and Sargent, T.J. (2007), Robustness, Princeton University Press, Princeton, New Jersey.

Harari, Y.N. (2015), Homo Deus: a brief history of tomorrow, Random House UK.

Hellwig, M. (2014), “Systemic risk and macro-prudential policy”, paper prepared for De Nederlandsche Bank’s High-Level Seminar Making Macroprudential Policy Work in Practice, 10 June.

Kambhu, J., Weidman, S. and Krishnan, N. (2007), “Systemic risk in ecology and engineering”, Economic Policy Review of the Federal Reserve Bank of New York, Vol. 13, No 2, pp. 25-40.

Kane, E. (1977), “Good intentions and unintended evil: the case against selective credit allocation”, Journal of Money, Credit and Banking, Vol. 9, No 1, pp. 55-69.

King, M. (2016), The end of alchemy: money, banking and the future of the global economy, Little Brown, London.

Langer, E. (1975), “The illusion of control”, Journal of Personality and Social Psychology, Vol. 32, No 2), pp. 311-328.

Rogoff, K. (2012), “Ending the financial arms race”, Project Syndicate, September.

Squam Lake Group (2009), “A new information infrastructure for financial markets”, working paper.

Warwick Commission (2009), In praise of unlevel playing fields, report of the Warwick Commission on International Financial Reform, November.

This SUERF Policy Note is based on the report “Regulatory complexity and the quest for robust financial regulation” by the Advisory Scientific Committee of the European Systemic Risk Board (Gai et al., 2019).

System robustness refers to the capacity of a system to maintain its core functions in the face of unexpected perturbations or disturbances.