In recent years, intensive discussion has arisen about restricting or even abolishing the use of cash. I am aware that there is a much longer and more extensive debate about the costs and benefits of phasing out paper currency, which is the title of a paper of Rogoff (2014).3 But what is new, all of a sudden, is the suggestion that the restriction or even abolition of cash would more or less do miracles: If cash were to be severely restricted or no longer existed, there would be much less crime and the shadow economy would be drastically reduced, because most shadow economy transactions are usually undertaken in cash. In addition, if cash were not easily available, terrorist attacks would be severely hampered. This short note tries to shed some light on whether cash has such an important influence on the shadow economy, crime and terrorism, but also on the effect, which reduced cash would have on civil liberties.

In many countries, the dominant means of transfer in paying legally (but also illegally) for goods and services is cash, which has proved to be an efficient means of handling all economic activities. However, there is a growing literature claiming that cash supports the shadow economy, crime and terrorism and is risky, old fashioned and unnecessary, especially if one considers the fast increase in electronic payments.4

The challenging question is “To what extend does cash stimulate illegal activities?”, starting with the shadow economy, then crime and corruption, and finally considering terrorist financing. It is obvious that cash cannot be easily traced, which makes cash attractive for transactions related to the shadow economy, bribery, crime and finance of terrorism. Still an important question is the following: Is cash a major source/reason of the shadow economy, of crime (here corruption) and of terrorism?

2.1 Cash and the shadow economy

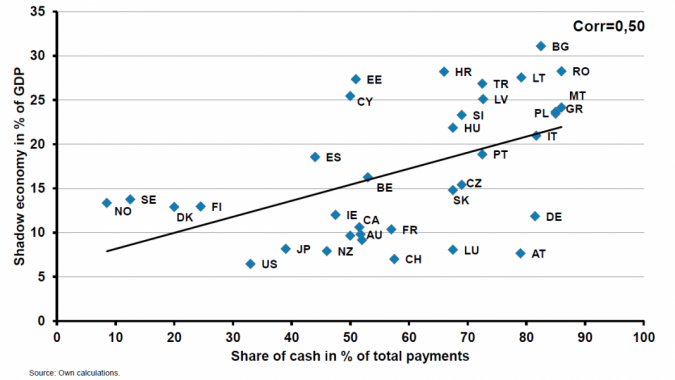

Shadow economy refers to business/economic activities off the books, which are legally allowed but not recorded in order to avoid tax and social security payments and to avoid labor market and other regulations.5 In figure 2.1, the share of cash payments versus the size of the shadow economies of 36 highly developed countries averaged over 2013–2015 are shown. One clearly realizes that the larger the share of cash in total payments the larger the size of the shadow economy. The correlation coefficient between the two variables is 0.50 and is highly statistically significant. Hence, at a first glance, it looks like the higher the share of cash (as a percentage of total payments) the larger the shadow economy. However, if one also looks at figure 2.1 there are some distinct exceptions, for example Germany and Austria are cash-intensive countries with relatively small shadow economies. In Sweden, where cash payments have become rare, the country still has a medium-sized shadow economy.

Given these inconclusive findings and in order to fulfill the ceteris paribus conditions an econometric investigation is undertaken. I know that the shadow economy is driven by tax burden, by regulation, by the quality of public institutions, unemployment, tax morale and other factors.6 However, how is it related to the use of cash and/or cash limits? I discuss three ways of investigation.

First, using a MIMIC estimation, shadow economy is a constructed figure with various causes, such as tax burden, regulation measures, economic freedom, legal system, tax morale, etc. Indicators, like employment and GDP and cash or cash limits are used here neither as indicator nor as cause variables. These “cash free” shadow economy figures are now regressed on the availability of cash approximately by the share of cash in total payments and by cash limits. The size of the shadow economy in 38 highly developed countries as averaged over the years 2013/2014 is regressed on GDP per capita, share of cash payments and cash limits, which exist in a number of European countries. The results of Schneider (2019) clearly show that the share of cash payments has an influence on the size and development of the shadow economy and is statistically significant; the more cash, the larger the shadow economy, ceteris paribus. However, the estimate coefficient of cash limits which is in place in various European countries (for example Italy, France), has the theoretically expected negative sign, but is not statistically significant.

In Schneider (2019) some simulation results are undertaken about the importance of the cash figures on the size of the shadow economy. The results clearly show that when GDP decreases by 10%, the shadow economy increases by 18.4%. When the share of cash payments decreases by 10% the shadow economy decreases just by 2%. If we make the assumption that no cash is available anymore, the shadow economy would decrease by 20%. Cash limits have no significant effects.

The second way to test how important cash is for the shadow economy, or whether a cash limit would reduce the shadow economy as a causal variable, is investigated by undertaking a MIMIC estimation. The results of Schneider (2019) clearly show that the cash limit variable has no statistically significant influence as a causal factor on the size of the shadow economy whereas the tax burden, rule of law index and the inflation rate all have the theoretically expected sign and are highly statistically significant. The only exception is unemployment, which has the expected sign, but is not statistically significant. Cash as an indicator of the shadow economy has a statistically significant influence on the size of the shadow economy.

The third way is a first attempt to undertake a micro study. In Schneider (2019) first micro results about the following question are shown. The question is: „Imagine there was no cash anymore. What would you have done in the following situations?” The answers are in percent of those persons who said that they paid in cash for services or craftsmen’s activities because it was anonymous. 33% of the Austrians interviewed (interviews were done from May 24 to June 29, 2016 in Austria with 1056 interviewed persons) would still demand the service and would pay cashless. 13% said that they would still have demanded this service but would have paid more attention to correct tax treatment. 13% would not have demanded this service anymore and 41% would have negotiated another anonymous payment method with the other party, such as vouchers or gifts. Hence, even under the extreme assumption that no cash is available, 41% of the people who prefer anonymous payment would still seek an anonymous payment method. To summarize, cash is an important element in the shadow economy. However, cash is by no means a causal factor and it has quantitatively limited influence on the development of a shadow economy. Without any cash, a shadow economy might be reduced between 15 to 20%.

2.2 Cash versus illegal activities – the case of corruption

As in 2.1, the use of cash is often blamed as the main enabler of bribery, corruption and other crime activities. In many countries the simple equation of much cash, much bribery, seems to hold true in media stories. In countries such as Switzerland and Austria, low levels of perceived public-sector corruption and bribery occur alongside a high share of cash in total payments and/or low number of cashless payments per person. However, in countries like Greece and Bulgaria (which have high corruption) also have a high share of cash payments measured as a percentage of total payments;. However, as already argued, other countries such as Switzerland, Germany and Austria have a high share of cash payments, but quite low corruption.

Again, Schneider (2019) undertake an econometric investigation, trying to explain corruption. Corruption has considerable impact on economic, political and social factors and is subject to a vast range of institutional, jurisdictional, society and economic conditions. In a survey paper, Dimand and Tosato (2017) provide a comprehensive state of the art survey of the existing literature on corruption and its causal effects. They reach the conclusion that thanks to more convenient and better availability of data, empirical research on corruption has advanced vastly over the last decade. They conclude that from a scholarly perspective, the remaining challenge is how to deal with noisy data and they try to capture hidden behavior. Their survey shed light on the development of empirical corruption research and on the non-robustness of older and newer empirical findings. They show that recent empirical findings on the interrelation between corruption and bureaucracy, press and economic freedom, poverty wages and/or the shadow economy are in line with both theoretical assumptions and older empirical research. They further conclude that the quality of empirical research and corruption is still advancing and needs to settle important issues, such as the right way to measure corruption, before being able to settle debate of conflicting empirical findings. They conclude that more micro-data is required in order to get consistent findings.

Considering these survey results, an attempt to explain corruption is made in Schneider (2019). The transparency corruption index (TCI) is used as dependent variable; and indices of rule of law and economic freedom, GDP per capita, share of cash payments and cash limits are used as independent variables. The TCI of 38 highly developed countries over 2014/2015 is used. The regression shows that the better the rule of law and more economic freedom is granted, the lower is corruption. It also shows, the higher GDP per capita is, the lower is corruption. The result also shows that the higher the share of cash payments, the higher is corruption; the estimated coefficient is statistically significant. Finally, the cash limit dummy variable has the wrong sign and is not statistically significant.

Schneider (2019) undertakes some simulation results about quantitative importance between cash and corruption, fulfilling the ceteris paribus conditions. The results are: if the rule of law (economic freedom), increases by 10 percentage points, the TCI increases by 6.1 (5.0%), which means less corruption. If the share of cash payments is decreased by 10 percentage points, the TCI increases only by 1.8%, which means less corruption. Here, I have a statistically significant effect of the estimated coefficient of the cash variable, but compared to the other two variables, it is only of minor importance (roughly one tenth).

2.3 Cash versus terrorist financing

There are a number of statements that draw a connection between the financing of terrorism and cash. Some studies also support the view that cash is used also for terrorism financing.7 Schneider (2019) clearly shows that not much money is needed in order to undertake terrorist attacks. Even if all of such a sum is needed in cash, it can be easily supplied. What is also quite often the case that before the attacks, terrorists are unknown as terrorists and they can use their bank accounts and other financial means. Hence, even severe cash restrictions can easily be bypassed if one goes several times to cash (ATM) machines or asks friends to do this.

2.4 Summary of the empirical findings

I reach the following findings/conclusions:

i) Figures on crime and criminal cash usage often contain large errors (problem of double counting) and are difficult to interpret.

ii) The available evidence suggests that restrictions on cash use will probably reduce profits from crime to a small amount but will certainly not eliminate them. When cash is reduced in cash or a cash limit is put into effect, I got the following results: Shadow economy reduction between 2 and 20% (the higher figure is the extreme case: no cash); corruption reduction between 1.8 and 18 percentage points (the higher figure is the extreme case: no cash); crime reduction between 5 and 10%.

iii) Other means of storing and transferring illegally obtained assets without leaving traces are already in use. They include:

a. the transport of physical valuables (e.g. prepaid instruments, precious metals, diamonds),

b. using false identities and fake firms,

c. criminal middlmen and shell companies to facilitate cashless transfers via regulated entities like the banking system, money transmitters or onlice payment service providers,

iv) also, funds can be moved through traditional or new, alternative transfer systems like Hawala banking or private virtual currency schemes.

v) Finally, technical progress, especially cyber money (bitcoin), and other electronic means are rapidly changing payment habits and hence will be heavily used by criminals, too.

For liberal societies, the importance of cash has much deeper aspects than “pure” economic ones. Cash reflects the fundamental relation between citizens or taxpayers and state authorities. Using cash means freedom, independence and personal fulfillment for a citizen who does not want a state intervention when using cash. The “voices” calling for the limitation or abolishment of cash argue that tighter and more comprehensive state control over individuals’ financial flows and funds will effectively fight crime, shadow economy and terrorism. Nevertheless, in my opinion we have weak or almost no empirical evidence.

Of course, anonymous cash makes tax evasion easier, especially for those who cannot afford to shift funds abroad. However, easily available cash is clearly not the main reason for tax evasion, though it does facilitate it. Indeed, citizens’ willingness to pay taxes crucially depends on tax morale. Tax morale has been found to correlate with the relation between citizens and the government. The better the relation the higher the tax morale. A high degree of trust and of political influence (direct democracy) strengthens tax morale and the willingness of the citizens to pay their taxes, so that the state can provide goods and services. Tax authorities should treat taxpayers or citizens with respect and as clients rather than as suspects or servants. Hence, such a fundamental basic contract between the taxpayer and the state is crucial for the functioning of society.

The abolishment or strict limitation of cash carries the risk of seriously weakening trust in state authorities. Abolishing cash as a simple tool against citizens to enforce state control can easily prove to be counter-productive. Given the real perceived importance of cash for civil liberties, a limitation or abolition could only be justified by sound reasons and large benefits. Only then may trust between citizens and authorities remain intact. As cash is neither the motivation nor the reason for shadow economies, crime or terrorist attacks, its abolition would not lead to large welfare gains. In a democracy, the choice between cash and other means of payment should be left to users, who happen to be citizens, taxpayers, consumers and producers at the same time. Hence, my conclusion is that citizens do not want to be forced by state authorities not to use cash anymore. They should be free to choose which payment instrument they use.

Figure 2.1 Share of cash payments versus the size of the shadow economy (averages over 2013–2015)

Anderson, R., Barton, C., Bo hme, R., Clayton, R., Van Eeten, M.J.G., Levi, M., Moore, T. and Savage, S. (2013), Measuring the cost of cybercrime, in: Bo hme, R. (ed.), The economics of information security and privacy, Springer Verlag Berlin Heidelberg, 2013, pp. 265-300.

Dimand, Eugen and Tosato, Guglielmo, (2017), Causes and Effects of Corruption: What has past Decade’s Empirical Research Taught us? A Survey, Journal of Economic Surveys, 32/2, pp.335-356.

Feld, Lars P. and Schneider, Friedrich (2010), Survey on the Shadow Economy and Undeclared Earnings in OECD-Countries, German Economic Review, 11/2, pp. 109-149.

Immordino, G. and F.F. Russo, (2016), “Cashless payments and tax evasion”, Center for Studies in Economic and Finance (CSEF) working paper n.445, June 2016.

Levi, M. (2017), Assessing the Trends, Scale and Nature of Economic Cyber Crime, Crime, Law and Social Change, 67/1/3.

Masciandaro, D. (2004), Global Financial Crime: Terrorism, Money Laundering and Off Shore Centres, Aldershot (England)/Burlington: Ashgate.

Masciandaro, D. (2005), Financial Supervisory Unification and Financial Intelligence Units, Journal of Money Laundering Control, 8/4, pp. 354-371.

Masciandaro, D. (2006), Offshore Financial Centres and International Soft Laws: Explaining the Regulation Gap, Second Annual Conference: Societa Italiana di Diritto ed Economia, Roma, pp. 1-49.

Riccardi, Micele and Levi, Michael (2017), “Cash, Crime and Anti-Money-Laundering”, in: King C., Walker C. and Gurule J. (eds.): The Handbook of Criminal Terrorism, Financing Law, Palgrave McMillan Publishing Company, 2017.

Rogoff, Kenneth S. (2014), Costs and Benefits to Phasing Out Paper Currency, Washington (DC), National Bureau of Economic Research NBER, working paper 20/126.

Sands, Peter (2016), Making It Harder for the Bad Guys: The Case for Eliminating High Denomination Notes, Boston, Harvard Kennedy School, M-RCBG Associate Working Paper Series No. 52, February 2016.

Sauka, A., Schneider, F. and Williams, C.C. (2016), Entrepreneurship in the Shadow Economy, Cheltenham (UK), Edward Elgar Publishing Company.

Schneider, F. (2015), Zahlungsstro me der transnationalen organisierten Kriminalita t (TOK) und Steuerbetrug in OECD La ndern, in: Ja ger, T.C. (ed.), Handbuch für Sicherheitsgefahren, Springer Verlag, Wiesbaden, pp. 147-172.

Schneider, F. (2019), “Restricting or Abolishing Cash: An Effective Instrument for Eliminating the Shadow Economy, Corruption and Terrorism? Some Remarks”; forthcoming in SUERF Conference Proceedings, (2019), Vienna.

Schneider, F. and Enste, D. (2000), Shadow Economies: Size, Causes and Consequences, The Journal of Economic Literature, 38/1, pp. 77-114.

Schneider, F. and Linsbauer, K. (2016), The Financial Flows of Transnational Crime and Tax Fraud: How Much Cash is Used and What Do We (Not) Know?, in: Beer, C., Gnan, E. and Birchler, O.W. (editors), Cash on Trial, SUERF Conference Proceedings 2016/1, Vienna and Zurich.

Williams, Collin C. and Schneider, Friedrich (2016), Measuring the Global Shadow Economy: The Prevalence of Informal Work and Labor, Cheltenham (UK), Edward Elgar Publishing Company.

Prof. Dr. Dr.h.c.mult. Friedrich Schneider, Department of Economics, Johannes Kepler University, Altenbergerstr. 69, A-4040 Linz, Austria, Phone: +43 (0)732 2468-7340, Fax: +43 (0)732 2468-7341, E-mail: friedrich.schneider@jku.at, http://www.econ.jku.at/schneider

A first and much longer version of this paper was presented at the Bundesbank Conference in Konstanz/ (Germany), April 20–23, 2017; see also Schneider (2019).

Compare here only some recent references: Sands (2016), Feige (2012), Schneider and Linsbauer (2016), Riccardi and Levi (2017), Imordino and Wussow (2016), and Masciandaro (2004, 2005, 2006).

Riccardi and Levi (2017), Levi (2016), Andersen et al. (2013).

There is an extensive literature about the definition of a shadow economy also estimating a shadow economy and its interaction with the official economy. Compare for example Feld and Schneider (2010), Schneider (2015) and Williams and Schneider (2016). Due to this extensive literature, a longer discussion about defining and estimating a shadow economy and its interaction with the official one is not undertaken in this paper.

Compare here for example Feld and Schneider (2010) and Schneider (2015).

Compare e.g. Riccardi and Levi (2017).