Business cycles among major advanced economies have shifted since the 1960s – notably on macroeconomic volatility and persistence, but also in terms of duration and depth of the cycles and in terms of the predictability, synchronization, and cyclicality of output and inflation. The evidence shows empirical support for a connection between these broad shifts in business cycles and the concurrent wave of globalization broadly consistent with the implications from the workhorse open-economy New Keynesian model. Through the lens of this model, globalization should matter for monetary policymaking – not necessarily because of the ‘fear of losing control’ and being unable to achieve the central bank’s desired policy objectives, but because globalization alters the economic environment under which policymakers operate and, in doing so, change the relevant trade-offs on macroeconomic stabilization for the central bank.

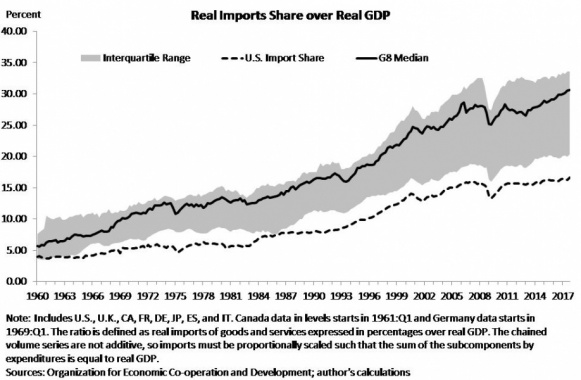

A sustained wave of globalization has led to deeper ties in the post-World War II period: The decision to terminate the convertibility of the U.S. dollar into gold in 1971 effectively ended Bretton Woods, ushering in a new era of fiat and free-floating currencies. The international monetary system has significantly evolved since then, leading economies to abandon both the multilateral constraints of Bretton Woods and fixed exchange rates as anchors of the policy framework. Current account and then capital account liberalization followed, deepening trade relations—which had been intensifying in the post-Korean War period—as moving goods across borders became increasingly cheaper and trade as well as financial and other barriers declined (Figure 1).

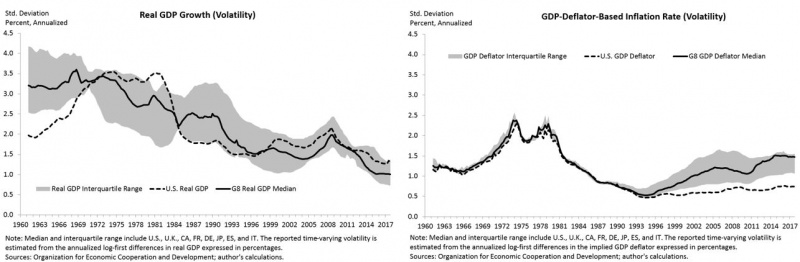

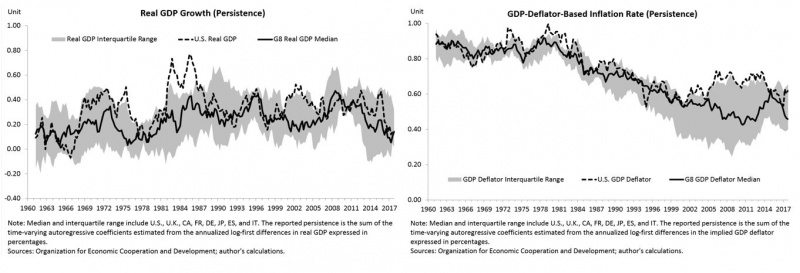

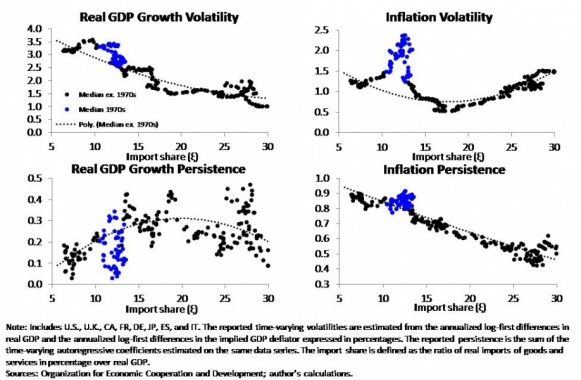

Business cycles across major advanced economies have notably changed since the 1960s: Major advanced economies (U.S., U.K., Germany, France, Italy, Spain, Japan, and Canada, henceforth referred to as the G8 countries) experienced declining inflation rates and somewhat more robust growth after the Great Inflation period of the 1970s. Since the 2008 global recession, the major advanced economies have generally posted weaker growth than in the preceding years while experiencing low inflation. On top of that, Martínez-García (2018) documents a period of declining macro volatility since at least the 1980s (in what became known as the Great Moderation), followed by increasing and diverging inflation volatility patterns since the mid-1990s (Figure 2.A). The evidence also suggests significant shifts in inflation persistence which gradually but noticeably declined during the Great Moderation (Figure 2.B).

Figure 1. Ties that Bind: Deepening Trade Linkages

Figure 2.A Macroeconomic Volatility

Figure 2.B Macroeconomic Persistence

The main shifts in business cycles observed across major advanced economies can be summarized as follows:

a. Changes in macroeconomic volatility (Figure 2.A):

i. Gradual yet sizeable declines in real GDP growth volatility since the mid-1970s, predating the onset of the Great Moderation in the 1980s.

ii. Widespread declines in inflation volatility during the 1980s and early-1990s, after experiencing high volatility in the 1970s accentuated during the oil crises of 1973 and 1979. Rising inflation volatility—mostly concentrated among European countries—and greater cross-country disparities have followed since the mid-1990s. Interestingly, this coincided with tighter monetary arrangements in Europe (the three stages for the implementation of the Economic and Monetary Union among European Union countries started to roll over in July 1990).

b. Changes in macroeconomic persistence (Figure 2.B):

i. The persistence of real GDP growth has remained fairly stable over time.

ii. The persistence of inflation was quite high earlier on, but has gradually declined since the late-1970s (leveling off around the time of the 2008 global recession).

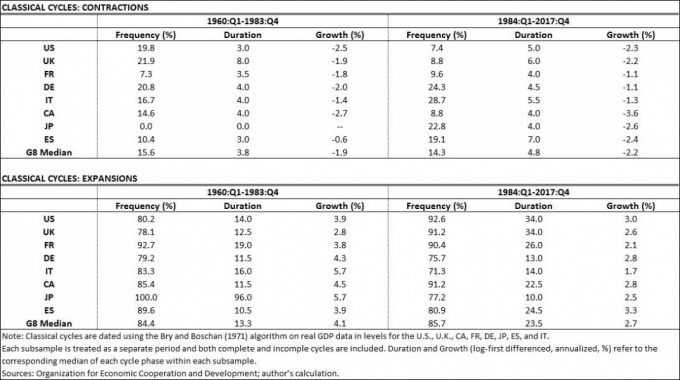

c. Other features of the business cycle have changed as well (see Martínez-García (2018) for more details):

i. Contractions became both shorter and less frequent during the Great Moderation, as growth volatility declined (Table 1).

ii. Forecastability of real GDP growth and inflation based on simple univariate time series models tended to improve as macroeconomic volatility fell. The implications of this for the Phillips curve and Phillips curve-based forecasting models is further explored in Duncan and Martínez-García (2015) and Kabukçuoglu and Martínez-García (2018).

iii. The synchronization of real GDP growth across countries remained low and largely stable until it quickly spiked in the aftermath of the 2008 global recession.

iv. Before the mid-1990s, the cross-country correlation (synchronization) of inflation was very high and countercyclical. Since then, the cross-country correlation has declined (only gaining some ground after 2008) and inflation has become largely acyclical.

Table 1. Properties of the Classical Cycles

Both theory and evidence suggest a relationship between globalization (trade openness) and the shifting business cycles: A large body of research has investigated the role played by different factors as explanations for the observed changes in business cycles. The literature continues to debate whether the observed business cycle changes—the Great Moderation in particular—are the result of “good luck,” improved macroeconomic policies (particularly better monetary policy), changes in the structure of the economy or structural transformation, or some combination of all of them (Stock and Watson (2003)).

Arguments based on structural transformation postulate that changes in institutions, new technologies, or even globalization can affect the economy’s ability to absorb shocks and alter the propagation of different shocks over the business cycle. The wave of financial globalization unfolding since at least the 1970s (resulting from deepening domestic and international financial markets, increased international capital flows, financial deregulation, etc.) is one of the explanations advocated by Dynan et al. (2006), among others. Globalization through trade (increased international trade openness) also features as another prominent structural transformation explanation in the work of Cecchetti et al. (2005).

Martínez-García (2018) continues this line of inquiry specifically looking at the impact of trade linkages on cross-country business cycles motivated by the predictions of the workhorse open-economy New Keynesian model (Martínez-García and Wynne (2010)). This class of models suggests that the observed shifts can be partly attributed to (nonlinear) changes in deep structural parameters, and in particular to deepening trade integration (trade openness), as shown in the analytical exploration of this model worked out in Martínez-García (2017).

The findings reported in Martínez-García (2018) indeed show empirical support for a nonlinear relationship between greater trade openness and the reported central tendency patterns of shifting business cycles across the major advanced economies. The illustration in Figure 3 (a highlight of some of the key findings in Martínez-García (2018)) shows that trade openness indeed has a strong but nonlinear association with key observed business cycle features documented in the data in post-Korean War period, broadly consistent with the implications of the workhorse open-economy model.

Figure 3. A Closer Inspection of the Empirical Relationship between Macro Volatility/Persistence and the Import Share (Openness)

(G8 Medians)

Some implications for our understanding of business cycles and for monetary policymaking: The last wave of global economic integration after the Korean War is a transformative phenomenon that has shaped the world economy for decades and may continue to do so for many decades to come. Globalization has not negated the central banks’ ability to influence domestic economic conditions and achieve their macroeconomic stabilization goals (a point forcefully argued by Woodford (2010)). However, what the empirical evidence in Martínez-García (2018) suggests in line with standard open-economy New Keynesian theory (Martínez-García and Wynne (2010), Martínez-García (2017)) is that globalization can impact the economic environment in which central banks must operate:

According to theory, globalization’s role depends on more than the degree of openness of the economy—the trade elasticity, changes in labor market institutions, the interplay between monetary policy and fiscal policy, etc., must be considered as well. Thus, much more work is still needed to understand the effects of globalization in general and its impact on the conduct and international transmission of monetary policy in particular.

Bernanke, Ben S. 2004. “The Great Moderation.” Speech given at the meetings of the Eastern Economic Association, Washington (DC), February 20.

https://www.federalreserve.gov/boarddocs/speeches/2004/20040220/

Cecchetti, Stephen G., Alfonso Flores-Lagunes, and Stefan Krause. 2005. “Assessing the Sources of Changes in the Volatility of Real Growth.” In The Changing Nature of the Business Cycle, edited by Kent, C. and D. Norman, 115–139. Sydney, Australia: Reserve Bank of Australia. https://doi.org/10.3386/w11946

Duncan, Roberto, and Enrique Martínez-García. 2015. “Forecasting Local Inflation with Global Inflation: When Economic Theory Meets the Facts.” Globalization and Monetary Policy Institute Working Paper no. 235, April. https://doi.org/10.24149/gwp235

Dynan, Karen E., Douglas Elmendorf, and Daniel Sichel. 2006. “Can Financial Innovation Help to Explain the Reduced Volatility of Economic Activity?” Carnegie-Rochester Conference Series on Public Policy – Journal of Monetary Economics 53 (1): 123–150. https://doi.org/10.1016/j.jmoneco.2005.10.012

Kabukçuoglu, Ayse, and Enrique Martínez-García. 2018. “Inflation as a Global Phenomenon–Some Implications for Inflation Modelling and Forecasting.” Journal of Economic Dynamics and Control 87 (2): 46–73. https://doi.org/10.1016/j.jedc.2017.11.006

Martínez-García, Enrique, and Mark A. Wynne. 2010. “The Global Slack Hypothesis.” Federal Reserve Bank of Dallas Staff Papers, No. 10, September 2010.

https://www.dallasfed.org/-/media/documents/research/staff/staff1002.pdf

Martínez-García, Enrique. 2017. “Good Policies or Good Luck? New Insights on Globalization and the International Monetary Policy Transmission Mechanism.” Computational Economics, 1–36: 2017. https://doi.org/10.1007/s10614-017-9746-9

Martínez-García, Enrique. 2018. “Modeling Time-Variation Over the Business Cycle (1960-2017): An International Perspective.” Studies in Nonlinear Dynamics & Econometrics 22(5). https://doi.org/10.1515/snde-2017-0101

Stock, James H., and Mark W. Watson. 2003. “Has the Business Cycle Changed and Why?” In NBER Macroeconomics Annual 2002, Vol. 17, edited by Mark Gertler and Kenneth Rogoff. MIT Press. https://doi.org/10.1086/ma.17.3585284

Woodford, Michael. 2010. “Globalization and Monetary Control.” In NBER book International Dimensions of Monetary Policy, edited by Jordi Galí and Mark J. Gertler. University of Chicago Press. Conference held June 11–13, 2007. https://doi.org/10.7208/chicago/9780226278872.003.0002

Enrique Martínez-García is a Senior Research Economist and Policy Advisor at the Federal Reserve Bank of Dallas; the views expressed here are those solely of the author and do not reflect those of the Federal Reserve Bank of Dallas or the Federal Reserve System.