The study explores the determinants of sovereign interest rate spreads of euro area countries (vis-à-vis Germany). It focuses on the role of fiscal, macroeconomic and institutional fundamentals, considering also some contextual factors such as global risk aversion and controlling for the influence of central banks’ asset purchases. Through extensive testing of various (fiscal) variables, interactions and non-linearities, the analysis confirms that sovereign spreads respond to fundamental variables, especially government debt, in non-linear fashion. The results also show that structural factors can largely mitigate the government debt impact on spreads, as the marginal effect of government debt on spreads would be close to zero in countries with the highest potential growth and strongest institutions. From a policy angle, the results remind that, even in an environment of persistently low rates, governments with less solid fundamentals pay more than others to borrow and are exposed to higher risks. They highlight that policies reinforcing potential growth and government effectiveness can be expected to improve investors’ perception of sovereign risk and their forbearance of higher debt.

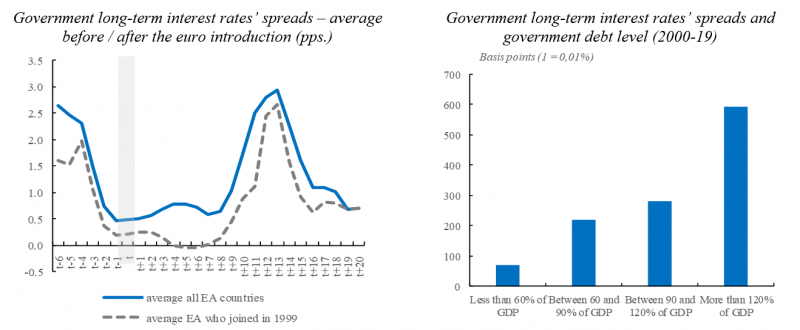

Interest rates paid by governments on their debts have fallen for decades, but cross-country differentials between such rates (bond yields), also known as spreads, have behaved idiosyncratically. This is conspicuous in Europe, particularly within the euro area. Differentials between yields on euro area government bonds fell in the early years of the Economic and Monetary Union (EMU), shot up in the financial and debt crisis, and since then have hovered at non-negligible levels (see Graph 1 – left panel). There are recurrent market spikes such as those affecting Greece in 2015, Italy in 2018, and vulnerable countries across the board at the onset of the Covid-19 crisis in March 2020.

In this study, we investigate the relationships between spreads on euro area government bonds and fundamental factors. A casual look at the data suggests that spreads are correlated with fundamental characteristics, such as public debt levels (see Graph 1 – right panel). However, that influence is unlikely to obey simple laws, making it a challenge to capture in empirical work. Building on the existing literature, we conjecture that fundamental conditions likely to affect spreads (called ‘spread fundamentals’) are of three main kinds: fiscal, macroeconomic (including external), and institutional. Moreover, we also consider ‘context’ variables, measuring financial market conditions (e.g. through indicators capturing international risk aversion, liquidity proxied by the size of the sovereign debt market) and the role of monetary policy, including the Eurosystem programme of government securities purchases.

Graph 1. Government spreads’ developments and their relation to government debt level, euro area countries

Note: 1) The left panel graph represents the (non-weighted) average nominal spreads on 10-year government bonds (vis-à-vis German yields) calculated, respectively, over all euro area members and those who joined the euro area in 1999, i.e. Austria, Belgium, Finland, France, Germany, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain. Year t represents the year when the euro was introduced. 2) The right panel graph represents the average spreads depending on the government debt to GDP ratio level (calculated over all EA countries on data since 2000).

Source: Ameco, ECB, authors’ calculations.

We rely on a gradual empirical strategy, while paying attention to pitfalls in estimations. We analyse the role of fundamentals using data from the inception of the euro until 2019 included, which makes for a longer sample than earlier studies and includes the interesting ‘post-financial crisis’ period (but pre-Covid-19). Moreover, this study considers the variety of ways through which fundamental factors, involving inter alia government debt, the external position, potential growth, and the quality of institutions, can affect spreads. Relying on a large range of specifications and robustness checks, it recognizes that the influence of fundamentals may be non-linear and context-dependent2.

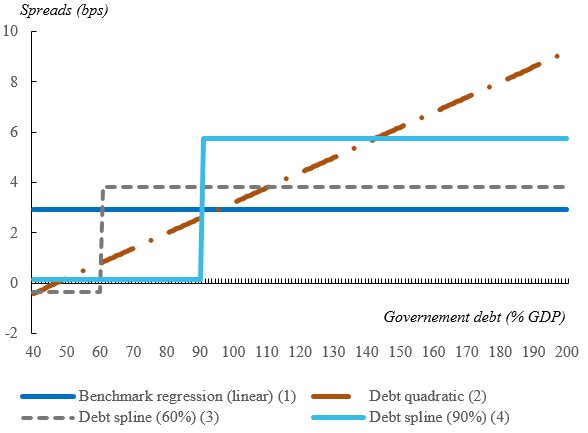

We find clear evidence that euro area spreads respond to fundamentals, especially the level of government debt, through several channels. Higher government debt significantly contributes to higher spreads, with strong indications that this effect is non-linear. That is, the marginal effect of additional debt on spreads increases with the level of debt. In a linear regression, an additional one percent of GDP of debt increases the spread by around 3 basis points. However, once non-linearity is taken into account, the marginal impact of additional debt can be twice that at higher debt levels (See Graph 2).

Graph 2. Marginal impact of an increase in the government debt to GDP ratio on spreads (bps), as a function of the level of the government debt ratio

Note: the graph reports the marginal impact of government debt on spreads as a function of the government debt ratio. The quadratic form suggests that the reaction of spreads to government debt becomes positive only for debt ratios above about 50% of GDP, but the marginal impact strongly increases thereafter and is higher than found in the benchmark regression for debt ratios beyond 95% of GDP. Other non-linear forms, with a debt spline function (above 60% and 90% of GDP) also corroborate a higher responsiveness of spreads to changes in the debt ratio beyond these levels. At debt levels exceeding 100 percent of GDP, the marginal impact is typically in the high part of the range of estimates found in the rest of the literature.

Source: See Pamies et al. (2021) for the specifications represented in the graph.

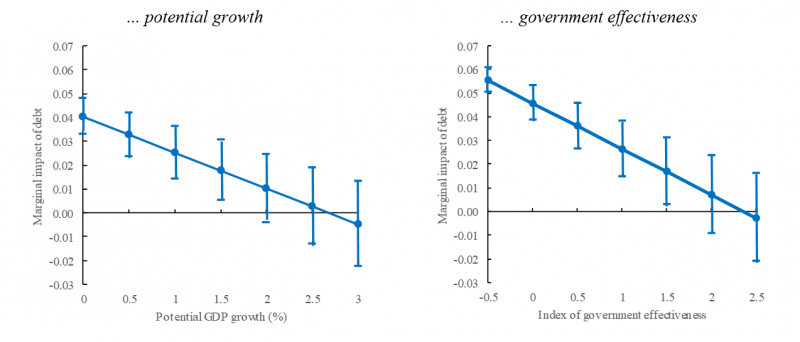

Other macroeconomic and institutional fundamentals including the net external position, potential growth and government effectiveness3, also have a bearing on spreads. Importantly, these factors are found to influence spreads both on their own and in interaction with government debt. This implies that the incidence of fiscal fundamentals may be importantly mitigated or aggravated by other macroeconomic or institutional factors. For instance, the results show that structural factors, such as potential growth and the quality of institutions, can largely mitigate the impact from government debt on spreads. (See Graph 3). These results are obtained controlling for the influence of context variables such as global risk aversion, sovereign bond market size, and central banks’ asset purchases.

Graph 3. Marginal impact of government debt on spreads, depending on…

Note: the graphs report the (total) marginal impact of government debt on spreads conditional to a given level of potential growth (left panel) and government effectiveness (right panel). Bars represent the confidence interval of the estimated coefficients. Taken at face value, our estimates suggest that the responsiveness of spreads to government debt would be close to zero when potential growth is at or exceeds 2.5% (see left panel). By contrast, for countries with a weak potential growth, spreads are more sensitive to government debt (an increase of government debt of 1pp. of GDP raises spreads by more than 3 bps. for countries with a potential growth around 0.5%). Similarly, in countries with the highest government effectiveness index (e.g. countries where this index is around 2), the marginal effect of government debt on spreads would be close to zero (see right panel), while countries deemed to have less strong institutions (e.g. countries where this index is less than 0.5), the marginal effect of government debt on spreads is far higher (an increase of government debt of 1pp. of GDP raises spreads by close to 4 bps). See Pamies et al. (2021) for the specifications represented in the graph.

Source: Authors’ calculations.

Some ‘context’ variables such as international investors’ risk aversion also play a role. The sensitivity of spreads to government debt increases with international investors’ risk aversion according to the study. On the other hand, spreads’ responsiveness to debt would not be more acute in smaller countries assumed to have less liquid sovereign bond markets, as shown by the not significant interactive term between debt and the relative economic size.4

These results dovetail with earlier empirical findings, but give a complementary insight on political challenges. From a policy angle, the results are a reminder that even in an environment of persistently low rates, governments with less solid fundamentals pay more than other to borrow and are exposed to higher risks. Such findings echo previous research that establishes that more indebted countries generally experience less favourable interest–growth rate differentials. Importantly, our results highlight that policies aimed at reinforcing potential growth and government effectiveness can be expected to improve investors’ perception of sovereign risk and their forbearance of higher debt.

Yet, the behaviour of spreads can only partly be explained by fundamental variables. Even in a relatively homogenous panel focusing on euro area economies only, it remains empirically difficult to decide between alternative specifications of fundamentals with approximately similar explanatory power in the data. The results also suggest that there have been already several ‘regimes’ in the euro area with specific incidences of fundamentals on spreads. Observed volatility factors such as global risk aversion only help to some extent in capturing these regime changes. While the latter part of the 2010s featured a regime of persistent, though contained spreads, the 2020s may involve yet other developments given the surge in public borrowings following the Covid-19 crisis and the further evolution of the European fiscal and monetary response.

For more information about the full set of specifications, results and robustness checks, see Pamies, S., Carnot, N., and Patarau, A (2021), ‘Do Fundamentals Explain Differences between Euro Area Sovereign Interest Rates?’, European Economy Discussion Paper, No. 141, June.

Our paper extends the existing literature, wherein many articles examined the behaviour of interest rate spreads following the sovereign debt stresses of the early 2020s. For references, see the main paper.

Government effectiveness is measured by the index constructed by the World Bank (extracted from the Worldwide Governance Indicators database). It captures perceptions of the quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies. Values range from -2.5 (weak government effectiveness) to 2.5 (strong).