References

Aaronson, S. (2009). Quantum Copy-Protection and Quantum Money. Conference on Computational Complexity (pp. 229-242). IEEE.

Agur, I., Ari, A., & Dell’Ariccia, G. (2019). Designing Central Bank Digital Currencies. Working Paper No. 19/252.

Allen, S., & others. (2020). Design Choices for Central Bank Digital Currency: Policy and Technical Considerations. IZA Discussion Papers.

Auer, R., & Böhme, R. (2020). The technology of retail central bank digital currency. BIS Working Paper.

Barontini, C., & Holden, H. (2019). Proceeding with Caution — A Survey on Central Bank Digital Currency. BIS Papers.

Boar, C., Holden, H., & Wadsworth, A. (2020). Impending arrival – a sequel to the survey on central bank digital currency. BIS Papers.

Brunnermeier, M., James, H., & Landau, J. (2019). The Digitalization of Money. National Bureau of Economic Research.

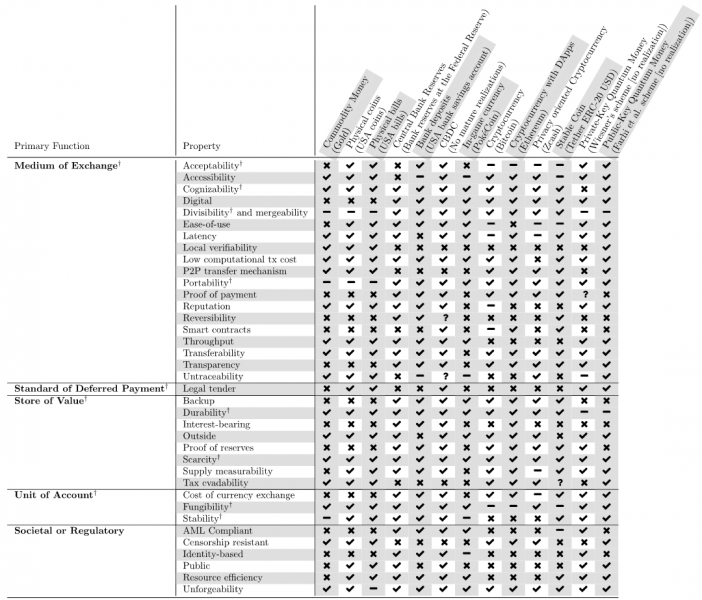

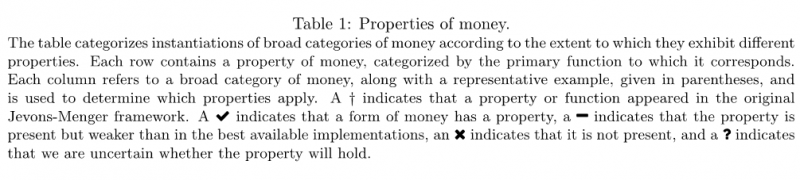

Hull, I., & Sattath, O. (2021). Revisiting the Properties of Money. Sveriges Riksbank Working Paper Series No. 406.

Jevons, W. (1876). Money and the Mechanism of Exchange. New York: D. Appleton and Co.

Khattak, S., & others, a. (2016). SoK: Making Sense of Censorship Resistance Systems. Proceedings on Privacy Enhancing Technologies. Warsaw: De Gruyter Poland.

Menger, K. (1892). On the Origin of Money. The Economic Journal, 239-255.

Ron, D., & Shamir, A. (2013). Quantitative Analysis of the Full Bitcoin Transaction Graph. Financial Cryptography and Data (pp. 6-24). Springer.