References

Ampudia, Miguel, Dimitris Georgarakos, Michele Lenza, Jiri Slacalek, Oreste Tristani, Philip Vermeulen, and Giovanni L. Violante. 2018. “Household Heterogeneity and the Transmission of Monetary Policy in the Euro Area.” CEPR. August 14, 2018. https://cepr.org/voxeu/columns/household-heterogeneity-and-transmission-monetary-policy-euro-area.

Asdrubali, Pierfederico, Bent Sorensen, and Oved Yosha. 1996. “Channels of Interstate Risk Sharing: United States 1963–1990.” The Quarterly Journal of Economics 111 (4): 1081–1110.

Bénassy-Quéré, Agnès, Markus K Brunnermeier, Henrik Enderlein, Emmanuel Farhi, Marcel Fratzscher, Clemens Fuest, Pierre-Olivier Gourinchas, et al. 2018. “Reconciling Risk Sharing with Market Discipline: A Constructive Approach to Euro Area Reform.” CEPR Policy Insight No. 91 (91): 24.

Eichenbaum, Martin, Sergio Rebelo, and Arlene Wong. 2018. “State-Dependent Effects of Monetary Policy: The Refinancing Channel.” CEPR. December 2, 2018. https://cepr.org/voxeu/columns/state-dependent-effects-monetary-policy-refinancing-channel.

Farhi, Emmanuel, and Iván Werning. 2017. “Fiscal Unions.” American Economic Review 107 (12): 3788–3834. https://doi.org/10.1257/aer.20130817.

Hauptmeier, Sebastian, Fédéric Holm-Hadulla, and Katerina Nikalexi. 2020. “Monetary Policy and Regional Inequality.” CEPR. April 22, 2020. https://cepr.org/voxeu/columns/monetary-policy-and-regional-inequality.

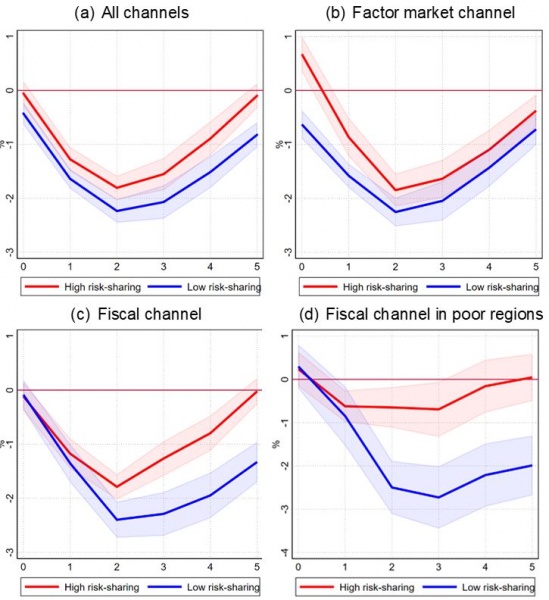

Hauptmeier, Sebastian, Fédéric Holm-Hadulla, and Théodore Renault. 2022. “Risk Sharing and Monetary Policy Transmission.” CEPR. 2022. https://cepr.org/voxeu/columns/risk-sharing-and-monetary-policy-transmission.

———. 2022. “Risk Sharing and Monetary Policy Transmission.” Working Paper Series 2746. European Central Bank. https://econpapers.repec.org/paper/ecbecbwps/20222746.htm.

Kenen, Peter B. 1969. “The Theory of Optimum Currency Areas : An Eclectic View.” Monetary Problems of the International Economy, Monetary problems of the international economy. – Chicago, Ill. [u.a.] : Univ. of Chicago Press, ISBN 0-226-55065-6. – 1969, p. 41-60, .

Machado, José A. F., and J. M. C. Santos Silva. 2019. “Quantiles via Moments.” Journal of Econometrics 213 (1): 145–73.

Mundell, Robert A. 1961. “A Theory of Optimum Currency Areas.” The American Economic Review 51 (4): 657–65.