The views expressed here are those of the authors and do not necessarily reflect those of the European Central Bank, the Federal Reserve Bank of San Francisco, or the Federal Reserve System.

Firms’ inflation expectations represent a key variable for monetary policy makers. In this column, we present new survey evidence of euro area firms’ inflation expectations that are measured on a consistent basis across euro area countries. We study the predictors of these expectations and show, using a randomised controlled trial, that firms update their inflation expectations when they receive new information about past inflation or the inflation outlook. Moreover, we find that firms revise their economic plans in response to such information treatments.

Firms’ decisions, including setting prices, negotiating wages, deciding how much to invest and how many people to employ, have profound macroeconomic implications. Understanding how firms form and update their inflation expectations, and assessing the extent to which these expectations influence their plans and actions is therefore of paramount importance. Despite their prominence, still relatively little is known about euro area firms’ inflation expectations, partly owing to a lack of consistent measures across countries. In a recent paper (Baumann et al, 2024), we present novel evidence on the properties of euro area firms’ inflation expectations, based on new questions that have recently been added to the ECB’s Survey on the Access to Finance of Enterprises (SAFE).

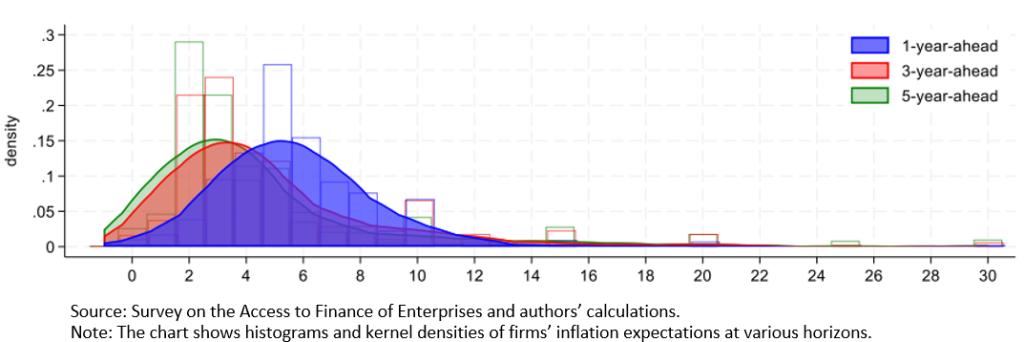

Figure 1 plots the distributions and histograms of firms’ inflation expectations, with several facts standing out. On average, firms’ expectations of inflation one year ahead stood at 5.8 percent in June 2023, somewhat above actual inflation (of 5.5 percent) at the time. The rate of expected inflation falls with the forecast horizon, to 5.0 and 4.8 percent on average, for expectations of inflation 3-years-ahead and 5-years-ahead, respectively. The disagreement (measured by the cross-sectional standard deviation of firms’ inflation expectations) is relatively high and increases with the horizon. Thus, although on average firms expect inflation to moderate over time and come closer to the ECB’s 2 percent inflation target, they have diverging views on where inflation is going to land in the longer run. Finally, the histograms in Figure 1 show that quite a few firms report expectations in multiples of 5, which can signal uncertainty about their expectations (Binder 2017).

We also find that inflation expectations of euro area firms are distinct from those of households or professional forecasters. Firms on average expect higher inflation than professional forecasters, but in this they are similar to households.1 At the same time, firms’ expectations one year ahead exhibit more disagreement than the expectations of professional forecasters and less than those of households.

Figure 1: The distribution of inflation expectations across euro area firms

x-axis: level of inflation expectations in percentages per annum, point predictions, y-axis: share of firms

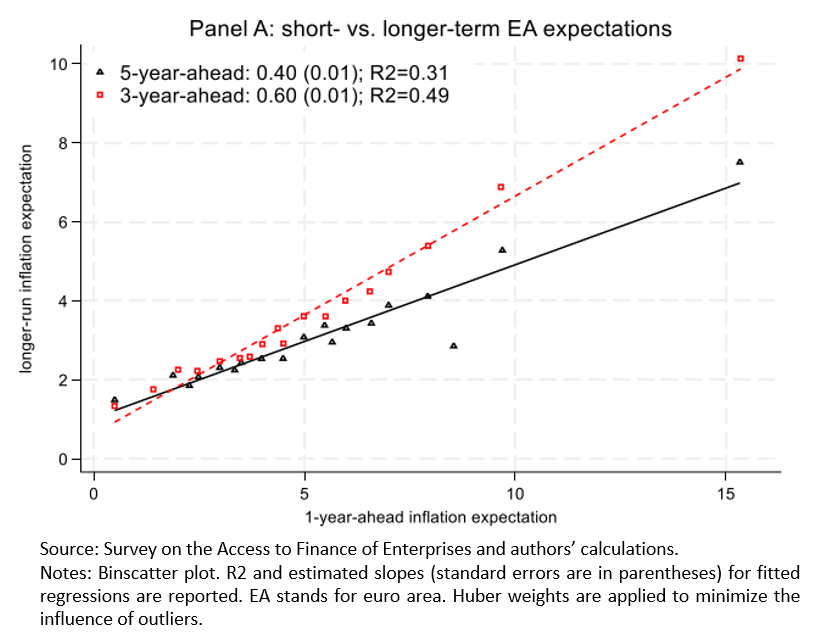

As shown in Figure 2, firms longer-term inflation expectations are correlated with short-term expectations. Such correlation can serve as a metric for how anchored inflation expectations are (Kumar et al. 2015). However, the strength of the correlation as well as the “pass-through”2 from short- to long-term inflation expectations declines with the forecast horizon, with the pass-through standing at 0.6 for 3-year-ahead forecasts and 0.4 for 5-year-ahead forecasts. For comparison, the pass-through was estimated at 0.7 for New Zealand (Kumar et al. 2015) and for the US (Candia et al. 2024) in low-inflation settings.

The richness of SAFE allows to provide new insights on the impact of company characteristics on inflation expectations. In the paper we show that firms’ inflation expectations negatively correlate with size and age. Also, firms’ investment plans, leverage and access to credit seem to play a role. Firms with higher debt ratios, for instance, tend to have higher inflation expectations. Finally, it matters who is responding: male managers tend to have lower inflation expectations than female ones, and chief financial officers have lower expectations compared with respondents that have other positions within the firm.

Figure 2: Joint distribution of short-term and longer-term inflation forecasts

(x-axis: 1-year ahead inflation expectations, y-axis: 3-year or 5-year ahead inflation expectations, point predictions, in percentages per annum)

To establish causal effects of inflation expectations on firms’ choices as well as to gauge the power of policy communication, in June 2023, we run a randomised controlled trial (RCT). In a first stage, we first asked all firms where they expect inflation to be in one year, in three years, and in five years. We then randomly split the firms into two treatment groups and one control group.

In the second stage, firms in the two treatment groups were provided with additional inflation-related information, while the control group received no information. Firms in the first treatment group received the latest available euro area HICP inflation outturn, which referred to the month of April 2023, where inflation stood at 7.0%.3Firms in the second treatment group received the latest available expert forecast for inflation, which we took from the ECB’s Survey of Professional Forecasters (SPF).4 This information treatment revealed to firms that professional forecasters expected inflation to be 2.8% in one year.

In the third stage, firms in both treatment groups were then asked again about their inflation expectations at the three horizons. These firms thus had the opportunity to revise their inflation expectations in the light of the information received, while firms in the control group were not asked again.

Figure 3 shows the extent to which respondents update their beliefs about 1-year ahead inflation immediately after having obtained one of the information treatments. If agents follow a Bayesian update rule, these updated beliefs should be a weighted average of their initial beliefs and the treatment (Coibion et al, 2022). The magnitude of the revision depends on (i) the estimated slope coefficient (i.e. the negative of the gain of the Kalman filter that respondents use to update their beliefs after the information treatment); and (ii) on the level effect, which captures a product of the Kalman gain and the difference between the signal and the average expectation for the signal. For example, if the provided inflation forecast is below average inflation expectations in the sample, the estimated level effect should be negative as respondents should lower their inflation expectations toward the provided signal. For the control group, by construction, the prior inflation expectations correspond to the posterior, since these firms were not given the possibility to update their expectations. As a result, the 45 degree line in Figure 3 provides a benchmark relative to which the two treatments can be assessed.

Overall, we find that, consistent with Bayesian learning, treatments move inflation expectations significantly across the horizons. This happens despite the fact that the survey was done in a high-inflation setting in which economic agents should be more aware of publicly available information such as past inflation statistics, current inflation forecasts, and the inflation target of the central bank (Weber et al. 2023). The treatment effects are stronger for the group provided with the inflation forecast: the estimated slope coefficient for this group (blue line in Figure 3) is smaller than the estimated slope for the group that was provided with past inflation (red line).

Figure 3: Firms’ adjustment of 1-year-ahead inflation expectations upon receiving one of the information treatments

(x-axis: firms’ expectations before the information treatment, y-axis: firms’ expectations after the information treatment (both in %))

A key question is how inflation expectations translate into actions. To this end, we exploit post-treatment variation in posterior beliefs to measure the causal effect of inflation expectations on the plans that firms have for their wage and price setting, employment, and costs over the next twelve months.

We find that exogenously raising 1-year-ahead inflation expectations by one percentage point via the information treatment in the RCT increases firms’ (planned) prices by approximately 0.3 percentage point. This pass-through is larger than what was found in earlier studies for low-inflation environments (e.g., Coibion et al. 2020). At the same time, firms expect an even larger (0.64) pass-through into costs, which suggests declining profit margins. We find that higher inflation expectations result in plans to hire more workers: one percentage point higher inflation expectations lead to 0.3 percentage point planned increase in employment. This result contrasts with Coibion et al. (2020) documenting that Italian firms had a stagflationary view of inflation for at least some time after the Great Recession. We interpret this result as suggesting that firms’ interpretation of inflation is potentially state-dependent and that the current view is consistent with a demand-driven boom in the economy.

Finally, we find that the (planned) changes are weaker for wages than for prices. The relatively moderate pass-through to wage growth is consistent with workers expecting a low pass-through from inflation to wage growth even in a high-inflation environment (e.g., Hajdini et al. 2022). Buchheim et al. (2023) offer a potential explanation: as wage contracts tend to have long durations in European countries, few changes in wage contracts happen while contracts are in force but there is more flexibility at the time when a new contract is signed. At that moment, the pass-through from inflation expectations to wage growth is likely to be the highest.

Euro area firms’ inflation expectations in the SAFE represent a rich and novel source of data, complementing the wealth of information stemming from surveys of households and professional forecasters in the euro area. These data are key to improving our understanding of how firms form expectations and how that affects their decisions.

Even in the high-inflation environment of June 2023, information treatments with past inflation and with inflation forecasts to randomly chosen firms are found to have large and persistent effects on inflation expectations. Moreover, the exogenous variation in inflation expectations translates into firms’ plans to change prices, wages, costs and employment. Our findings thus highlight an important role for policy communication in guiding inflation expectations, which in turn affect firms’ economic plans.

Baumann, U., Ferrando, A., Georgarakos, D., Gorodnichenko, Y. and Reinelt, T. (2024). “SAFE to update inflation expectations? New survey evidence on euro area firms”, ECB Working Paper No. 2949.

Binder, C. (2017). “Measuring uncertainty based on rounding: New method and application to inflation expectations,” Journal of Monetary Economics 90(C): 1-12.

Buchheim, L., Link, S. and Mo hrle, S. (2023). “Wage Expectations of Firms and Employees,” manuscript.

Candia, B., Coibion, O. and Gorodnichenko, Y. (2024). “The Inflation Expectations of U.S. Firms: Evidence from a new survey,” forthcoming in Journal of Monetary Economics.

Kumar, S., Afrouzi, H., Coibion, O. and Gorodnichenko, Y. (2015). “Inflation Targeting Does Not Anchor Inflation Expectations: Evidence from Firms in New Zealand,” Brookings Papers on Economic Activity 46(2 (Fall)): 151-225.

Coibion, O., Gorodnichenko, Y. and Weber, M. (2022). “Monetary policy communications and their effects on household inflation expectations,” Journal of Political Economy 130: 1537–1584.

Coibion, O., Gorodnichenko, Y. and Ropele, T. (2020). “Inflation Expectations and Firm Decisions: New Causal Evidence,” Quarterly Journal of Economics 135(1): 165-219

Hajdini, I., Knotek, E., Leer, J., Pedemonte, M., Rich, R. and Schoenle, R. (2022). “Low Passthrough from Inflation Expectations to Income Growth Expectations: Why People Dislike Inflation,” Working Papers 22-21R, Federal Reserve Bank of Cleveland.

Weber, M., Candia, B. Afrouzi, H., Coibion, O. Frache, S., Georgarakos, D., Kenny, G., Kumar, S., Lluberas, R., Meyer, B., Ponce, J., Ropele, T., and Gorodnichenko, Y. (2023). “Tell Me Something I Don’t Already Know: Learning in Low and High-Inflation Settings,” NBER Working Paper 31485.

The ECB Consumer Expectations Survey’s (CES) corresponding 1-year-ahead average inflation expectations stood at 5.1% in June 2023, while the ECB Survey of Professional Forecasters (SPF) average 1-year-ahead forecast stood at 2.8% in the second quarter of 2023.

The “pass-through” is measured with the estimated slope in the regression where a long-term inflation expectation is the dependent variable and a short-term inflation expectation is the regressor.

The exact wording was: “We would now like to provide you with some information about the inflation rate in the euro area. In April 2023, the annual inflation rate in the euro area was 7.0%.”

The randomised control trial was conducted in June 2023. The exact wording of the information provision was: “We would now like to provide you with some information about the expected inflation rate in the euro area going forward. The Survey of Professional Forecasters (SPF) is a survey of professional economists. According to the latest data, they expect, on average, inflation in 12 months to be 2.8%.”