In this Policy Brief, we document that set-up costs, i.e. the initial capital expenditure required to start a new business, are a key determinant of the capital structure of young firms. Theoretically, when firms face high set-up costs, they can only be established by leveraging up and lengthening debt maturity. Empirically, we use a large sample of French firms over 2006-2016 to show that young firms have a significantly higher leverage and issue longer-maturity debt than seasoned companies. These patterns are stronger in high set-up cost industries and for firms with lower profitability. Last, we show that, following an exogenous shock that reduces banks’ supply of long-term loans, the creation of young firms in high set-up cost industries is significantly lower in counties where shocked banks have a large market share and bank competition is limited.

An entrepreneur who starts a new firm has to make an initial investment in fixed assets, which are required to run her business. We label these unavoidable capital expenditures set-up costs. These costs are largely industry-specific: set-up costs are intuitively higher on average for launching a fishing company, opening a hotel or even a dentist’s practice than for starting translation activities or a management consultancy. Despite the importance of young firms in the economy, little is known about their financing and their capital structure. The main reason for this neglect in the academic literature has been severe data limitations, as young firms are by definition mostly very small and non-listed. In a recent study (Derrien et al., 2021), we exploit new disaggregated data for France and show that set-up costs are key for understanding important facts relative to the financing of young firms.

We merge several sources of data, including balance sheet data on a random 20% of all firms created in France between 2006 and 2016, and detailed loan-level data to firms from the Banque de France. We start by documenting a set of stylized facts about the capital structure of young firms. In our sample, the ratio of total debt to assets falls from an average of 52% in the first two years of existence of firms to about 37% for 10-year old companies. The maturity of the bank debt also decreases significantly with age. At the loan level, the average maturity of new loans falls from 72 to 54 months on average over the first ten years. Note that these facts are a priori surprising if one accepts the usual assumption that young firms are more subject than older firms to adverse selection and moral hazard frictions. Indeed, in standard models of corporate finance, such frictions are associated with lower external financing of any type, whether equity or debt. Conditional on accessing debt markets, these models also predict low leverage and short-term maturities for the most constrained firms.

We propose a new explanation for the stylized facts we uncovered, and test a rich set of associated predictions. In sum, the key feature that can reconcile theory and data is the existence of fixed set-up costs. When firms face set-up costs that are large relative to the entrepreneur’s initial net worth, they need to turn to external financiers. Provided they have limited cash flows when they are young, their ability to repay debt each period is limited. The only way to finance set-up costs is thus to lengthen debt maturity, provided the debt contract remains feasible. These effects are magnified in industries in which set-up costs are higher.

To formalize our predictions on the role of set-up costs, we first develop a simple model with moral hazard, inspired by Holmstrom and Tirole (1997). In this model, firms borrow at date 0 and repay financiers at dates 1 and 2, using cash flows that are subject to moral hazard. In this context, it is efficient for firms to repay debt as soon as possible in order to limit moral hazard problems that can arise in the future. However, firms’ ability to repay debt early is limited by the magnitude of their early cash flows. Firms with high set-up costs or low early cash flows thus need to borrow with longer-term debt. Their ability to do so is itself limited by moral hazard problems, so that there is a selection of potential entrepreneurs into firm creation: entrepreneurs with too limited a net worth cannot create firms, particularly if set-up costs are high.

This model generates three main testable predictions. First, in industries with higher set-up costs, initial leverage and debt maturity are higher, and decline more quickly as firms age. That is, the stylized fact discussed above is particularly strong in industries with high set-up costs. A corollary is that there is tougher selection in these industries: fewer entrepreneurs are able to enter. Second, within industries characterized by a given set-up cost, firms with lower initial profitability should borrow with longer-term debt. This prediction is again at odds with the received view that more constrained firms need to borrow with shorter-term debt. Third, when the ability of financiers to supply longer-term debt is impaired, there can be heterogeneous effects across industries with different set-up costs: the patterns of firm creation and growth will differ across industries. In other words, set-up costs are not only important for firms’ capital structure, but also for the transmission of bank shocks.

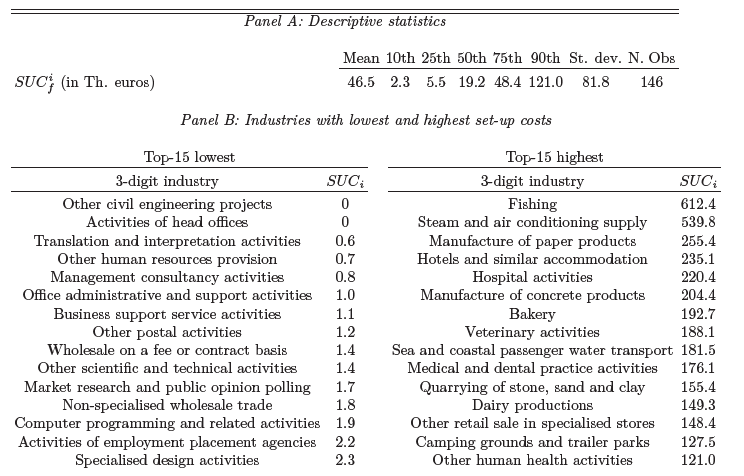

We test the predictions of the theory in two steps. First, we classify 3-digit industries into terciles based on the level of set-up costs, which we measure using the median value of tangible and intangible assets (in euros) of young firms in each industry. Table 1 provides descriptive statistics on estimated set-up costs across the 146 industries for which the measure exists. There is significant cross-sectional variation in set-up costs across industries: the median industry has a set-up cost of 19,000 euros, while the cost jumps to 121,000 euros at the 90th percentile. Not surprisingly, industrial activities tend to have high set-up costs (e.g., manufacture of paper products, quarrying of stone, sand and clay), while services relying primarily on human capital have low set-up costs (e.g., translation and interpretation activities, business support service activities). We also show in the paper that, relative to firms in the lowest tercile of set-up costs, firms in high set-up cost industries have significantly higher ratios of PPE/Assets and Intangibles/Assets (by 16.3 and 22.2 percentage points, respectively) when they start operating. Thus, firms in high set-up cost industries not only require a large absolute amount of tangibles and intangibles to operate, but these assets also represent a large proportion of their balance sheets. Finally, firms in these industries also start with significantly larger size (i.e., more total assets). These differences are persistent when firms age.

Table 1: Descriptive statistics on set-up costs

Note: This table provides descriptive statistics on set-up costs, measured at the 3-digit industry level. Panel A displays moments of the cross-industry distribution of set-up costs. Panel B shows the 15 industries with the lowest (left panel) and with the highest (right panel) set-up costs. Source: Diane (Bureau van Dijk), computations by the authors.

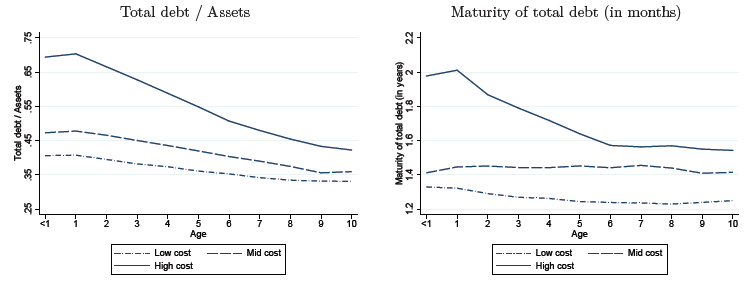

Second, we show that the above mentioned patterns for the leverage and debt maturity of young firms are almost entirely driven by firms operating in industries with high set-up costs. The ratio of total debt over assets decreases from about 70% to about 40% in the first ten years for firms in high set-up cost industries, while this proportion decreases much less, from about 40% to about 35% for firms in the lowest tercile of set-up costs. Similar patterns hold for debt maturity. We then turn to formal tests using regressions. This allows us to include a variety of controls, as well as firm and time fixed effects. These fixed effects allow us to notably rule out the possibility that stylized facts are driven by selection, which could be the case if firms surviving until age 10 are systematically different from firms surviving only until age 2. We confirm the finding that leverage and debt maturity decrease with age. We additionally test the second specific prediction from the model, namely that, within industries with a given set-up cost, firms with lower cash flows borrow with longer-maturity debt. We do indeed find that, after including fixed effects at the industry level, young firms with lower EBITDA borrow longer-term debt.

Figure 1: Capital structure by set-up cost terciles

Note: This figure plots stylized facts about the capital structure of firms between their creation and age 10. Each line is obtained by computing the mean of the relevant variable for all firms in each tercile of the measure of set-up cost. Set-up costs are computed at the 3-digit industry level. Total debt is defined to include both financial debt (from banks or other lenders, including family and friends) and payables. Source: Diane (Bureau van Dijk), computations by the authors.

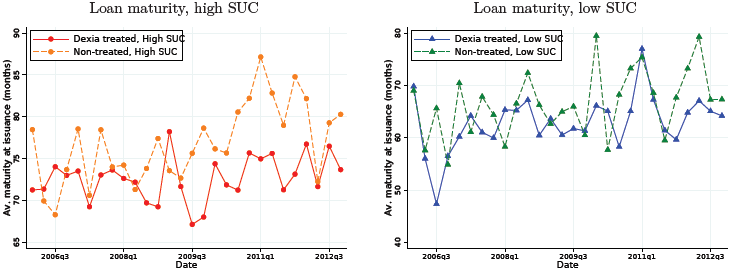

In the last part of the paper, we confirm the prediction that set-up costs are an important determinant of the transmission of financial shocks to the real economy. We do so using a quasi-natural experiment. Specifically, we exploit an event that exogenously forces some French banks to suddenly shorten the maturity of loans to corporations. This event is the failure in 2008 of Dexia, a large French-Belgian bank whose main business was to provide funding to local governments, notably municipalities. Following this shock, municipalities previously relying on loans from Dexia increasingly borrowed from other local banks with whom they had pre-existing relationships. Given that loans to municipalities have very long maturities, the duration mismatch between assets and liabilities increases mechanically for banks making these loans. To reduce this mismatch, they were constrained to cut the maturity of new loans to corporations, as shown by Figure 2.

Figure 2: Corporate loan maturity across treated and control banks: comparing set-up costs terciles

Note: This figure shows the initial maturity of loans and loan amounts to young firms (below 24 months) across treated and control banks. A bank is treated by the Dexia shock if it is highly exposed to municipalities borrowing heavily from Dexia before 2008. In each panel, we break down the sample between firms in low and high set-up cost (SUC) industries.

In difference-in-differences regressions, we confirm that treated banks (that is, banks heavily exposed to municipalities that were previously borrowing mostly from Dexia) significantly reduce the maturity of new corporate loans after Dexia’s failure. More importantly, we do find that the effect picked up by our estimation concentrates on firms in high set-up cost industries, for which the availability of long-term financing is more important.

As a last step, we find that this maturity rationing by treated banks had significant real effects. In line with the theory, we show that the creation of new firms in high set-up cost industries was relatively lower in counties where treated banks had a larger market share. The effect is limited however to counties where, in addition, the level of competition on the market for corporate loans is low, which prevents young firms to shop around and fetch more favorable loan conditions.

Derrien, François and Mésonnier, Jean-Stéphane and Vuillemey, Guillaume, 2020. Set-Up Costs and the Financing of Young Firms. Banque de France Working Paper No. 792.

Holmstrom, Bengt, and Tirole, Jean, 1997. Financial intermediation, loanable funds, and the real sector. Quarterly Journal of Economics, volume 112, p. 663 – 691.