This policy note studies the impact of the COVID-19 shock on the portfolio exposures of euro area investors, incorporating a “look-through” approach to holdings of investment fund shares. We find a broad-based rebalancing towards domestic sovereign debt at the expense of extra-euro area sovereigns amid the COVID-19 shock, consistent with heightened home bias. These patterns were strongly driven by indirect holdings – via investment funds – especially for insurance companies and pension funds, but levelled off in the second quarter when financial market tensions subsided and uncertainty receded. On the contrary, for listed shares we observe that euro area investors rebalanced away from domestic towards extra-euro area securities in both the first and the second quarter, which may be associated with better relative foreign stock market performance. Our findings corroborate the importance of investment funds in assessing investors’ full exposures via securities, in particular in times of large shocks.

The unprecedented health measures introduced in the first quarter of 2020 to contain the COVID-19 pandemic unleashed a severe financial shock. The latter had a striking impact on euro area financial markets, with far-reaching consequences across countries and sectors, as corporate bond yields rose, stock markets declined and fragmentation pressures emerged in sovereign bond markets. After the European Central Bank (ECB) introduced comprehensive monetary policy measures in mid-March 2020, including the Pandemic Emergency Purchase Programme (PEPP), euro area financial markets started to stabilise. Against this background, we study the shifts and rebalancing in euro area investors’ portfolio holdings in the first two quarters of 2020. To this end we use a method of “looking-through” the holdings of investment fund shares by euro area investors, so that a clearer picture of their full portfolio exposures is attained.

There are two main reasons why looking through investment funds is a relevant exercise. First, from a structural point of view, as some euro area institutional sectors, in particular pension funds, insurance companies and households, exhibit large holdings of investment fund shares. Second, euro area investment funds played an important role in the developments in financial flows amidst the COVID-19 shock, with a stark retrenchment in their cross-border holdings in the first quarter of 2020, followed by an almost equally sized rebound in the second quarter when uncertainty receded.

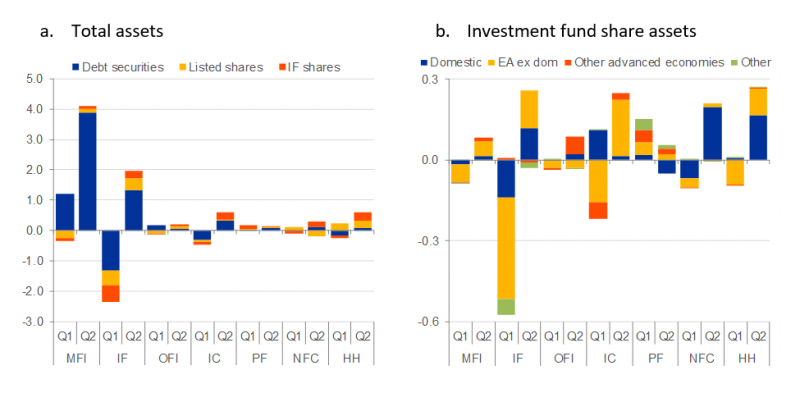

We first analyse Securities Holding Statistics (SHS) data, which, unlike balance of payments data, also include domestic transactions. Starting with the asset side (Figure 1a), these show that most of the pro-cyclical deleveraging and the subsequent rebound were carried out by investment funds followed, by a long distance, by insurance companies. In terms of instruments, investment funds executed net sales of debt securities, listed shares and investment fund shares in the first quarter of 2020, and made net purchases of these instruments with very similar magnitudes in the second quarter. Banks, on the other hand, had a counterbalancing effect in the first quarter, taking on both foreign and domestic debt securities. In the second quarter net purchases by banks increased even further. Moving to the liability side of investment funds, Figure 1b focuses solely on transactions of euro area residents in investment fund shares. It shows that all euro area sectors – with the exception of pension funds – reduced their exposures to other securities via investment funds in the first quarter of 2020, while increasing it again in the second quarter. In turn, this points to the usefulness of trying to determine the indirect exposures via investment funds of other euro area sectors. Figure 1b also shows that the overwhelming portion of the transactions were in investment funds shares issued in the euro area, either domestically or in other euro area countries, mainly in Ireland and Luxembourg. Transactions in non-euro area investment fund shares by euro area investors were mostly residual, which is to be expected, given the low relative exposure of euro area investors to investment funds located outside the euro area.

Figure 1: Portfolio investment flows by sector in 2020Q1 and 2020Q2

(quarterly flows in % of euro area GDP)

Source: ECB and Eurostat.

Notes: “Domestic” refers to cases where the holder country is the same as the issuer country; “EA ex dom” refers to cases where the euro area holder country is not the same as the issuer country; “Non-EA” are all other countries. “MFI” and monetary financial institutions; “IF” are investment funds; “OFI” are other financial intermediaries; “IC” are insurance companies; “PF” are pension funds; “NFC” are non-financial corporations; “HH” are households.

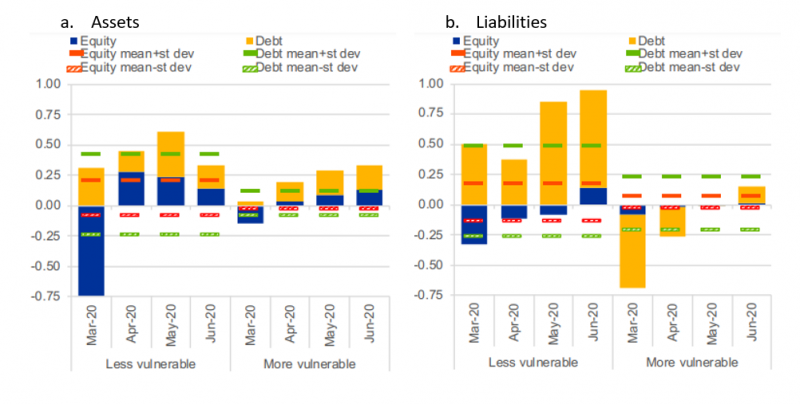

Monthly balance of payments data highlight the intra-euro area fragmentation dynamics set off in March 2020, on account of safe haven and flight-to-quality behaviour (Lane, 2020), whereby sizeable outflows from debt securities issued by more vulnerable euro area countries – Greece, Italy, Portugal and Spain – were recorded, while less vulnerable countries – i.e., Austria, Belgium, Finland, France, Germany and the Netherlands – experienced significant inflows – see Figure 2b. These debt inflows persisted and grew even larger in the second quarter, while more vulnerable countries’ debt outflows declined in April, before turning into net inflows in June. On the asset side, net sales of equity, which also encompass investment fund shares, were recorded for both groups of countries in March and were particularly large in the case of the less vulnerable countries – see Figure 2a. In both groups of countries, net purchases of equity were recorded as of April, while net purchases of debt were recorded in March and throughout the second quarter.

Figure 2: Portfolio flows by country group

(monthly flows in % of euro area GDP)

Source: ECB and Eurostat.

Notes: Averages and standard deviations calculated from January 2008 to June 2020. “Less vulnerable” countries are Austria, Belgium, Finland, France, Germany and the Netherlands; “more vulnerable” countries are Italy, Greece, Portugal and Spain.

As regards the asset side, SHS data offer a more complete picture and show the role of euro area investment funds in the retrenchment-rebound dynamic in the first half of 2020, both in terms of the size of flows in investment fund shares and in that most of these flows were vis-à-vis euro area-based investment funds. However, there are clear differences between the two groups of countries, including the fact that less vulnerable countries resorted heavily to domestic investment funds, whereas more vulnerable countries transacted more with those based in other euro area countries, which also reflects that more vulnerable countries have, on average, much lower shares of exposure to domestic investment funds (around a third in end-2019, whereas that of less vulnerable countries was closer to two thirds).

Considering the aforementioned differences between the two groups, our analysis focuses on less and more vulnerable euro area countries, presenting their direct and indirect exposures to securities at the end of 2019, before delving into the changes in the first two quarters of 2020, amid the COVID-19 shock.

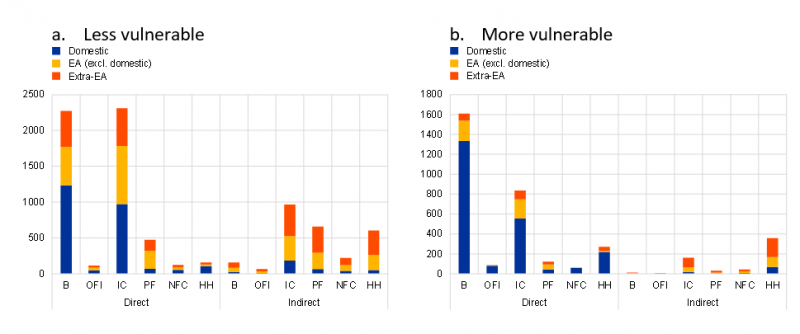

Figure 3: Direct and indirect exposures of euro area investors to debt securities

(EUR bn, 2019Q4)

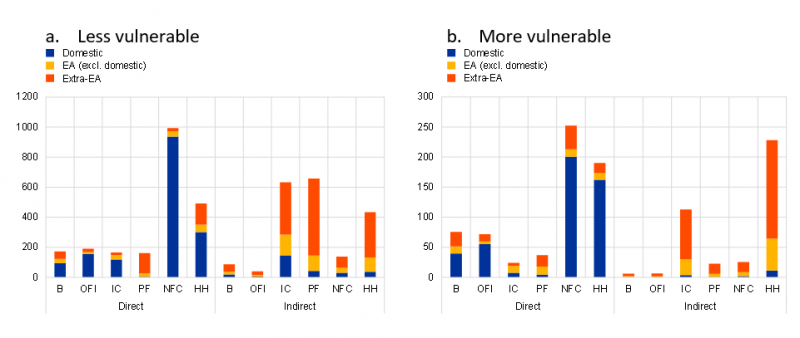

Figure 4: Direct and indirect exposures of euro area investors to listed shares

(EUR bn, 2019Q4)

Source: ECB, SHS and author’s calculations. Notes: “Less vulnerable” countries are Austria, Belgium, Finland, France, Germany and the Netherlands; “more vulnerable” countries are Italy, Greece, Portugal and Spain. “Domestic” refers to cases where the holder country is the same as the issuer country; “EA excl. domestic” refers to cases where the euro area holder country is not the same as the issuer country; “Extra-EA” are all other countries. “B” are deposit-taking corporations; “OFI” are other financial intermediaries; “IC” are insurance companies; “PF” are pension funds; ”NFC” are non-financial corporations; “HH” are households.

In broad terms, our estimates for debt securities (Figures 3a and 3b) and listed shares (Figures 4a and 4b) show that euro area investors tend to resort proportionally more to investment fund shares when they invest in listed shares. To the extent that home bias is generally lower in equity investment, it may render it more efficient to rely on investment funds to enter more distant markets/securities which carry higher information costs. Analogously, the lower information costs associated with bonds and in particular for sovereigns (which are present in fixed income markets only) may explain higher levels of direct exposures. Moreover, Figures 3 and 4 highlight a high heterogeneity across sectors regarding their direct and indirect exposure structure, mechanically resulting from the different proportions of investment fund shares in the total sectoral portfolios. On the one hand, a significant share of pension funds’, insurance companies’ and households’ overall exposures are attained via investment fund shares, which for the latter may be the result of the lower level of investor sophistication typically associated to this sector; on the other hand, banks’ exposures are mostly via direct holdings, especially when it comes to debt securities. These idiosyncratic differences point to the need to explore the patterns of exposures at the sectoral level instead of at the aggregate level. The latter is further reinforced by the differentiated behaviour that sectors have in response to returns – see, for instance, Adrian and Shin (2010), Timmer (2018) and Bergant and Schmitz (2020) – as well as the need to comply with certain regulatory requirements, which apply to some sectors.

To assess the shifts in exposures of the different sectors in the first and second quarters of 2020, we use a regression approach, which combines a set of gravity variables, standard in the literature, with a battery of geography and issuer sector dummies. Focusing on debt securities and starting with the shifts observed in the first quarter of 2020, there was a widespread re-orientation towards domestic sovereigns at the expense of extra-euro area sovereigns, strongly driven by indirect holdings for some sectors, in both less and more vulnerable euro area countries, in an environment of a general sell-off of the latter securities by foreign investors. In the second quarter of 2020, however, these shifts came to a halt and, for some sectors, investment in non-domestic debt securities resumed, against the backdrop of the stabilisation seen in financial markets. In listed shares, euro area investors rebalanced away from domestic towards extra-euro area securities in the first quarter of 2020, which is the opposite of what was observed for debt securities, and was strongly driven by indirect holdings. In contrast to debt securities, these investment patterns largely continued in the second quarter of 2020.

What can explain the difference in rebalancing patterns between debt securities and listed shares? On the one hand, the rebalancing from non-euro area securities towards domestic debt securities is consistent with heightened home bias and a preference to reduce foreign currency exposure in times of crises (Lane, 2020). It is well documented that home bias tends to be higher in debt securities than equities – in part due to foreign currency risk (Fidora et al., 2007). Furthermore, Broner et al. (2014) argue that investors may have an incentive to buy domestic debt to the extent they are positively discriminated vis-à-vis foreign investors, since they have a lower probability of being negatively affected in a default episode; domestic investors may also buy domestic debt due to moral suasion. On the other hand, the rebalancing towards non-euro area listed shares may have been driven by the better relative stock market performance in non-European indices (in particular in the US) and the fact that, in the second half of the first quarter of 2020, Europe was at the centre of the pandemic’s developments with strong containment measures being enacted. What is more, this behaviour is in line with Broner et al. (2006), who find that mutual funds, when facing returns below average, tend to retrench from those countries in which they are positioned overweight.

In a final exercise, we apply our “look-through” framework to the rebalancing observed during the most intense phase of the ECB’s Asset Purchase Programme (APP) from early-2015 to end-2017. The results of this exercise show that euro area investors increased their exposure to securities issued by non-residents, while in many instances decreasing their exposures to domestic securities, issued by the government sector and banks. This is broadly in line with studies which specifically focused on the portfolio balance effects of the APP – see, for instance, Bergant et al. (2020). Strikingly, the rebalancing towards foreign debt securities was heavily driven by indirect holdings via investment fund shares for most sectors. Thus, the main vehicle to increase exposures to extra-euro area debt during the APP period, was precisely the one used to reduce these exposures during the COVID-19 shock: indirect holdings via investment fund shares.

Adrian, T. and H. S. Shin (2010). Liquidity and leverage. Journal of Financial Intermediation 19 (3), 418–437.

Bergant, K. and M. Schmitz (2020). Valuation Effects and International Capital Flows – Security-Level Evidence from Euro Area Investors. mimeo, European Central Bank and International Monetary Fund.

Bergant, K., M. Fidora, and M. Schmitz (2020). International Capital Flows at the Security Level – Evidence from the ECB’s Asset Purchase Programme. IMF Working Papers 20/46, International Monetary Fund.

Carvalho, D. and M. Schmitz (2021). Shifts in the portfolio holdings of euro area investors in the midst of COVID-19: Looking through investment funds. ECB Working Paper No. 2526.

Broner, F. A., R. G. Gelos, and C. M. Reinhart (2006). When in peril, retrench: Testing the portfolio channel of contagion. Journal of International Economics 69 (1), 203–230.

Broner, F., A. Erce, A. Martin, and J. Ventura (2014). Sovereign debt markets in turbulent times: Creditor discrimination and crowding-out effects. Journal of Monetary Economics 61, 114–142.

Fidora, M., M. Fratzscher, and C. Thimann (2007). Home bias in global bond and equity markets: the role of real exchange rate volatility. Journal of international Money and Finance 26 (4), 631–655.

Lane, P. R. (2020). The market stabilisation role of the pandemic emergency purchase programme. The ECB Blog, 22 June.

Timmer, Y. (2018). Cyclical investment behavior across financial institutions. Journal of Financial Economics 129 (2), 268–286.

This policy note is based on Carvalho and Schmitz (2021). The views expressed in this article are those of the authors and do not necessarily reflect those of Banco de Portugal or the European Central Bank.