Based on data from the bank lending survey for Poland, we show that shocks to the capital position are an important driver of bank lending standards, terms and conditions. Standards for small and medium-sized enterprises are affected more than those for large entities. Shocks to capital are channelled to firms mostly through the terms and conditions which are related to loan price: average spreads and spreads on riskier loans. The third most used channel is required collateral. Adverse shocks to the capital position result in lower lending for real property acquisition, for financing working capital and on the current account.

Since the global financial crisis (GFC), capital requirements have become a standard instrument in the macro-prudential policy toolkit. Thus, there is a need to have a good grasp of the impact of changes in bank capital on lending to the non-financial sector and on real sector activity. Usually, empirical works which estimate the impact of changes in bank capital use the actual data on capital ratio, e.g. Kanngiesser et al. (2017). In our paper (Wróbel (2021)), we do it in a different way. Namely, to analyse the case of Poland, we employ data from the Senior Loan Officer Opinion Survey (SLOOS).2 In the survey, lending officers are asked about current and expected credit policy as well as its drivers, such as macroeconomic or industry-specific risk, asset quality or capital position.

Our estimates show that a short answer to the question posed in the title of this report is that surveys are indeed informative and may indicate which strategy banks would employ to adjust capital. Namely, banks can (i) issue new equity, (ii) use the retained earnings, or finally (iii) deleverage. The latter comprises reducing lending and risk weights, i.e. changing the structure of lending or the structure of total assets, increasing the share of those which are safer, such as government securities. We find that in Poland banks tend to de-risk and reduce lending, in particular for real property acquisition and for financing working capital and on the current account.

In the paper, we analyse the impact of shocks to the bank capital position, as perceived by credit officers, on a wide range of financial variables and investment (Gross Fixed Capital Formation). The list of financial variables comprises lending standards for large (LE) and small and medium-sized enterprises (SME), lending terms and conditions (T&C)3, and various types of loans to corporates and sole proprietors. Moreover, we check whether such shocks are transmitted through price channels, e.g. spreads or rather by non-price channels, such as required collateral or loan maturity. This gives information whether in response to shocks to the capital position banks reduce the supply of loans – this can be the case if they adjust average spreads – or whether they tend to de-risk their loan portfolio. In the latter case we would expect a reaction of spreads to riskier borrowers. A by-product of such an analysis is a signal to the monetary policy setters concerning behaviour of spreads and making it easier to avoid excess monetary tightening or laxity. In a parallel analysis of lending standards to LE and SME, we verify if shocks to capital induce a tighter policy with respect to the latter group, which is commonly considered as riskier and vulnerable to information asymmetry. A tighter policy with respect to small and medium sized enterprises gives another indication that banks might want to de-risk their portfolio of loans.

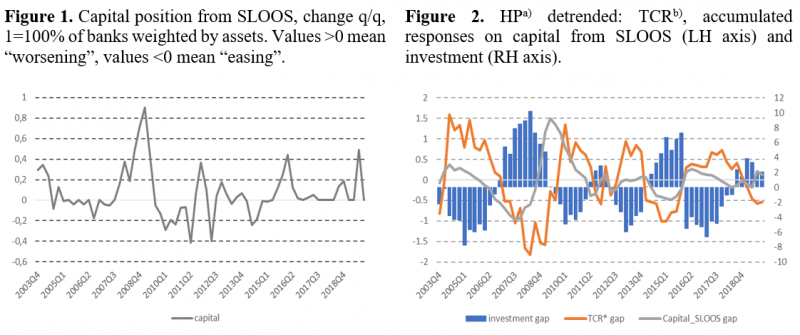

The capital position reported in SLOOS displays 4 episodes of increased concerns of banks in Poland: at the time of the GFC and the European sovereign debt crisis, and then transitorily in 2016 and 2019; the latter two cases were due to the expected fall in profits (Fig.1).

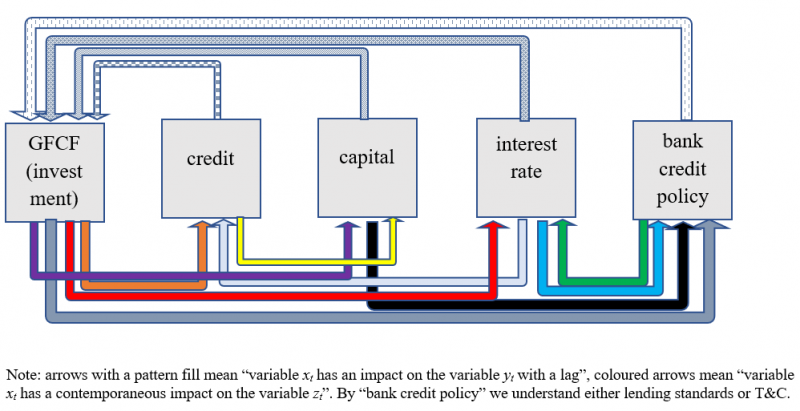

There is a clear-cut cyclical pattern in both “soft” data from SLOOS and “hard” data on the capital ratio (Fig. 2). “Hard” data and accumulated data on the capital position from SLOOS display a long-term relationship (are cointegrated). Changes in the capital position from SLOOS are weakly exogenous with respect to changes in the capital ratio. Moreover, the Granger causality test shows that data from the survey “cause” changes in the capital ratio, which actually means that SLOOS data are forward-looking and bring additional information on future developments in the capital ratio. Lending standards show that in “good” times, banks tended to gain more ground in the riskier SME segment of the market, but in “lean” times this sector was more vulnerable to policy tightening (Fig. 3). What is particular in the behaviour of lending terms and conditions (Fig. 4) is the relatively high variability of spreads. They are less downward rigid than other T&C and seemingly reflect developments in the capital position and macroeconomic risk. Other lending terms are more related to the quality of banks’ assets (represented by the share of non-performing loans).

Note:a) HP means Hodrick-Prescott filter, λ=1600. b)TCR stands for Total Capital Ratio. To the end of 2013 Capital Adequacy Ratio.

Source: NBP and own calculates.

Source: NBP.

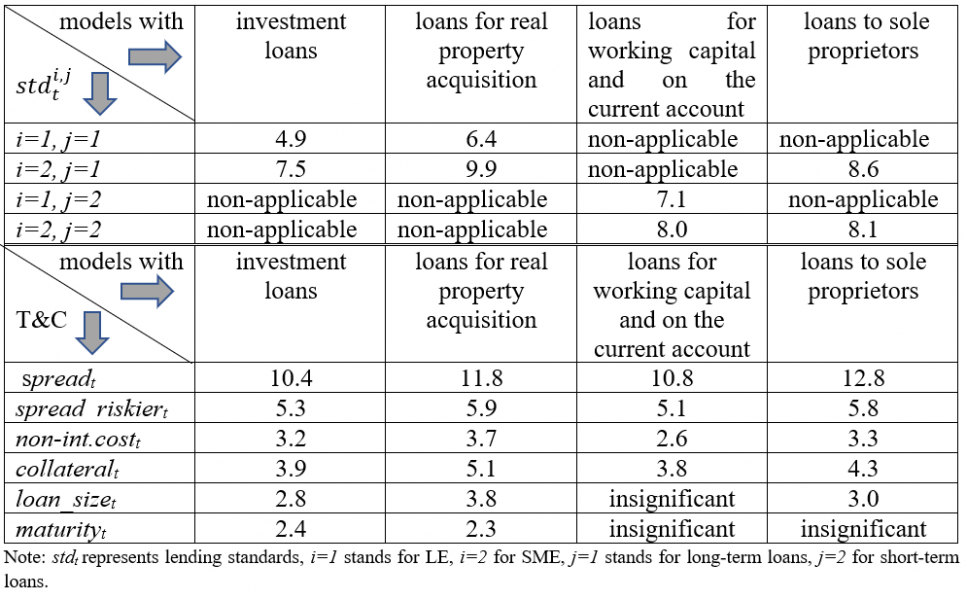

We build a set of structural vector autoregression models. This way it is possible to account for dynamic relationships between variables and avoid the endogeneity problem. The latter is binding since bank capital depends on macroeconomic developments, monetary policy and lending.

There are three groups of models. They differ by the type of loan and lending standards (or T&C). The first group contains long-term loans (for investment or for real property acquisition) and long-term standards for either LE or SME. The second group – short-term loans (for working capital and on the current account) and short-term standards, as before either for LE or SME. The last group is devoted to sole proprietors. In total, we have 32 models with various combinations of loans and lending standards or terms and conditions. To identify structural shocks, we have used a set of assumptions and restrictions. They are displayed in Scheme 1.

Scheme 1. Assumptions and restrictions used in the models.

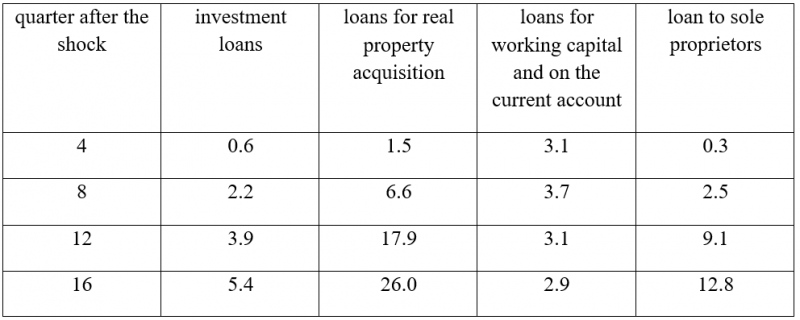

Once again, a short answer is yes, they do. Adverse shocks to the capital position lead banks to tighten credit policy. After an innovation, more banks tend to tighten standards for SME than for LE. This is particularly true in the case of standards on long-term loans (Table 1). While a typical reaction of standards for SME to a 15% shock4 is 7.5-9.9%, for LE this is around 4.9-6.4%, depending on the model. This gives some evidence that in response to adverse shocks to capital, banks tend to de-risk their credit portfolios.

In turn, responses of T&C show that after a shock to capital, banks mostly adjust average spread and spread on riskier loans. Although these two kinds of T&C are used the most, there is a considerable difference between them: the response of spreads amounts from about 10 to nearly 12%, depending on the model, whereas the response of spreads on riskier loans from about 5 to 6%. It should be noted here, that it does not mean that average spreads increase more than spreads on riskier loans, but that after an innovation to capital, more banks (weighted by assets) tend to tighten average spreads than spread on riskier loans. The third largest response is that of required collateral. It is followed by another price dimension of credit policy, i.e. non-interest rate cost. Thus, it seems that banks react mostly by reducing the overall supply of credits, and as a second most frequently used strategy – de-risk their loan portfolio. These results are in line with Tressel and Zhang (2016) for the euro area.

Responses obtained from models which employ loans to sole proprietors suggest that these borrowers are perceived as risky and are the most vulnerable to tightening of loan supply. The response of spread is the largest of all obtained from our models, whereas the response of spread on riskier loans is close to that from the model with loans for real property acquisition for corporates. The responses of other T&C are more in line with those obtained for the corporate sector. This supports our previous observations that after adverse innovations to capital, banks de-risk their portfolios.

In addition to reactions of lending standards, terms and conditions, we have examined impulse responses of other variables of the models: investment, loans and the interest rate. Adverse shocks to the capital position tend to gradually increase the interest rate. As a result, investment falls, followed by a reduction in loans for real property acquisition and short-term loans for financing working capital and on the current account. The responses of investment loans, although negative, are statistically insignificant (we use 95% confidence intervals). Table 2 shows that in the short-run, shocks to capital are the most important for loans for working capital and on the current account, whereas in the longer horizon – for loans for real property acquisition and to sole proprietors.

Table 1. Responses of standards, T&Cs (in %) to a standardized 15% adverse shock to capital position

Table 2. Variance decomposition of loans: the role of capital shocks, in %

In the paper, we use bank lending survey data for Poland and find that they make it easier to understand the implications of shocks to bank capital for their lending policy. By virtue of the construction of the questionnaire, it brings information on the strengthening (weakening) of banks’ balance sheets if it indeed contributed to changes in credit policy. This feature means that we dispose of a set of less noisy data as compared to the actual capital ratios and that they are directly related to bank credit policy. What is more, a comparison of changes in the actual capital ratios and survey data shows that the latter bring information about the future behaviour of the former.

Our estimations confirm that bank declarations about changes in the capital position are reflected in lending standards, terms and conditions. Shocks to capital are transmitted mainly through spreads, both average and for riskier borrowers. The most used non-price channel is required collateral. Banks treat SME as riskier than LE, and therefore after negative innovations to capital, more banks would tighten credit policy with respect to SME than LE. The fact that shocks to capital are mainly transmitted through spreads means that to avoid excessive tightness (or laxity) of monetary conditions, macroprudential and monetary policies need to be coordinated.

Kanngiesser D., Martin R., Maurin L., Moccero D., (2017), Estimating the impact of shocks to bank capital in the euro area, Working Paper, 2077, European Central Bank.

Tressel Th., Zhang Y.S., (2016), Effectiveness and Channels of Macro-prudential Instruments, Lessons from the Euro Area, IMF Working Paper, WP 16/4, International Monetary Fund.

Wróbel E. (2021), Shocks to bank capital position: Do they matter for lending to firms and how they are channelled? Evidence from Senior Loan Officer Opinion Survey for Poland, NBP Working Paper 336, Narodowy Bank Polski.

Narodowy Bank Polski, Financial Stability Department, Macroprudential Research Division, ewa.wrobel@nbp.pl. Opinions expressed by the author do not necessarily reflect the official viewpoint of Narodowy Bank Polski. The author would like to thank Ryszard Kokoszczyński, Mateusz Pipień, Tomasz Łyziak and Dobiesław Tymoczko (all NBP), and an anonymous referee for helpful comments and valuable suggestions.

Data come from the Senior Loan Officer Opinion Survey conducted by Narodowy Bank Polski, https://www.nbp.pl/homen.aspx?f=/en/systemfinansowy/kredytowy.html.

Terms and conditions comprise average and riskier spreads, non-interest rate cost, maturity, required collateral, and loan size.

Shocks are normalized across models to 15% (they usually ranged from 14.6% to 16%). A 15% shock means that 15% of banks (weighted by assets) perceived an adverse change in the capital position. Similarly, a 7.5% reaction of standards (or T&C) means that in response to a shock to capital, 7.5% of banks (weighted by assets) tightened their credit policy.