This policy brief summarizes the results of Fernández Lafuerza and Galán (2024). This policy brief is the exclusive responsibility of the authors and does not necessarily reflect the opinion of the Banco de España or the Eurosystem.

Abstract

Our study provides compelling evidence of the association between credit standards at loan origination in the corporate sector and bank default risk. Using data from the Spanish credit register merged with corporate balance sheet information spanning the last financial cycle, we demonstrate that leverage and debt burden ratios at loan origination are key predictors of future corporate loan defaults. The strength of these associations varies over the cycle, across sectors and depending on firm characteristics such as size, age and the existence of prior banking relationships. Real estate firms and SMEs exhibit the strongest connection between credit standards and future default. Overall, our findings support the adoption of borrower-based measures targeting corporate credit and provide guidance for its implementation, emphasizing the importance of accounting for relevant firm specificities when deploying this tool.

The prominent role of non-financial private sector debt in previous financial crises (Schularik and Taylor, 2012; Claessens et al., 2012) prompted the introduction of broad macroprudential policy measures, such as the countercyclical capital buffer. However, the existence of pockets of heightened systemic risks in specific segments has highlighted the need of targeted macroprudential measures. In this regard, the connection between house prices and credit before the global financial crisis has focused the attention on mortgage debt as a determinant of systemic vulnerabilities (Jorda et al., 2016; Ru nstler and Vlekke, 2017). Notably, previous research has revealed that the relaxation of lending standards significantly contributed to the surge in mortgage volumes leading up to the global financial crisis, and this easing was strongly associated with the severity of the crisis (Duca et al., 2010; Schelkle, 2018).

Following this, in terms of policy, borrower-based measures (BBM) are being increasingly employed as macroprudential tools to mitigate systemic risk stemming from mortgage credit. BBM are implemented by restricting the types of mortgages banks can grant, based on the indebtedness of the borrower. They are typically operationalized as limits to leverage and debt burden such as the loan-to-value and the loan-to-income ratios. Recent literature has shown that mortgage BBM can have significant effects on reducing the probability of mortgage defaults (Nier et al., 2019; Gala n and Lamas, 2023), and curbing credit and house price growth (Claessens et al., 2013; Cerutti et al., 2017).

Nonetheless, less attention has been paid to the relationship between lending standards in credit to non-financial corporations (NFC) and default risk. This is particularly noteworthy given the substantial imbalances observed in corporate credit prior to the global financial crisis, and the elevated non-performing loan ratios within this sector during the crisis. Furthermore, after the crisis, the relative importance of corporate credit has steadily risen. Between 2008 and 2019, NFC credit in the 43 countries reporting data to the Bank for International Settlements expanded by 63%, reaching approximately 100% of GDP. This represents more than double the growth rate observed for HH credit. These developments raise significant concerns, not only due to the potential imbalances with respect to fundamentals but also because of the link between the relaxation of lending standards during periods of high credit growth and the build-up of systemic risk. This association, previously demonstrated for mortgages, may also be relevant in the context of NFC credit.

Against this background, we investigate the relationship between credit standards at origination and default risk in NFC lending. This analysis provides justification for the use of BBM in the corporate sector, which may complement sectoral capital measures, in the same line it has been found in the mortgage market by increasing the resilience of borrowers to shocks and mitigating cyclical vulnerabilities (see O’Brien and Ryan 2017, Apergis et al., 2022 and Valderrama, 2023 for a discussion).

We perform the analysis by employing bank-firm level data on corporate credit granted in Spain during the period 2000-2020, covering a complete credit cycle. Specifically, we collect data for over 10.9 million bank-firm transactions during that timeframe, by combining Spanish credit register data with firm balance sheet information in the Central de Balances, a service collecting data from the mercantile registry. We identify new bank loans granted to NFC, and follow them over time to see if they ever enter into default.1 Then, we construct firm indebtedness measures at the time of the loan origination. In particular, we focus on the debt-to-assets ratio (DTA), the debt-to-earnings (DTE) ratio, and the interest coverage ratio (ICR). We compute debt as the sum of the outstanding bank exposures of the firm in the credit register and non-bank debt reported in the mercantile register. As a measure of earnings we consider the EBITDA. We divide NFC credit into three subsectors of interest: construction and real estate companies (RE), small and medium-size enterprises in other sectors (SME), and large corporations in other sectors. This approach aligns with the findings of previous studies, which identify the benefits of a separate analysis by size and relevant subsectors (Müller and Verner; 2023; Altman and Sabato, 2007; Cathcart et al., 2020), which played a highly predominant role during the global financial crisis in Spain. The relationship between credit standards at origination and defaults is assed with a linear probability model, where a variety of firm controls and fixed effects are included.

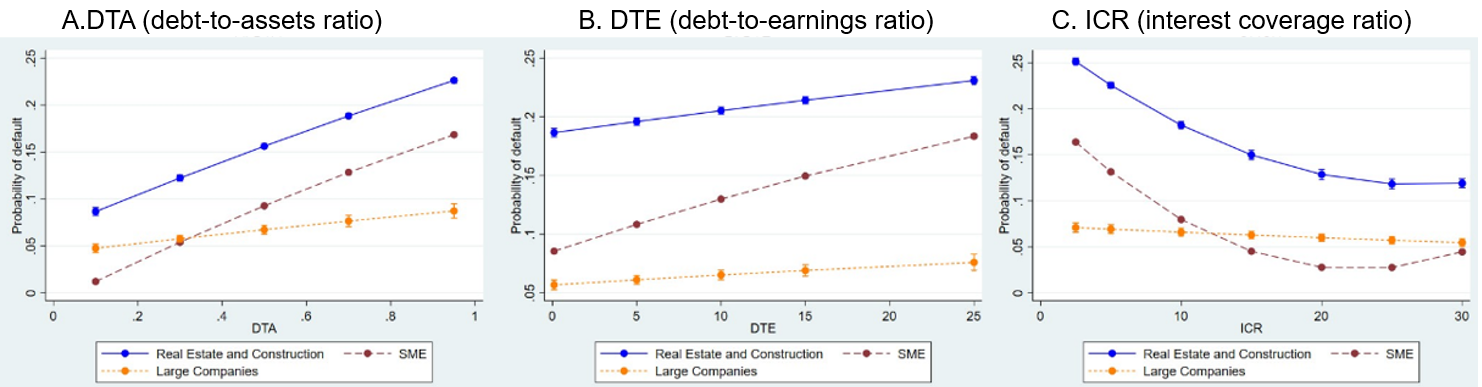

Our results show that credit standards at origination have a strong association with future defaults, even after controlling for a variety of firm and loan characteristics, and fixed effects. These associations are particularly strong for RE companies and SMEs (Figure 1).

Highly leveraged RE companies present high default probabilities, reaching up to 23% for those with a DTA ratio of 0.95. This probability is almost 3 times higher than for lowly leveraged firms (DTA = 0.1). The association is also strong, although of smaller magnitude for DTE and ICR. For SMEs, probabilities are lower in terms of magnitude, though marginal effects are larger, signalling the high sensitivity of the default risk of these firms to variations in credit standards. In fact, the default probability of SMEs with a DTA of 0.95 is around 14 times higher than that of firms with a DTA of 0.1. Likewise, SMEs with a low fraction of interest expenses covered by earnings (ICR=2.5) have a default probability about 3.5 higher than firms with high values of the ICR (around 25) at loan origination.

In the case of large companies, default probability is significantly lower than for the other types of firms at almost all relevant values of the three credit standard measures, though marginal effects are still quite sizable. The default rate in large companies is found to increase from 5%, in lowly leveraged firms (DTA=0.1), to 9% in highly leveraged firms (DTA=0.95).

Figure 1. Estimated association between credit standards at loan origination and default

Note: The models include a linear and a quadratic term in the corresponding credit standard (DTA, DTE or ICR), and a dummy for negative income (EBITDA) in the models including DTE and ICR, as well as controls for firm size (log assets), liquidity (liquid assets over liquid liabilities), profitability (ROE), age, firm-level interest rate, dummies identifying whether the loan has any guarantee and whether the firm belongs to a group, as well as bank, postal code, year and sector (2 digits NACE code) fixed effects. Higher ICR values correspond to lower debt burden.

We also find that the relationship between credit standards at loan origination and default risk is quite heterogeneous depending on the existence of a prior bank-firm relation and on the age of the firm. In particular, we find that risk discrimination of credit standards is lower for young firms. That is, easier lending standards (higher DTA or lower ICR) increases default risk less in young firms compared to more mature firms. The economic significance of these results is also quite relevant. The reason behind these results may be related to the stricter screening processes faced by these firms, suggesting that unobserved factors assessed by banks are more relevant than financial ratios at the moment of granting the loan. In addition, young firms might be particularly dependent on bank funding to establish and expand operations, implying that medium-term prospects are more relevant for their repayment capacity than their financial ratios at loan origination. This relationship is especially relevant for SMEs and RE companies, while it is very weak or even not significant for large firms, implying that lending standards are less sensitive to age in these type of companies.

Regarding bank-firm relationship, we also find interesting results showing that the association between lending standards and default risk is less strong in firms with new bank relations. As in the case of age, the reason behind these results may also be related to stricter screening processes faced by firms establishing a new bank relation (Berger and Udell, 1995). Economically, the effects are also relevant in this case. In particular, the reduction in default risk for a firm establishing a new bank relation (at similar levels of DTA or ICR) can reach up to 65% for RE, 62% for SMEs and 93% for large companies. From a policy perspective, these findings indicate the need of accounting for the heterogeneous effects of lending standard limits on firms with these characteristics. This might be particularly relevant for young firms, as these firms can be highly dependent on bank credit for growing.

Since our sample covers a complete financial cycle in Spain, we can investigate whether the association of default risk with credit standards at loan origination is dependent on the phase of the cycle. In general, we observe that the associations between lending standards and defaults are stronger for credit originated during crisis years. This is especially evident for DTA in SMEs and RE companies. This result is interesting since the pre-crisis period in Spain was characterized by a credit boom and relaxed credit standards, so one could expect that the standards would be more informative for credit originated before the crisis. However, the fact that pre-crisis DTA is less associated with default risk, might be related to the asset overvaluation presented in the boom period. Certainly, overvaluation of house prices introduced significant distortions to the relationship between lending standards and risk in the mortgage market in Spain (see Galán and Lamas, 2023). This phenomenon could also affect the valuation of assets of companies in the RE sector, which had a starring role during the boom in Spain.

In contrast, lending standards of loans granted during the post-crisis period show weaker effects on default risk, although still highly statistically significant (except DTE for RE and large companies). This is reasonable since during this period credit conditions have not been relaxed while the financial situation of firms has improved. The relation between ICR and default is similar for credit originated before the crisis and during the crisis, but is markedly lower for credit originated after the crisis. This might be the result of the direct effect that interest rates have in the ICR. These results suggest that a combination of limits on leverage and debt burden could be more effective on reducing default risk across the financial cycle. We indeed find that interactions between credit standards are statistically significant and that accounting for them improve the performance of default predictions.

The findings described above support the use of BBM as an effective tool to reduce corporate credit default risk and enhance financial stability during adverse shocks, mirroring the success of similar measures implemented in the HH sector (Cerutti et al., 2017; Akinci and Olmsted-Rumsey, 2018). By introducing BBM in the corporate sector, policymakers can complement existing lender-based tools aimed at enhancing bank resilience to corporate exposures. In particular, BBM would strengthen firms’ resilience to both systemic and specific shocks (such as sudden income or interest rate variations), while also mitigate the build-up of systemic vulnerabilities associated with corporate lending (Apergis et al., 2022; Brandao-Marques et al., 2022).

The evidence presented in this study highlights the importance of explicitly incorporating BBM for corporate credit within national macroprudential regulatory frameworks, which typically focus primarily on HH loans. For a practical implementation, our results provide some key thresholds that could be considered as a reference when deploying this tool, and suggest that combining limits on firm leverage and debt burden might lead to policies that are more robust across the financial cycle. Nonetheless, our findings suggest that a one-size-fit-all approach would be not appropriate. The policy design of these tools should take into consideration the identification of key systemic sectors, such as RE, as well as distinctions based on firm size, age, and new bank relationships. Additionally, the position in the financial cycle and firms’ health play critical roles in calibrating these policies to prevent credit constraints from adversely affecting solvent but illiquid firms during financial stress events. Drawing experience from the use of BBM in the mortgage sector, implementing speed limits (i.e. allowing a fraction of loans above specified limits) tied to firm characteristics and the economic cycle could offer a practical mechanism to address these concerns.

Akinci, Ozge, and Jane Olmstead-Rumsey. (2018). “How effective are macroprudential policies? An empirical investigation”. Journal of Financial Intermediation, 33, pp. 33–57.

Altman, Edward I. (1968). “Financial ratios, discriminant analysis and the prediction of corporate bankruptcy”. The Journal of Finance, 23(4), pp. 589-609.

Altman, Edward I., and Gabriel Sabato. (2007) “Modelling Credit Risk for SMEs: Evidence from the U.S. Market”. Abacus, 43 pp. 332-357.

Antunes, Antonio, Homero Gonçalves, and Pedro Prego. (2016). “Firm default probabilities revisited”. Banco de Portugal Economic Studies, 4 pp. 21-45.

Apergis, Nicholas, Ahmet F. Aysan, and Yassine Bakkar. (2022). “Borrower- and lender-based macroprudential policies: What works best against bank systemic risk?”. Journal of International Financial Markets, Institutions and Money, 80, 101648.

Araujo, Juliana, Manasa Patnam, Adina Popescu, Fabian Valencia, and Weijia Yao. (2020). “Effects of Macroprudential Policy: Evidence from Over 6,000 Estimates”. IMF Working Paper WP 2020/67, International Monetary Fund.

Berger, A. N. and Udell, G. F. (1995). “Relationship lending and lines of credit in small firm finance”. The Journal of Business, 68, pp. 351–381.

Brandao-Marques, Luis, Qianying Chen, Claudio Raddatz, Jerome Vandenbussche, and Peichu Xie. (2022). “The riskiness of credit allocation and financial stability”. Journal of Financial Intermediation, 51:100980.

Cathcart, L., Dufour, A., Rossi, L., and Varotto, S. (2020). “The differential impact of leverage on the default risk of small and large firms”. Journal of Corporate Finance, 60:101541.

Cerutti, Eugenio, Stijn Claessens, and Luc Laeven. (2017). “The use and effectiveness of macroprudential policies: New evidence”. Journal of Financial Stability, 28, pp. 203-224.

Claessens Stijn, M. Ayhan Kose, and Marco E. Terrones. (2012) “How do business and financial cycles interact?”. Journal of International Economics, 87, pp. 178–190.

Claessens, Stijn, Swati R. Ghosh, and Roxana Mihet. (2013). “Macro-prudential policies to mitigate financial system vulnerabilities”. Journal of International Money and Finance, 39 pp. 153-185.

Duca, John V., John Muellbauer, and Anthony Murphy, A. (2010). “Housing markets and the financial crisis of 2007-2009: Lessons for the future”. Journal of Financial Stability, 6 pp. 203–217.

Galán, Jorge E. and Matías Lamas. (2023). “Beyond the LTV Ratio: Lending Standards, Regulatory Arbitrage, and Mortgage Default”. Journal of Money, Credit and Banking, 13041.

Jordà, Òscar, Moritz Schularick, Alan M. Taylor. (2016). “The great mortgaging: housing finance, crises and business cycles”. Economic Policy, 31, pp 107–152.

Müller, Karsten, and Emil Verner. (2023). “Credit Allocation and Macroeconomic Fluctuations”. Working Paper 31420, National Bureau of Economic Research.

Nier, Erlend, Radu Popa, Maral Shamloo, and Liviu Voinea. (2019). “Debt Service and Default: Calibrating Macroprudential Policy Using Micro Data”. IMF Working Paper 2019/182, International Monetary Fund.

O’Brien, E. and Ryan, E. (2017). “Motivating the Use of Different Macroprudential Instruments: The Countercyclical Capital Buffer vs. Borrower-Based Measures”. Economic Letter Series, 15. Central Bank of Ireland.

Rünstler, Gerhard, and Marente, Vlekke. (2017). “Business, housing, and credit cycles”. Journal of Applied Econometrics, 33, pp. 212-226.

Schelkle, Thomas. (2018). “Mortgage Default during the U.S. Mortgage Crisis”. Journal of Money, Credit and Banking, 50 pp. 1101-1137.

Schularick, Moritz, and Alan Taylor (2012). “Credit Booms Gone Bust: Monetary Policy, Leverage Cycles, and Financial Crises, 1870-2008”. American Economic Review, 102(2), pp. 1029-1061.

Valderrama, Laura. (2023), “Calibrating Macroprudential Policies in Europe”. IMF Working Paper 2023/75, International Monetary Fund.

Our baseline definition of default is being in arrears for more than 3 moths, but the results are robust to considering softer or stricter definitions of default.