We estimate the impact of country risk premium shocks for a panel of advanced economies and study the welfare implications of capital controls. A positive risk premium shock leads to a contraction in output, but only in countries belonging to the European Monetary Union. Under floating exchange rates, the output response is insignificant. Imposing a counter-cyclical tax on external debt supports monetary policy in offsetting the adverse effects of risk premium shocks and is therefore welfare enhancing, particularly under monetary union. However, such a tax could also reduce welfare if the economy faces other shocks, such as demand and productivity shocks. With rising risk premia hampering the transmission of monetary policy to individual member countries, macro-prudential policies that aim at managing capital flows may be a tool to support monetary policy.

The literature on cross-border capital flow management has mostly singled out emerging market economies whilst ignoring advanced economies. Yet the events of the European sovereign debt crisis revealed that sudden capital outflows and rising risk premia can occur in developed countries as well. In our paper (Bonam et al 2020), we estimate the impact of such risk premium shocks for a panel of advanced economies using a Bayesian panel vector autoregression model. We find that the response of output to a positive risk premium shock is significantly negative, yet only in a monetary union. Under flexible exchange rates and autonomous monetary policy, risk premium shocks do not reduce output.

To better understand how risk premium shocks propagate through the economy, we employ a stylized two-country New Keynesian model. Consistent with our empirical findings, the model predicts a contractionary impact of risk premium shocks under monetary union, and an expansionary impact under flexible exchange rates. The latter arises from a strong depreciation of the real exchange rate that supports output growth through higher net exports and which is more limited under monetary union.

Finally, we use the model to investigate the welfare implications of capital controls, which we introduce as a counter-cyclical tax on external debt. The welfare gains of imposing such a tax hinge on the type of shock hitting the economy and the prevailing exchange rate regime. When faced with only risk premium shocks, the counter-cyclical tax raises welfare under both monetary union and flexible exchange rates as it supports monetary policy in stabilizing inflation and economic conditions. The welfare gains are substantially larger under monetary union than under a float. When faced with other (e.g. demand and productivity) shocks, the tax might, however, undermine monetary policy and thereby reduce welfare.

To estimate the effects of country-specific risk premium shocks, we use monthly data for 16 advanced economies covering the period 1999M1 to 2016M12. We group the countries into those belonging to the euro area (labeled ‘monetary union’) and those operating under flexible exchange rates and autonomous monetary policy (‘floats’).2 For each group, we estimate a Bayesian panel vector autoregression (BPVAR) model.3 Included in our baseline model are the composite Purchasing Managers Index (PMI), which we use as a measure for real economic activity, the Consumer Price Index (CPI), the short-term interest rate, the real effective exchange rate (REER), the VIX volatility index, to control for global risk, and the oil price, to capture global supply-side shocks.4

To identify risk premium shocks, we also include a measure of the country risk premium. Following Bernoth et al. (2004), Beetsma et al. (2013) and Beirne and Fratzscher (2013), among others, we proxy the country risk premium by the spread between a country’s long-term sovereign bond yield and the long-term interest rate of a base country. The choice of the base country may, of course, differ per country. Here, we follow Davis and Zlate (2019) and use either the US or Germany for all the countries. The risk premium shocks are then identified by assuming that risk premium shocks have no immediate impact (i.e. within the same month) on the other variables.

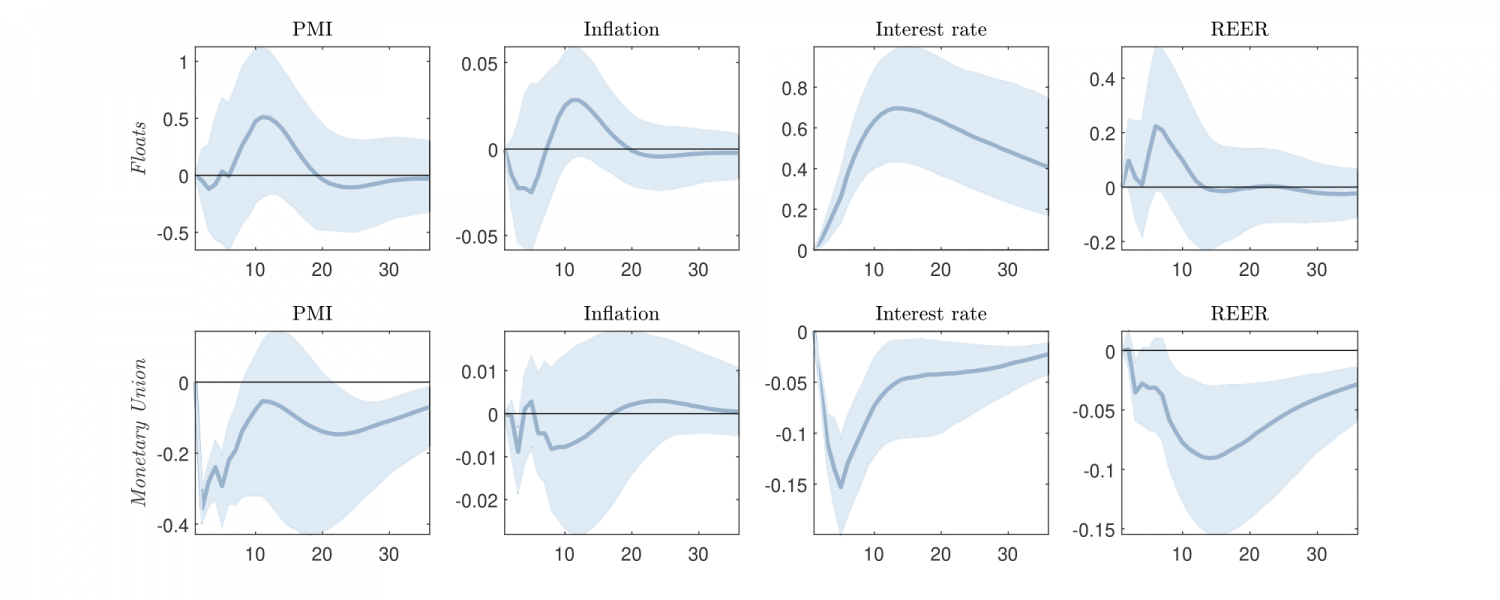

Figure 1. Impulse responses to a risk premium shock, BPVAR model

Figure 1 shows the estimated responses to a 100bp increase in the risk premium for our panel of countries operating under floating exchange rates (top row) and those belonging to a monetary union (bottom row). The risk premium shock has a significantly negative impact on output, but only in a monetary union. Under a float, the risk premium shock does not reduce output. If anything, the median estimate points to an increase in economic activity following a risk premium shock, yet the response is not significant (in Bayesian terms).

To better understand the effects of risk premium shocks across exchange rate regimes and evaluate the welfare implications of imposing capital controls, we employ a standard New Keynesian (NK) model consisting of two countries, Home and Foreign. In line with our empirical analysis, we consider two versions of the model: one in which both countries operate under flexible exchange rates and one where they form a monetary union.

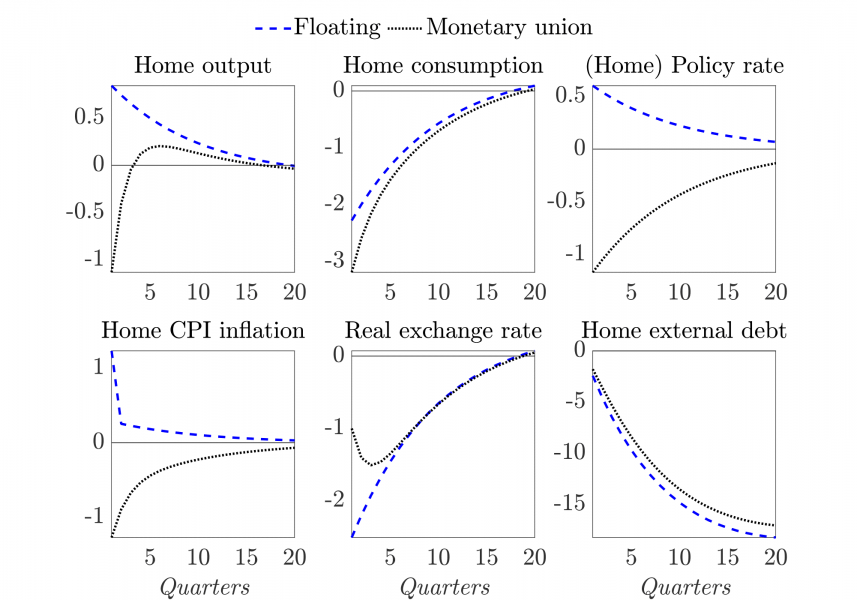

Figure 2 shows the responses to a risk premium shock in Home, as predicted by the model. Consistent with our empirical findings, the risk premium shock has a negative impact on output, but only under monetary union. Under flexible exchange rates, the shock leads to a sharp depreciation of the real exchange rate which supports net exports and thereby output. As a consequence, the risk premium shock raises inflation under a float, which prompts the central bank to raise the interest rate despite the contraction in consumption. Under monetary union, the inflation response is negative and so the central bank lowers the interest rate. However, since the supranational central bank targets union-wide (rather than national) inflation, the amount of monetary accommodation is less than what it would have been if Home had full autonomy over monetary policy.

Figure 2. Impulse responses to a risk premium shock, NK model

The results show that, under both exchange rate regimes, the central bank is ill-equipped to fully stabilize inflation and output following a risk premium shock. Hence, there might be scope for macro-prudential policies to support monetary policy and improve macroeconomic outcomes. We introduce capital controls to the model by assuming that Home households pay a proportional tax on their external debt position vis-à-vis Foreign. The tax is meant to discourage an all too large build-up of external debt and thereby prevent financial imbalances from becoming unsustainable. Conversely, shocks triggering sharp capital outflows from Home to Foreign result in a decline in the tax that support the demand for external debt. Hence, the tax moves counter-cyclically with Home’s net external asset position.

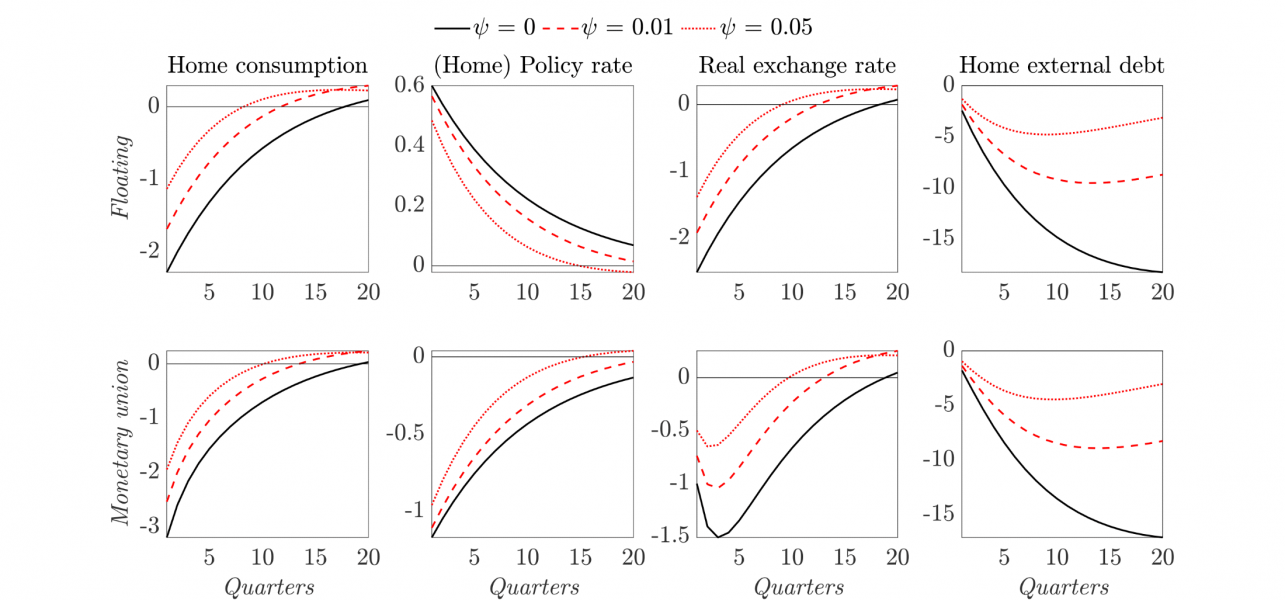

Figure 3 shows the impact of a risk premium shock under floating exchange rates (top) and monetary union (bottom), and for different calibrations of the tax elasticity with respect to external debt, denoted by ψ. The stronger is the counter-cyclical bent of the tax, the more muted are the effects of the risk premium shock, under both exchange rate regimes. As capital flows out, the tax turns into a subsidy and thereby reduces the effective interest rate on external debt. This implies a more limited exchange rate depreciation required to satisfy the uncovered interest parity (UIP) condition.5 Under a float, inflation therefore rises by less and so the central bank is not prompted to raise the interest rate by as much as it would have in the absence of the tax. Under monetary union, the (negative) tax complements monetary policy by lowering household’s borrowing costs, thereby effectively increasing the scope of monetary accommodation at the national level.

Figure 3. Impulse responses to a risk premium shock under a debt tax

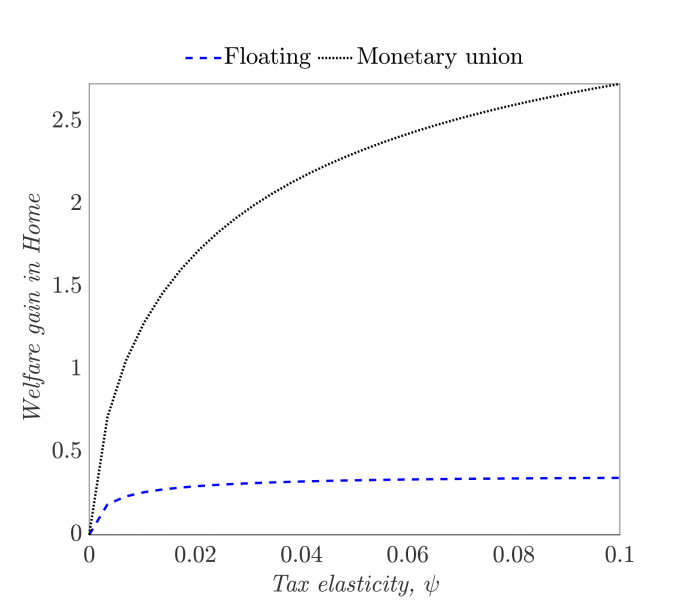

Given the ability of the debt tax to support monetary policy in warding off risk premium shocks, it follows that imposing such a tax has the potential to raise welfare. Indeed, as shown in Figure 4, welfare increases monotonically with the tax elasticity.6 These welfare gains, which are larger under monetary union than under a flexible exchange rate regime, are conditional on risk premium shocks being the sole driver of economic fluctuations. The welfare implications of imposing the debt tax may be negative when the economy faces other shocks. For example, a positive shock to aggregate demand raises inflation and is associated with a buildup of external debt as households borrow to finance their increased spending. The latter implies a rise in the tax on debt which, by the UIP condition, puts downward pressure on the exchange rate as it lowers the after-tax return on external debt. Under a float, the exchange rate depreciation further fuels inflation, making it more difficult for the central bank to stabilize inflation. Hence, in this case, the debt tax undermines monetary policy and reduces welfare. Under monetary union, the debt tax is still welfare improving as it prompts the central bank to respond more aggressively to the rise in inflation in Home, thereby bringing the monetary policy response closer to what would have emerged under autonomous monetary policy.

Figure 4. Welfare gain of tax on external debt, conditional on risk premium shocks

Note: Welfare units are measured in consumption perpetuities (i.e. the perpetual increase in consumption as a percentage of steady-state consumption). The welfare gain is derived by comparing welfare outcomes against a baseline scenario in which ψ=0.

Similar to emerging market economies, advanced economies can be subject to ‘sudden stops’ and shifts in investor risk aversion that trigger risk premium surges and vast capital outflows. Such episodes are likely to be more problematic when countries belong to a monetary union and autonomous monetary policy cannot be employed to absorb country-specific shocks.

We provide novel estimates on the impact of risk premium shocks and show that they are contractionary under monetary union, but not under floats. Monetary policy may be inadequate to fully offset the adverse effects of risk premium shocks, regardless of the prevailing exchange rate regime. Capital controls, such as a tax on external debt, may complement monetary policy in stabilizing inflation and economic conditions, and can therefore improve welfare. Capital controls are more likely to raise welfare when a country is part of a monetary union and when risk premium shocks are an important source of aggregate fluctuations.

The recent COVID-19 crisis exemplified that, even in the face of a large symmetric shock, the transmission of monetary policy in a monetary union can be hampered by heterogeneous developments of risk premia across member states. Our results suggest that macro-prudential policies, which manage cross-border capital flows within the monetary union, can support monetary policy by offsetting risk premium shocks and thereby contribute to a smooth functioning of the monetary union.

Beetsma, R., Giuliodori, M., De Jong, F., and Widijanto, D. (2013). Spread the news: The impact of news on the European sovereign bond markets during the crisis. Journal of International Money and Finance, 34: 83–101.

Beirne, J. and Fratzscher, M. (2013). The pricing of sovereign risk and contagion during the European sovereign debt crisis. Journal of International Money and Finance, 34: 60–82.

Bernoth, K., Von Hagen, J., and Schuknecht, L. (2004). Sovereign risk premia in the European government bond market. Working Paper Series 369, European Central Bank.

Bonam, D., Goy, G., and Veirman, Emmanuel de (2020). Should developed economies manage international capital flows? An empirical and welfare analysis. De Nederlandsche Bank Working Paper No. 702.

Davis, J. S. and Zlate, A. (2019). Monetary policy divergence and net capital flows: Accounting for endogenous policy responses. Journal of International Money and Finance, 94: 15-31.

Jarocinski, M. (2010). Responses to monetary policy shocks in the east and the west of Europe: A comparison. Journal of Applied Econometrics, 25(5): 833–868.

The views presented are those of the authors and do not necessarily reflect the official position of De Nederlandsche Bank or the Eurosystem.

Monetary union: Austria, Belgium, Finland, France, Ireland, Italy, the Netherlands, Portugal, and Spain; Floats: Australia, Japan, New Zealand, Sweden and the United Kingdom.

We do not impose the coefficients to be the same across countries, but rather allow for cross-subsectional heterogeneity by assuming that these coefficients are drawn from the same posterior distribution (see Jarocinski, 2010).

The PMI, CPI, REER, VIX and oil price series enter the model in deviations from an HP-filtered trend, whereas the short-term interest rate is expressed in levels.

The UIP condition states that the difference between the Home and Foreign interest rate should be proportional to the expected depreciation of the Home currency.

Welfare is proxied by the household’s utility function. Welfare units measure the perpetual increase in consumption as a percentage of steady-state consumption.