In exceptional times, monetary finance may provide helpful policy support but there are risks.

The severe economic challenges posed by the global financial crisis, and more recently the pandemic, sparked a debate on whether central banks should expand their unconventional monetary policy toolkit to include monetary finance − the financing of government via money creation.

Monetary finance is often associated with Milton Friedman’s metaphor of a helicopter dropping money from the sky. Reflecting on the role of monetary policy during the Great Depression, the Nobel laureate argued that a permanent increase in the monetary base could stimulate aggregate demand even in a severe liquidity trap, that is when interest rates are at zero and prices are stagnant or declining. This increase could be transferred to households via tax cuts or other forms of government support.

The 1970s struggle to contain inflation, and the many catastrophic episodes during which monetary policy became hostage to a country’s fiscal needs, however, made monetary finance taboo. Central banks’ success in lowering inflation was built on asserting their independence from fiscal authorities. The idea of financing fiscal deficits via money creation thus came to be seen as a mortal threat to central bank independence.

Should monetary finance remain taboo? Or are there merits to recent calls for using this tool during times of severe crises? In a recent paper, we review the arguments in favor of and against monetary finance and provide some suggestive empirical evidence about the effects on inflation.

Proponents of monetary finance argue that it has a stronger effect on aggregate demand than a debt-financed fiscal stimulus. Because there is no increase in public debt, monetary finance does not need to be paid for with future tax hikes, making consumers more likely to spend. This argument hinges on the assumption that central bank reserves, or at least the new amounts created via monetary finance, are not remunerated.

Monetary finance may also prevent self-fulfilling runs on government debt. If investors suddenly lose confidence in debt sustainability, the central bank may avert a default by partially monetizing debt. Importantly, if the central bank commits to this strategy − and does not abuse its power to monetize debt outside of self-fulfilling runs − investors are unlikely to lose confidence in the first place, without requiring the central bank to intervene.

But even advocates of monetary finance will point out that there are very serious risks. The primary concern is that it may pave the way to fiscal dominance whereby monetary policy decisions are made subordinate to the fiscal needs of the government. The resulting loss of confidence in the central bank’s ability to keep inflation low and stable could lead to hyperinflation, as happened for example in the well-known case of Zimbabwe in 2007-08.

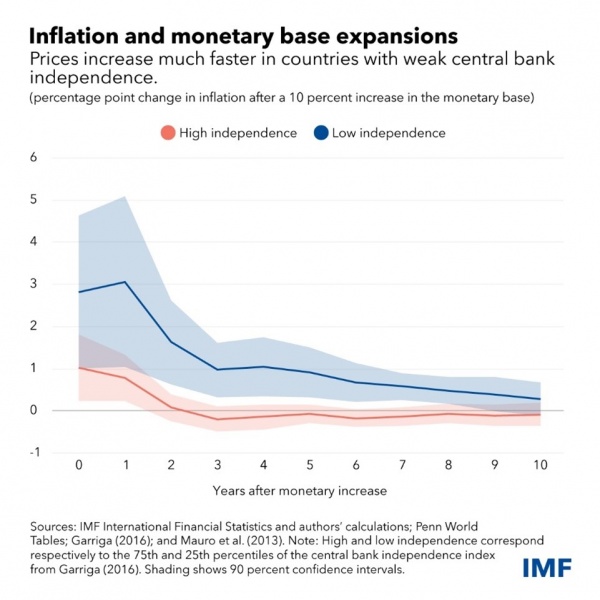

We use two empirical approaches to provide a preliminary assessment of the inflationary risks. First, we analyze the association between the monetary base and inflation across several countries back to the 1950s.

We find that a monetary expansion has modest effects on inflation in countries with strong central bank independence, low initial inflation, and small fiscal deficits. But the effects are much stronger if central bank independence is weak, inflation is high, and fiscal deficits are large. The analysis also detects considerable non-linear effects. While small expansions of the monetary base are associated with modest increases in inflation, large monetary expansions can have much stronger effects on inflation.

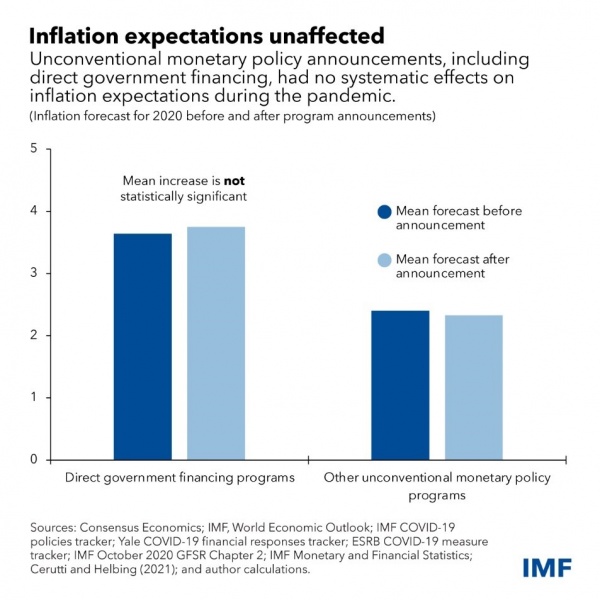

Second, we examine whether unconventional monetary policy (UMP) announcements in response to the start of the COVID-19 pandemic in 2020 led to an increase in inflation expectations. The sample includes 49 advanced economies and emerging markets and developing economies (EMDEs) during the period between March and December 2020.

Most countries embarked on asset purchases in secondary markets within the framework of quantitative easing (QE) programs. QE increases the monetary base, but unlike monetary finance, it is temporary as the central bank is expected to eventually unwind the assets it purchased.

However, in several EMDEs, UMP programs included components of direct government financing through the purchase of government bonds in primary markets and the extension of loans and grants to the government, often with the explicit goal of providing fiscal support. These programs resemble forms of monetary finance.

As the chart shows, we do not find evidence of systematic effects of UMP announcements on inflation expectations, even when we focus on direct government financing (DGF) programs in EMDEs. In interpreting these findings, it is important to note that these operations were relatively modest in size and were likely perceived as one-off interventions.

Based on the review of the conceptual arguments in favor of and against monetary finance and considering our empirical findings, we see merit in further exploring the conditions under which monetary finance may or may not be appropriate in exceptional circumstances. However, possible experimentation with this tool should be modest and limited to countries with credible monetary frameworks, low inflation, and sustainable fiscal positions.

Most importantly, possible monetary finance operations should be decided exclusively and independently by central banks with the sole goal of ensuring economic stability. This is admittedly a difficult standard to achieve. A difficulty seen by some as sufficient reason to ban monetary finance altogether. Indeed, in this context, departures from central bank independence can be very dangerous. History abounds with examples where the use of monetary finance under inappropriate circumstances had devastating effects on economies and livelihoods.

This article is based on the IMF Blog posted on February 22, 2022, and available here.