Inflation has been below the ECB’s price stability definition for roughly a decade now. Inflation expectations have been considerably below this figure, too. How might the ECB get inflation up to target, if it has failed to do so for so long, despite massive expansionary monetary policy stimulus? This note first explores three routes which central banks can pursue (part A); second, it discusses various fiscal policy measures, and the interaction between fiscal and monetary policy, which could raise inflation and inflation expectations (Part B). The note concludes that while “more of the same unconventional monetary policy” is the most likely outcome, innovative approaches to monetary policy communication and commitment, notably an opportunistic locking in of current higher headline inflation through “talking inflation up”, might be more efficient and reduce side effects. The note also argues that, by contrast, dovish central bank communication with respect to inflation might backfire by depressing inflation expectations. Among the fiscal policy options, environmental taxes, if phased in gradually, might be a win-win option, combining the needs for climate protection, fiscal consolidation and a rise of inflation and inflation expectations to target. “Fiscal inflation targeting” and the creation of “inflation scares” through fiscal dominance and monetary financing (or aggressive communication thereof) are discarded as overly risky.

Inflation has been below the ECB’s price stability definition of below but close to 2% for roughly a decade now. Inflation expectations as measured by information embedded in financial market prices and the forecasts of professional economists, including the ECB itself, have been considerably below this aim, too (while rising somewhat recently on the back of the post-COVID economic rebounce and global supply constraints). Among the reasons for this inflation undershooting, a low natural rate of interest and the resulting higher incidence of the zero or effective lower bound on interest rates are often given as major reasons: they imply that the central bank is constrained in its scope to bring inflation up to target around recessions and crises. So, the question arises: how might the ECB manage to get inflation up to target (the current one of below but close to 2%, or, as some Governing Council members have hinted, to a possible, slightly higher new aim of around 2%), if it has failed to do so for a decade, despite massive expansionary monetary policy stimulus?

There are in principle several routes, some well-known, others less so, some more generally accepted, others quite “unorthodox”, some more moderate, others quite unpredictable in their effects. This note first explores three routes which central banks can pursue (part A); second, it discusses various fiscal policy measures, and the interaction between fiscal and monetary policy, which might raise inflation and inflation expectations (Part B).

1: “More of the same, and longer”

First, the ECB could do more of the same, and for longer, while signaling even stronger commitment. I.e. it might further extend the time horizon for its negative interest rate policy (NIRP) and extend the various asset purchase programs in one way or the other. If the price stability definition were to be raised by the ECB Strategy Review, this would increase the needed additional stimulus. More of the same, and for longer, might work through contributing to a closing of the output gap after the COVID crisis, thus creating wage and price pressures. Furthermore, keeping interest rates low for even longer could work as a signal of the ECB’s commitment to bringing inflation back to target, thus raising inflation expectations. The latter, if (partly) backward-looking, would also be brought up by the rise in actual inflation reflecting increasing capacity utilization. This is the approach taken by the major central banks globally over the past decade at least, including the BoJ, the Fed and the ECB. In the first case, the approach was not successful in bringing up inflation, the Fed seems to have been quite successful (helped, though, by fiscal stimulus and by its own Strategy Review – on both points see further below); in the case of the ECB the picture seems mixed.

2: The “benevolent dovish central banker”

A second approach might be called “the benevolent dovish central banker”. Some of the older readers already in the business of central banking in the 1990s may remember that back then one of the recipes to bring inflation down and keep it low was to put a “conservative central banker” epitomized by Fed Chairman Paul Volcker and conceptualized by Ken Rogoff, in charge of monetary policy. The idea was that a “hawkish” central banker would manage more easily and at lower cost in terms of lost output to convince the public of her resolve to bring inflation down and keep it low. Due to her high anti-inflationary credibility, agents would believe that she was serious and able to bring inflation down. Thus, agents would lower their inflation expectations. This in turn would bring actual inflation down. So, just the nature and reputation of this central banker would do the magic and break high inflation expectations.

In the current situation of too low inflation and inflation expectations, the same approach, just with opposite signs, might be applied: Putting a “dovish” central banker (i.e. one who is perceived to weigh low inflation less compared to full employment and growth, and who attaches priority to the short term over medium to long term developments) in charge of monetary policy should more easily manage to get inflation expectations up. The Fed’s adoption, in last year’s Strategy Review, of average inflation targeting and its commitment to full employment can be interpreted as a move in this direction. The risk of this approach is that, in the end, inflation might indeed get out of hand. For instance, the current Fed President has already been likened to the ill-fated former Fed President Arthur Burns, who, in the 1970s, faced with the first oil price shock, neglected signs of rising inflation so long until it got out of hand.

3: The “opportunistic inflation-hawkish but inflation-tolerant central banker”

A third approach would combine communication that emphasizes upward risks to inflation with a commitment to tolerate such rise in inflation. The respective central banker could be typologized as an “opportunistic inflation-hawkish but inflation-tolerant central banker”. This approach would „opportunistically“ and actively use the current rise in headline inflation due to various post-pandemic factors (strong recovery in energy prices, disruption in global value chains, labor scarcity in some sectors that were particularly hard hit by the pandemic and where workers do not want to return) and increased public attention to inflation. Contrary to the dovish central banker above, the „inflation hawkish“ central banker would publicly recognize the possibility that the current hump in headline inflation might become “entrenched” into inflation expectations; and that international supply bottlenecks of raw materials, intermediate and consumption goods might last longer than thought. If this „inflation-hawkish communication“ were at the same time combined with the public commitment to tolerate this higher inflation (e.g., in the case of the ECB, by using the leeway given by the medium term nature of the price stability aim), then the result could indeed be that inflation expectations, and as a further consequence, inflation itself, rise and can permanently be anchored at a higher level.

It may seem paradoxical that a rise in inflation expectations may thus be achieved both by “talking inflation down” and by “talking it up”. How is this possible, what are the differences and the similarities between both strategies? What are the risks and the costs of both approaches?

The dovish central banker uses his dovish communication on inflation to signal the continuation of very loose monetary policy, to stimulate aggregate demand, inflation and, as a consequence, hopefully, inflation expectations. The risk is that the inflation dovishness in itself depresses inflation expectations so much that the hoped-for reflationary Keynesian and expectation effects do not materialize. A further risk is that the implied or explicitly announced expansionary monetary policy response is not (fully) credible, e.g. due to perceived limitations to the central bank’s toolkit. The cost of such an approach in terms of the needed monetary policy stimulus, which may entail undesired side effects in the form of high leverage, asset price bubbles, various real economic distortions (“zombie firms”) and distributive effects due to the very long phase of very low interest rates will be higher, the less the announcement is credible and/or the stronger the potential depressing effect on inflation expectations.

The inflation-hawkish central banker aims to directly bring up inflation expectations in the first place, without resorting to the Keynesian demand channel. As the central bank commits to tolerating the higher inflation, such announcement needs also to come with a commitment to keeping monetary policy loose, with the same side effects, though probably at a lesser scale, as the alternative “dovish” approach. The success of the “hawkish” approach hinges on two things: that the inflation concerns expressed by the central banker are regarded as credible and not just wishful thinking or empty rhetoric; the commitment to tolerate higher inflation is credible. The latter might be particularly difficult if the central banker pointing to the inflation risks is seen as wanting to taper monetary expansion measures. The cost of this approach in terms of scope of monetary expansion and resulting side effects would seem to be smaller than in the alternative approach. This is made possible by the central banker “riding the upward inflation narrative” triggered by higher headline inflation. But this is only possible if her commitment to inflation tolerance is credible. If this were not the case, then this approach might backfire, with the inflation talk triggering expectations of monetary policy tightening, which in turn would choke the economic and inflation (expectations) recovery. So, again, credibility is key.

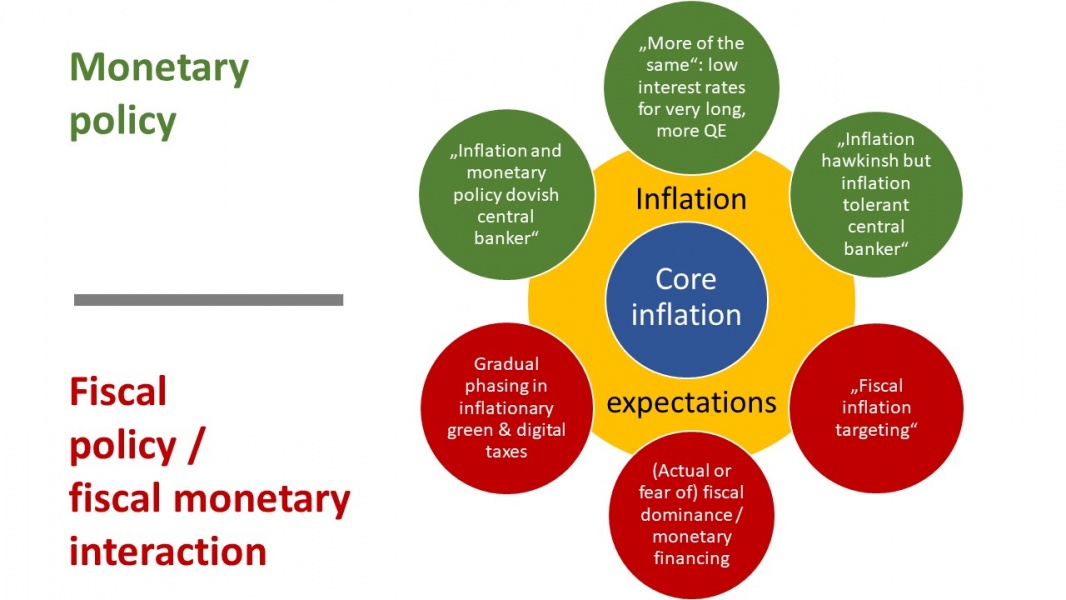

Figure 1: Six ways to raise inflation (expectations)

Source: author.

The options explored in this part are far less conventional and probably also less acceptable to most economists, central bankers, citizens and EU lawyers; still, for the sake of completeness they merit a mention, and in fact some of them might not seem quite so unorthodox or out of this world at a second glance, particularly if one considers monetary history. Let’s have a look at three channels.

4: Environmental and digital taxes phased in over several years

A first non-monetary policy approach to raise inflation, which is actually related to the opportunistic approach mentioned above, is to use inflationary government measures to raise headline inflation. A first candidate are climate protection measures, such as a hike in gasoline taxes, the introduction of wider carbon taxes, including kerosine and air fare taxes etc. Similarly, a further tightening of house insulation regulations would increase house prices and rents. Digital taxes would increase the price of online shopping. Such measures would coincide with the broader policy agenda for the next years; they might also help to consolidate public finances after the pandemic. In principle, a tax rise brings only a one-off rise in the price level, not inflation (as defined as consecutive rises in the general price level over several years). However, if CO2 and digital taxes were phased in gradually, the price level effect would be spread out over several years, de facto raising inflation over an extended period. This in turn would increase the probability that the price rises might be entrenched into inflation expectations, thus raising inflation permanently.

To be effective, the central bank might, similarly with the opportunistic approach above, want to actively communicate the possibility that decarbonization, at least in the short to medium run, inevitably implies a rise in prices/loss in purchasing power, that the tax rises may indeed feed into inflation expectations, and that due to the supply cost-push nature of these shocks, the central bank will accommodate the rise in the inflation. It would, by contrast, be counterproductive to the inflationary impact of these taxes if the central bank emphasized, like the dovish central banker above, that these price rises are just tax induced, temporary, just distort headline inflation upwards, while core inflation is actually much lower.

5: “Fiscal inflation targeting” or “fiscal policy-supported inflation targeting”

While the standard canon of macroeconomics of the 1990s emphasized that it is primarily or exclusively monetary policy which is responsible for inflation, it is obvious that in the short to medium run, the demand effects of fiscal policy also do affect inflation. So, an expansionary fiscal policy can be used to bring inflation up. Again, if this leads to a rise in inflation expectations, the rise in inflation becomes permanent. Indeed, to some extent, the present US administration’s huge fiscal expansion is at least partly responsible for the current strong rise in US inflation. Conventionally, such inflationary effects of fiscal policy happen as a side effect, while fiscal policy actually pursues other objectives, such as economic growth, employment, equal opportunities, etc. But it would, in principle, be conceivable that the fiscal policy maker also includes inflation (concretely: a rise in inflation) among her objectives and in her reaction function. This approach could be called “fiscal inflation targeting” or “fiscal-policy supported inflation targeting”.

In practice, this would raise all kinds of complications: First, it would confuse the currently fairly clear separation of competences between government and central bank; in the euro area, the complexity would be further exacerbated by the fact that 19 governments and parliaments are responsible for national fiscal policies. Finally, to achieve the desired aim of raising inflation and inflation expectations, the central bank would, as with tax increases, need to commit to accommodating the inflationary effects of the expansionary fiscal policy or policies.

6: Fiscal dominance and monetary financing

A third, somewhat scary mechanism to raise inflation and inflation expectations happens if the relationship between the government and the central bank evolves into a situation in which monetary policy loses its leeway to fight inflation. This could happen if government debt reached such a high level that a tightening of interest rates by the central bank – even if needed to contain rising inflation – would threaten sovereign debt sustainability and potentially provoke a financial and currency crisis. Already if economic agents perceived this to become possible, then this could create inflation fears. Such loss of central bank credibility due to fiscal dominance would under normal circumstances be regarded as highly undesirable. In a situation of persistent below-target inflation some might view it as becoming desirable. There is also the possibility that fiscal dominance happens unintentionally, evolving slowly as the government’s reliance on cheap financing facilitated by the central bank becomes entrenched. The downside to both intentional and unintentional fiscal dominance is that sovereign debt crises and also inflation fears from fiscal dominance do not come in small steps and doses. They rather remain unnoticed for long, and then suddenly break out with full force. In other words, the risks from fiscal dominance (unintentional or intentional) or communication thereof by the authorities are very high, most likely much higher than the small gain in inflation.

Monetary financing is a special form of fiscal dominance. In this case the central bank’s dependence vis-à-vis the fiscal authority is created through the piling up of credit claims by the central bank to the government. Again, the inflationary effect arises if the central bank either is forced or persuaded or volunteers (the distinction may at times be difficult) to finance fiscal spending through low, zero or even negative-interest central bank credit. If inflation rises, the central bank may find it difficult or impossible to reverse the credit operations in order to withdraw monetary stimulus, or does so belatedly. The rise in inflation is already conceivable when the fear of such future development becomes prevalent. Again, raising inflation expectations on purpose through this mechanism would be fraught with risks of non-linear sudden developments.

It is noteworthy in this context that virtually all central banks worldwide bought substantial fractions of outstanding sovereign debt in response to the Global Financial Crisis and the Corona pandemic, to achieve the desired monetary policy stimulus. This does not necessarily imply fiscal dominance or monetary financing, as long as the central bank retains its freedom and leeway to raise interest rates and reduce its sovereign debt holdings, if the monetary stance so requires; and as long as the purchases of sovereign debt happen with a view to achieving the central bank’s inflation aim and not with the aim of financing the government. Careful communication is required to make this distinction clear, otherwise inflation fears might inadvertently be generated.

This note has sketched six channels through which inflation expectations might be raised: three by the central bank, three by fiscal authorities (or the interaction between fiscal and monetary authorities).

The first option of “more of the same” seems the most conventional, and thus the most likely and realistic one; it may, however, not be the most efficient one in terms of costs (use of monetary policy instruments; side effects), as the BoJ experience seems to indicate. The “dovish central banker” approach may be seen to somewhat reflect the current Fed approach (at least until May, less so since June 2021). It seemed to work in bringing up inflation in the case of the Fed, but bears the risk of shooting beyond its aim (not least due to the concomitant massive fiscal stimulus, combined with supply-side constraints and the release of pent-up demand). The “opportunistic inflation hawkish inflation-tolerant central banker” approach is new and unexplored; it would seem to come in handy at the current period of a jump in headline inflation. Using this hump “opportunistically” to bring inflation expectations up seems to entail potentially lower costs in terms of the size of monetary policy stimulus and economic side effects; but the success of this approach crucially rests on the combination of “inflation-hawkish yet inflation-tolerant” communication and action.

Among the three fiscal-policy induced inflationary approaches, the first one of using CO2 and digital economy induced tax rises to opportunistically raise inflation and inflation expectations seems a win-win approach, combining various policy aims synergeticly. The idea of generating continuous price level rises and thus inflation through a gradual phasing in of such taxes would also facilitate agents’ adjustment to these taxes and make them politically more acceptable. The second approach of “fiscal inflation targeting” happens automatically, as a by-product, in the current period of expansionary fiscal policies but will be at odds once the recovery is better on track and fiscal sustainability concerns move more into the center, prompting fiscal consolidation. Furthermore, its short-term gains would come at the big cost of – permanently – blurring the borders between fiscal and monetary policies and authorities. Finally, (threat of) fiscal dominance and monetary financing are potentially extremely powerful channels to generate inflation expectations. Due to their highly non-linear and unpredictable effects, they, however, are equivalent to a “nuclear option”, which should never be even considered.

The views expressed in this note are those of the author only and do not necessarily represent those of the Oesterreichische Nationalbank, the Eurosystem or SUERF.