We thank public finances and country experts of the European Commission’s Directorate-General for Economic and Financial Affairs (ECFIN) for providing us with the relevant data and helpful explanations about the different scenarios we consider. The views expressed in this paper are those of the authors and do not necessarily represent those of the European Commission, the European Fiscal Board, the IMF, its Executive Board or IMF management. The full article is available at: https://www.cesifo.org/en/publications/2025/working-paper/some-intergenerational-arithmetic-control-public-debt-eu

Abstract

Adverse demographic trends are increasingly weighing on public finances, and debt sustainability analysis (DSA) has become the instrument of choice across national governments and international organizations to assess their impact. Using the EU’s long-term projections, we quantify the orders of magnitude of additional economic growth needed to neutralise the effect of adverse demographic scenarios such as lower fertility rates or lower immigration on the government debt-to-GDP ratio. Our estimates underscore (i) the urgency to apply measures to raise productivity growth to alleviate sustainability risks and (ii) the need to build demographic projections on cautious assumptions.

Demographic trends are set to reshape the EU’s economic landscape. The EU’s working-age population is projected to shrink on average by more than 1.2 million people annually, leading to a smaller labour force, slower economic growth and higher old-age dependency ratios. This shift will inevitably drive up costs for pensions, healthcare, and long-term care as a share of GDP. The additional costs are persistent and will negatively impact public debt dynamics barring corrective measures – meaning either by cutting spending, raising taxes, or stimulating economic growth. The larger the adverse demographic trend, the larger the impact on public finances if no countervailing measures are taken.

A debt sustainability analysis can shed light on the projected impact over the longer term. However, the results are highly sensitive to the underlying assumptions, including demographic projections. For some countries past vintages of population projections turned out to be on the optimistic side, with migration being the most difficult driver to predict (Larch and Busse, 2024). As EU countries grapple with already high levels of public debt and massive investment needs (see Draghi, 2024), understanding how anticipated and unanticipated demographic changes affect fiscal sustainability is crucial for policymakers.

Against this background, it is instructive to analyse the impact of alternative demographic scenarios on government debt. We combine information from the European Commission’s (2024c) Debt Sustainability Monitor 2023 and the European Commission’s (2024a) Ageing Report, and focus on four alternative demographic scenarios from the Ageing Report:1

I. high life expectancy, captured by a two-year higher life expectancy than in the baseline;

II. low fertility, captured by a fertility rate 20% lower than in the baseline;

III. high migration, which assumes 33% higher non-EU immigration than in the baseline;

IV. low migration, where non-EU immigration is 33% lower than in the baseline.

For each demographic scenario (from 2022-2070), we calculated in every period going forward the extra amount of GDP growth needed to keep the debt ratio at its baseline path. As the Debt Sustainability Report and the Ageing Report do not contain information on scenario-specific debt ratios, we have to construct these using a standard debt accumulation equation (see Romp et al., 2025, for more detail on the conceptual framework underpinning the analysis). Costs of ageing are provided by the 2024 Ageing Report for the baseline and alternative scenarios. A number of macroeconomic assumptions are made in the Ageing Report for each country, for example on total factor productivity convergence, interest rate convergence or labour market indicators (see Romp et al., 2025).

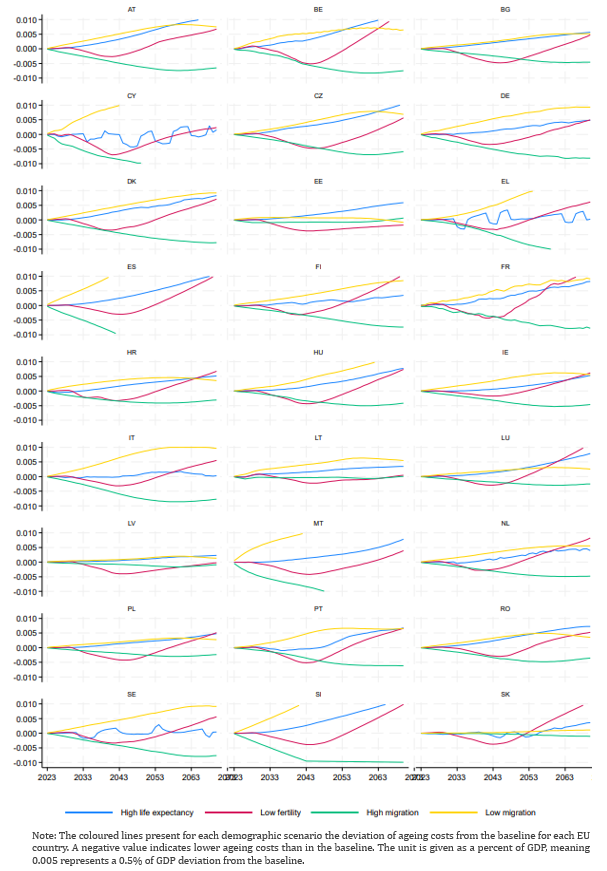

In the high-life-expectancy scenario, economic growth remains largely unchanged in most cases (see Figure 1). The exception are countries that link the retirement age to life expectancy, such as the Netherlands, Greece, and Italy, thereby increasing labour supply relative to the baseline. This extra age-related spending increase (pensions and healthcare costs) reaches for some countries up to 1% of annual GDP (see Figure 2).

The low fertility scenario has a time-varying effect. At first, declining birth rates reduce education costs and increase workforce participation, as fewer parents leave the labour market to care for children. However, over the long term, fewer young workers enter the labour force and output growth falls by 0.3 – 0.5 percentage points relative to the baseline. This is a strong deceleration given the already low real economic growth projected over the longer term in many EU countries.2

Figure 1. Economic growth in various demographic scenarios compared to the baseline scenario, 2022 – 2070

Figure 2. Cost of Ageing (as a fraction of GDP) in various demographic scenarios compared to the baseline scenario, 2022 – 2070

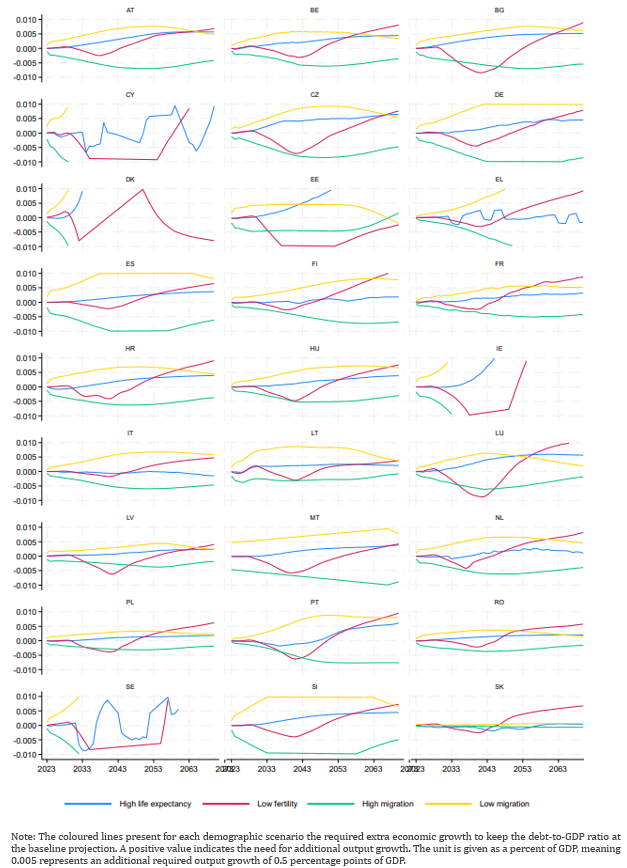

The sizable impact of the different scenarios on growth and on age-related costs already foreshadows a significant effect on debt trajectories. In fact, the patterns of required extra growth are rather similar in most cases (see Figure 3). There are some oddities for several countries under certain scenarios that are driven by country specificities or assumptions underpinning the ageing reports that have an effect on a subset of countries (see for more details Romp et al., 2025).

The high life-expectancy scenario for most countries requires extra economic growth to maintain debt developments at the baseline. In some countries, the additional growth exceeds 0.5%-points relative to the baseline (e.g. Austria). The high-life-expectancy scenario includes the ingrained reaction of pensions systems. Some countries have designed their systems to automatically adjust (partially and with some delay) to a rise in life expectancy (e.g. the Netherlands). This is reflected in the low additional effort needed in the Netherlands in this scenario. As outlined above the low fertility shock has an initial positive impact on public finances, which is gradually superseded by long-term negative effects. Consequently, debt eventually rises above the baseline unless extra growth is generated to compensate the demographic shock.

Figure 3. Scenario-specific required extra economic growth to keep debt-to-GDP ratios at the baseline trajectories, 2022 – 2070

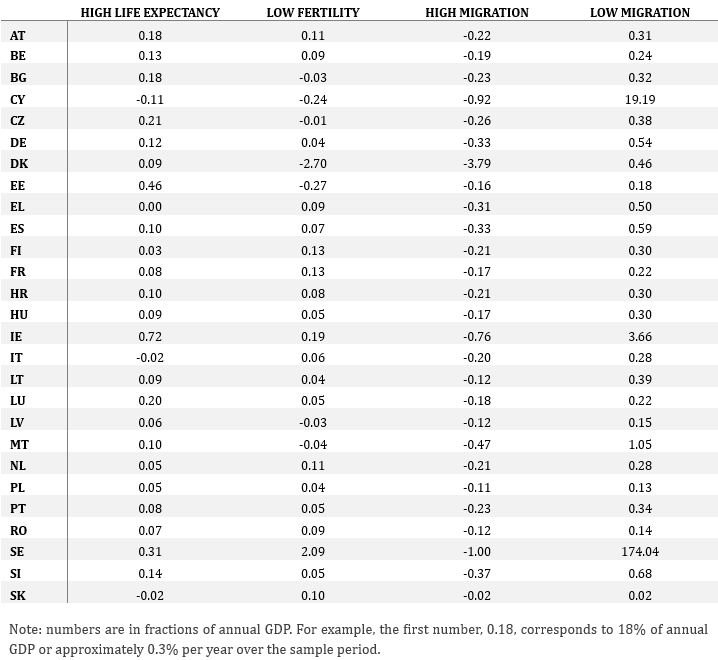

The migration scenarios show the most immediate and most significant impacts on economic growth and debt sustainability. For most countries, the required growth is between 0.5 and 1%-points higher (low migration scenario) or lower (high migration scenario) than the baseline. Keeping in mind that these are annual extra growth rates, the compounded effect over many years is very large for some countries (see Table 1).

Table 1. Scenario-specific cumulative required extra economic growth to keep debt-to-GDP ratios at the baseline, 2070

Notably, the Ageing Report data assumes the same age-specific participation rate of the immigrating population compared to the existing domestic population. However, in reality this is unlikely to be the case as immigrants tend to be less acquainted with domestic needs and a skill-mismatch (incl. language barriers) constitutes a non-negligible impediment. Our analytical framework allows us to relax this mirrored participation assumption. Through a growth decomposition exercise that sets the participation rate of immigrants at 50% of the domestic population we can show that the difference in required extra growth does not increase substantially as age-related costs do not rise as much as one may think at first. The reason behind this is that most European pension systems have a defined-contribution setup. Consequently, lower contributions (due to lower participation) also lead to lower entitlements in future. This underscores that high migration, even under the lower participation rate assumption, remains beneficial from a debt sustainability perspective. Nevertheless, it also confirms the importance of implementing effective labour market integration policies to maximize the economic benefits of immigration.

Demographic change presents significant fiscal challenges. Our analysis confirms that migration plays a particularly important role in easing fiscal pressures, while low fertility and rising life expectancy increase the need for additional economic growth.

To address the fiscal challenges posed by demographic change, our study underscores the importance of several policy approaches. First, boosting productivity through investments in education, innovation, and digital infrastructure can help offset the impact of demographic shifts. Second, managed migration, particularly of skill-matched workers, can support economic growth and reduce fiscal pressures provided that integration efforts are effective. Third, indexing retirement age to life expectancy, as seen in the Netherlands, can mitigate the fiscal burden of an aging population. Finally, governments should adopt forward-looking fiscal strategies, including pension reforms and healthcare efficiency improvements.

Beetsma, R. (2024), The new economic governance framework: Implications for monetary policy, In-depth Analysis at request of ECON committee of the European Parliament, https://www.europarl.europa.eu/RegData/etudes/IDAN/2024/760265/IPOL_IDA(2024)760265_EN.pdf

Draghi, M. (2024), The future of European competitiveness, part A, September, European Commission.

European Commission (2024a), 2024 Ageing Report. Economic and Budgetary Projections for the EU Member States (2022-2070), Institutional Paper 279, April 2024, doi:10.2765/022983 (online).

European Commission (2024b), 2024 Ageing report – Statistical annexes all horizontal tables.

European Commission (2024c), Debt Sustainability Monitor 2023, Institutional Paper 271, March 2024, doi:10.2765/860483 (online).

European Commission (2024d), Debt Sustainability Monitor 2023, Annex 8 Country fiches tables and graphs.

Economic Policy Committee – Ageing Working Group (2025), PENSREF database, https://economy-finance.ec.europa.eu/economic-research-and-databases/economicdatabases/pensref-pension-reform-database_en

Larch, M. and M. Busse (2024), Europe’s demographic winter and the new EU fiscal rules, https://cepr.org/voxeu/columns/europes-demographic-winter-and-new-eu-fiscal-rules.

Notably, we focus on deviations from the demographic baseline scenario, which may entail an increasing debt ratio over the long term – in other words, we do not impose any concept of long-term sustainability.

Because emigration is assumed constant as a fraction of the population and because emigrants tend to be relatively concentrated in the younger cohorts, countries with relatively large emigration rates, such as Cyprus, Luxemburg or Malta, will be hurt relatively less in terms of GDP growth under the low fertility scenario.