This policy brief is based on Banca de España, Working Papers Series, No 2503, January 2025. The views expressed in this paper are the authors’ and do not necessarily reflect those of Banco de España, Banque de France, the OECD or the Eurosystem.

Abstract

Highly concentrated imports can be a source of vulnerability in an environment characterized by geopolitical tensions. We study how countries’ import concentration in a few external providers affects the price they pay for their imports at the product level. Import concentration decreased in OECD countries in the last two decades, especially up to the Global Financial Crisis, in the hyper-globalization period. For EU countries, integration in the single market was crucial to keep fostering diversification also beyond the hyper-globalization years. A high import concentration tends to be associated with higher import prices, which is compatible with the view that strongly concentrated markets correspond to a low level of competition. This effect tends to be more pronounced when a supplier country’s perceived market power is strong; while it is found to be weaker for goods produced in high-tech industries.

In the last years, several events have brought forward the potential risks implied by external trade dependencies and, in particular, by a high concentration of imports in a few external providers. Pandemic-related interruptions of trade flows, as well as trade tensions linked to the Russian invasion of Ukraine, have shown that highly concentrated imports can be a source of vulnerability for the importer –and the more so in an environment characterized by geopolitical tensions and a potential weaponization of supply chains. In light of these considerations, various policies recently adopted by the European Union –like the Critical Raw Materials Act, the Chips Act, and the REPowerEU Plan— specifically aim at decreasing import concentration for key products.1 A tendency towards supplier diversification has also been observed in recent firm surveys. Among these, an ECB survey of leading companies operating in the euro area (Attinasi et al., 2023) documents that more than 60% of these firms are planning to diversify their input sourcing across different countries in the next five years.

In light of these tendencies, a key question is how import diversification could affect import –and hence consumer— prices. In the next years, as shown in recent studies, a potential deepening of geopolitical tensions could affect international trade with inflationary consequences. An escalation of geopolitical tensions could give rise to negative supply shocks, trade disruptions or higher transport costs, with an upward impact on global prices (Attinasi and Mancini (co-leads), 2024; Carrière-Swallow et al. 2023). In this context, changes in import concentration could have an additional and potentially significant impact on the level of import prices, which could either limit or boost inflationary pressures.

In Balteanu, Schmidt and Viani (2025), we study how countries’ import concentration and other trade dependencies affect the price they pay for their imports. As a first step, we analyze the evolution of import concentration in a sample of OECD and EU countries in the last two decades. We then investigate the impact of the import concentration of these economies on their import prices using granular trade data. In both analyses, we explore the role of sectoral heterogeneity, goods’ position in the supply chain, the availability of diversification opportunities, and the political proximity of suppliers, with a special focus on strategic goods, such as the ones related to the digital and green transition.

From a methodological point of view, we rely on bilateral trade flows data and bilateral trade unit values data at the importer country level from, respectively, the CEPII-BACI database (Gaulier and Zignago, 2010) and the CEPII-TUV database (Berthou and Emlinger, 2011). At the product level, both sets of data are highly granular, getting up to the HS 6-digit level and partitioning the universe of each country’s imports into more than 5100 different product categories. The focus is on a sample of 43 importers encompassing OECD countries and other EU economies that are not OECD members, between 1996 and 2022. We analyze the evolution of the import concentration of these economies, as well as other dimensions of external trade dependency, using a number of trade dependency indicators. Panel regressions at the importer-product level are employed to study the impact of import concentration on import prices.

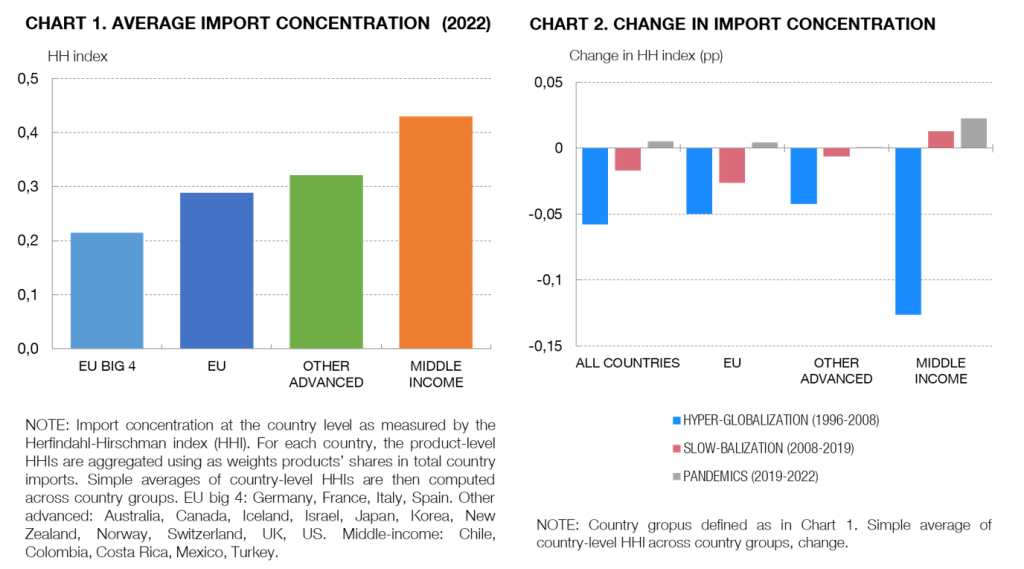

Import concentration –as measured through the Herfindahl-Hirschman index (HHI)2 of concentration, based on the (squared) shares of exporters in each country’s imports— varies widely across importer countries (Chart 1). EU economies’ imports are less concentrated with respect to other advanced countries’, with the EU four largest economies displaying the lowest levels of concentration. Import concentration decreased, on average, in OECD countries in the last two decades, especially in the years up to the Global Financial Crisis, in the so-called “hyper-globalization” period (Chart 2).3 While in the hyper-globalization years the decrease in import concentration was generalized across countries, dynamics were more heterogeneous in the following “slow-balization” phase, as concentration kept decreasing on average for EU economies while it stagnated in other countries.

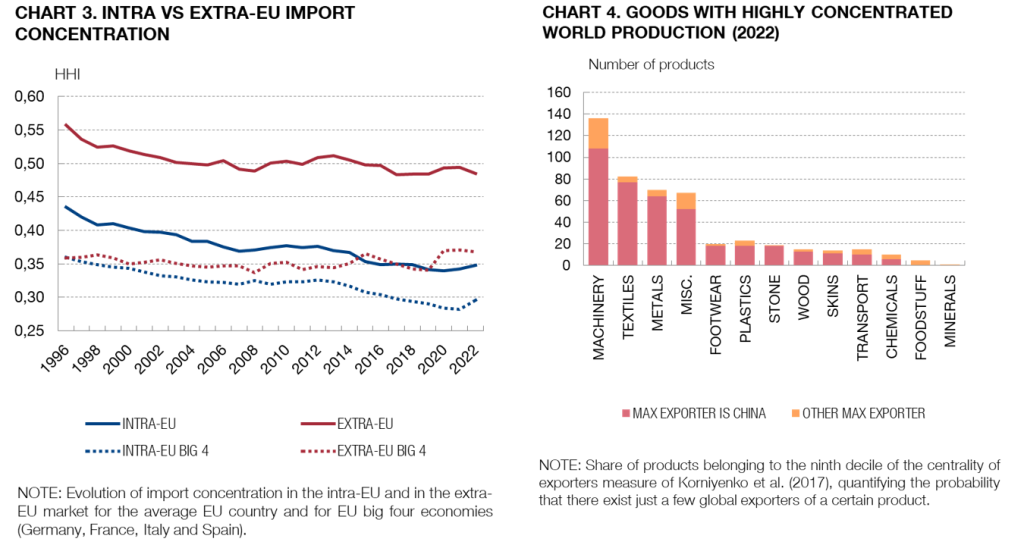

Key to foster the continued import diversification of European economies, was their increasing integration in the intra-EU market, with imports switching away from large traditional goods suppliers like Germany, Italy and France and towards newly-integrated providers such as Poland and Bulgaria (Chart 3). Another relevant finding concerns the role of China as a leading global supplier. China is the main provider of the majority of goods whose production, at the world level, is highly concentrated –as measured through the index of centrality of exporters developed by Korniyenko et al. (2017) (Chart 4). Also, focusing on strategic products –advanced technology goods, technologies related to the green transition and semiconductors— shows that OECD countries’ imports tend to be much more concentrated in China with respect to other categories of products.

As industrial economic theory suggests, a high import concentration could result either in higher or lower import prices, depending on the factors underlying import concentration itself. On the one hand, if concentrated imports are optimal from an economic point of view –because they are due, for instance, to the presence of economies of scale— a high concentration would tend to be associated, everything else equal, to lower prices (Covarrubias et al., 2020; Bonfiglioli et al., 2021). On the other hand, if concentrated imports are the result of some kind of distortions that give rise to a low level of competition, then a high observed concentration would tend to be associated to higher import prices (Covarrubias et al., 2020). Therefore, in theory, a higher import concentration could result either in higher or lower prices. Which effect will materialize in practice is likely to be the outcome of complex effects, and could depend on factors such as the specific type of product; its technological category and level of sophistication; its position in the supply chain; or on whether, for geographical or industrial development circumstances, its production is restricted to a few global producers.

Panel analysis at the granular importer-product level shows that countries whose imports are highly concentrated in a few providers tend to pay a higher price4 for their imports with respect to economies whose imports of the same products are more diversified across different suppliers. This finding is compatible with the view that strongly concentrated import markets correspond to a low level of competition. A high import concentration results in even higher prices in those cases in which firms’ perceived market power is strong –namely, for goods whose production is highly concentrated at the world level, or that a country cannot (fully) produce by itself. On the other hand, a higher geopolitical distance between an importer and its main providers does not result in a stronger impact of import concentration on prices.

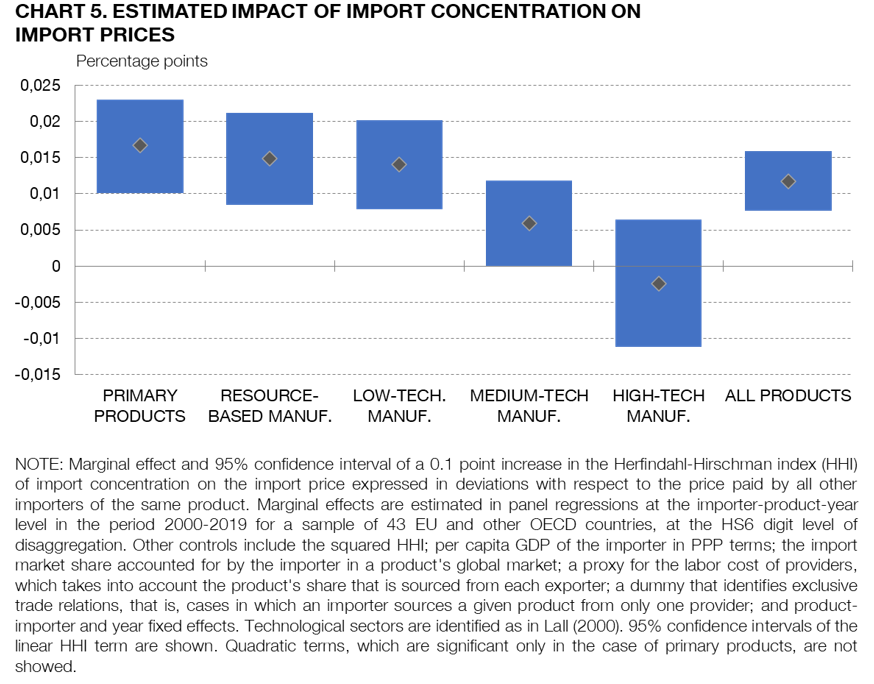

If on average results point to a positive link between import concentration and import prices, findings are more heterogeneous at the sectoral level. The positive relationship between concentration and prices is much less pronounced in medium and high-technology industries with respect to goods produced in sectors with a lower level of technological complexity, such as primary products, resource-based manufactures and low-tech. manufactures

(Chart 5). This finding is consistent with the notion that in high-tech. industries a pronounced concentration is also associated to the presence of pro-competitive effects and economies of scale –deriving most likely precisely from their technological processes that rely heavily on IT and intangible capital, which have been shown to give rise to relevant scale effects (Crouzet and Eberly, 2019). The association between concentration and prices is also less pronounced for capital goods as compared to final consumption goods and intermediate products, being capital goods mostly the product of medium and high-tech. industries. Another special case are exclusive trade relations, i.e. those instances in which the importer sources a product from only one provider. We find that these relationships –even if only existent for a small number of products and countries— are associated with lower import prices, and could therefore be costlier to break. Finally, for European economies, the positive impact of concentration on import prices is less pronounced in the intra-EU market, which points again at the special role of the single market in shaping EU countries’ trade relations.

Our results have relevant policy implications. Going forward, a potential deepening of geopolitical tensions in the next years could entail inflationary consequences at the world level. Our results –showing that countries whose imports are highly concentrated tend to pay more, everything else equal, to source the same product— suggest that import diversification could mitigate to some extent these upward pressures on prices. Recent contributions have also documented that a selective process of trade fragmentation along geopolitical lines could already be under way (Gopinath, 2023; Fernandez-Villaverde et al., 2024). Our results indicate that, in this context of trade flows reallocation, it is important that shifts away from geopolitically-distant exporters to be coupled with effective diversification across alternative providers, as diversification itself could contribute to contain import prices. Finally, some works have also found recent evidence of a tendency towards a regionalization of trade flows (Attinasi and Mancini (co-leads), 2024). In light of this trend, our findings suggest that regionalization –that is, an increase in concentration on a regional basis— could likely result in a lower competition and higher prices.

Attinasi, Maria Grazia, Demosthenes Ioannou, Laura Lebastard and Richard Morris. (2023). “Global production and supply chain risks: insights from a survey of leading companies”. ECB Economic Bulletin Boxes, 7, European Central Bank.

Attinasi, Maria Grazia, and Michele Mancini (co-leads). (2024). “Navigating a fragmenting global trading system: insights for central banks”. Occasional Document, European Central Bank.

Balteanu, Irina, Katja Schmidt and Francesca Viani. (2025). “Sourcing all the eggs from one basket: trade dependencies and import prices”. Bank of Spain working paper 2503.

Berthou, Antoine, and Charlotte Emlinger. (2011). “The trade unit values database”. International Economics, 128, pp. 97-117.

Bonfiglioli, Alessandra, Rosario Crinò and Gino Gancia. (2021). “Concentration in international markets: Evidence from US imports”. Journal of Monetary Economics, 121.

Carrière-Swallow, Yan, Pragyan Deb, Davide Furceri, Daniel Jiménez and Jonathan D Ostry. (2023). “Shipping costs and inflation”. Journal of International Money and Finance, 130, p. 102771.

Covarrubias, Matias, Germán Gutiérrez and Thomas Philippon. (2020). “From good to bad concentration? US industries over the past 30 years”. NBER Macroeconomics Annual, 34(1).

Crouzet, Nicolas, and Janice C. Eberly. (2019). “Understanding weak capital investment: The role of market concentration and intangibles”. NBER working paper, w25869, National Bureau of Economic Research.

Fernandez-Villaverde, Jesus, Tomohide Mineyama and Dongho Song. (2024). “Are We Fragmented Yet? Measuring Geopolitical Fragmentation and Its Causal Effects”. CEPR Discussion Paper, DP19184, CEPR

Gaulier, Guillaume, and Soledad Zignago. (2010). “BACI: International trade database at the product-level. The 1994-2007 version.” Working Paper, 23, CEPII.

Gopinath, Gita. (2023). “Cold War II? Preserving economic cooperation amid geoeconomic fragmentation”. Plenary Speech at the 20th World Congress of the International Economic Association.

Jaimovich, Esteban. (2012). “Import diversification along the growth path”. Economic Letters, 117(1).

Korniyenko, Yevgeniya, Magali Pinat and Brian Dew. (2017). “Assessing the fragility of global trade: The impact of localized supply shocks using network analysis”. IMF Working Papers, 2017/030, International Monetary Fund.

Lall, Sanjaya. (2000). “The technological structure and performance of developing country manufactured exports, 1985-98”. Oxford Development Studies, 28(3), pp. 337-369.

For instance, the Critical Raw Materials Act requires that no more than 65% of the EU’s annual needs of each strategic material at any relevant stage of processing should come from a single extra-EU country.

The Herfindahl-Hirschman index (HHI) is computed using granular trade data at the HS6-digit product level. The index ranges from 0 to 1, with highly concentrated imports resulting in a higher value of the index. A HHI very close to zero indicates that a country imports a certain product from a continuum of providers, each supplying a very small share. Conversely, a HHI equal to 1 represents a case of extreme concentration, in which an importer sources a product from one trading partner only. The importer-product-year level HHIs are then aggregated at the level of the importer country through a weighted sum of the concentration indices of all the goods imported by the country, using as weights products’ shares in the country’s total imports.

This term is commonly used to refer to the phase characterized by a strong push towards trade globalization, which began in the late Nineties and ended with the 2008 Global Financial Crisis. The word “slow-balization”, instead, is commonly used to indicate the years that followed the Global Financial Crisis, characterized by a marked slowdown of the trade opening and globalization process.

We compute relative import prices, i.e. the price paid for a product by a given country compared to the average price paid for this product by all countries, to level out general price trends.