The views expressed in this briefing are the sole responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Board or the European Stability Mechanism.

We systematically compare sovereign defaults on debt issued externally and domestically. Defaults at home and abroad are equally frequent, and governments often default selectively. Compared to domestic defaults, external defaults are larger and take longer to resolve. Both external and domestic defaults are often resolved through maturity extensions and coupon reductions. Face value reductions are infrequent, especially as part of domestic restructurings. Yet, domestic defaults are more punitive, as they are associated with larger creditor losses. We also document that domestic and external sovereign defaults occur in macro financial, political and geo-economic environments that show marked differences. Our stylized facts inform policy-makers interested in the resolution of modern time sovereign defaults, as well as a growing theoretical literature concerned with sovereign defaults in the presence of domestic debt markets.

Sovereign debt markets have experienced radical transformations in recent decades. Domestic markets for sovereign debt have grown increasingly important and are nowadays the backbone of domestic financial system. While a growing body of economic theory studies sovereign default in the presence of domestic debt markets, comprehensive studies on sovereign defaults involving domestic debt lag behind.1

In Erce, Mallucci and Picarelli (2024) we take a first step towards covering this gap, and offer a novel set of stylized facts to guide both theorists and practitioners alike. More specifically, we combine data on defaults and restructurings of sovereign debt issued externally (Asonuma and Trebesch, 2016), with data on defaults and restructurings of sovereign debt issued domestically (Erce et al. 2022), to create a new database with detailed information on 116 restructurings involving debt issued domestically and 177 restructurings involving debt issued externally.

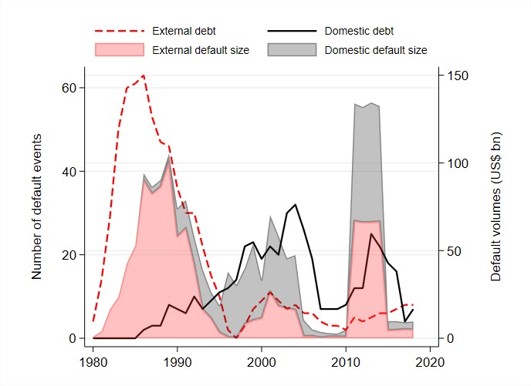

The database contains the universe of sovereign defaults on private sector creditors from 1980 to 2018. As depicted in Figure 1, mirroring the expansion of domestic debt markets since the 1990s, domestic debt restructurings were rare in the 1980s, and became increasingly frequent in the 1990s and in the 2000s. Conversely, external debt restructurings peaked in the mid-1980s, and became less frequent in later years. As a result of these trends, domestic sovereign defaults and restructurings have become nowadays as frequent as external sovereign defaults and restructurings.

Domestic and external defaults happen worldwide. The incidence of domestic and external defaults and restructurings is the highest in Latin America and Africa. Countries that restructure domestic debt are often the same countries that restructure external debt. In fact, roughly 50% (35%) of the countries that restructure domestic (external) debt also restructure external (domestic) debt at some point. Most restructuring episodes, both domestic and external, have occurred in lower-middle income and upper-middle income countries. That said, restructuring events have also happened in advanced economies, confirming that sovereign defaults are a pervasive phenomenon.

Figure 1. Sovereign defaults over time

Note: The solid black line plots the four-year rolling sum of domestic default events. The dashed red line plots the four-year rolling sum of external default events. The red area represents the four-year rolling average of the total amounts of external debt in default (in US$ bn) per year. The gray area represents the four-year rolling average of the total amounts of domestic debt in default (in US$ bn) per year.

We document that, in contrast with what is often assumed in theoretical models (Broner et al. 2010, D’Erasmo and Mendoza 2021), selectivity and differential treatment of creditors are the norm.2 Restructuring episodes where only either domestic or external debt are involved account for more than two thirds of all episodes.

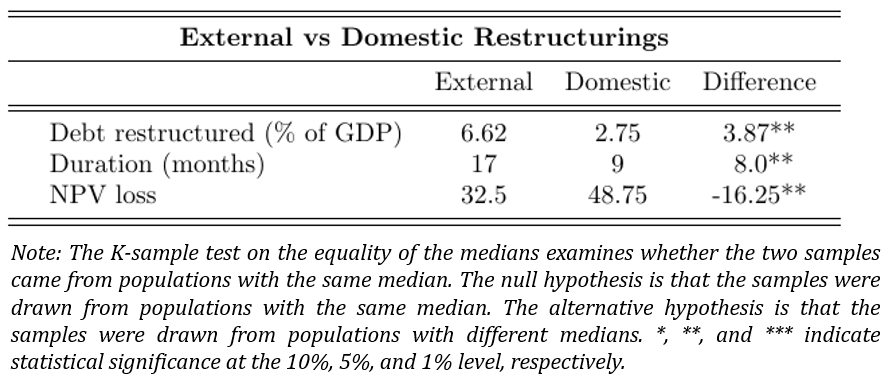

Our dataset measures the volume of debt being restructured, the duration of the restructuring process, the losses for creditors, the final amendments to the original debt instruments, as well as on whether the sovereign accumulated arrears during the restructuring process.3 Using T-tests and K-tests, we offer a systematic comparison of the debt restructuring process for domestic and external debt along these key dimensions.

Our main findings (see Table 1 for our K-tests) are the following. The median volume of debt involved in external debt defaults is over two times larger than in domestic ones. Median domestic debt restructurings proceed faster, although they are as likely to protract significantly as external ones. Domestic defaults impose larger losses on investors than external ones.4

Table 1. K-sample Test on the Equality of Medians

When we analyze how governments implement restructurings, we observe that domestic and external restructurings share several similarities. In contrast with the standard approach to modelling sovereign debt restructuring, we find that face value reductions are rare, and feature more frequently in external debt restructurings than in domestic ones. Maturity extensions and amendments to the coupon structure are the most frequent forms of restructurings both for domestic and external debt. We also document a sovereign preference for conducting both domestic and external debt restructurings in a pre-default fashion, without missing payments.

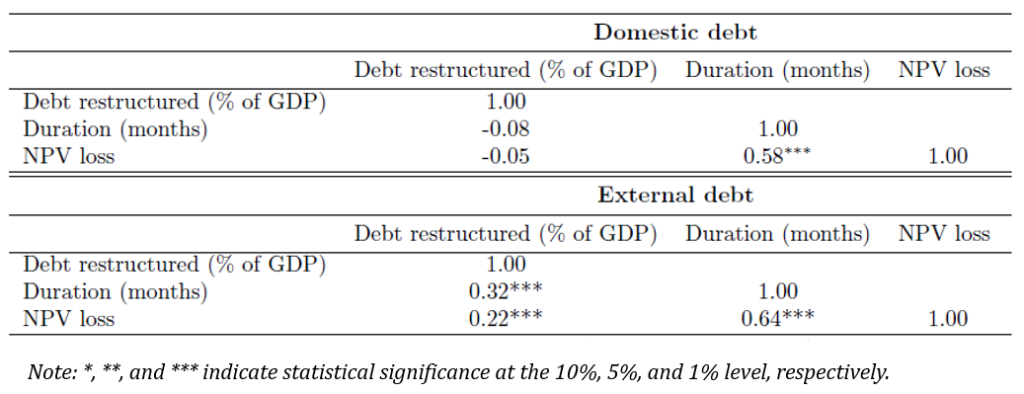

In line with workhorse models of sovereign default (see Pitchford and Wright 2011, Dovis 2019 or Thaler 2021), we find a significant and positive correlation between the size of debt in default, the duration of the restructuring process, and the resulting losses during external defaults (Table 2). Larger defaults go hand in hand with longer restructuring durations and larger NPV losses.

Table 2. Main debt restructuring outcomes. Correlations

In contrast, we document that the volume of debt restructured during domestic defaults is uncorrelated with both NPV losses and restructuring durations. This, perhaps points to the fact that governments have greater bargaining power in domestic restructuring episodes regardless of the volume of debt being restructured. That said, we still find a significant and positive correlation between the duration of the restructuring process and the losses suffered by investors, hinting to the fact that delays in the restructuring process are harmful to investors.

Next, we compare the environment in which domestic and external defaults occur. We document that the macro-financial environment surrounding domestic and external defaults differs markedly in some dimensions. While growth falters around both domestic and external defaults, domestic defaults happen at times of financial instability, characterized by low private credit growth and a high likelihood of banking crises. In contrast, external restructurings happen at times of significant fiscal and external adjustments, characterized by trade surpluses and substantial capital flight.5

We also document differences in the political and geo-economic landscape in which different types of default occur. In line with recent theoretical contributions (Andreasen et al. 2019, Scholl 2024), we find that external defaults happen in periods of heightened political tensions, are less likely when moderate parties are in power, and when political constraints are tighter. Results are drastically different for domestic defaults. Domestic defaults are more likely when political constraints are tighter, and governments’ ideologies shows no relation to them.

Last but not least, we document that the interplay between bilateral and official lending and defaults involving private creditors are profoundly different depending on whether domestic or external debt is involved. Domestic and external debt defaults are dealt with using different elements of the international financial architecture. IMF programs often overlap with domestic debt defaults but not external ones. In turn, Paris Club debt restructuring often accompanies external defaults but not domestic ones. These differences in tools and resources available to governments have profound implications for the resolution of debt crises (Erce 2021).

In a world where public debt, both domestic and external, is growing alarmingly fast, our stylized facts offer important information and analytical material for policymakers interested in understanding modern-time sovereign default and restructuring patterns, or in the need of designing policies to tackle debt distress.

These new facts also inform the theoretical literature concerned with sovereign default in the presence of domestic public debt markets. Our comparison between domestic and external restructurings shows researchers should calibrate their quantitative sovereign default model models differently depending on whether they are focusing on domestic or external sovereign debt. Our works provides guidance on how to choose such calibration values.

Our data might also be useful for economists, lawyers, political scientists and sociologists interested on the interplay between sovereign defaults and political cycles, on how geopolitical factors affect fiscal performance, or on whether and how debt default and restructuring impacts social cohesion and economic inequality.

Andreasen, Eugenia, Guido Sandleris, and Alejandro van der Ghote (2019). The Political Economy of Sovereign Defaults. Journal of Monetary Economics, 104.

Asonuma, Tamon, and Christoph Trebesch (2016). Sovereign Debt Restructurings: Preemptive or Post-Default. Journal of the European Economic Association, 2016, 14 (1).

Beers, David, and Patrisha de Leon-Manlagnit (2019). The BoC-BoE sovereign default database: what’s new in 2019? Bank of England working papers 829,

Broner, Fernando, Alberto Martin, and Jaume Ventura (2010). Sovereign Risk and Secondary Markets. American Economic Review, 2010, 100 (4), 1523–1555.

Broner, Fernando, Aitor Erce, Alberto Martin, and Jaume Ventura (2014). Sovereign Debt Markets in Turbulent Times: Creditor Discrimination and Crowding-Out Effects. Journal of Monetary Economics, 61 (C).

Chari, Varadarajan, Alessandro Dovis, and Patrick Kehoe (2020). On the Optimality of Financial Repression. Journal of Political Economy 128 (2020): 710 – 739.

Aitor Erce (2021). Market Debt Operations and Growth in IMF-Supported Programs. IEO Background Paper BP/21-01/06 (Washington: International Monetary Fund).

Erce, Aitor, Enrico Mallucci, and Mattia Picarelli (2022). A Journey in the History of Sovereign Defaults on Domestic- Law Public Debt. International Finance Discussion Papers 1338, Board of Governors of the Federal Reserve System.

Erce, Aitor, Enrico Mallucci, and Mattia Picarelli (2024). Sovereign Defaults at Home and Abroad. CEPR Discussion Paper DP18739.

Hatchondo, Juan Carlos, Leonardo Martinez, and Horacio Sapriza (2010). Quantitative properties of sovereign default models: Solution methods matter. Review of Economic Dynamics, Vol. 13, Issue 4.

Hatchondo et al. (2016). Debt Dilution and Sovereign Default Risk. Journal of Political Economy, 124, 1383–1422.

D’Erasmo, Pablo and Enrique G. Mendoza (2021). History remembered: Optimal sovereign default on domestic and external debt. Journal of Monetary Economics, Volume 117.

IMF (2021). Issues in Restructuring of Sovereign Domestic Debt. IMF Policy Paper 2021/071, International Monetary Fund.

Pitchford, Rohan, and Mark Wright (2011). Holdouts in Sovereign Debt Restructuring: A Theory of Negotiation in a Weak Contractual Environment. The Review of Economic Studies, Vol. 79.

Reinhart, Carmen, and Kenneth Rogoff (2011). The Forgotten History of Domestic Debt. The Economic Journal, 121.

Almuth Scholl (2024). The politics of redistribution and sovereign default. Journal of International Economics, Vol. 148.

Dominik Thaler (2021). Sovereign Default, Domestic Banks and Exclusion from International Capital Markets. The Economic Journal, 131.

Hatchondo et al. (2016) discuss issues in calibrating quantitative sovereign default models with domestic debt.

Broner et al. (2014) or Chari et al. (2021) model discriminatory sovereign default.

Our database complements and extends existing domestic sovereign default databases, such as IMF (2021) that is based on the residence of investors, Reinhart and Rogoff (2011) that is based on the governing law, and Beers and de Leon-Manlagnit (2019) that is based on the currency denomination.

This contrasts with a sometimes-held assumption that sovereigns favor resident creditors (Broner et al. 2010).

In an ongoing revision to our analysis, we also document that, in contrast with a widely held narrative in policy circles (IMF 2021), high inflation is no substitute to domestic default. Indeed, high inflation often co-exists with domestic default, and is as likely to occur during external defaults.