Since early 2020, special purpose acquisition companies (SPACs) have become increasingly popular. In a recent article, the Financial Times called them “Wall Street’s hottest investment product.” SPACs are a type of listed shell companies and not a novelty; in fact, they have been around for quite some time. However, with equity markets booming and investors searching for alternative investment opportunities, the popularity of SPACs has been surging especially over the past few months, in particular with hedge fund managers but also with traditional investors. In Europe, Amsterdam seems to be establishing itself as the most important listing location for SPACs, which is attributable to flexible listing rules and Amsterdam Euronext’s international reputation. In the following, we describe how SPACs work and discuss market developments as well as the potential risks and opportunities involved.

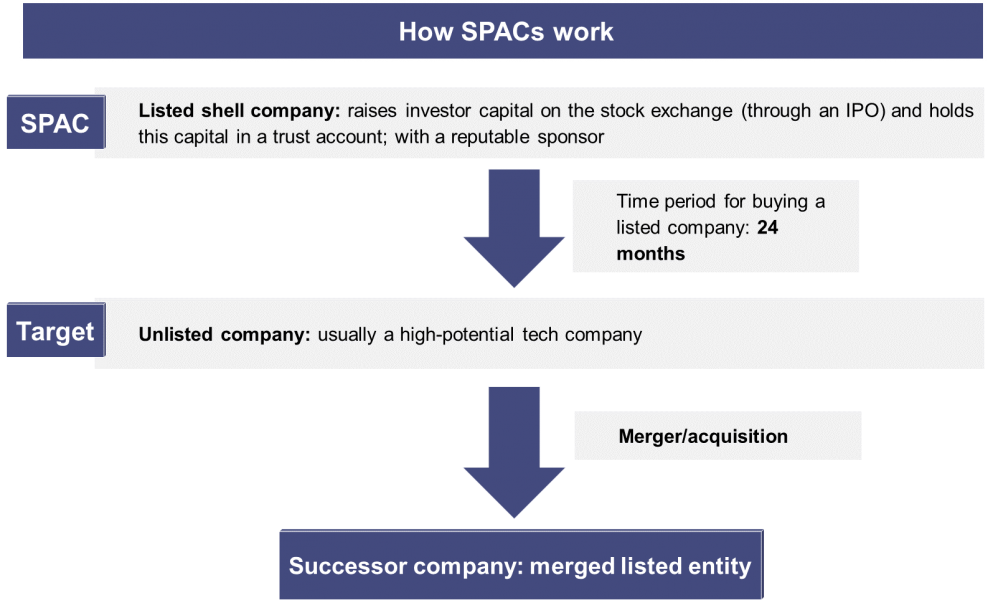

Definition: A SPAC (special purpose acquisition company) is a shell company founded to raise capital through an initial public offering (IPO) for the purpose of buying, or merging with, an unlisted company within a predefined period of time (usually 24 months). SPACs thus enable private companies to become listed companies without actually going public.

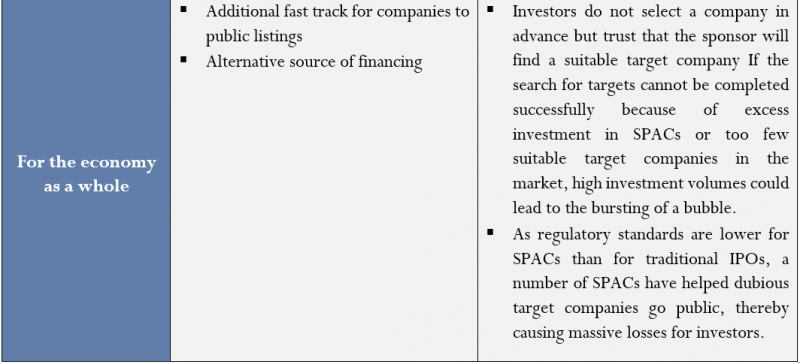

The illustration below shows how a SPAC merger works:

SPACs are also called “blank check companies” because at the time of their IPO they are only shell companies without assets and it is usually not known with which company a merger will eventually take place. As a result, the sponsor’s reputation plays a crucial role: “sponsor picking” replaces “stock picking.” The IPO prospectus usually contains information about the industry the sponsor is considering for a merger and information about the remuneration for the sponsor and their management team.

Difference between SPAC IPOs and traditional IPOs: A traditional IPO serves the purpose of selling a company’s stocks to predominantly institutional investors with the help of investment banks within a strictly defined regulatory framework. In the case of SPACs, by contrast, investors provide capital already before the IPO in order to help acquire an unlisted company afterwards. For the target company, the listing procedure is comparatively fast and simple: it takes, on average, only eight weeks, it is not necessary to hold roadshows or go through comprehensive due diligence processes, and regulatory requirements are less stringent.

SPAC investors’ rights and trading venues: The shareholders of a SPAC must approve the merger with a target company. Usually, they are also entitled to redeem their investment shares if they do not agree with the merger. Regulations in this respect differ across jurisdictions, however. In London, for instance, SPAC investors do not have both options (approval and redemption). As a rule, they may redeem their investment only if no suitable target can be found within a period of two years. This is also the reason why Amsterdam with its more investor-friendly regulations seems to be establishing itself as the European SPAC exchange (see also next section).

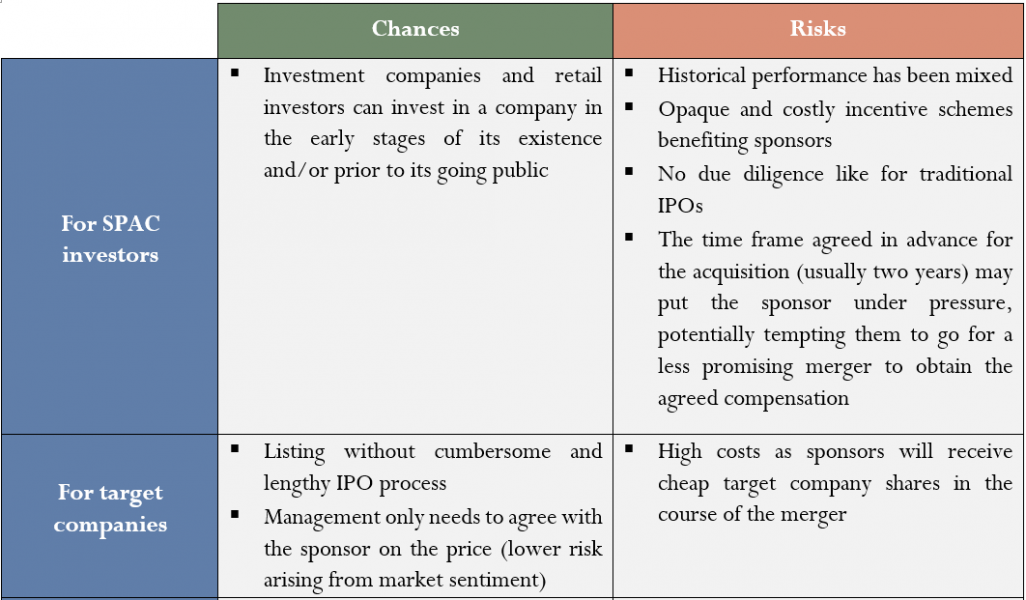

Compensation and costs: While the fees charged by investment banks for conducting conventional IPOs range between 5% to 7%, those charged for a SPAC IPO average 5.5%. Additional fees become payable when the actual merger takes place, however. In addition, the SPAC sponsor usually purchases a 20% stake in the company for a low nominal amount (“founder shares”). Furthermore, the sponsor or “sponsor teams” often enter into so-called PIPE (private investment in public equity) deals to participate in the merger. In practice, the capital invested through the PIPE frequently exceeds the capital raised in the SPAC IPO. Insiders claim that an investment in a SPAC only pays off for investors if they are also invested in the PIPE, which, however, is only open to a more exclusive circle of investors. In sum, the costs of a SPAC may total up to a quarter of the funds raised in the IPO, which is about three to four times the costs of a traditional IPO. Moreover, most SPACs come with warrants (similar to call options) for IPO investors, which may involve a substantial risk of dilution.

Risks and returns: From an investor’s perspective, SPAC transactions are not very transparent, given that at the time of the SPAC IPO the target company is usually not known. The biggest advantage for investors is that they have the opportunity to acquire a stake in a rapidly growing company which up to that point has been unable to go public because it has not yet reached market maturity. In other words, SPAC investors enjoy better earnings prospects while also facing higher risks. After all, there are hardly any other deals that offer retail investors the chance to acquire a stake in a company before an IPO.

Advantages for target companies: From the perspective of target companies, the major advantage of a SPAC merger is that they only have to negotiate with one investor (the sponsor) and not with numerous institutional investors coordinated by investment banks (that charge fees of 5% to 7% of the capital raised, as is the case with traditional IPOs). Also, there are no discounts, which institutional investors usually seek in conventional IPOs – another advantage for the owner of the target company. That said, in most cases, the costs of a SPAC transaction exceed those of a traditional IPO by far (see above). Hence, the real advantage for the target is the swift and comparatively simple listing process. Apart from that, regulatory requirements are much lower compared with a traditional IPO.

Oversight and regulation: In view of the risks, lack of transparency, high fees as well as past cases of fraud associated with SPACs, it is likely that regulations will be tightened in future. In this context, the focus will be on the amount of due diligence required for a merger of a SPAC with the target, which is less strict compared with traditional IPOs, and disclosure obligations.

The new chairman of the US Securities and Exchange Commission (SEC), Gary Gensler, announced in January 2021 that stepping up regulation for SPACs will be one of his top priorities. The fact that Gensler explicitly mentioned SPACs alone shows that there is a need for stricter regulation. In particular, current disclosure obligations are less stringent than in traditional IPOs (for instance as regards the shares that are held by the sponsor and the shareholders).

Meanwhile, the SEC has issued several warning letters to investors. In March 2021, SEC issued a warning regarding the growing trend of SPACs sponsored by celebrities. In April 2021, SEC officials said that companies going public through SPACs should face IPO-like scrutiny and that SPAC IPOs should be treated rather like traditional IPOs.

Performance of SPACs: In 2020, the performance of SPACs was below that of newly listed companies and the general market performance. From an investor’s perspective, SPACs’ performance hence did not justify their heightened risks. Given SPACs’ current popularity, however, investors do expect high yields in future.

Alternatives: Direct listings, which have also gained in popularity lately, are an alternative to SPACs. In direct listings, opening stock prices are not predetermined but completely subject to market demand. Among the companies that have opted for direct listings instead of a traditional IPO is music streaming platform Spotify, for instance.

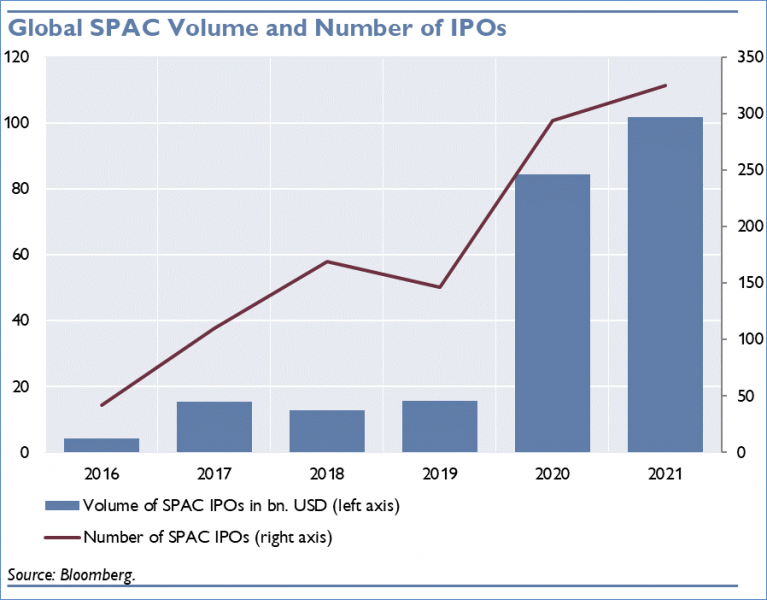

Over the past few months, the number of SPACs has risen rapidly. While, initially, they were more widespread in the USA, more recently, SPACs have also started to turn into a trend in European markets.

The chart below shows the total proceeds raised through SPAC IPOs (in USD billion) and the number of SPAC IPOs globally:

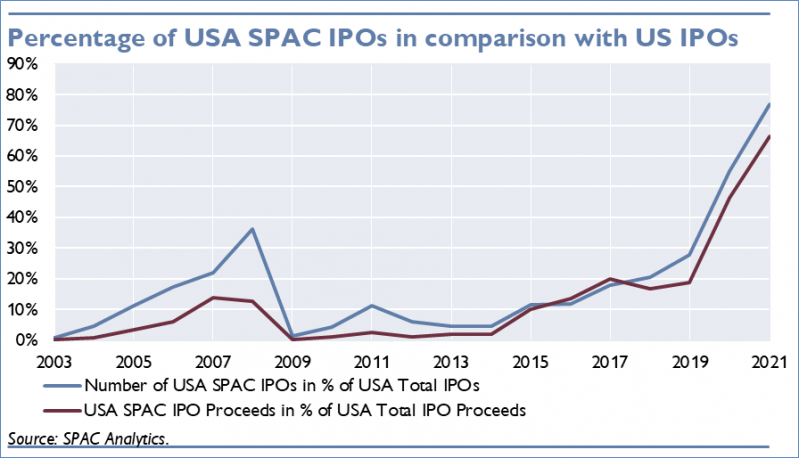

Developments in the USA: Since mid-2020, there has been a boom of US-American SPACs going public. In total, there were 248 IPOs of SPACs in the USA in 2020, raising capital of USD 83.3 billion. Since early 2021, this trend has accelerated further: by April 15, 2021, there had been 308 SPAC IPOs, attracting overall funds of approximately USD 99.1 billion. As a consequence, hundreds of SPACs are currently looking for suitable target companies. This search is becoming increasingly difficult in the USA, which is why, in their hunt for promising companies, many SPAC operators are casting a wider net on European and Asian markets. In the first quarter of 2021 SPACs struck deals with target companies worth USD 172 billion, which account for more than a quarter of all M&A transactions in this time period.

The chart below shows the total proceeds raised through SPAC IPOs in the USA in percent of the total proceeds overall in the USA, as well as the number of SPAC IPOs in percent of the total number of IPOs in the USA:

Developments in Europe – SPACs are only beginning to gain a foothold:

In 2020, only two SPACs went public in Europe (proceeds: EUR 410 million), but investors are becoming more interested. Since early 2021, there have already been four new listings of SPACs in Europe (proceeds: more than EUR 1 billion).

In Europe, we are currently witnessing power struggles between different stock exchanges (e.g. Amsterdam, Frankfurt and Paris) trying to establish a dominant position on the SPAC market.

Amsterdam is likely to emerge as the most important European market for SPAC listings, as its stock exchange Euronext has relatively flexible rules for stock market listings, which may create similar conditions as in the USA. Also, there are provisions in place which make it easier for investors to get out of SPACs. Finally, Amsterdam’s Euronext exchange has already built a very good reputation.

In mid-February, there was also the first listing of a SPAC in Frankfurt. This SPAC was allotted 27.5 million units at a price of EUR 10 each; these were over-subscribed 8-fold, and the first price was set at EUR 11.15.

In recent years, however, European SPACs have favored listings on US exchanges.

In turn, US SPACs have been focusing on Europe more strongly, as the US market is already saturated and many private companies in Europe are mature enough to go public. One example is the Arrival Group (a British electric vehicle manufacturer), which is being merged with a NASDAQ-listed SPAC (CIIG Merger Corp.). The merger was announced in November 2020 and has been finalized on March 24, 2021. Arrival then started trading one day after finalization.

The opinions expressed are those of the authors and do not necessarily reflect the views of the Oesterreichische Nationalbank.