This Policy Brief is based on European Central Bank Working Paper Series No 2917. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

The importance of non-banks in providing financing for euro area banks and firms has grown significantly since the global financial crisis. In this policy brief, we study the impact of a liquidity shock affecting the investment fund segment of non-banks on the financing conditions of firms. Due to their abrupt liquidity needs triggered by the outbreak of the Covid-19 pandemic, investment funds halted corporate bond purchases and withdrew short-term funding from banks. This had an impact on firm financing costs directly via bond markets, and indirectly via banks. We find that the spreads of corporate bonds held by investment funds increased, while banks more exposed to the withdrawal of short-term funding from investment funds decreased their lending to corporates. Our results show that while non-banks in general support firm financing by acting as a spare tyre, their own stress can trigger a contractionary credit supply effect for firms.

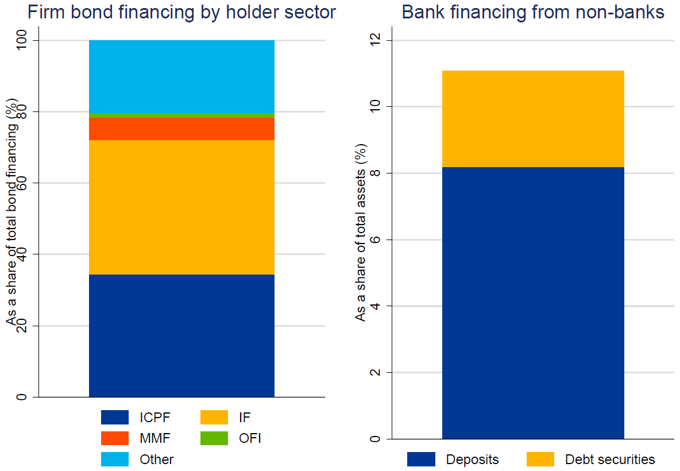

Although the euro area financial sector remains largely bank-based, the importance of non-banks in providing financing to euro area banks and firms has grown significantly since the global financial crisis (Albertazzi et al., 2020 and Cappiello et al., 2021). By non-banks we refer to investment funds (IF), insurance corporations and pension funds (ICPFs), money market funds (MMF) and other financial institutions (OFI). At the onset of the pandemic, non-banks held around 80% of bonds issued by euro area firms, with investment funds (IFs) holding the lion’s share of this amount (Figure 1, left panel). At the same time, the share of bank funding from non-banks stood at more than 10% of banks’ total assets (Figure 1, right panel), predominantly in the form of deposits by investment funds.

Figure 1: The importance of non-banks in firm and bank financing

Notes: The left panel shows the distribution of corporate bonds by holder sector in the euro area in 2022Q3. The right panel shows deposits and debt securities of non-banks in banks’ balance sheets as a share of banks’ total assets in 2022Q3. Own calculations based on ECB Supervisory reporting and Securities holding statistics by sector.

Given their importance in overall firm and bank financing, in this paper we focus on the investment fund segment of the non-bank sector. While investment fund financing brings benefits in terms of funding diversification for banks and firms (acting as ‘spare tyre’ when needed), a turmoil in investment funds carries its own risks: liquidity risks linked to easy redemption policies, procyclical margining, fire-sale dynamics, lack of regulation, are just a few among the many concerns that surround their growing footprint (see for example Brunnermeier and Pedersen, 2008; Fecht and Wedow, 2014; Gennaioli et al., 2013; Pozsar and Singh, 2011). Moreover, adverse dynamics in the investment fund segment are also expected to jeopardise the smooth transmission of monetary policy (Falato et al., 2020). Eventually, the pandemic put these concerns to test exposing firms to even stronger procyclical risks.

In March 2020, global uncertainty linked to the outbreak of the Covid-19 coronavirus triggered an extreme, albeit short-lived, liquidity shock for investment funds as fund-holders started to liquidate their positions in firms and banks. In parallel, corporate bond yield spreads soared overall, as markets briskly re-assessed corporate risks against an expected global fall of corporate sales. To meet these redemptions and the negative revaluations on their investments, investment funds were forced to either fire-sell bonds or to resort to their cash-holdings in banks. Transaction level repo data confirms that in the days after the Covid-19 outbreak, investment funds’ short-term deposits in banks (both secured and unsecured) declined significantly.

Did the liquidity shock of investment funds have an impact on firm financing conditions? By combining granular firm, loan, bond, bank and money market transaction level datasets for the euro area and using difference-in-differences research design methods, we estimate the impact of the investment funds related liquidity shocks on credit to firms for a short time window around the outbreak of the Covid-19 pandemic. Further details are provided in our working paper (Nicoletti et al., 2024).

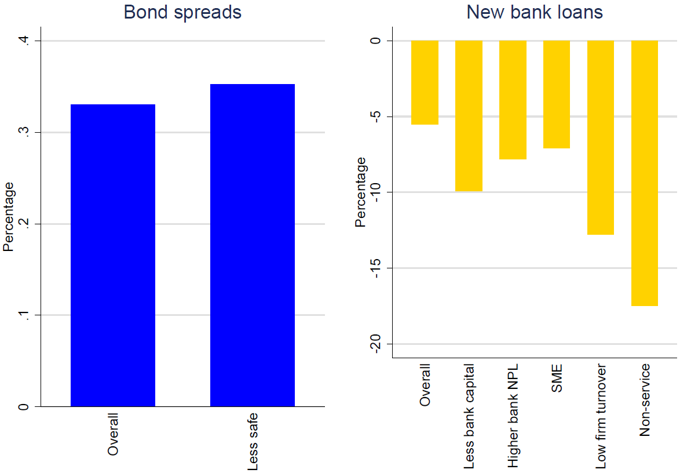

In our analysis, we look first at whether funds’ fire-sale behavior accelerated the increase of corporate bond yields for firms whose bonds were predominantly held by investment funds. Our results suggest that for bonds largely held by the investment fund sector, spreads increased more in the days after the outbreak of the COVID-19 pandemic, relative to those held more predominantly by other non-banks. This is in line with the procyclical nature of investment funds which may need to sell bonds to match their outflows, after or as complement to withdrawing their deposits from banks (see Goldstein et al.,2017). In particular, a firm whose bonds were more concentrated in investment funds by 1 percentage point (pp.), is estimated to have additional bond spread increases by about 0.33% (Figure 2, left panel, column 1). This translates into an increase in bond funding costs by almost 16 bps per each 100 bps increase in the spreads for a firm whose bonds are held by investment funds (i.e. with a median concentration around 40%). This is an economically significant increase, entirely explained by the fact that a procyclical investor, i.e. investment funds, rather than other investors, i.e. insurers, hold the bonds.

Finally, we document that the impact of bond concentration varies with the risk characteristics of the bond and is stronger for bonds with a rating quality below the median (Figure 2, left panel, column 2). This echoes and confirms results by Giuzio et al. (2021), which find that investment fund outflows (triggered by monetary policy) can affect more than proportionally assets with ratings of lower quality.

Figure 2: Investment fund shock and impact on firm bond financing and bank lending to corporates

Notes: The figure plots regression coefficients. The left panel shows the impact of a 1 pp. increase in the IF concentration of the bond holding, for bonds mostly held by investment funds, relative to those mostly held by other non-banks, for the period 11-17 March 2020, relative to the period 2-10 March. The second bar gives the effect for bonds with below median rating, which is between AAA and A. The right panel shows the impact of a 10 pp. increase in the investment fund exposure of banks (in terms of short term liabilities) on new lending by banks, for the period 11-17 March 2020, relative to the period 2-10 March. Median characteristic is used as a cutoff for low/high bank capital intensity, banks’ non-performing loan share and firms’ turnover, all defined as of end-2019. Non-service sector firms refer to firms in manufacturing and construction. In both exercises, we trace the effect of the pandemic up to the announcement of the European Central Bank’s pandemic emergency purchase programme (PEPP). All coefficients are significant at the 5% significance level.

Furthermore, we ask whether banks more affected by investment fund deposit outflows reduced their supply of new loans to firms more than other banks over the same time window around the outbreak of the Covid-19 pandemic.

According to our results, a 10 percentage point increase in IF exposure on the short term liability side of the bank reduces the volume of new lending by 5.5 percent (Figure 2, right panel, column 1). In addition, we estimate the effect of investment fund exposure on rates and maturities associated with new lending but find mixed results. Results for rates show no significant effect. We see a small decrease with respect to the maturity of the new loans granted, however this effect is also not significant. These results are in line with our expectations, as it is likely that banks can adjust very quickly by reducing the quantity of loans on offer, however, transmission of shocks to credit standards and terms and conditions for new loans is likely to take more time to pass-through.

We provide results for the heterogeneous impact of new lending related to some bank-specific characteristics (Figure 2, right panel, columns 2-3). We use as key bank balance sheet strength variable the bank capital-to-total-assets ratio (e.g. Bernanke et al., 1996, Kashyap and Stein, 2000) and show that for less capitalized banks, the negative impact of being more exposed to investment funds is more pronounced. Finally, we show that the intermediation capacity is more impaired for banks with higher NPL ratios, in line with Huljak et al. (2020) and Sánchez Serrano (2021).

To better understand which firms are more affected, we explore the effect of the shock by firm characteristics (Figure 2, right panel, columns 4-6). Our main results are driven by lending to small and medium enterprises. These findings corroborate the results of the Survey on the Access to Finance of Enterprises in which SMEs indicated concerns related to accessing bank loans as the pandemic broke out (See SAFE, 2020). For firms having below median turnover in 2019 the impact is more pronounced, as banks might be willing to give loan to firms with better prospects to repay their debts. Finally, we show that the negative impact on lending is associated with firms in the manufacturing and construction sectors. This is in line with our expectations, as firms in these sectors are generally more credit dependent because of higher physical investments and their buyer-supplier links, which need to be financed more prevalently with short term credit (e.g. Rajan and Zingales (1998), Braun and Larrain (2005)).

Our analysis tracks the impact of a shock to the investment fund sector on corporate bond financing and bank credit to firms over a short period after the outbreak of the Covid-19 pandemic. Nonetheless, it provides useful insights into the financial system’s reaction to a global liquidity shock. While a diversified financial sector is more resilient (e.g. as bonds mostly held by insurers were largely unaffected in this period), it is also more exposed to various risks. Overall, we show that shocks in the euro area non-bank sector can spillover to firms and banks, raising financial stability concerns and highlighting the importance of regulation for non-banks.

Albertazzi, U., F. Barbiero, D. Marqués-Ibáñez, A. Popov, C. Rodriguez d’Acri, and T. Vlassopoulos (2020, February). Monetary policy and bank stability: the analytical toolbox reviewed. Working Paper Series 2377, European Central Bank.

Bernanke, B., M. Gertler, and S. Gilchrist (1996, February). The Financial Accelerator and the Flight to Quality. The Review of Economics and Statistics 78(1), 1–15.

Braun, M. and B. Larrain (2005, June). Finance and the Business Cycle: International, InterIndustry Evidence. Journal of Finance 60(3), 1097–1128.

Brunnermeier, M. K. and L. H. Pedersen (2008, 11). Market Liquidity and Funding Liquidity. The Review of Financial Studies 22(6), 2201–2238.

Cappiello, L., F. Holm-Hadulla, A. Maddaloni, L. Arts, N. Meme, P. Migiakis, C. Behrens, A. Moura, S. Corradin, A. Ferrando, J. Niemelä, M. Giuzio, O. Pierrard, L. Ratnovski, L. Ratnovski, A. Gulan, A. Schober-Rhomberg, A. Hertkorn, M. Sigmund, C. Kaufmann, L. K. Avakian, P. Stupariu, K. Koskinen, M. Taboga, F. Sédillot, L. Tavares, J. Matilainen, E. V. den, F. Mazelis, A. Zaghini, and B. McCarthy (2021). Non-bank financial intermediation in the euro area: Implications for monetary policy transmission and key vulnerabilities. ECB Occasional Paper No. 2021/270.

European Central Bank (2020). Survey on the access to finance of enterprises. October 2019 to March 2020. Link: https://www.ecb.europa.eu/stats/accesstofinancesofenterprises/pdf/ecb.safe202005~c4b89a43b9.en.pdf.

Falato, A., A. Hortaasu, D. Li, and C. Shin (2021). Fire-sale spillovers in debt markets. The Journal of Finance 76(6), 3055–3102. ECB Working Paper Series No 2917 23.

Fecht, F. and M. Wedow (2014). The dark and the bright side of liquidity risks: Evidence from open-end real estate funds in germany. Journal of Financial Intermediation 23(3), 376–399.

Gennaioli, N., A. Shleifer, and R. W. Vishny (2013). A model of shadow banking. The Journal of Finance 68(4), 1331–1363.

Giuzio, M., C. Kaufmann, E. Ryan, and L. Cappiello (2021, October). Investment funds, risk-taking, and monetary policy in the euro area. ECB Working Paper Series (2605).

Goldstein, I., H. Jiang, and D. T. Ng (2017). Investor flows and fragility in corporate bond funds. Journal of Financial Economics 126(3), 592–613.

Huljak, I., R. Martin, D. Moccero, and C. Pancaro (2020, May). Do non-performing loans matter for bank lending and the business cycle in euro area countries? Working Paper Series 2411, European Central Bank.

Kashyap, A. K. and J. C. Stein (2000, June). What do a million observations on banks say about the transmission of monetary policy? American Economic Review 90(3), 407–428.

Nicoletti, G., J. Rariga, C. Rodriguez D’Acri. (2024). Spare tyres with a hole: investment funds under stress and credit to firms. ECB Working Paper Series No 2917.

Pozsar, M. Z. and M. M. Singh (2011, December). The Nonbank-Bank Nexus and the Shadow Banking System. IMF Working Papers 2011/289, International Monetary Fund.

Rajan, R. G. and L. Zingales (1998, June). Financial Dependence and Growth. American Economic Review 88(3), 559–586.

Sánchez Serrano, A. (2021). The impact of non-performing loans on bank lending in Europe: An empirical analysis. The North American Journal of Economics and Finance 55, 101312.