The euro is the second most important global currency, and the euro area’s economic weight can lay solid foundations for its greater role on financial markets. A stronger international role of the euro would benefit not only the euro area but also the global financial system. The ongoing reforms in the European Economic and Monetary Union can support the common currency on the international scene, and further policies at the European level can strengthen a wider use of the euro on international capital markets.

Changing Landscape

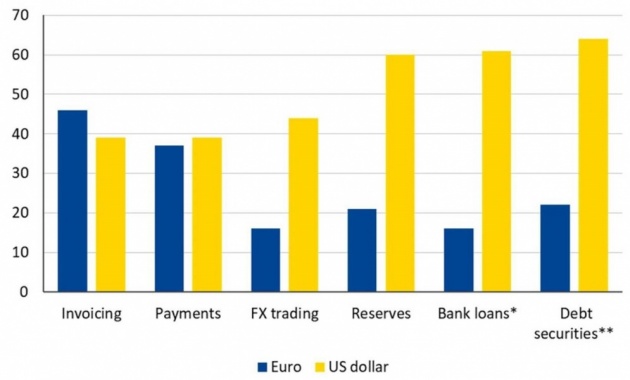

The international monetary and financial system may be slowly moving towards a ‘multipolar’ structure. The US dollar remains the dominant global currency, and serves as a point of reference for international borrowers and investors. The euro is a distant second behind the dollar on global financial markets, but it is on par with the dollar for international trade invoicing and global payments (Figure 1). Furthermore, the international use of the renminbi is also rising with the opening up of Chinese financial markets and with the authorities’ active policy support.

European policymakers have recognised the importance of the issue and the international role of the euro featured high on the agenda at the latest Euro summit on 25 March 2021.2 The European Commission has highlighted the need for more geopolitical financial sovereignty,3 and a recent ESM discussion paper focused on the main drivers of the euro’s global role and the policies to support it.4

A more prominent international role for the euro would benefit Europe by ensuring more stable financing conditions and it would lend greater stability to the international financial system as a whole. A wider use of the euro for financial transactions and investments can also promote diversification across the international monetary and financial system.

An excessive reliance on the US dollar entails certain drawbacks. For instance, US monetary policy can induce shocks to global financial markets,5 while dominant-currency pricing and financing can hinder external adjustment through exchange rate flexibility.6 A more diversified mix of global currencies would allow borrowers and investors to diversify their assets and liabilities, enable effective risk sharing and hedge volatilities induced by capital flow fluctuations.7

The Euro‘s Strengths and Weaknesses

Different functions of an international currency strengthen one another.8 Countries with euro-denominated export receipts have economic incentives to manage their financial assets and liabilities in euros. This logic works in two ways. It can increase demand for euro-denominated safe assets if other central banks wish to invest their foreign reserves in the currency in which the countries’ export receipts are denominated. And it can foster more diverse euro-denominated debt markets if other countries decide to issue a larger share of their sovereign debt in euros.

Figure 1 The euro is the world’s second most important currency

(Global share of the US dollar and the euro in %)

Notes: *Bank loans include cross-border loans denominated in a foreign currency (i.e. currencies foreign to bank location country); **Debt securities include securities that are issued in a currency other than that of the borrower’s residency.

Sources: Invoicing based on Boz et al. (2020); Payments based on Swift via Bloomberg Finance L.P.; FX trading, bank loans, and international debt securities based on BIS; Reserves based on the International Monetary Fund’s (IMF) Cofer, latest available data”

The euro has many strengths that can support a stronger role globally. Its large economic area, well-advanced financial markets, and relatively low currency volatility support an international euro status, underpinned by an independent central bank with a clear price stability mandate and a prohibition against monetising government deficits. The euro area demonstrates its strong external position with a persistent current account surplus since 2012. Its broadly balanced international investment position shows that the monetary union can attract foreign investors, including those seeking a safe haven,9 and it can support investment in the rest of the world as a capital exporter.

However, diversification away from the US dollar has benefitted the euro only to a limited extent so far.10 Economic fundamentals vary greatly across member states. Without an overarching risk-sharing mechanism, idiosyncratic economic and political risks bring about varying impacts across European financial markets. In particular, on sovereign debt markets some government bonds exhibit the characteristics of safe assets, while others trade like risky assets.11

A scarcity of euro-denominated safe assets is an obstacle to establishing the euro as a safe-haven currency. Safe assets accounted for about 25% of euro area GDP at the end of 2019,12 while the US Treasury market accounted for 90% of GDP – and the volume of all euro area sovereign debt combined is still smaller than that of the US Treasury market. This means that a large part of euro area assets may lose value during increased global risk aversion, and such sentiment generates capital outflows seeking to preserve value.13

The euro area’s heavy reliance on bank financing also limits the depth and liquidity of European financial markets. A large share of outstanding corporate debt registers as unmarketable assets on bank balance sheets and as unavailable assets for foreign investors. European capital markets remain small and fragmented, with a relatively small share of corporate liabilities securitised and a large share of European investors’ assets concentrated in their national markets.14

What can be done to support the international role of the euro?

The bedrock of a currency’s international status is the strength and resilience of its underlying economy. Thus, reforms to strengthen growth potential in euro area member states will be crucial. Markets will look at the ability of European countries to deal with impediments to growth and address the scars left by the pandemic crisis. Supporting growth will enhance market perception of the euro and demonstrate an ability to address longer-term euro area economic challenges. It will also help mitigate the risk of social and political conflict undermining euro area cohesion. Measures taken during the pandemic crisis go a long way to supporting the international role of the euro. The EU recovery fund addresses macroeconomic instability with intra-regional transfers and promotes structural reforms. The fund, together with substantial ECB purchases of government debt, helps mitigate sovereign credit risk in high-debt countries, which should encourage inflows from foreign investors and support the currency.

Safe assets. An ample supply of safe assets can act as a ballast to dampen euro area sovereign debt price fluctuations during times of stress.15 The EU is on course to become one of the largest issuers in the euro area and to expand the supply of euro-denominated safe assets.15 By 2026, a total of €850 billion new EU bonds could be issued. This could expand the pool of highly rated bonds to about 40% of GDP over the coming years,16 which would offer a new alternative for low-risk euro-denominated investments. EU bonds appear to exhibit better performance when it comes to risk-off or systemic euro risk correlations,17 and common liabilities have a more powerful effect on semi-core markets than core markets, so they can contribute to convergence between euro area issuers.18

This should, in turn, facilitate the diversification of official reserves into euros. Supranational issuance is already fairly well-subscribed relative to national bonds, with a large share absorbed by central banks.19 However, the additional EU bond supply will only lead to a permanent increase in the euro’s share of official reserve allocation if reserve managers are confident such instruments will remain available over an extended period, possibly beyond the envisaged expiry of the debt issued under the Recovery and Resiliency Facility in 2058. Otherwise, there is a risk that EU bonds would merely substitute other euro-denominated reserve holdings and dampen demand for member states’ sovereign debt.

The ECB’s Pandemic Emergency Purchase Programme also supports market confidence in the euro, as it reaffirms the ECB’s ability and commitment to act as the euro area lender of last resort. The programme’s flexibility helps to tame divergences across euro area government bond markets and to reduce sovereign credit risk in high-debt member states. However, the ECB’s purchases reduce the volume of government debt securities available to investors. To address this issue, some observers suggested the ECB could offset this decline in sovereign securities with the issuance of its own certificates of deposit to expand and stabilise the supply of euro safe assets.20

Policy coordination. Euro internationalisation may require further efforts, such as enhancing European policy coordination. A well-coordinated economic, fiscal, and monetary policy mix can strengthen confidence that euro area countries can avoid a protracted debt overhang after economic shocks, such as the pandemic. Simple effective rules and procedures would help guide market views, and bolster investor trust. Clear communication and guidance about fiscal and monetary policy outlooks could steer market expectations and underpin confidence in the euro.

Risk sharing. In the long run, a more explicit and permanent public risk mechanism would reinforce confidence in the euro and help mitigate asymmetric shocks. Financing under the Next Generation EU plan will support the recovery from the pandemic shock, but a permanent mechanism for risk-sharing among euro area countries hit by asymmetric shocks is missing. Establishing such a fiscal capacity to stabilise economies beyond the current crisis would reinforce global investor confidence in the euro area’s capacity to respond to economic and financial shocks.

Banking union. Completing banking union and improving private sector risk sharing would make euro-denominated financial markets more attractive. More cross-border banking in Europe is one way to increase risk sharing in the private sector. The completion of banking union is a precondition for a more integrated European banking market, including the common backstop to the Single Resolution Fund and European Deposit Insurance Scheme. Implementing these projects would strengthen market trust in the ability to secure financial stability.

Capital markets union. In the wake of Brexit, European capital markets need to increase their openness to, and attractiveness for, international capital. Advancing towards financial union would support an international euro. Financial market depth and liquidity are key determinants for any currency’s global status, so progress towards a capital markets union21 – along with completing banking union – would better connect European capital markets and deepen the euro-denominated markets, making the euro more attractive and enhancing its use internationally. Connections established by capital markets integration could also promote private sector risk-sharing and shock absorption. A more harmonised and centralised European supervisory authority – mirroring the supervisory model implemented for banking union – would considerably ease market access for international investors.22

Green finance. The growing demand for green bonds could be a promising development. A Bank for International Settlements report23 found two thirds of central banks have not included sustainability considerations in their list of objectives, yet 68% identify scope to adopt one. The euro would reap advantage from progress on this front, because almost half the world’s green bond issues are euro-denominated.24 EU residents are now the largest green bond issuers and the Taxonomy regulation25 will likely establish the EU as the largest pool of certified investors for green finance.

Market infrastructure. Improvements in financial market infrastructures facilitate access by global investors to euro-denominated markets. Since the euro’s launch, the Eurosystem has helped reshape and consolidate the infrastructure for large-value payments, post-trading services, and instant retail payments, aiming to establish a truly single financial market across Europe where payments, securities, and collateral can shift safely and efficiently between participants without friction or restrictions.26 Central bank digital currencies, and in particular a digital euro, could bring additional payment efficiency gains. Furthermore, there is room to develop an infrastructure for euro-denominated debt issuance. One potential change would be to develop a European platform for debt distribution, where a secure, stable, and transparent market within a common regulatory environment would nurture euro-denominated debt issuance.

Reaching beyond the euro area. Policies could aim to increase the use of the euro in specific markets, such as the emerging market sovereign debt market or in the energy sector, based on existing trade and financial links. For countries with extensive exports to the euro area, scope may exist to use the euro more widely as an invoicing unit, buttressing the economic rationale to increase euro-denominated debt issues to mitigate currency mismatches. Euro-denominated funding and bond issuance by partner countries could reduce their reliance on the US dollar and expand euro usage in emerging markets. This development could be augmented by measures to support euro liquidity on foreign exchange markets, helping the direct conversion of emerging market currencies into euros. Promoting euro-based financial instruments to hedge against exchange rate movements would also help, because even when instruments like cross-currency swaps are available for emerging market currencies, they are usually not liquid enough to appeal to investors. Trading through the US dollar, called triangulation, remains common practice.

Conclusion

A stronger international role of the euro would benefit both Europe and the global financial system. It would ensure more stable financing conditions in the euro area, attract more investors, and help finance the post-pandemic recovery. A wider global use of the euro would also allow international borrowers and investors to diversify their exposures and hedge currency volatilities in the system as a whole. The ongoing reforms in the European Economic and Monetary Union can support the common currency on the international scene.

The views expressed hereafter do not necessarily represent those of the Bank for International Settlements (BIS), the European Stability Mechanism (ESM) or their policies.

Statement of the members of the Euro Summit, 25 March 2021

European Commission (2021), The European economic and financial system: fostering openness, strength and resilience

Hudecz, G, E. Moshammer, A. Raabe and G. Cheng (2021), “The euro in the world” , ESM Discussion Paper 16

Miranda-Agrippino, S. and H. Rey (2020), “U.S. Monetary Policy and the Global Financial Cycle,” The Review of Economic Studies, 87/6, pp. 2754–2776.

Adler G. et al. (2020), “Dominant Currencies and External Adjustment,” IMF Staff Discussion Note 20/05.

Carney, M. (2019), “The Growing Challenges for Monetary Policy in the current International Monetary and Financial System,” Speech at Jackson Hole Symposium.

Gopinath, G. and J. Stein (2018),” Banking, Trade, and the Making of a Dominant Currency,” NBER Working Paper 24485.

Habib, M. M. and L. Stracca (2011), “Getting beyond carry trade: What makes a safe haven currency?” ECB Working Paper 1288.

Bank of America Merrill Lynch (2021), CB reserves: a smaller offset to USD weakness & UST selloff.

Cole, G. (2018) “EMU sovereign bond / equity correlations,” Goldman Sachs Economics Research.

This includes debt issued by member states rated AA+ or higher (Germany, Netherlands, Luxembourg, Austria, and Finland – about €2.3 trillion combined as of end-2019), and highly-rated European supranational issuers: the EIB (€450 billion), EFSF/ESM (€310 billion) and the European Commission (€50 billion).

Cole, G. and K. Reichgott (2018), “The EUR as a Safe Haven: Not There Yet,” Goldman Sachs Economics Research.

IMF (2019), “A Capital Market Union for Europe,” Staff Discussion Note 19/07.

See Appendix I in Hardy, D. C. (2020), “ECB Debt Certificates: the European counterpart to US T-bills,” University of Oxford, Department of Economics Discussion Paper.

Lenarc ic , A. and M. Sus ec (2020), Pandemic crisis as a catalyst for a common European safe asset, ESM blog.

Cole, G. et al. (2020), “EU Bonds — A New Supra Hero,” Goldman Sachs Economics Research.

Valla, N. (2012), “All debts are not equal,” Goldman Sachs Economics Research.

Saravelos, G. (2020), “Someone likes Europe,” Deutsche Bank Research.

Hardy, D. C. (2020); Capolongo A, B. Eichengreen and D. Gros (2020), “Safely increasing the supply of safe assets: Internationalising the euro in the age of COVID-19,” VoxEU.

European Commission (2020), A New Vision for Europe’s capital markets , Final Report of the High Level Forum on the Capital Markets Union, June 2020.

European supervision fit for capital markets union , ESM blog, 2021.

Fender, I, M. McMorrow, V. Sahakyan and O. Zulaica (2020), “Reserve management and sustainability: the case for green bonds?” BIS Working Paper 849.

ECB (2020), The international role of the euro.

ECB (2019), The international role of the euro .