I simulate an increase in the unemployment rate to assess the impact of an income shock on the financial vulnerability of households in ten countries of Central, Eastern and Southeastern Europe (CESEE). A household is defined as being financially vulnerable when its debt service-to-income (DSTI) ratio is 40% or more. Using microdata from the 2019 fall wave of the OeNB Euro Survey allows me to calculate the share of vulnerable households in a consistent manner across countries. This indicator is used to analyse the response to various shock scenarios to assess the impact of the COVID-19 pandemic on households’ debt service capacity across the ten examined CESEE countries. The results suggest that the share of vulnerable households increases almost linearly with a rise in the unemployment rate but to a quite different extent across countries. Several factors are identified that drive the observed variability, one being the amount of wage replacement rates. In countries where unemployment benefits are comparatively high, adverse effects can be mitigated to a significant degree.

The COVID-19 pandemic has caused a worldwide economic crisis with potential adverse impacts on labour markets and consequently on households´ financial positions. From a financial stability viewpoint, it is of interest to know which and how many debtors will have a high risk of not being able to repay their loans as a result of the crisis in order to evaluate the adverse implications for the banking sector. In a recently published paper (Riedl, 2021), I make use of OeNB Euro survey data to shed light on household debt in ten Central, Eastern and Southeastern European (CESEE) economies2 from the perspective of the borrower. In particular, I assess how job losses due to the COVID-19 slump might impact on the debt service capacity of households.

Household vulnerability varies to a large degree across CESEE countries

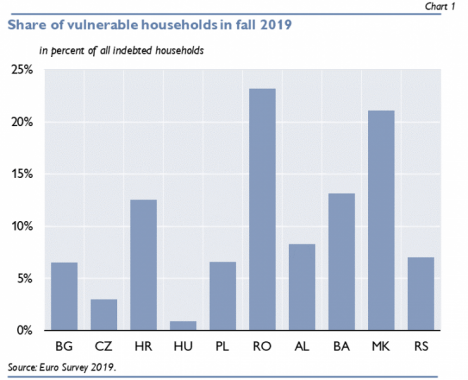

To identify vulnerable households, I make use of two questions included in the 2019 fall wave of the OeNB Euro Survey. Respondents were asked to report the household´s monthly loan instalment payments3 as well as the total monthly net income (after taxes). Dividing the former by the latter (and multiplying by 100) yields the DSTI ratio, which is the relevant metric in my analysis. Following the literature, I define the vulnerability indicator as the share of households with DSTI-ratios of 40% or more over all indebted households (in %). Chart 1 presents the respective indicator for all ten CESEE countries, which unveils a large heterogeneity across countries with respect to repayment risks. While in Hungary only 1% of all indebted households spend 40% or more of their incomes on debt service payments, in Romania nearly one-fourth of all indebted households have DSTI ratios equal to or above 40%.

To which extend does a rise in the unemployment rate affect the share of vulnerable households?

In order to compare the countries’ responsiveness to a unified income shock I simulate an increase in the unemployment rate by 5 percentage points (pp). The simulation design consists of two main ingredients: (1) an employed respondent is randomly selected and becomes unemployed, (2) this affects the respondent´s personal income and consequently the income of the household. This allows to calculate the modified DSTI ratio and the new share of vulnerable households. By repeating the Monte Carlo simulation 1,000 times, I obtain the result by taking the mean value of the vulnerability indicator over all these draws.

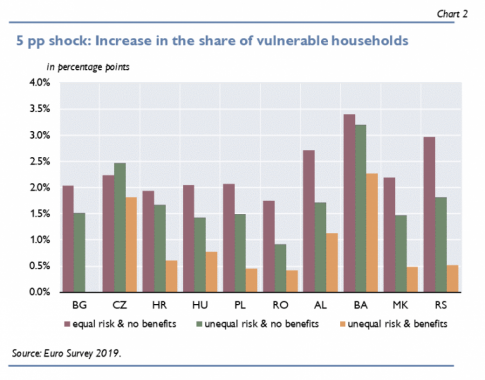

Chart 2 presents the simulation result for a 5 pp increase in the unemployment rate in each country for three different scenarios. Based on the actual values in 2019, the dark red part of the bar shows to which extent the share of vulnerable households increases due to the unemployment shock when we assume that each employed individual has the same chance of becoming unemployed and, once unemployed, does not receive any unemployment benefits, i.e. the personal income is set to zero in the case of an unemployment shock. Again, we observe a large heterogeneity. The amount of the impact varies across countries but seems to be unrelated to the actual share of vulnerable households, i.e. we do not observe the largest impacts in countries with the largest actual shares of vulnerable households.

The highest impact is observed in Bosnia (3.5 percentage points), where the increase is twice as high as in Romania (1.7 percentage points). This variability is driven by two very country-specific factors. First, the distribution of DSTI ratios across households determines how likely it is that the threshold of 40% will be exceeded after an unemployment shock. In countries where the share of households with DSTI ratios below but very near to 40% is high, the responsiveness to an unemployment shock is more pronounced. Second, the household structure has an important influence on the shock outcome. If the number of income earners in a household is high, income shocks can be absorbed much more easily. In Bosnia, where the shock responsiveness is highest, single-earner households are much more frequent than in the other nine CESEE countries. Also, the share of households with DSTI ratios between 35% and 40% is highest in Bosnia.

Accounting for individual heterogeneity in modelling job loss mitigates the increase of vulnerable households

The second scenario assigns different unemployment probabilities to respondents taking into account that individuals with different personal characteristics have a different likelihood of becoming unemployed. The results are depicted by the green bars in chart 2. Comparing them to the outcome of the previous setting (dark red bars), we observe that in almost all countries the adverse impact is reduced when we assume heterogenous unemployment risk. This result reflects two opposing effects. First, in all countries except in the Czech Republic unemployment rates are lower for indebted households than for households with no debt. Hence, in most countries, the estimated unemployment probabilities are on average lower for respondents in indebted households. Therefore, fewer respondents from indebted households (compared to debt-free households) are selected into unemployment in the first place. This effect dampens the adverse impact resulting from the shock compared to the scenario where every individual was assigned an equal risk of losing their job. On the other hand, if out of the pool of indebted households those with the “bad characteristics” are selected first, the adverse impact of the shock could be reinforced. In the CESEE region, typically higher-educated, white-collar workers have lower DSTI levels and at the same time have a lower probability of becoming unemployed. Hence, assuming heterogenous unemployment risk implies that those respondents are picked first (out of the pool of indebted households) who have higher DSTI levels on average. Depending on which of the both effects dominates, this will either reinforce or dampen the adverse impact. In my setting, heterogenous unemployment risk has a dampening effect in almost all countries.

Unemployment benefits can significantly reduce adverse outcomes

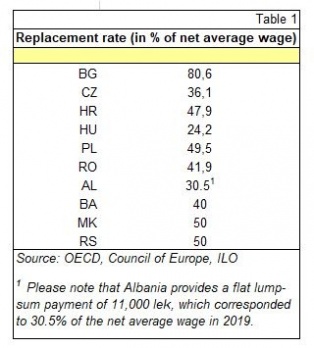

Finally, the third stress test scenario assigns unemployment benefits to individuals who lose their jobs while leaving the remaining assumptions unchanged. The unemployment benefit in the stress test exercise corresponds to the amount of the net wage replacement rate according to national regulations. This rate is available from the OECD for six out of the ten countries under review and represents the share of net income from work that is maintained when people become unemployed. We complement this indicator for the remaining four countries by considering various sources (Council of Europe, ILO). Table 1 provides an overview of the wage replacement rate in the ten countries.

The orange bars in chart 2 represent the results from this scenario. While in all countries the adverse impact is reduced, we again observe large heterogeneities across countries. This is quite obviously related to the different national unemployment benefit regulations. When we look at the different wage replacement rates, we can immediately see the correlation between the generosity of unemployment benefits and the shifts in the outcome compared to the previous setting (green bars). In Bulgaria for example, where unemployed persons receive a benefit of 80% of their net salary, the adverse impact from an unemployment shock vanishes completely. In contrast, in the Czech Republic, in Bosnia or in Albania, for example, where wage replacement rates are among the lowest in the region, the reduction of the adverse impact is least significant. Hence, our results argue in favor of generous allowances as they seem to significantly mitigate adverse outcomes.

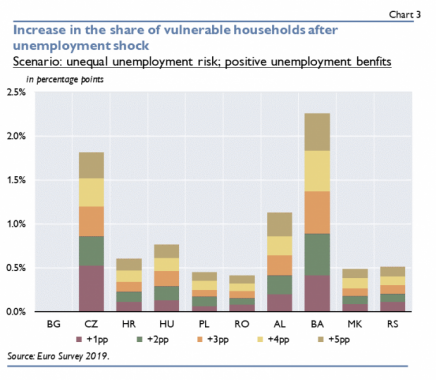

The share of vulnerable households increases almost linearly with a rise in the unemployment rate

Chart 3 summarizes the results of the last scenario, i.e. assuming heterogeneous unemployment risk and unemployment benefits, simulating unemployment rate shocks of 1 up to 5 percentage points. The colored parts in the bars represent the change in the share of vulnerable households after each percentage point increase in the unemployment rate. Thus, by summing up the individual effects, the height of the bars shows the overall impact from a 5-percentage point shock (orange bars in chart 2). For the reasons outlined before, the impact varies largely across countries. Interestingly though, the effect from the income shock seems to increase almost linearly with the unemployment rate in each country.

Are CESEE borrowers at risk?

So far, unemployment rates have increased only modestly in the CESEE region from 2019 to 2020. This might be related to the fact that the COVID-19 pandemic has prompted large-scale policy support to preserve employment relationships including wage subsidies and short-term work schemes (IMF, 2021). According to the IMF4, the highest rise in unemployment rates are observed in Bosnia (+3,3 pp) and Serbia (+2,4 pp), while in North Macedonia and Poland unemployment rates have even lowered by -0,9 and -0,1 pp respectively. Recalling our results from chart 3, an increase in the unemployment rate in Bosnia by 3 pp is projected to increase the share of vulnerable households by 1,4 pp. The latest labour market developments in Serbia will raise the vulnerability indicator by around 0,2 pp according to our stress-test results. Hence, compared to the initial (i.e. actual) share of vulnerable households in 2019, the impact from the COVID-19 crisis can be classified as rather moderate so far. This is related to the fact that indebted households in general have higher incomes (compared to households without debt) as debt participation increases with income in these countries (see also Riedl, 2019). Also, unemployment rate shocks only hit a relatively small group of indebted households compared to other shocks, like interest rate or exchange rate shocks. This is why effects from unemployment rate shocks are typically found to be modest in the literature.

Does this mean that CESEE borrowers are not at risk? On the contrary, we have seen that the share of vulnerable households is quite high in some countries. More than 20% of all indebted households in Romania and North Macedonia spend at least 40% of their disposable income to meet debt service payments. We have also demonstrated that deteriorating labour markets have a negative effect on the vulnerability of households in the CESEE region, but that unemployment benefits can be a useful policy tool in mitigating those adverse developments.

International Monetary Fund. 2021. World Economic Outlook: Managing Divergent Recoveries. Washington, DC. April

Riedl, A. 2021. Are CESEE borrowers at risk? COVID-19 implications in a stress test analysis. In: Focus on European Economic Integration Q1/21. OeNB. 37–53.

Riedl, A. 2019. Household debt in CESEE economies: a joint look at macro- and micro-level data. In: Focus on European Economic Integration Q1/19. OeNB. 6–28.

IMF World Economic Outlook Database: April 2021. Unemployment rates were downloaded on the 25th of April 2021. World Economic Outlook Database, April 2021 (imf.org)