References

Coibion, Olivier, Yuriy Gorodnichenko, and Michael Weber, 2022. “Monetary Policy Communications and their Effects on Household Inflation Expectations,” Journal of Political Economy 130(6): 1537–1584.

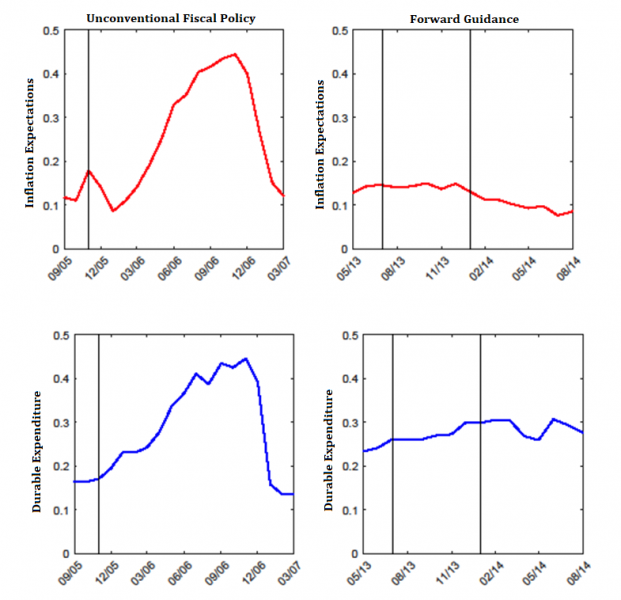

D’Acunto, Francesco, Daniel Hoang, and Michael Weber, 2022a “Managing Households’ Expectations with Unconventional Policies,” Review of Financial Studies 35(4): 1597–1642.

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber, 2021. “IQ, Expectations, and Choice,” Review of Economic Studies (forthcoming).

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber, 2019. “Cognitive Abilities and Inflation Expectations,” AEA Papers and Proceedings 109(5): 562-566.

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber, 2022c. “Human Frictions in the Transmission of Economic Policy,” Working Paper.

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber, 2022d. “Effective Policy Communication: Targets versus Instruments,” Working Paper.

D’Acunto, Francesco, Andreas Fuster, and Michael Weber, 2022e. “Diverse Policy Committees Can Reach Underrepresented Groups,” Working Paper.

D’Acunto, Francesco, Ulrike Malmendier, and Michael Weber, 2021a. “Gender roles produce divergent economic expectations,” Proceedings of the National Academy of Sciences 118(21): 1-10.

D’Acunto, Francesco, Ulrike Malmendier, Juan Ospina, and Michael Weber, 2021b. “Exposure to Grocery Prices and Inflation Expectations,” Journal of Political Economy 129(5): 1615-1639.

D’Acunto, Francesco, Ulrike Malmendier, and Michael Weber, 2022f. “What Do the Data Tell Us About Inflation Expectations?” Handbook of Economic Expectations (forthcoming).

D’Acunto, Francesco, Michael Weber, Olivier Coibion, and Yuriy Gorodnichenko, 2022b. “Wage-Price Spirals? Evidence from Households,” Working Paper.

Hackethal, Andreas, Philip Schnorpfeil, and Michael Weber, 2022a. “Inflation Expectations and Investment Choices,” Working Paper.

Hackethal, Andreas, Philip Schnorpfeil, and Michael Weber, 2022b. “Inflation Expectations, Net Nominal Positions, and Consumption,” Working Paper.

Lucas, Robert E. Jr. 1972. “Expectations and the Neutrality of Money.” Journal of Economic Theory 4(2): 103–124.

Weber, Michael, Francesco D’Acunto, Yuriy Gorodnichenko, and Coibion, Olivier, 2022. “The Subjective Inflation Expectations of Households and Firms: Measurement, Determinants, and Implications,” Journal of Economic Perspectives (forthcoming).

Weber, Michael, Yuriy Gorodnichenko, and Coibion, Olivier, 2022b. “The Expected, Perceived, and Experienced Inflation of U.S. Households before and during the COVID19 Pandemic,” IMF Economic Review (forthcoming).

Weber, Michael, 2022. “Subjective Expectations and Reality,” Annual Review of Economics (forthcoming).