The Great Recession that followed the 2008 financial crisis led to an unprecedent L-shaped recovery, as the level of GDP shifted to a permanently lower growth trajectory in most advanced countries. In contrast, past recessions were typically followed by V-shaped recoveries, as the level of GDP returned to its pre-recession path. We suggest a theoretical framework to reconcile episodes of V-shaped and L-shaped recovery. In a DSGE model with endogenous growth, negative shocks destroying productive capacity move GDP to a lower trajectory. A Taylor rule policy designed to reduce the output gap may counterbalance the shocks, preventing the destruction of economic capacity and inducing a V-shaped recovery. However, when shocks are deep and persistent enough, like during the Great Recession, they call for a downward revision of potential output measures, the so-called switching-track, weakening the recovering role of monetary policy and inducing an L-shaped recovery.

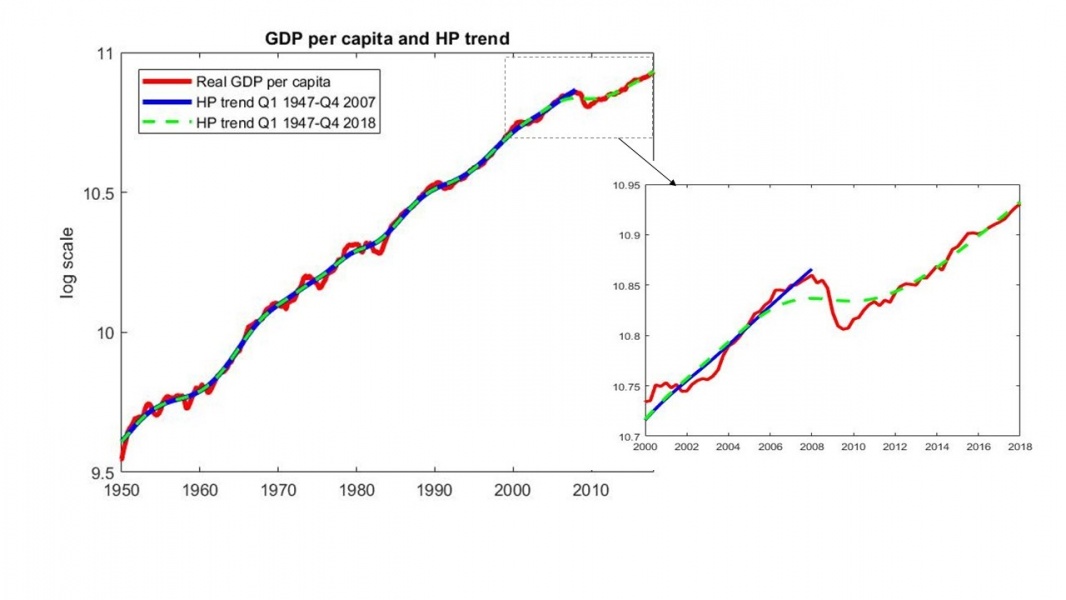

Before the Great Recession that followed the 2008 financial crisis, the broad consensus among economists was that negative shocks reducing GDP would be followed by a temporary acceleration in growth, bringing GDP back to its original trajectory. This dynamic is typically referred to as a V-shaped recovery and implies that the underlying trend in the productive capacity of the economy, potential output, is hardly affected by recessions. Conversely, the Great Recession was a deep and prolonged downturn, with permanent scarring effects on the productive capacity of advanced economies. Our framework, although applicable to the majority of OECD countries, focuses on the United States, where the level of GDP severely fell at the beginning of the Great Recession to gradually resume growing at a similar rate as before, resulting in a downward parallel shift in the GDP trajectory of around 10%. This implies a 10% permanent gap between the actual level of GDP and what it would have been had the recession not happened, giving rise to an L-shaped recovery. In Figure 1 we approximate potential output by an HP filtered GDP trend. If we think about potential output as a running train, we can see it switching-track in conjunction with the crisis. Consistently, the official estimates of potential output published by the Congressional Budget Office (CBO) each year were revised down as the recession unfolded. The economy then converged to its new lower potential output path, ending the recession without a full recovery. We refer to the downward revision of potential output estimates during the Great Recession as the switching-track.

Figure 1: United States GDP and HP-filter trend

The main contribution of this paper is to propose a single framework to replicate episodes of V-shaped and L-shaped economic recoveries, applying it to replicate both the 1973 and 1990 Oil recessions and the Great Recession. This novel framework combines endogenous growth and DSGEs, and shows that a learning-by-doing technology à la Romer (1986) is consistent with both V-shaped and L-shaped recovery episodes once monetary policy follows a standard Taylor rule and the Fed’s potential output estimates may switch-track. The paper builds on Christiano, Motto and Rostagno (2014), and introduces a novel amplification mechanism through bankruptcy spillovers on the depreciation rate of capital, so that an increase in risk and bankruptcy leads to the destruction of economic capacity.

Endogenous growth technology. L-shaped recoveries are inconsistent with a fundamental modelling assumption commonly used to represent the technology behind GDP production in the literature aiming to model recessions through dynamic stochastic general equilibrium models (DSGEs). A Neoclassical production function (Cobb-Douglas) assumes diminishing returns to capital, so that a negative shock affecting the capital stock would increase the return to capital, sustaining investment and bringing GDP back to its original growth trajectory. In this case, the level of potential output, i.e. the maximum level of feasible production, would not be affected by the recession. For this reason, we assume that, thanks to learning-by-doing, the aggregate production technology is AK. A production function featuring endogenous growth, like an AK technology, is inconsistent with V-shaped recovery episodes. When the return to capital is constant, any shock that moves capital below its past trajectory does not generate any additional stimulus to bring capital back to its previous trajectory. In this case, potential output switches track, permanently moving to a lower path. Other papers using an endogenous growth technology to explain the Great Recession include, Ikeda and Kurozumi (2019), Anzoategui, et al. (2019), Benigno and Fornaro (2018), among others.

Taylor rule and switching-track. This paper assumes the Fed follows a Taylor rule policy, aiming at closing the gap between GDP and potential output (Taylor, 1993). This implies a systematic countercyclical policy response, providing stimulus when GDP falls below its potential level until the gap is closed. If the production technology features diminishing returns, the model naturally generates a V-shaped recovery with monetary policy stimulus playing a stabilising role. However, if the production technology is AK, policy interventions are not only stabilising but could prevent the destruction of productive capacity, being able to generate V-shaped recoveries. This framework rationalises the role of monetary policy in explaining past observed episodes of V-shaped recovery. The Great Recession being unusually deep and persistent pushed the Fed to revise potential output estimates, triggering the switching-track and acknowledging the destruction of productive capacity. The Great Recession was then followed by an L-shaped recovery.

Moreover, the standard model is augmented by allowing for the switching-track, i.e. the revision of potential output estimates by the central bank based on a moving average of past observed GDP. This last assumption is key to replicate the Great Recession in our framework. If the central bank updates its beliefs on the level of potential output, as GDP falls due to the crisis, the estimate of potential output will follow, so that the output gap will shrink over time, the policy stimulus will get increasingly weaker and the economy will stabilize on a new level of potential output.

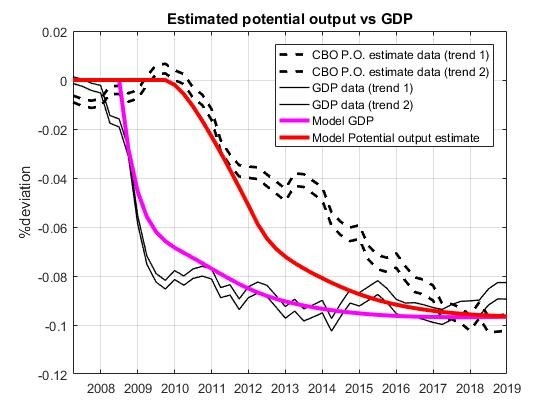

In order to replicate the Great Recession, we calibrate the model to match key U.S. data and subject the economy to a large demand shock affecting investment and consumption demand, also calibrated on U.S. data. Through a novel endogenous capital depreciation mechanism, the demand shock propagates to the supply side and destroys the productive capacity of the economy. As the fall in GDP is deep and persistent, the monetary authority revises the estimate of potential output downwards, until the output gap closes, and the economy stabilizes on a lower level of potential output. Figure 2 compares the dynamics of GDP and potential output in the model simulation with linearly detrended data, showing that the model can capture appropriately the L-shaped recovery as well as the potential output switching-track.

Figure 2: The Great Recession model simulation vs detrended data

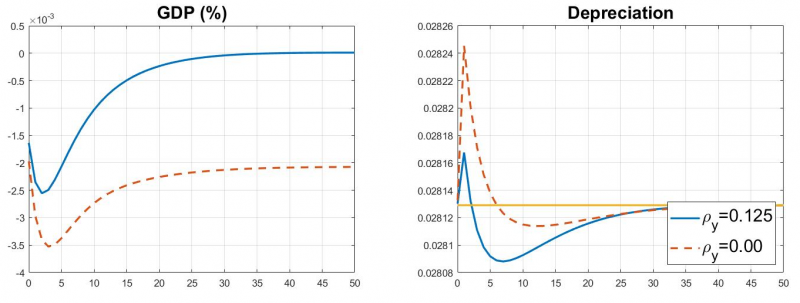

In order to explore the mechanics of V-shaped recoveries in the model, we subject the economy to a textbook negative 1% productivity shock (TFP) and consider two alternative monetary policies. The first is pure inflation targeting, i.e. the central bank puts zero weight on the output gap when deciding interest rates, the second is a standard Taylor rule, with a small but positive weight on the output gap. Moreover, we keep the estimate of potential output constant as the revision process that took place in the aftermath of the Great Recession was unprecedented. Figure 3 shows that the shock has a permanent negative effect on GDP under pure inflation targeting, whilst the economy recovers when a positive weight on the output gap is applied. In the second case, the monetary authority responds with stimulus to aggregate demand when the output gap is negative, by offering a lower nominal interest rate for each level of inflation. More importantly, the presence of the output gap in the Taylor rule tames financial risk in the economy overall, sustaining demand and preventing capital destruction (see right panel in Figure 3), keeping output higher until the output gap closes. By preventing capital destruction monetary policy acts as a cushion on the productive capacity of the economy and leads to a V-shaped recovery.

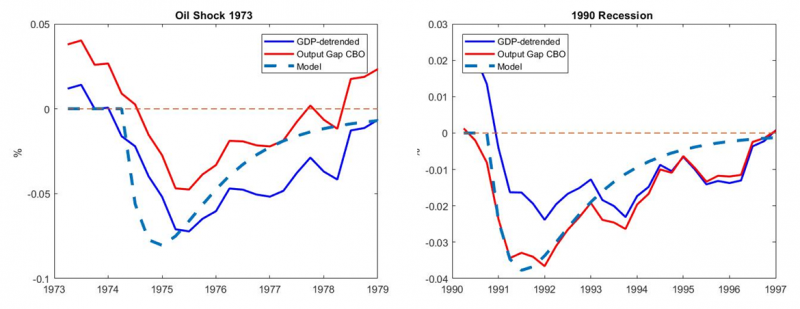

To test whether this mechanism is strong enough to generate V-shaped recoveries, we calibrate the model to replicate the oil crises that took place in 1973 and 1990. Figure 4 shows that a simple Taylor rule with no switching-track is sufficient to generate V-shaped recoveries in line with historical data.

Figure 3: TFP shock: Taylor rule vs inflation targeting

Figure 4: Oil crises model simulation vs data

Our paper contributes to the literature and the policy debate by showing that an endogenous growth model can reproduce the dynamics of U.S. L-shaped and V-shaped recoveries well, once the Fed’s beliefs about the current state of economic activity are modelled consistently with the data. In our framework, a simple Taylor rule with a positive weight on the output gap provides enough stimulus to replicate the V-shaped recoveries that followed the oil crises. On the other hand, a large and highly persistent demand shock such as the Great Recession induced the Fed to revise its potential output beliefs down, accepting the permanent negative effect the shock had on productive capacity and giving rise to the so-called switching-track. In this framework, monetary policy acts a cushion in the model economy, preventing the destruction of productive capacity. This constitutes a novel transmission mechanism of monetary policy and another fundamental contribution of this paper. In conclusion, this paper sheds new light on the drivers of economic recovery and the role played by monetary policy in shaping them, offering a new tool to inform policy-makers. For more details see Vinci and Licandro (2021).

Anzoategui, Diego, Diego Comin, Mark Gertler, and Joseba Martinez. 2019. “Endogenous Technology Adoption and R&D as Sources of Business Cycle Persistence.” American Economic Journal: Macroeconomics 11 (3): 67-110.

Benigno, Gianluca, and Luca Fornaro. 2018. “Stagnation Traps.” The Review of Economic Studies 85 (3): 1425–1470.

Christiano, L. J., R. Motto, and M. Rostagno. 2014. “Risk Shocks.” American Economic Review (104(1)): 27-65.

Ikeda, Daisuke, and Takushi Kurozumi. 2019. “Slow Post-financial Crisis Recovery and Monetary Policy.” American Economic Journal: Macroeconomics 11 (4): 82-112.

Romer, Paul M. 1986. “Increasing returns and long-run growth.” Journal of political economy (94, no. 5): 1002-1037.

Taylor, John B. 1993. “Discretion versus policy rules in practice.” Carnegie-Rochester Conference Series on Public Policy. Elsevier. 195-214.

Vinci, Francesca, and Omar Licandro. 2021. “Switching-track after the Great Recession.” ECB Working Paper Series, No 2596.