Abstract

Inflation targeting has been a resounding success in helping to anchor inflation to a low and stable regime. Even so, the changing nature of the inflation process gives cause for a reassessment of how inflation targeting should be conducted going forward. Partly due to the success of anchoring inflation to a low and stable level, and partly as a result of changes in underlying economic structures, inflation dynamics going forward are likely to be dominated by relative price shocks, particularly supply-side ones. Controlling inflation precisely could be harder and the desirability of doing so questionable. Operating in this environment may well require larger tolerance for both the size and duration of deviations from inflation targets. Inflation targeting frameworks will need increased flexibility to accommodate these challenges in order to maintain policy credibility and safeguard operational independence.

Since its inception in the early 1990s, inflation targeting has transformed monetary policy becoming the most widely-used framework in the world. By most measures, inflation targeting has been a resounding success. Countries that have adopted inflation targeting have, on the whole, seen marked reductions in the level and volatility of inflation along with smaller output fluctuations. It has withstood big upheavals, including the GFC and the Covid Pandemic. And some 35 years on, inflation targeting has passed the “no-regret” test in that no country that has adopted it has abandoned it. Even so, maintaining success going forward requires that the framework adjusts in a way that recognize key limitations and challenges that are likely to emerge.

Over the last 25 years or so, central banks have generally successfully anchored inflation to a low and stable regime. Inflation targeting has played a key part in that success. In such a low inflation regime, two key features stand out (see Borio et al 2023).

First, when inflation is low, say 3% and under on average, most of the variations in inflation will reflect changes in prices of goods or services in particular sectors. These sector-specific price changes tend to be uncorrelated with each other, reflecting sector-specific shocks. For example, high vegetable prices due to a drought or cheaper TVs from more efficient global production. As a result, movements in inflation tends to reflect relative price changes, rather than broad-based changes in the underlying price level.

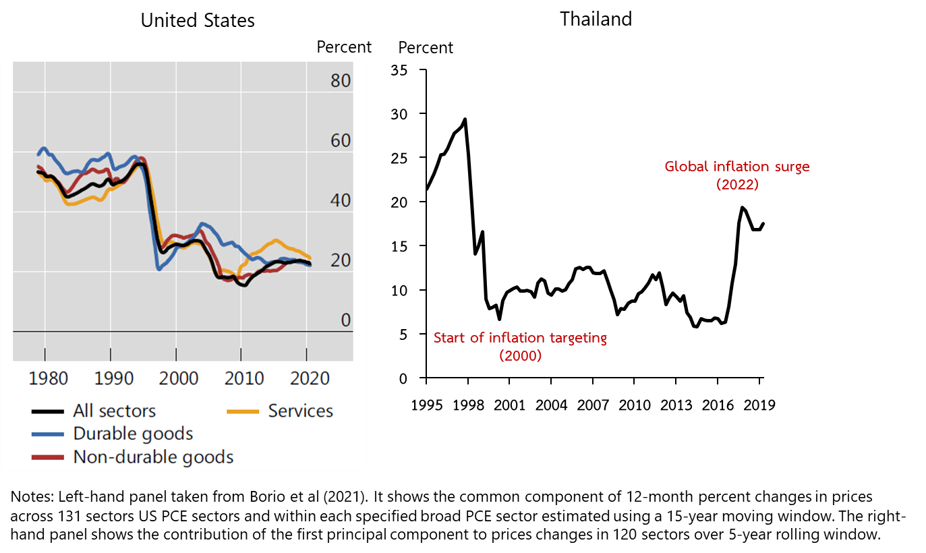

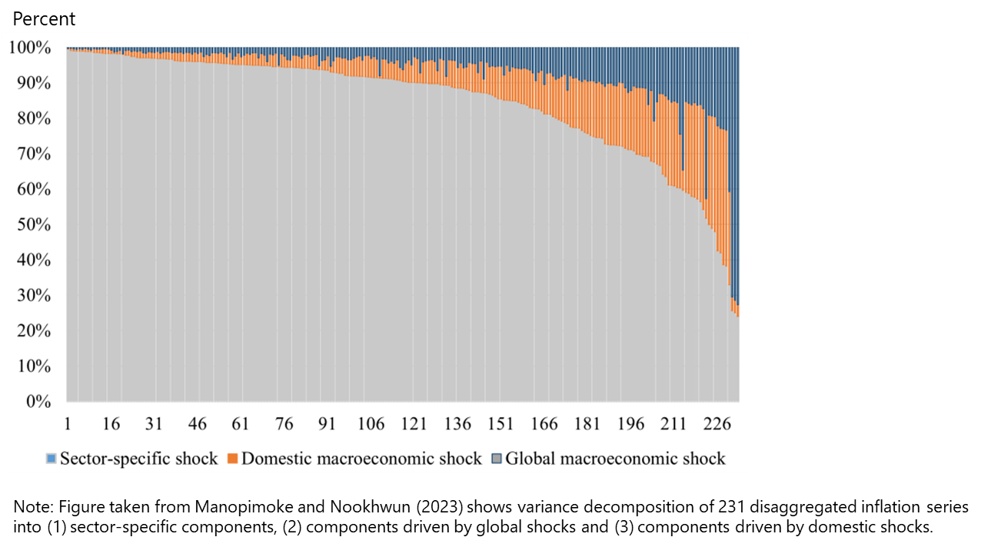

In other words, the various goods and services that make up the CPI basket don’t move together very much. This is in contrast to high inflation regimes where changes in prices are broad based. Statistical measures show this, with a large decline in the contribution of the common component of sectoral price changes as economies move from high inflation regimes to a low one. For example, for the United States the contribution of the common component fell from around 60% during the high-inflation years – up to the mid-1990s – to around 20% in the subsequent low-inflation period (Figure 1, left-hand panel). Other countries have had a similar experience. For Thailand, the decline of the common component coincided with the adoption of inflation targeting – the common component rose during the global inflation surge but has since fallen (right-hand panel). At the sectoral level, much of the movements in prices is dominated by sector-specific shocks, with aggregate domestic or external shocks playing only a small role for most sectors (Figure 2).

Figure 1. Fraction of variance in total price changes due to the common component

Figure 2. Sectoral variance decomposition Thailand (2002Q2-2019Q4)

The second key feature of low inflation regimes is that inflation tends to be self-stabilizing. With inflation expectations well-anchored, there is limited pass-through of shocks across sectors so that price changes in one sector do not spillover to other sectors. Importantly, wages and prices are only loosely linked with each other. As a result, the persistence of inflation is low as sectoral shocks do not propagate more broadly so that inflation quickly returns to previous levels after price shocks. For the same reasons, exchange rate effects on inflation also tend to be muted.

In addition to these two structural features of low inflation regimes, an important development in the underlying economic context is the greater role of supply shocks. These have generated large and persistent relative price changes, which have become much more prominent in driving overall inflation. Most recently, we have seen supply-side factors driving the post-pandemic inflation surge. Large scale disruptions in global supply chains as well as shortages in key commodities, notably energy and food, have resulted in sharp global price spikes.

The prominent role of supply-side developments for inflation dynamics not new. Since the early 2000s, globalization – in particular, the integration of China into world trade and the opening up of EMEs – along with rapid technological developments led to a long secular decline in the price of tradeable goods relative to that of non-tradables, mainly services. These kept a lid on overall inflation, which on average hovered below central banks’ objectives.

We will continue to face persistent supply-side price pressures going forward. Higher trade barriers, trade fragmentation, reconfigurations of global supply chains, demographic changes and the climate transition will drive large secular relative price changes. These forces may also increase inflation volatility to the extent that they make supply less elastic or less responsive so that demand shocks will translate into larger changes in prices.

In this environment, inflation targeting faces three main challenges.

First, central bank’s ability to steer inflation, especially within narrow ranges, becomes more limited. Monetary policy generally operates through the common component of inflation, which tends to reflect factors that affect all prices, such as aggregate demand. When sector-specific price changes account for the bulk of variations in the general price index, it is harder for monetary policy to steer inflation. This is because monetary policy has limited ability to offset idiosyncratic sector-specific price changes, especially when they are global in nature. There is nothing, for example, that monetary policy can do to alleviate shortages of some minerals or cheaper EV cars as production technology improves. All in all, this means that to move inflation by a given amount, large shifts in policy may be required, potentially causing undesirable side-effects.

Second, it is not a priori clear that central banks should offset changes in relative prices. For one, a substantial fraction of sector-specific price changes are transitory. Responding to them can easily lead to an overreaction if such changes are self-correcting. More importantly, relative price changes reflect fundamental shifts in sector-specific demand and supply factors and hence serve as key signals for needed adjustments in resource allocation. Seeking to compensate for such changes in sector-specific prices to achieve a specific inflation target may be counterproductive. This may be especially so in the face of persistent relative price trends, which would require sustained policy adjustment with proportionately larger side-effects.

Third, maintaining policy credibility can be challenging if inflation deviates persistently from stated targets. With the prominence of idiosyncratic price shocks and relative price trends, inflation will likely deviate from targets more often and more persistently even as it is anchored to a low level over time. This could generate pressures on central banks to act despite the fact that their actions can do little to move inflation closer to targets. And attempting to do so may have undesirable consequences, most prominently by contributing to a build-up in risk-taking and financial vulnerabilities.

Thus even as inflation targeting has been a resounding success, there is a need to reassess how it is implemented going forward. In successfully bringing down inflation and anchoring it to a low level, inflation targeting may have also reduced monetary policy’s ability to control inflation within those narrow ranges as the common component driving all prices naturally decline – a kind of paradox of success.

At the same time, the self-stabilizing dynamics of prices in a low-inflation regime endows central banks with considerable flexibility, generating potentially greater leeway for monetary policy to look-through moderate fluctuations in inflation – having succeeded in bringing inflation under control, central banks can enjoy the fruits of their hard-earned credibility (see BIS 2024).

It can thus be argued that the greater role of relative price fluctuations in driving overall inflation create a need for increased flexibility both in terms of greater tolerance for the size of deviations from inflation targets, as well as the time horizon over which inflation is brought back to target. We need to recognize clearly the risks associated with overly active and excessive fine-tuning of policy to hit narrowly defined inflation targets. At a minimum, such efforts are unlikely to work. At worst, they could well be counter-productive.

A key challenge in moving in the direction of more flexibility would be in communicating and explaining deviations from inflation targets that may be larger and more persistent. In certain situations, it may be the case that attaching heavy emphasis on a precise numerical target and tying central bank’s performance too closely to that target could be counterproductive.

The essence of inflation targeting is to anchor expected and actual inflation to a low and stable regime, underpinned by transparent and predictable conduct of policy. The actual average level of inflation within that low and stable regime is second order. Indeed, when inflation is low, the welfare costs of fluctuations away from narrowly defined targets tend to be limited. A key reason is that when inflation is low, it no longer exerts a significant influence on behaviour and agents no longer need to spend resources to acquire information about it – they become “rationally inattentive”.

Importantly, low or even slightly negative inflation rates are not associated with bad outcomes for the economy. Empirical evidence suggests that there is no systematic link between mild deflations and output weakness, even if the price declines are persistent (Borio et al 2015). I think as a profession, economists should get over the knee-jerk fear of deflation: the view that deflation is always everywhere associated with some self-reinforcing downward spiral in economic activity. Much of that view derives from the Great Depression which is very much an exception and reflected a unique set of forces that should not be generalized (see also Feldstein 2015).

Thus the key adjustment going forward would be greater tolerance for moderate, even if persistent, shortfalls of inflation from narrowly defined targets. This would help retain precious room for manoeuvre. And it would allow central banks to pay more attention to slow moving trends that have first order economic impact, including more systematic considerations of the financial cycle.

The bottom line is that an essential pillar in monetary policy frameworks going forward is to keep a sharp focus on the medium term, grounded in a realistic view of what monetary policy can and cannot deliver. Monetary policy cannot fine-tune inflation, let alone economic activity within narrow ranges. It can only provide the monetary preconditions for sustainable growth, but cannot itself be the engine of growth. It is important to build on these insights for inflation targeting to successfully evolve in the years ahead.

Bank for International Settlements (2024): “Monetary policy in the 21st century: lessons learnt and challenges ahead”, Annual Economic Report 2024, Chapter II.

Borio, C, M Lombardi, J Yetman and E Zakrajsek (2023): “The two-regime view of inflation”, BIS Papers No. 133, March.

Borio, C, P Disyatat, D Xia and E Zakrajsek (2021): “Monetary policy, relative prices and inflation control: flexibility born out of success”, BIS Quarterly Review , September.

Borio, C, M Erdem, A Filardo and B Hofmann (2015): “The costs of deflations: a historical perspective”, BIS Quarterly Review, March.

Feldstein, M (2015): “The deflation bogeyman” Project Syndicate, 25 February.

Manopimoke, P and N Nookhwun (2023): “Disaggregated Inflation Dynamics in Thailand: Which Shocks Matter?”, Puey Ungphakorn Institute of Economic Research Discussion Paper No. 211.