References

Devereux, M. P., and Griffith, R. (1999). The taxation of discrete investment choices. Institute for Fiscal Studies Working Paper, 98/16 (Revision 3). http://www.ifs.org.uk/wps/wp9816.pdf

Devereux, M. P., and Griffith, R. (2003). Evaluating Tax Policy for Location Decisions. International Tax and Public Finance, 10, 107–126.

Elschner, C., and Schwager, R. (2005). The Effective Tax Burden on Highly Qualified Employees – An International Comparison (1st ed.). Physica-Verlag.

Elschner, C., and Schwager, R. (2007). A Simulation Method to Measure the Effective Tax Rate on Highly Skilled Labor. FinanzArchiv / Public Finance Analysis, 63(4), 563–582.

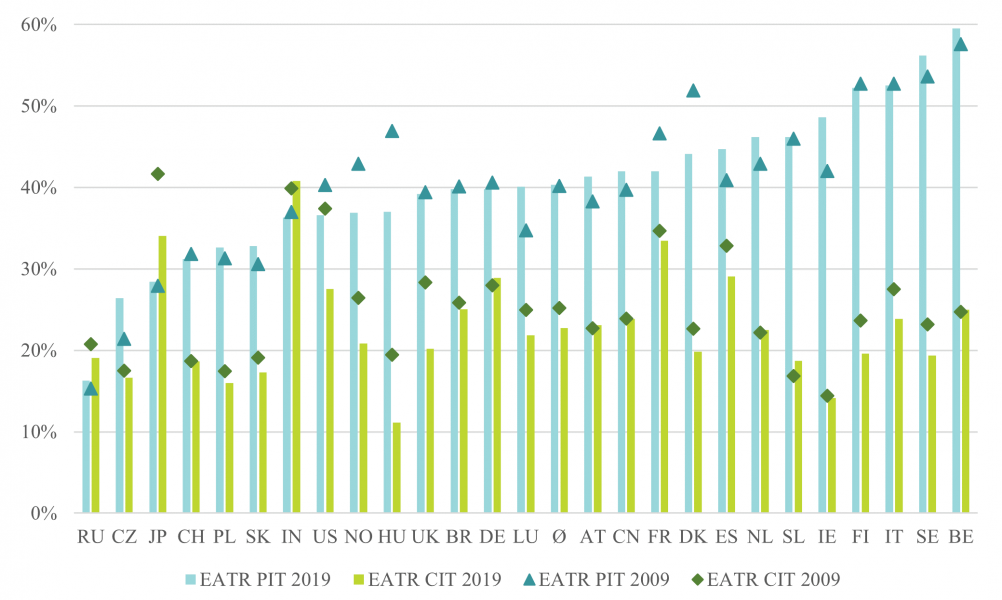

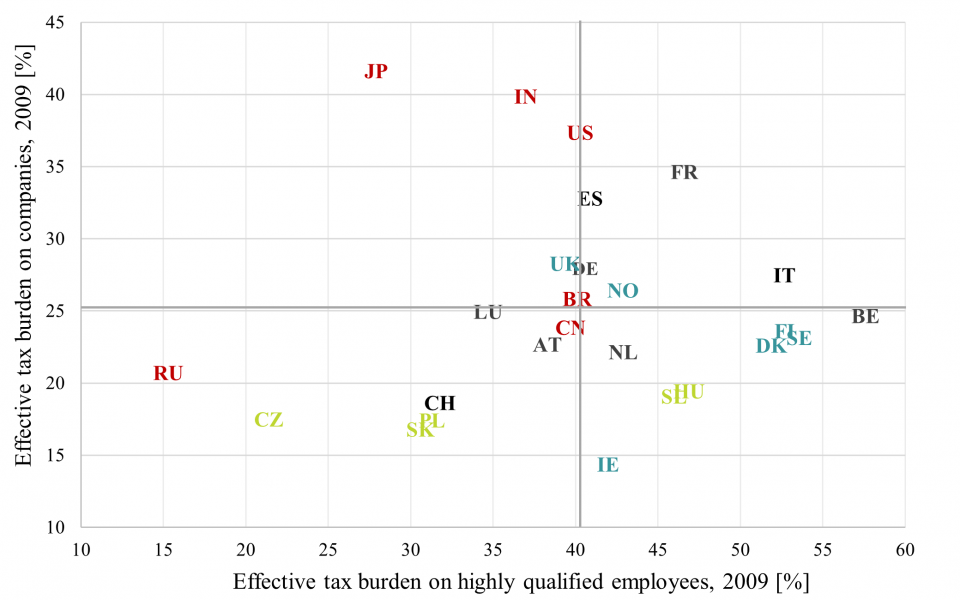

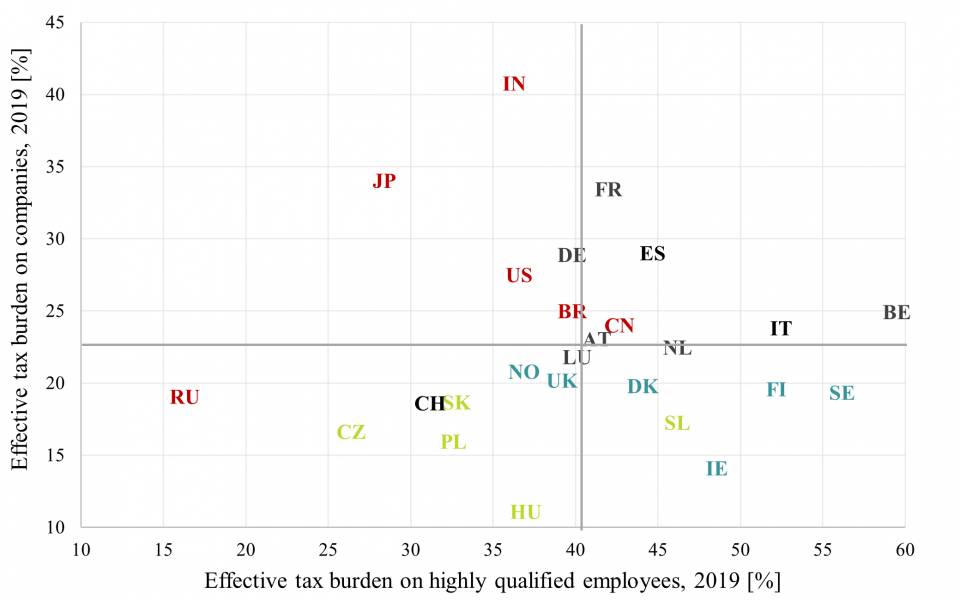

Fischer, L., Heckemeyer, J. H., Spengel, C., and Steinbrenner, D. (forthcoming). Tax policies in a transition to a knowledge-based economy – The effective tax burden of companies and highly skilled labour. Intertax. (An earlier version of the study can be downloaded at: www.zew.de/PU83087-1)