This column highlights the critical role of entrepreneurial tax avoidance in determining the economic and distributional effects of top-income taxation. High-income earners are typically business owners who can respond to tax reforms by actively exploiting opportunities in the tax code to reduce their tax liabilities. In Di Nola et al. (2024), we study tax reforms within a dynamic general equilibrium model of the U.S. economy. In the model, entrepreneurs can reduce their tax burden by choosing their legal form of business organization and by shifting income between different tax bases. Based on policy simulations, we find that tax avoidance by entrepreneurs weakens the distortionary effects of higher income taxes at the top but makes them ineffective at lowering inequality. Entrepreneurial tax avoidance reduces societal welfare and affects the optimal top marginal tax rate.

Concerns about income inequality have triggered a broad academic and political debate on how to tax the rich. When evaluating the effects of a higher income tax at the top, it is essential to account for the characteristics of rich households and their behavioral responses to tax reforms. Notably, the rich are likely to be entrepreneurs with small and medium-sized businesses who can actively exploit legal opportunities in the tax code to reduce their tax liabilities (Smith et al. 2019, 2022). In Di Nola et al. (2024), we incorporate this fact in a quantitative macroeconomic model of the U.S. economy to examine how tax avoidance by entrepreneurs impacts macroeconomic outcomes and societal welfare. We employ the model for policy analysis and assess the economic and distributional effects of increasing the top marginal tax rate.

We focus on two channels of tax avoidance. First, entrepreneurs can choose the legal form of business organization as a C-corporation or a pass-through business. C-corporations are taxed at the entity level and face double taxation: business income is subject to the corporate tax and then taxed again when paid to the owners as dividends. Pass-through businesses such as sole proprietorships and S-corporations involve no taxation at the entity level. Instead, as the name suggests, business income is passed through to the business owner and taxed as personal income. Second, on tax returns, entrepreneurs of S- and C-corporations can reduce their tax liabilities by shifting income between different tax bases and declaring their incomes as either wage or business income.

C-corporations are more difficult to organize and require a higher operational cost than S-corporations. However, fewer legal restrictions limit their ability to raise external capital, giving them better access to credit (Dyrda and Pugsley, 2022a,b; Chen et al., 2018; Chen and Qi, 2016).

We introduce the two channels of entrepreneurial tax avoidance in a dynamic general equilibrium model with occupational choice following Cagetti and De Nardi (2006) and Brüggemann (2021) and calibrate the model to match the US economy in 2013. Our model suggests that entrepreneurs who can afford the operational costs to run their businesses as S-corporations avoid the social security tax by declaring business income rather than wage income. In addition, they circumvent the double taxation of C-corporations. In line with data from the Survey of Consumer Finances in 2013, our model predicts that S-corporations are more common than C-corporations among small and medium-sized businesses.

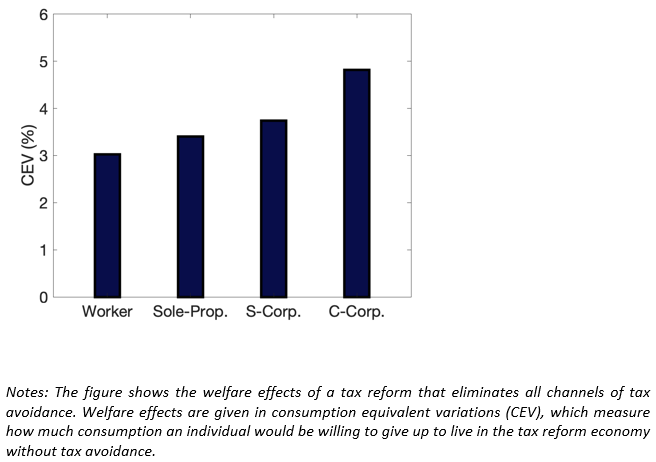

We then use our model as a laboratory to simulate economic responses to potential tax reforms. To understand how entrepreneurial tax avoidance affects macroeconomic outcomes and societal welfare, we consider a tax reform in which all entrepreneurs are taxed as sole proprietors independent of their legal form of business organization. In this scenario, there is no tax avoidance opportunity to exploit. Entrepreneurs choose the legal form of business organization solely based on the trade-off between the operational costs and the financial regulations determining their access to credit. The elimination of tax avoidance induces entrepreneurs to run their businesses as C-corporations, taking advantage of better access to credit. As a result, entrepreneurs invest more, and output increases. Since the tax reform removes all channels of tax avoidance and raises aggregate output, the government collects a higher tax revenue that can be redistributed to all households via tax cuts. The tax reform benefits workers and entrepreneurs and raises societal welfare (Figure 1).

Figure 1. The welfare effects of eliminating tax avoidance

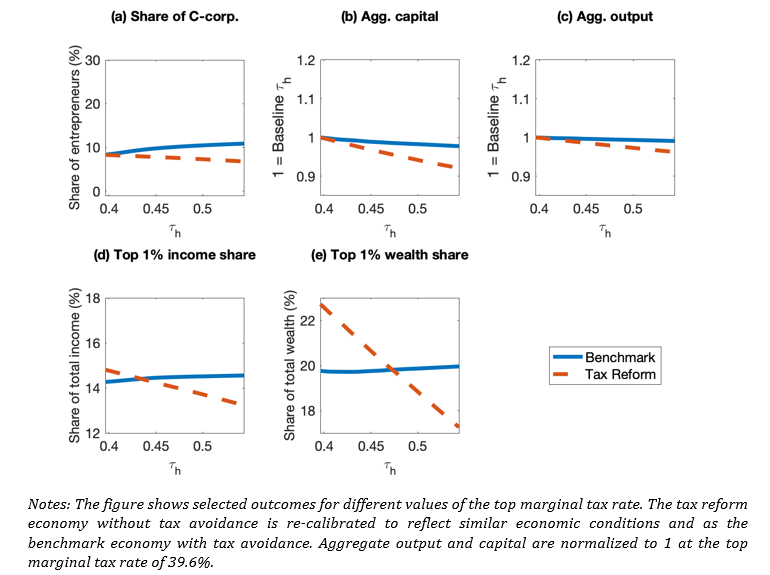

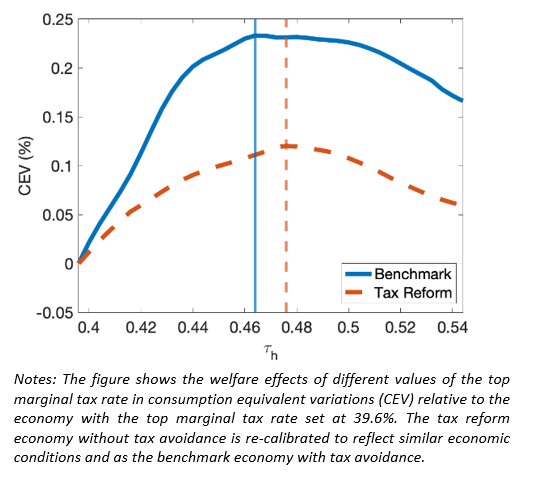

In a policy analysis, we study the aggregate and distributional effects of increasing the top marginal income tax rate. Let us start with the tax reform economy in which tax avoidance is eliminated. The dashed lines in Figure 2 highlight the well-known efficiency-equity tradeoff: a higher top marginal tax rate reduces capital and output but reduces income inequality. The solid lines in Figure 2 refer to the economy in which entrepreneurs can reduce their tax liabilities by choosing the legal form of their businesses and by shifting income between different tax bases. Raising the top marginal tax rate reduces the tax advantage of S-corporations relative to C-corporations, inducing entrepreneurs at the top of the income distribution to run their businesses as C-corporations. Moreover, they engage in income shifting to minimize their tax burden. Due to the improved access to credit experienced by C-corporations, the negative impact of income taxation on capital and output is dampened. However, the income and wealth shares held by the top 1% increase slightly. These findings highlight that tax avoidance weakens the distortionary effects of higher taxes at the top but makes them ineffective at lowering inequality. Moreover, tax avoidance reduces the optimal tax rate that maximizes societal welfare (Figure 3).

Figure 2. Top marginal tax rates and tax avoidance

Figure 3. The welfare-maximizing top marginal tax rate

We argue that when assessing the economic and distributional effects of top-income taxation, it is essential to account for the fact that high incomes are typically earned by entrepreneurs with small and medium-sized businesses who can actively exploit opportunities in the tax code to reduce their tax liabilities legally. In our study, we focus on two channels of tax avoidance: the choice of the legal form of business organization and income shifting between different tax bases. Based on a quantitative dynamic general equilibrium model of the U.S. economy, we find that tax avoidance reduces productive efficiency because avoiding taxes induces entrepreneurs to switch their legal form of organization from C-corporation to S-corporation despite facing tighter financial regulations with adverse effects on capital investment. While tax avoidance weakens the distortionary effects of higher income taxes at the top, it makes them ineffective at lowering inequality. Our simulations suggest that tax avoidance affects the optimal top marginal income tax rate with direct implications for applied policy.

Brüggemann, B. (2021). Higher Taxes at the Top: The Role of Entrepreneurs. American Economic Journal: Macroeconomics, 13(3):1-36.

Cagetti, M. and De Nardi, M. (2006). Entrepreneurship, Frictions, and Wealth. Journal of Political Economy, 114(5):835-870.

Chen, D., Qi, S., and Schlagenhauf, D. (2018). Corporate Income Tax, Legal Form of Organization, and Employment. American Economic Journal: Macroeconomics, 10(4):270-304.

Chen, D. and Shi Qi, (2016). The Importance of Legal Form of Organization on Small Corporation External Financing, Economic Inquiry, Western Economic Association International, vol. 54(3): 1607-1620.

Dyrda, S. and Pugsley, B. (2022a). How to Tax Capitalists in the Twenty-First Century? Working paper, University of Toronto.

Dyrda, S. and Pugsley, B. (2022b). The Rise of Pass-Throughs: A Quantitative Exploration. Working paper, University of Toronto.

Di Nola, A., Kocharkov, G., Scholl, A., Tkhir, A.-M. and Wang, H. (2024). Taxation of Top Incomes and Tax Avoidance. Working paper No 25/2024, Deutsche Bundesbank.

Smith, M., Yagan, D., Zidar, O., and Zwick, E. (2019). Capitalists in the Twenty-First Century. The Quarterly Journal of Economics, 134(4):1675-1745.

Smith, M., Yagan, D., Zidar, O., and Zwick, E. (2022). The Rise of Pass-Throughs and the Decline of the Labor Share. American Economic Review: Insights, 88(11):2283-2299.