This policy note discusses the causes, financial stability implications and policy implications of the exceptional speed and scale of bank runs in March 2023. While some of the factors that contribute to the increased volatility of deposits can and should be contained through policy measures, others, like the intensified competition between banks will inevitably stay, and bank balance sheet management and liquidity regulation need to accept the new normal of somewhat less stable and more expensive sight deposits.

The March 2023 demise of some US regional banks and of Credit Suisse suggests that, contrary to expectations, the additional regulatory frameworks introduced after 2008, notably in the field of liquidity requirements, have not overcome the problem of bank runs and the need for central banks to act forcefully as lender of last resort. Quite the contrary, the observed bank runs were of unprecedented speed, and central bank measures were equally unprecedented, such as providing liquidity against collateral at nominal value without a haircut. Policy makers like Federal Reserve Governor Bowman (2023) explained the unprecedented speed of the run on Silicon Valley Bank (SVB) bank as follows:

“For Silicon Valley Bank in particular, … the run … was fueled by the most modern communication methods and social media, and was enabled through new technology that allows customers to move money on a scale and at a velocity not previously accessible directly to customers. …. Back-end money transfer systems have been gradually shifting to real-time payments …. These changes have exacerbated the potential flight risks of uninsured deposits, while changing some of the incentives for depositors imposing market discipline.”

Moreover, the prospects of new forms of money, including means of payments issued by e-money institutions, narrow banks, or stablecoins and central bank digital currency (CBDC) are said to further threaten the stability of cheap bank funding via sight deposits in the future, potentially weakening the business model of commercial banking and its relative importance for financial intermediation.

While the likelihood and severity of bank runs appear to have changed over time, the basic economic logic of bank runs seems to remain unchanged. At least since the 19th century, it is understood that banks can in principle be in three states (for a recent restatement see e.g. Rochet and Vives, 2004, 1133; or Bindseil and Lanari, 2022): (i) a bank can be solid in terms of solvency and liquidity so that their deposit basis and access to funding markets are stable; (ii) a bank can be solvent conditional on sufficient liquidity, but insolvent conditional on certain negative liquidity scenarios because of the implied asset fire sales to be undertaken to address the possible liquidity gaps and related fire sale losses; i.e. the bank is in a multiple equilibrium situation, in which a run could take place or not; (iii) a bank can be insolvent regardless of liquidity scenarios, and in this case, a run of depositors and a loss of funding market access are quasi certain (once the solvency situation is known).

Banks can be pushed from state (i) into state (ii) or (iii) by a negative asset value shock. Banks can also be pushed from state (i) to state (ii) when asset liquidity alone deteriorates, or if the central bank suddenly narrows its collateral eligibility or increases haircuts. Vice versa, the central bank can, by making its collateral framework more supportive, push banks from state (ii) into state (i), but never from state (iii) to state (i) or to state (ii). Therefore, the lender of last resort (LOLR) should only be considered for solvent institutions.

Technological change does not alter this overall economic logic of bank runs but matters in particular for the speed of bank runs in state (ii) and (iii) and for the likelihood that in state (ii) the run equilibrium will prevail. For policy makers this matters a lot because central banks must be even more well prepared to take the right decisions quickly in case banks migrate because of exogeneous shocks out of state (i): act forcefully as LOLR in state (ii) and close the bank in case of (iii).

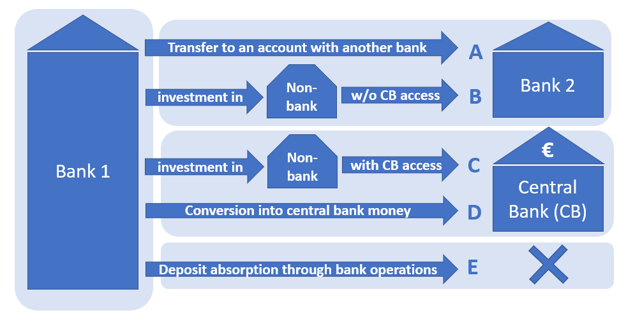

While the bank run literature rarely pays attention to where bank deposits can flow to, it is actually important to distinguish the different destinations of bank deposit leakages as a starting point of the analysis. The flow of funds mechanics in a closed system of financial accounts allows to understand and classify the different options for the migration of bank deposits within the financial system. Bank deposits do not simply disappear but are converted into a claim against a different entity or are absorbed when a bank issues debt or equity or does not renew a loan at maturity. We propose the following five types of outflows of deposits from a commercial bank, as also illustrated in Figure 1.

Figure 1. Stylized representation of all different cases of deposit outflows from a commercial bank

Bindseil and Senner (2023) provide the precise flows of funds mechanic for these five deposit absorption channels, including a number of sub-cases.

More intensive competition for bank deposits amongst banks

It is not obvious to argue that a more intense competition between banks for deposits (direct – or indirect via non-bank financial intermediaries) facilitated by new technology is negative from a social welfare perspective. First, competition is in general considered the very basis of an efficient market economy, and economic scenarios believed to suffer negative consequences of increased competition require thorough and convincing justification. OECD (2011, 29) considers that “competition and stability can co-exist in the financial sector… The results of the empirical studies linking competition and stability are ambiguous, however. Structural and non-structural measures of competition are found to be both positively and negatively associated with financial stability, depending on the country and the sample analysed and the measure of financial stability used”. In addition to this lack of compelling conceptual and empirical evidence that competition for deposits would be undermining financial stability and economic welfare, it seems that, anyway there are no attractive policy options to curb competition between banks in large, advanced economies in the age of online banking.

However, regulators should avoid creating an uneven playing field that can make deposit funding less stable. The recent deposit flows from regional banks to larger banks in the US, as discussed in section 3 of Bindseil and Senner (2023) have arguably also been driven by the greater protection of deposits at entities that are perceived as too big to fail. Similarly, segregated access to different funding sources, such as wholesale funding, may contribute to a two-tiered structure of the US banking system that can exacerbate deposit flows in times of stress.

Moreover, it could be considered to adjust again at some stage in the future the monetary policy framework in a way to provide incentives against banks hoarding large amounts of bank reserves, i.e. to specialise artificially in bank deposit collection for the sake of intermediating with the central bank balance sheet (instead of with the real economy). After the lift-off of monetary policy interest rates from the zero lower bound and the normalisation of spreads between various deposit-, short term market- and monetary policy interest rates, a floor system might create incentives for banks to collect deposits to place them at a higher rate with the central bank. This factor which might also have contributed somewhat to the destabilisation of deposits could be removed by eventually restoring the symmetric corridor system applied by many central banks before 2008.

Banknotes

The relative role of banknotes as a destination of bank runs is likely to decrease further, as the drawbacks of holding large amounts of banknotes at home remain, while electronic alternatives for deposit outflows have become more and more easy and appealing in a digitalised society.

Central bank digital currency

Central banks working on CBDC all affirmed their willingness to constrain deposit flows into CBDC by setting limits per resident (e.g. Panetta, 2022), although central banks have mentioned different levels of possible limits (e.g. the ECB has referred to 3000 euro as example, while the Bank of England to 10-20,000 pounds). Central banks do not want to offer central bank money as a large-scale investment asset since this would disintermediate banks and increase considerably the central bank balance sheet and would tend to increase the footprint of the central bank on securities and credit markets (unless the lengthening of the central bank balance sheet can be easily accomplished by holding more central government bonds, although even this conclusion is controversial).

Central bank access of foreign central banks and sovereign wealth funds

Central bank foreign reserves and holdings of sovereign wealth funds have grown significantly over the last three decades (Senner and Sornette, 2021). Often both are offered access to deposits of the major reserve currency central banks. Such access should however be granted in a way to deter large holdings with the central bank, and thereby incentivise sovereign wealth funds and central banks to seek other options to invest their foreign reserves. This ensures that the accounts with the reserve currency central bank are limited to serve transaction purposes, and not large-scale store of value functions. In acute financial crises, the foreign sovereign depositors are likely to exert pressure on the reserve currency central bank to be allowed to deposit larger amounts with the reserve currency central bank without having to accept harsh penalty interest rates. Central banks must find solutions that protect the domestic financial system against large additional deposit outflows. It is easy in any case to set the incentives right through a sufficiently unattractive pricing of these deposits, including a worsening of remuneration into negative territory if needed, or even a limitation on further inflows.

Deposit absorption by issuing new bank debt (or equity) to a non-bank or by a (central) bank selling assets to a non-bank

Obviously central banks should not implement quantitative tightening too aggressively or compressed to short periods of time, and certainly not to periods of bank stress. Instead, the reduction in the central bank’s securities portfolio should be smoothed over time and be predictable to allow the financial system to prepare for the compensation of the implied deposit absorption. Central banks generally apply this prudence, as the reduction of securities portfolios is done relatively slowly and gradually. However, the cumulated reduction of commercial bank deposits, even if smooth, may lead to deposit stress at banks, especially those that had invested the excess reserves created by QE (i.e. moving them to other banks) before QT started. Therefore, QT is, at least for some banks, more than just reversing QE, and should be accompanied by close monitoring and an a priori robust liquidity regulation (Nelson, 2021).

For sales of securities by a bank to a non-bank which uses deposits held previously with another bank, a policy conclusion is the importance of avoiding that in a banking crisis, also the relatively sound banks have incentives to pre-emptively liquidate securities aggressively (at the expense of deposits or the weakest banks being subject to an acute deposit flight). This policy is well-known and has typically been derived from the negative externality of fire sales in terms of depressing further securities prices, triggering book losses and weakening capital buffers, etc. A supportive LOLR framework seems key in this respect. Indeed, the Fed granted its special liquidity facility, the Bank Term Funding Program (BTFP) (FED, 2023) to all banks in the 2023 banking crisis, therefore also discouraging other banks to start selling assets.

Finally, in view of the result that bank deposits will remain in any case less stable, both the treatment of bank deposits in liquidity regulations as well as the effectiveness of the lender of last resort (LOLR) should be revisited (see also Restoy, 2023, and Cecchetti and Schoenholtz, 2023).

Regarding the regulatory treatment of deposits, the Net Stable Funding Ratio (NSFR) and the Liquidity Coverage Ratio (LCR), i.e., the most widely used regulatory metrics under the Basel Committee’s recommendations, do not seem to adequately reflect the new nature of less stable deposits. Credit Suisse, for example, fulfilled regulatory liquidity requirements until shortly before its demise (see section 2 of Bindseil and Senner, 2023). This assessment appears to be in line with Andrea Enria, Chair of the Supervisory Board of the ECB (Enria, 2023):

“But these indicators [LCR and NSFR] alone don’t provide enough visibility for phenomena that could appear very quickly, which was what happened with the deposit outflows from SVB and Credit Suisse. It’s important that the authorities also develop their own metrics. We have various metrics, such as counterbalancing capacity, which looks at the quantity of assets that banks can use as collateral with the central bank or can sell on the market and what other measures they can take to deal with a liquidity shock.”

Consequently, the assumptions about the share and speed of deposit outflows in a stress scenario, in particular in the 30-day LCR scenario, could be adjusted upward and downward, respectively, for uninsured, very large, and potentially correlated deposits. Banks can respond to such adjustments by adjusting either their asset or liability side of the balance sheet. Given that central banks are shrinking their balance sheets, i.e., draining central bank money from the banking system, and that other liquid assets like government bonds are neither in unlimited supply nor fully liquid during systemic events, a widespread and significant upward adjustment of HQLA levels could be challenging. Drawing on the experience of Credit Suisse, the (currency) composition and operational readiness of liquid assets should, however, be carefully reviewed in any case.

While individual banks cannot control the system-wide level of HQLA, they have substantial influence on their funding side. More equity as well as long-term wholesale funding are obvious candidates. In addition, banks define the terms and conditions of their accounts and have the following instruments at hand to reduce fast and large deposit outflows in times of stress – somewhat analogous to the tools that a central bank can use to control balances in central bank accounts: (i) generally exclude certain depositors (most European banks, for example, have never accepted deposits from crypto-related firms in contrast to SVB); (ii) limit the size of potential deposits in bank accounts, as well as potential out- and inflows; (iii) provide economic incentives against building up large volumes by remunerating the relevant accounts in a sufficiently unattractive way.

Moreover, the timely availability of liquidity data appears essential for the prudential supervision of deposit-taking institutions, not least to be able to prepare, implement or communicate LOLR measures in a timely manner (see below). In Switzerland, systemically important institutions are required to report the respective monthly LCR data survey within 15 days (instead of the usual 20 days that apply to all other banks). However, given the speed of recent bank runs, 15 days appear long. Reporting with a higher frequency appears technically feasible – and is something that banks should have internally anyway (see also Enria, 2023).

Finally, it is worth mentioning that higher competition for deposits not only has an impact on the bank’s liquidity situation, but also influences funding costs and therefore interest margins and profitability (Arsov and Cetina, 2023; SNB 2023, 9). As interest rates move away from the zero bound, interest margins and bank profitability can initially improve. However, increased competition for deposits could eventually offset these benefits. Supervisors should therefore analyse this interplay closely.

In terms of adjustments to central banks’ LOLR tasks, the increased speed of deposit outflows has important consequences, which all relate to the implied need to react faster. Within the LOLR, it is important to distinguish between the general elasticity of liquidity provision through regular monetary policy operations and relying on the associated collateral framework, and the emergency support to one or few specific financial institutions against collateral which would be ineligible for regular operations. The first does address systemic liquidity issues, but also individual ones in the sense that a bank with specific liquidity issues can take additional recourse to regular central bank credit operations and thereby gain time to rectify underlying causes or to prepare, if unavoidable, for individual emergency liquidity assistance. Therefore, sufficient unincumbered collateral buffers for regular operations are one important factor for a better ability of banks and authorities to react to the increased speed of bank runs (apart of course from the fact that larger liquidity buffers are in themselves helping to make bank runs less likely). Ensuring that the banks have on average sufficient collateral buffers for regular operations relies on two components: first a broad list of eligible collateral (and without extremely high haircuts) and second an aggregated structural liquidity position of the banking system vis-à-vis the central bank that does not imply a regular recourse to liquidity providing credit operations of the central bank which is so high that the very large part of the eligible collateral buffer is consumed to cover for this necessary recourse to central bank credit. Central banks may want to consider the second factor when deciding on the size of their outright securities portfolio holdings as these impact on the structural need of banks to take recourse to central bank credit.

Turning to the second form of LOLR, namely the provision of emergency liquidity to individual institutions against non-standard collateral, the timeline for the following tasks needs to be even tighter than it already was in a less digitalised age: the confirmation of solvency of the candidate financial institution; the identification of suitable collateral, its valuation and mobilisation; the possible agreement with the government on a government guarantee to support the potential amount of emergency liquidity assistance; the decision making by the central bank governing bodies.

This tightening of the timeline can only be achieved with additional preparations, in general, and for vulnerable banks in particular, which can be identified at a relatively early stage via more systematic horizon scanning. This is in line with recommendations made by the IMF in the context of FSAP missions, also before the March 2023 episodes, but having now become more pertinent (e.g. IMF, 2018, which relates to the euro area FSAP, although it is not specific to the euro area). Additional preparation is not for free and requires resources. Both the horizon scanning in itself, and the subsequent preparatory work with identified vulnerable banks (like the work on earmarking, valuing and preparing for the potential mobilisation of non-standard collateral) are demanding. Accepting the related costs may be an adequate adjustment to the changed environment, i.e. the increased speed of deposit outflows in bank runs in a digital age.

Moreover, the idea of “constructive ambiguity” to prevent moral hazard should be given up as it by nature prevents preparation. Preventing moral hazard needs to be achieved through other means, such as associating the recourse to emergency liquidity assistance of individual banks to costs relating to additional supervisory scrutiny and higher interest rates. Also, the reputational damage of having to take recourse to individual liquidity assistance remains a significant deterrent to moral hazard.

Arsov, Ana and Jill Cetina (2023), “Funding risks, weaker profitability and turn in asset quality will test bank credit strength”, Moody’s US banks sector in-depth, 7. August 2023.

Baer, Greg and Bill Nelson (2023), “Why Is the Federal Reserve Abetting a Drain of Deposits from Banks?”, Bank Policy Institute, 29 March 2023.

Bindseil, Ulrich and Edoardo Lanari (2022)”, “Fire Sales, the LOLR, and Bank Runs with Continuous Asset Liquidity,” Journal of Financial Crises: Vol. 4 : Iss. 4, 77-102. Available at: https://elischolar.library.yale.edu/journal-of-financial-crises/vol4/iss4/3

Bindseil, Ulrich and Richard Senner (2023), „Destabilisation of Bank Deposits Across Destinations – Assessment and Policy Implications”, September 7th, 2023. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4534754

Bowman, Michelle W (2023), “The Evolving Nature of Banking, Bank Culture, and Bank Runs”, Speech given at the 21st Annual Symposium on Building the Financial System of the 21st Century: An Agenda for Europe and the United States, European Central Bank, Frankfurt, Germany, May 12, 2023.

Cecchetti, Stephen G. and Kermit L. Schoenholtz (2023), “Making Banking Safe”. Available at SSRN: https://ssrn.com/abstract=4513903 or http://dx.doi.org/10.2139/ssrn.4513903

Enria, Andrea (2023), “Interview with Andrea Enria, Chair of the Supervisory Board of the ECB, conducted by Francesco Ninfole”, 22 July 2023, ECB Banking Supervision. https://www.bankingsupervision.europa.eu/press/interviews/date/2023/html/ssm.in230722~111bdb656b.en.html

FED (2023), “Federal Reserve Board announces it will make available additional funding to eligible depository institutions to help assure banks have the ability to meet the needs of all their depositors”, Press release, March 12, 2023.

IMF (2018) Euro Area Financial Assessment Program, Technical Note – Systemic Liquidity Management, Country Report No. 2018/229.

Panetta, Fabio (2022), “The digital euro and the evolution of the financial system”, Introductory statement at the Committee on Economic and Monetary Affairs of the European Parliament, Brussels, 15 June 2022. https://www.ecb.europa.eu/press/key/date/2022/html/ecb.sp220615~0b859eb8bc.en.html

OECD (2011), “Bank competition and financial stability”, report.

Restoy, Fernando (2023), “The quest for deposit stability”, BIS Speech at EFDI International Conference, Budapest, Hungary, 25 May 2023. https://www.bis.org/speeches/sp230525.htm

Rochet, Jean-Charles, and Xavier Vives (2004), “Coordination Failures and the Lender of Last Resort: Was Bagehot Right after All?”, Journal of the European Economic Association 2 (6): 1116–47.

Senner, Richard and Didier Sornette (2021), “Explaining global imbalances: the role of central-bank intervention and the rise of sovereign wealth funds”, Review of Keynesian Economics, vol. 9, issue 1, 61-82.

SNB (2023), “Financial Stability Report”, Swiss National Bank, available online.